If you're feeling overwhelmed by your student loan payments and are seeking a little breathing room, you're not alone. Many students find themselves in situations where extended loan deferment can provide the financial relief they need. This article will guide you through crafting the perfect letter to secure that deferment, ensuring you address all the necessary points while maintaining a friendly, respectful tone. So, let's dive in and explore how to effectively communicate your needs to your loan servicer!

Personal and Financial Background

A comprehensive understanding of an individual's personal and financial background is crucial when seeking extended student loan deferment, especially in circumstances of economic hardship or unforeseen life challenges. This may include details about the current employment status, such as working part-time (less than 20 hours per week) with an hourly wage of $15, which translates to a monthly income of $1,200, insufficient to cover essential living expenses like rent ($800), utilities ($150), and groceries ($300). Additionally, mentioning any family responsibilities, such as caring for dependents like children or elderly parents, can greatly enhance the context. An overview of education-related financial obligations, highlighting total student loan debt ($30,000) and interest rates (ranging from 4% to 6%), illustrates the burden and necessity for deferment. Any unexpected medical bills, estimated at $5,000 annually, or other significant expenses that deplete savings, also strengthens the case for seeking financial relief.

Reason for Deferment

Securing an extended student loan deferment often involves a variety of reasons that need to be clearly articulated. Financial hardship due to unforeseen circumstances such as job loss (over 15 million Americans reported job losses during the COVID-19 pandemic), medical emergencies carrying substantial expenses (average cost of a hospital stay can exceed $10,000), or ongoing education commitments resulting in limited work hours can all justify the need for deferment. Moreover, students preparing for licensure exams, like the CPA or BAR, which necessitate significant time and focus, may require this additional time without the pressure of loan repayments. Please ensure to gather supporting documents, such as income statements, medical bills, or enrollment verification to strengthen the deferment request.

Duration of Extension Request

Securing an extended student loan deferment is essential for managing financial responsibilities during challenging times. Students experiencing hardship can request a deferment for up to 36 months (three years) depending on federal or private lender policies. During this period, interest may continue to accrue, particularly on unsubsidized loans, affecting long-term repayment amounts. Institutions like the Department of Education provide specific guidelines and documentation requirements, often requiring proof of financial hardship such as job loss or medical expenses. Adhering to these procedures is critical to ensure eligibility and to maintain financial stability while pursuing education goals.

Supporting Documents and Evidence

To secure an extended student loan deferment, students must provide essential supporting documents. These documents may include a completed deferment application form, which outlines the request for postponement of payments due to qualifying circumstances. Financial hardship can be evidenced through bank statements, pay stubs, or tax returns, demonstrating income levels below federal poverty guidelines. Enrollment verification may require a form from the educational institution, confirming enrollment status in at least half-time studies. Additionally, students experiencing medical issues should submit a physician's statement outlining their condition and the expected duration of the impact on their ability to repay loans. Finally, any correspondence with loan servicers showing previous deferments or repayment changes can strengthen the case for obtaining an extended deferment.

