Are you feeling overwhelmed by your current loan repayments? It's not uncommon to find yourself in a tough financial spot, but there are options available to ease that burden. Restructuring your loan repayments can provide the relief you need to regain control of your finances. Ready to learn more about how to navigate this process effectively?

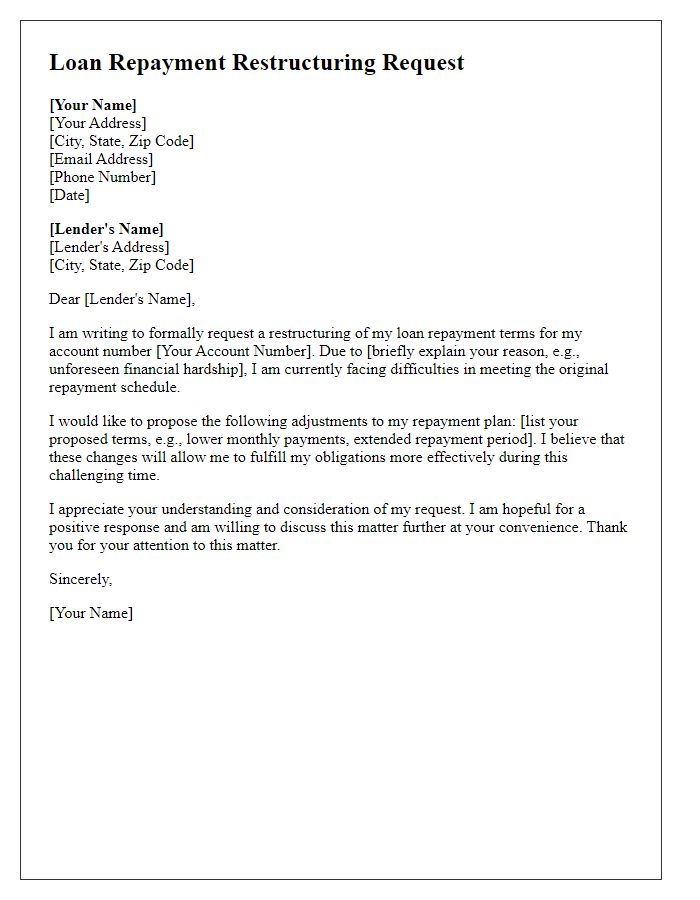

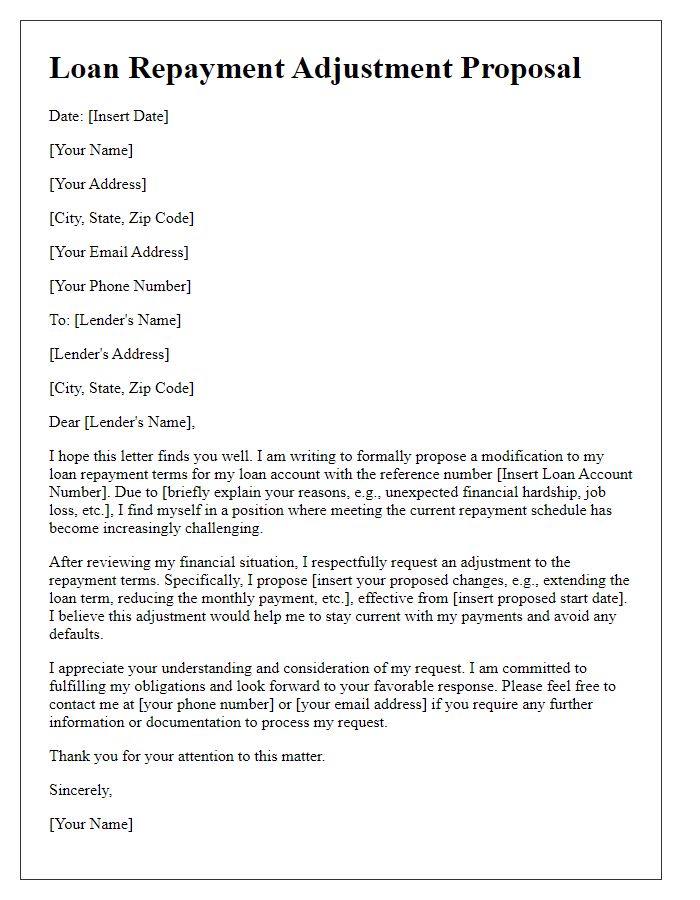

