Are you looking to adjust your personal loan agreement but not sure where to start? Making changes to your loan terms can feel overwhelming, but it doesn't have to be. In this article, we'll guide you through a simple letter template that you can use to request adjustments effectively. So, grab a cup of coffee and let's dive in to see how you can take control of your financial future!

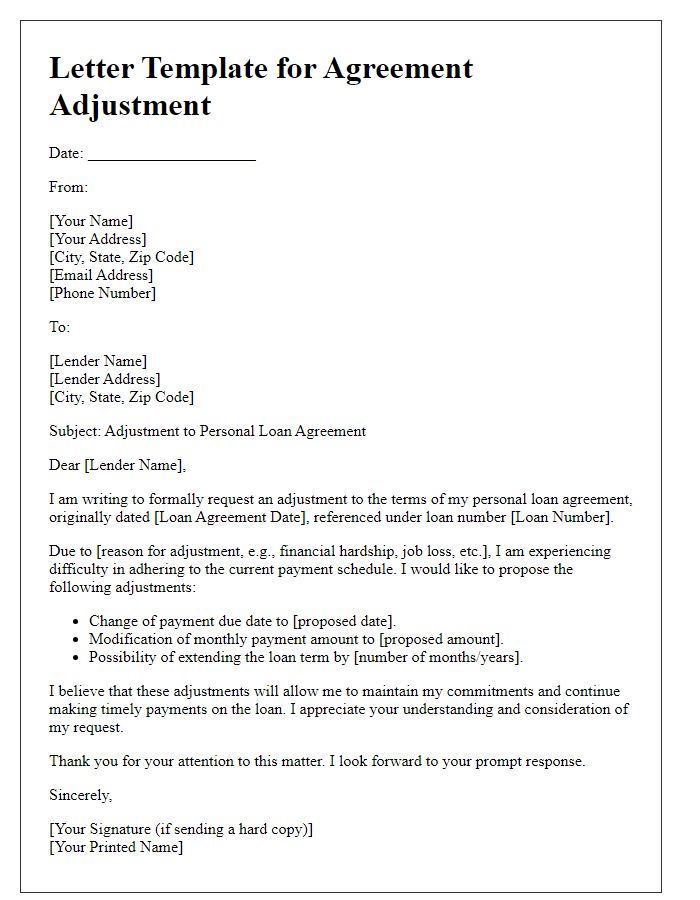

Loan Details and Reference Information

Personal loan agreements can undergo adjustments to meet changing financial circumstances. A personal loan, typically ranging from $1,000 to $50,000, allows borrowers to cover expenses such as medical bills or home renovations. Reference information includes the lender's name (e.g., Wells Fargo or Chase), loan number (a unique identifier such as 123456789), and original interest rate (often between 5% and 36%, depending on creditworthiness). Adjustments may involve altering payment plans, modifying interest rates, or extending the loan term, which can significantly impact the overall repayment amount. Clear communication and documentation are vital during this process to ensure all parties understand the updated terms and conditions.