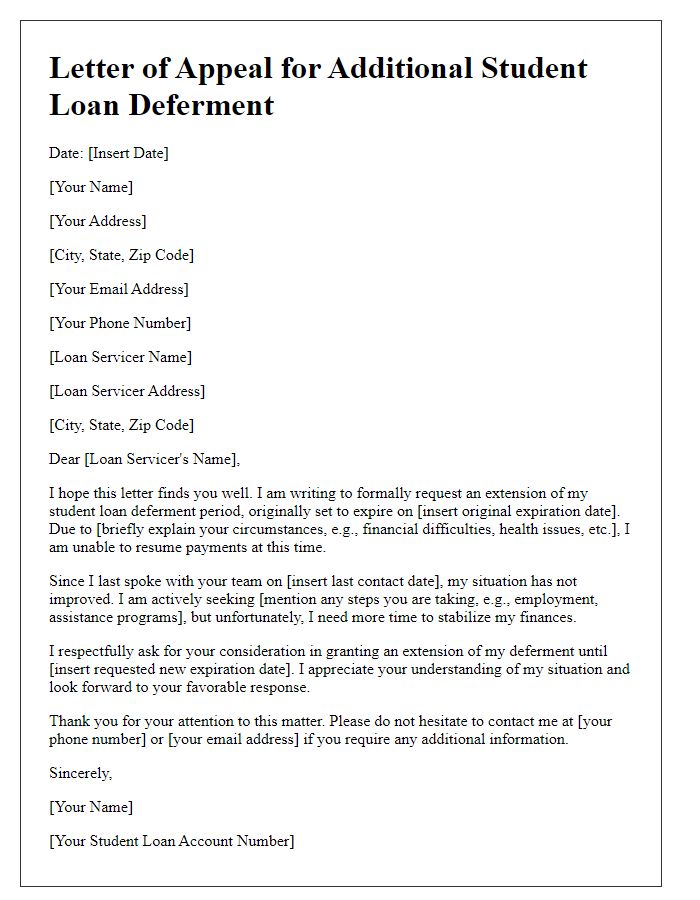

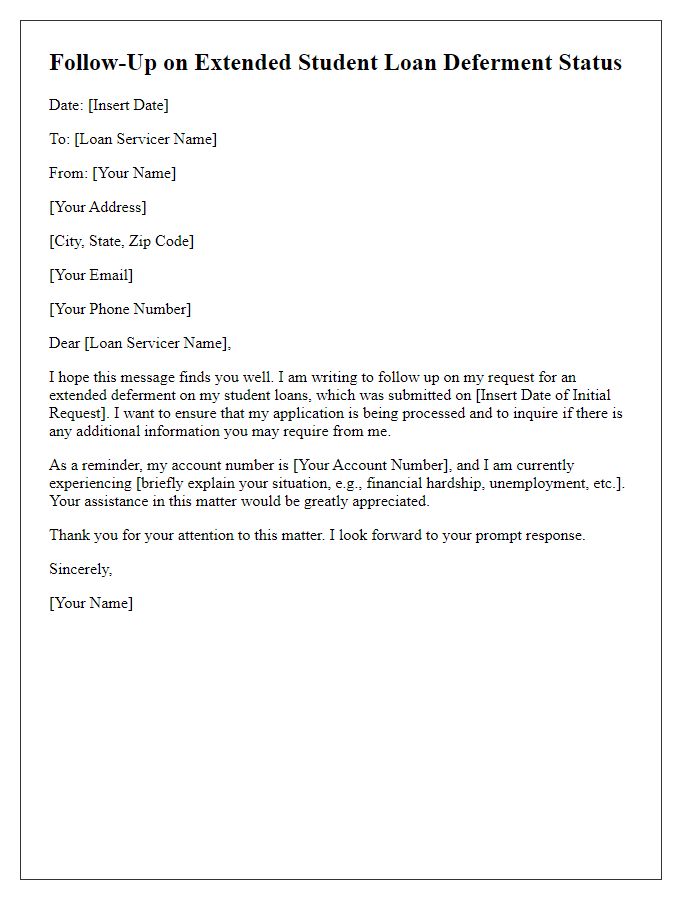

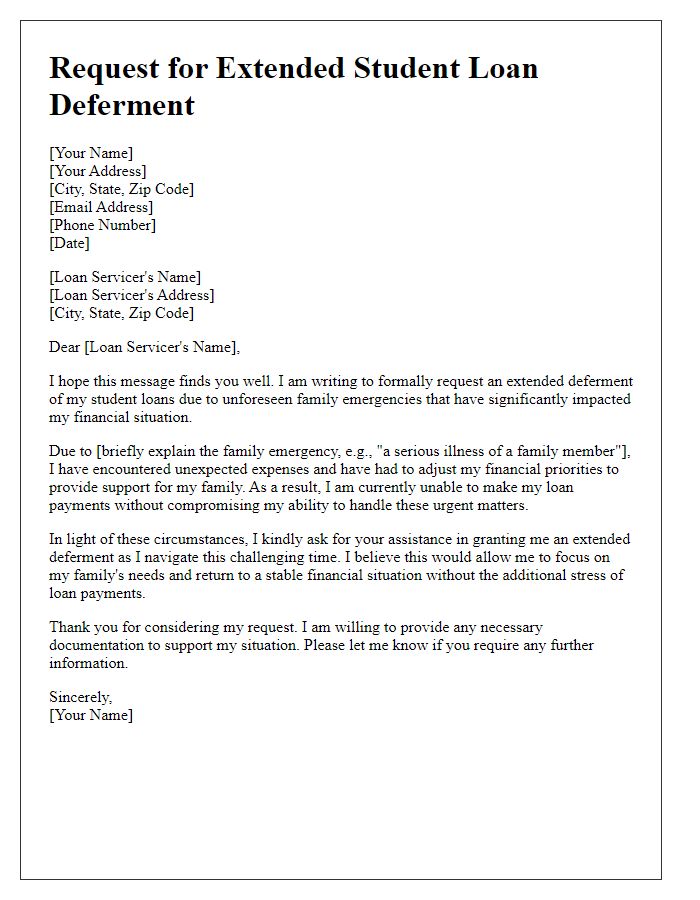

Formal Tone and Professional Formatting

A comprehensive request for extended student loan deferment includes a well-structured approach, demonstrating clarity and purpose. Begin with your full name, contact information, and loan details prominently displayed at the top. Clearly delineate your current financial circumstances, emphasizing any challenges such as unemployment or medical expenses that justify the need for deferment. Include a concise summary of your educational