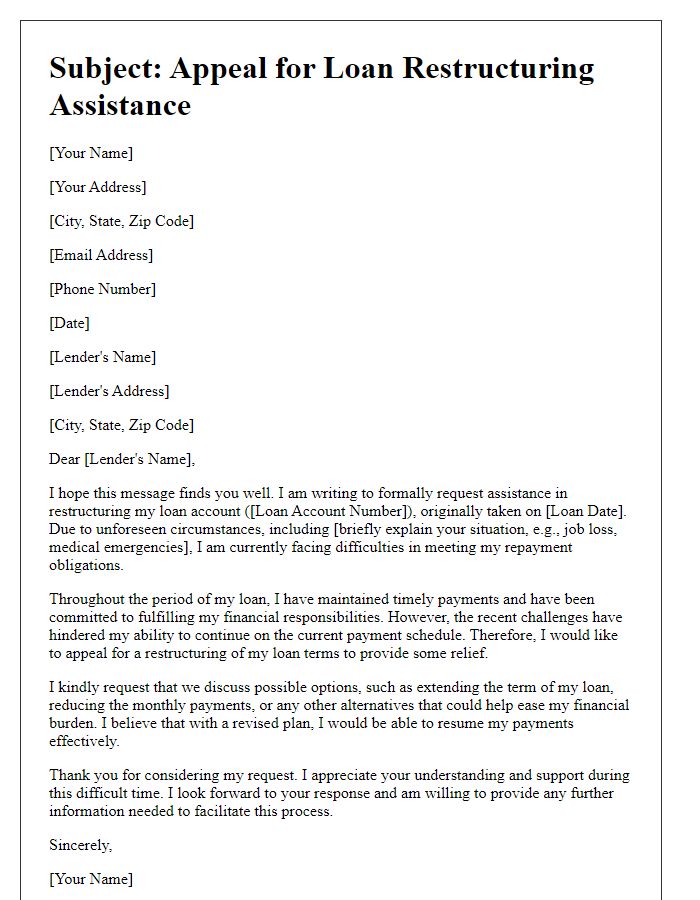

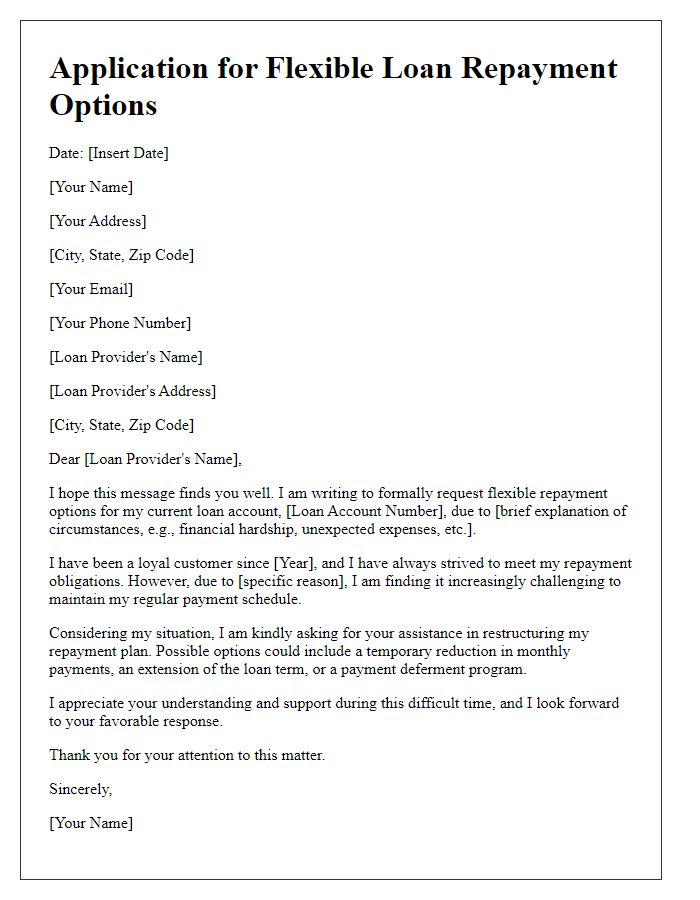

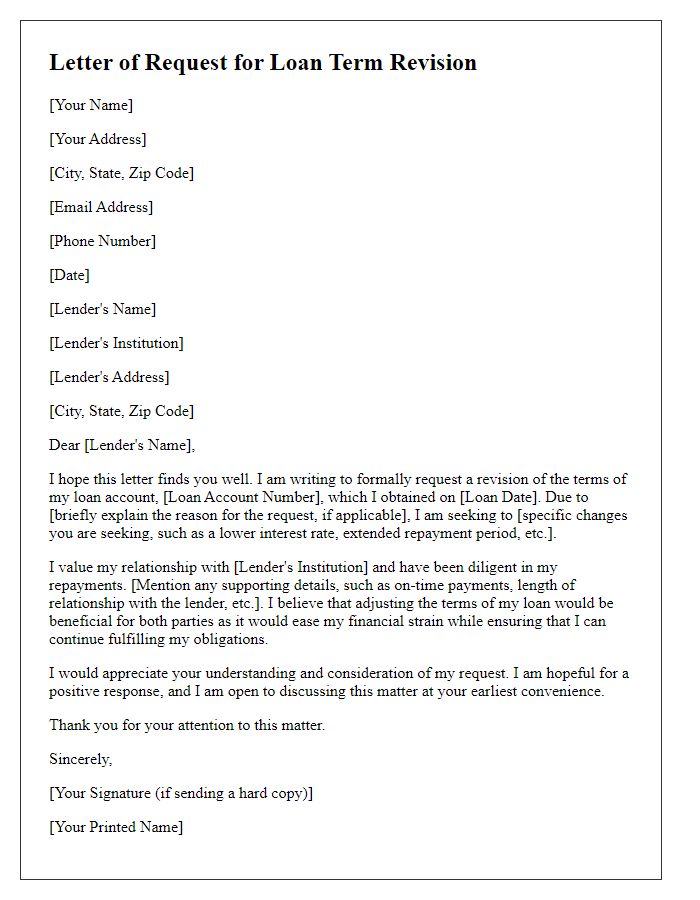

Personalized borrower information

The loan restructuring process is crucial for borrowers facing financial challenges, especially those with personal loans or mortgages in major banks such as Wells Fargo, Chase, or Citibank. Customized repayment plans can adapt to individual circumstances, potentially reducing monthly payments or extending loan terms. Borrowers should provide updated financial information, including income statements, expenses, and outstanding debts, to lenders for accurate assessments. Documentation is vital, often including tax returns, bank statements, and a proposed budget, to support requests. A structured repayment strategy can improve financial stability, assisting borrowers in managing obligations while avoiding default on loans.