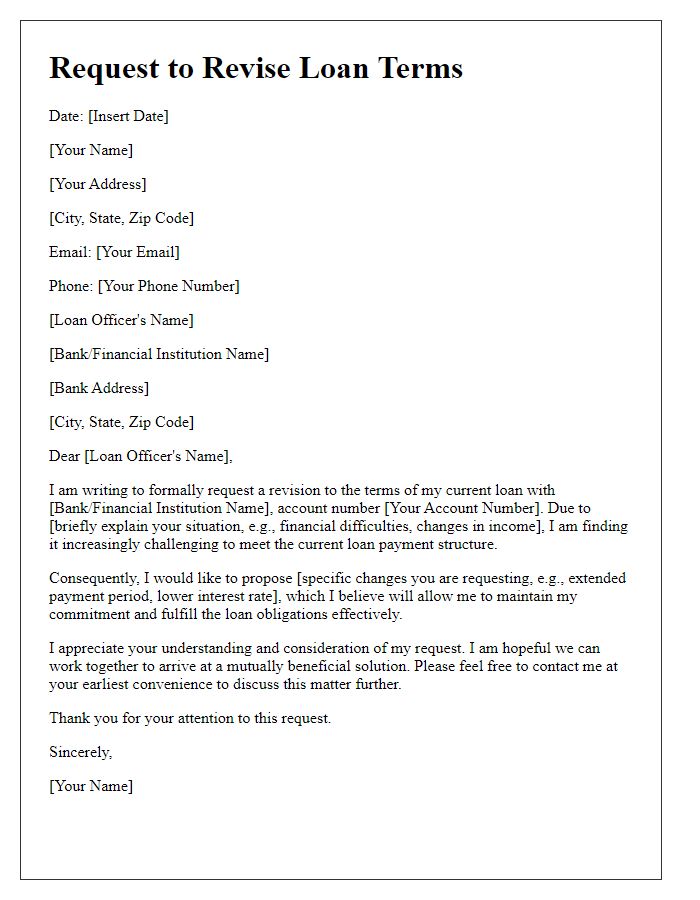

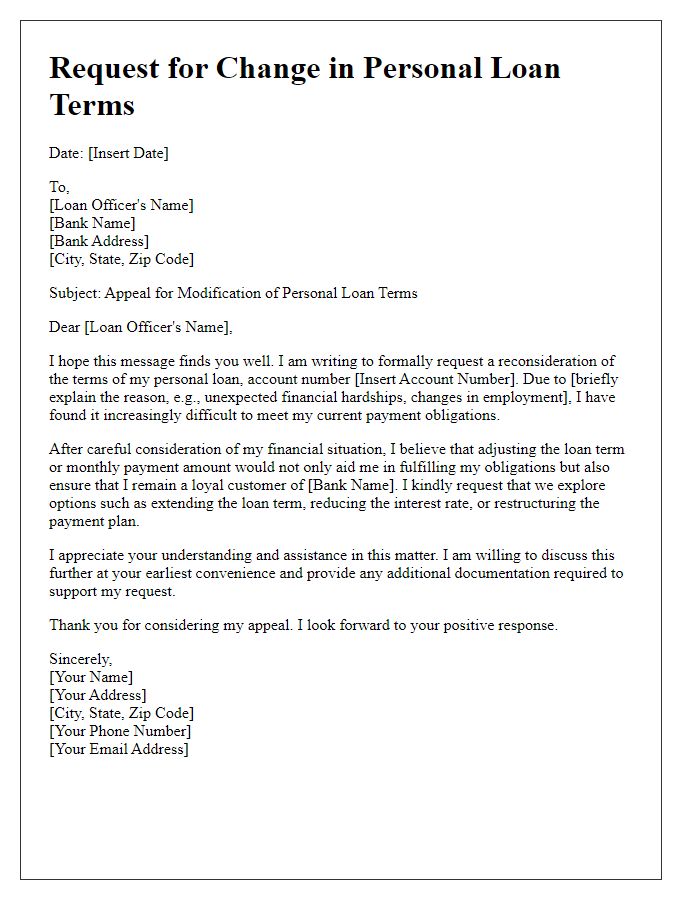

Request for Modification

Personal loan agreements may require adjustments due to life changes, financial circumstances, or unexpected events. Borrowers often need to request modifications to their payment terms, interest rates, or loan duration. Specific details such as original loan amount ($10,000), interest rate (7.5%), and repayment period (5 years) should be included in requests. The borrower's current financial situation, such as recent job loss or medical expenses, may necessitate lower monthly payments (e.g., $200 instead of $250). Communicating with the lender promptly can lead to favorable terms and help maintain a good credit score, facilitating a smoother financial recovery. Effective communication can also ensure that both parties understand the modified terms required for mutual benefit.

Justification for Adjustment

Personal loan agreements often require adjustments due to changing financial circumstances. Issues such as unexpected medical expenses, job loss, or reduced income can impact repayment abilities. Involuntary loss of employment can lead to a significant drop in monthly income, making original loan terms difficult to sustain. For instance, a borrower with a $20,000 personal loan and a monthly payment of $400 may find difficulty managing the obligation after losing a source of income. Additionally, variations in interest rates or the cost of living can further complicate repayment scenarios. A formal request for adjustment highlights these circumstances and suggests alternatives like modified payment schedules, interest rate reductions, or loan term extensions, ensuring that borrower commitments remain manageable and sustainable.