status, such as current enrollment in a degree program, along with the name of the institution. Attach any relevant documentation, such as proof of enrollment or financial statements, to reinforce your request. Conclude with a polite yet assertive closing statement, expressing gratitude for their consideration and the importance of their support for your academic and financial well-being.

Letter Template For Securing Extended Student Loan Deferment Samples

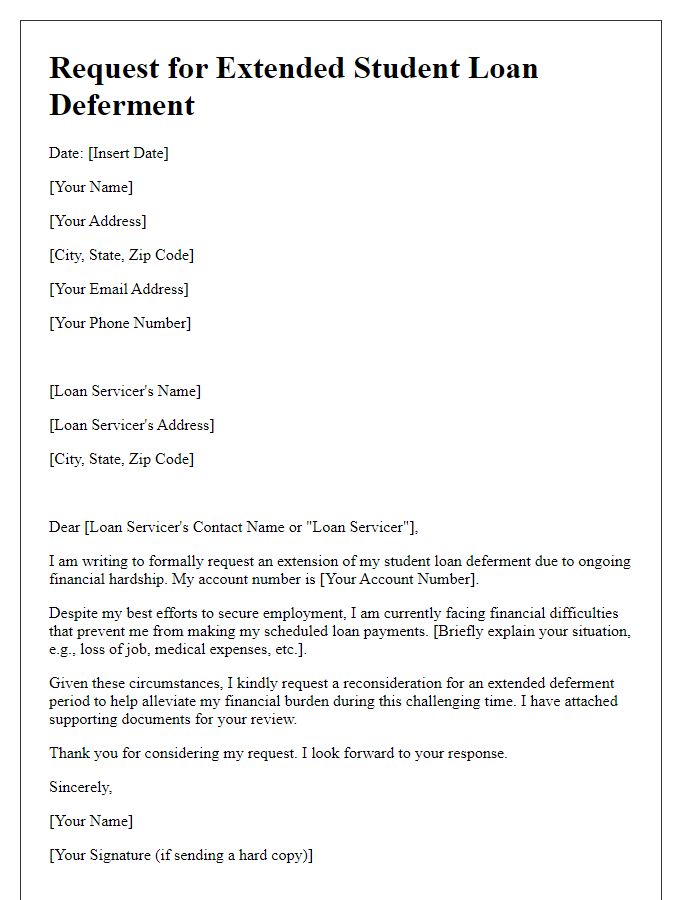

Letter template of request for extended student loan deferment due to financial hardship

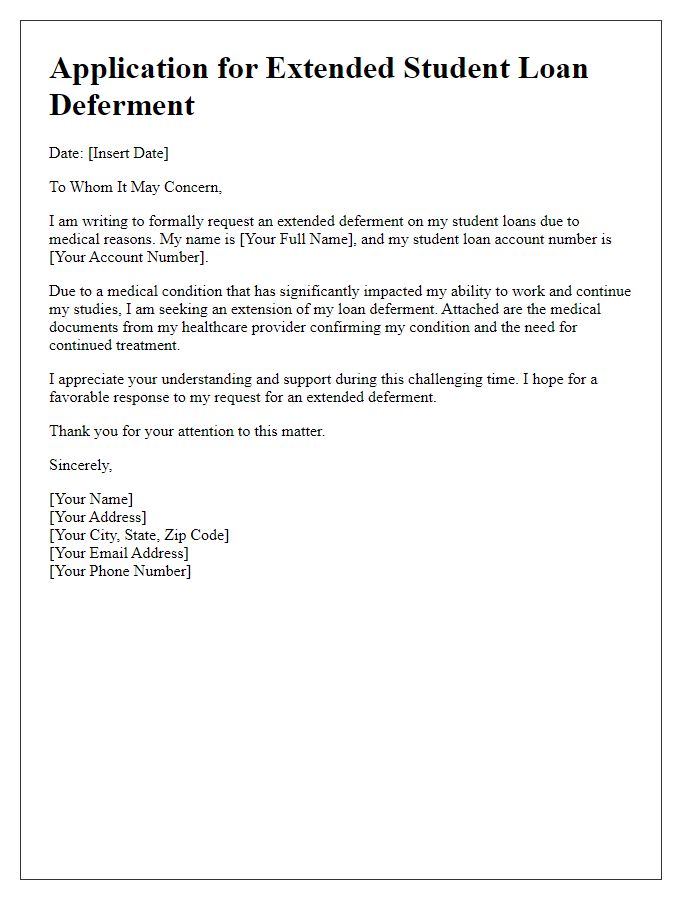

Letter template of application for extended student loan deferment for medical reasons

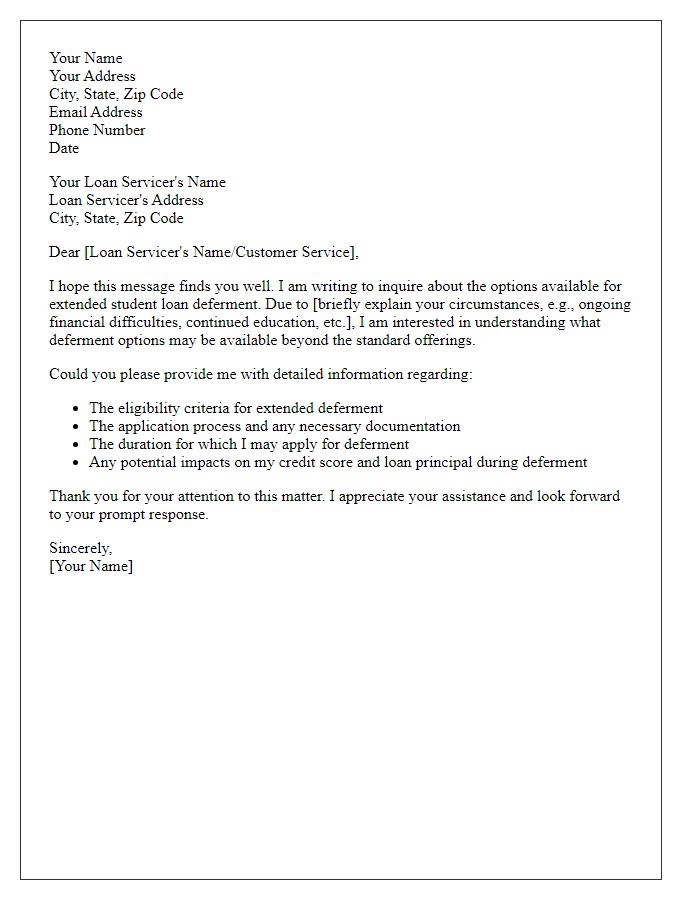

Letter template of inquiry regarding extended student loan deferment options

Letter template of notification of job loss for extended student loan deferment

Letter template of support documentation for extended student loan deferment

Letter template of student loan deferment request for continuing education

Letter template of justification for extended student loan deferment application

Comments