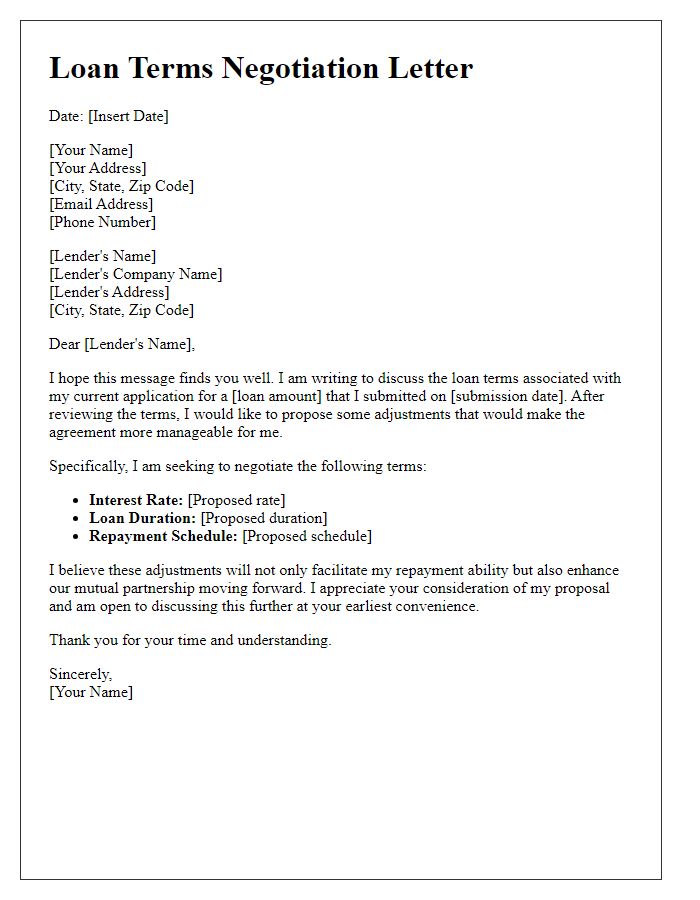

Proposed New Terms

Proposing new terms for a personal loan agreement involves careful consideration of interest rates, repayment schedules, and creditworthiness. The updated agreement may include a reduced interest rate (for example, decreasing from 7% to 5%) and an extended repayment period (such as extending from 36 months to 60 months) to improve affordability. Additionally, adjustments to the monthly payment amount (for instance, lowering from $400 to $300) can relieve financial pressure. Analysis of current market conditions, such as prevailing interest rates and economic factors, should influence these proposals, ensuring a fair and beneficial adjustment for both the lender and borrower.

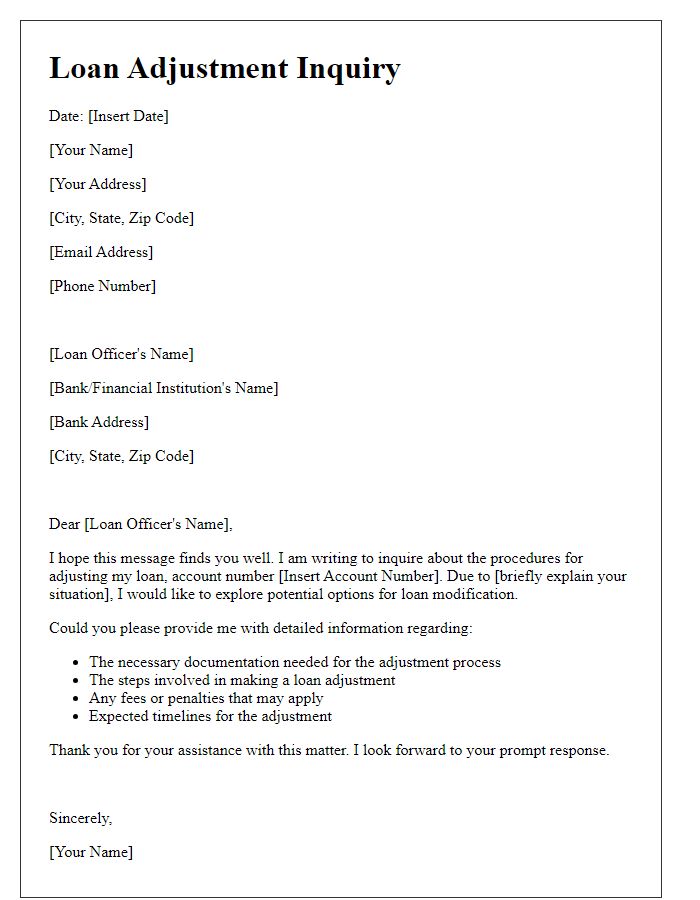

Contact Information and Next Steps

Adjusting personal loan agreements may involve significant changes to terms and conditions of repayment, interest rates, or loan amounts. Contact information should include the lender's customer service number (typically found on the loan statement), email address, and physical address of the lender's office (often the headquarters or local branch). Next steps typically involve preparing necessary documentation, such as proof of income, loan account details, and any correspondence related to financial hardship, which may influence the lender's decision during the modification process. Be prepared to outline specific requests, for instance, a proposed payment plan adjustment or refinancing options, to expedite the process effectively.

Comments