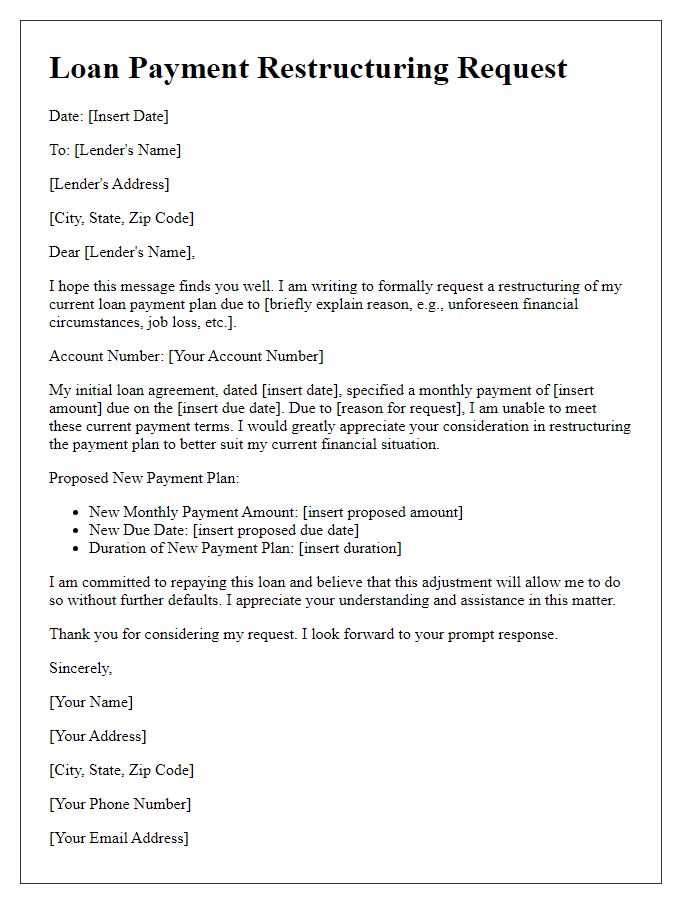

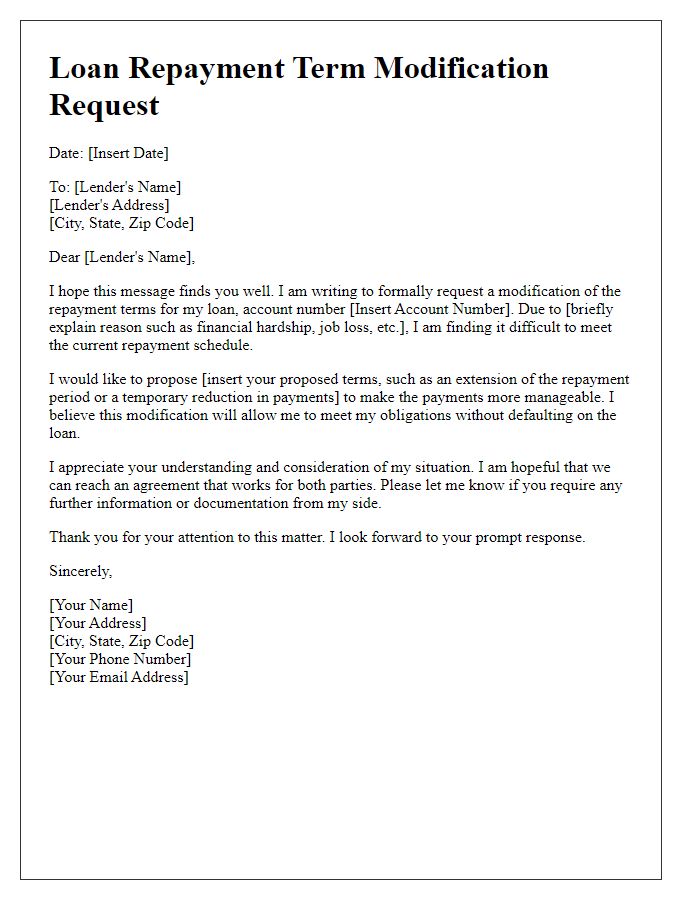

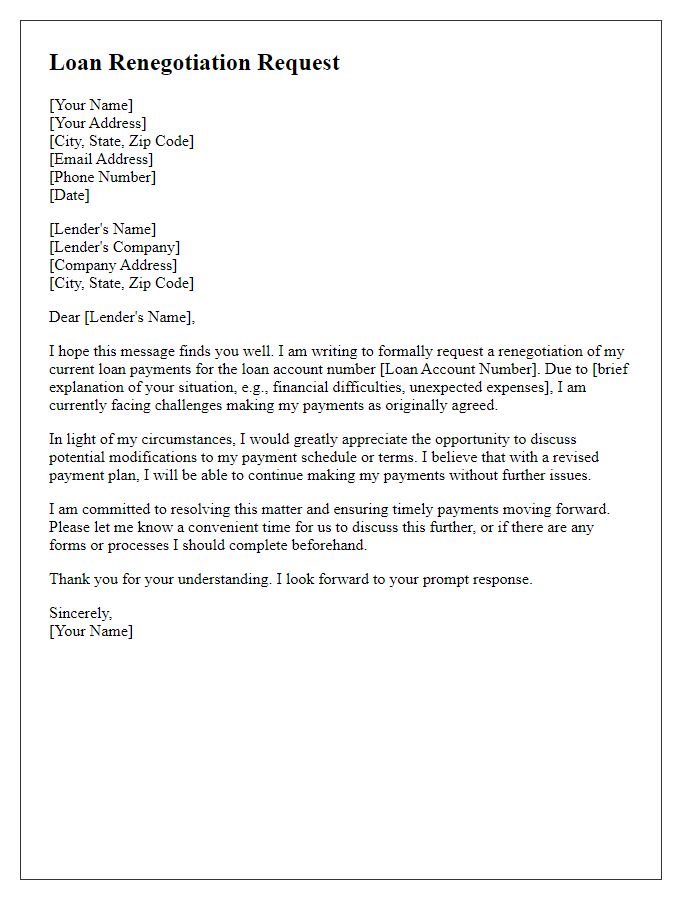

Clear statement of current loan terms

Current loan terms indicate a principal amount of $50,000 with a fixed annual interest rate of 5%. Monthly payments are set at $1,000 over a 60-month term, resulting in a total repayment cost of $60,000. The loan is serviced by First National Bank, established in 1863, and is secured against residential property located at 123 Maple Street, Cityville. Current market conditions, including an unemployment rate of 4% and inflation at 2%, have affected my ability to maintain the agreed payment schedule. Seeking a restructuring plan to increase repayment flexibility while reflecting updated financial circumstances and promoting sustainable repayment.

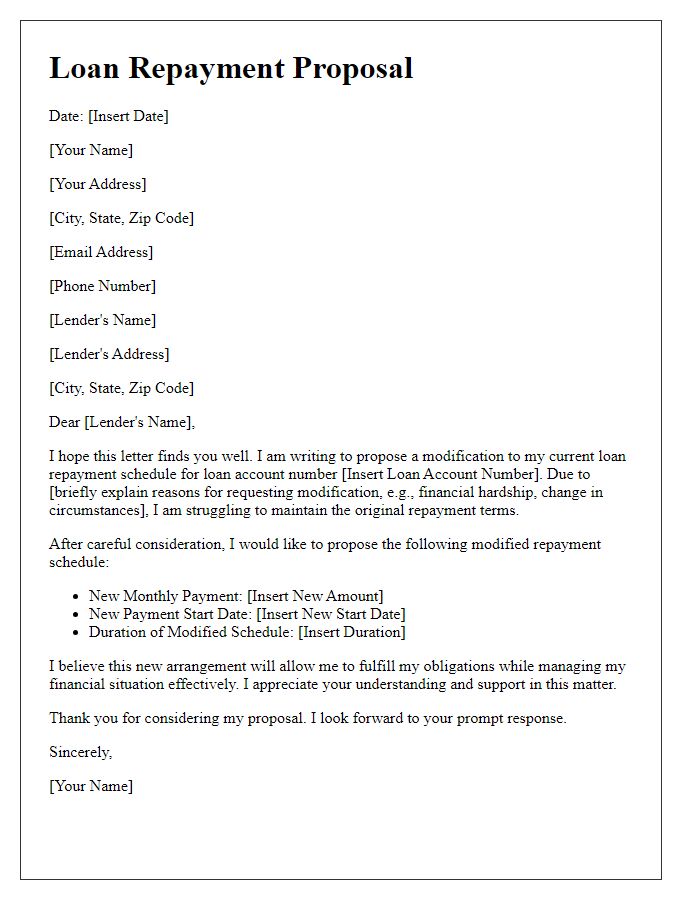

Explanation for needing restructuring

Financial constraints often necessitate restructuring loan repayments, especially in cases of unforeseen circumstances such as job loss, medical emergencies, or significant personal expenses. For instance, a family may face a sudden medical bill exceeding $10,000, which disrupts their monthly financial stability and makes it challenging to meet existing loan obligations. Similarly, a small business that generates average monthly revenue of $5,000 could experience a drastic decline in income due to market fluctuations or unforeseen events like the COVID-19 pandemic. These situations can lead to a compromised ability to maintain regular payments and prompt a borrower to seek a revised repayment plan. Effective communication with lenders about these circumstances can pave the path for a manageable restructuring arrangement that aligns with the borrower's current financial reality.

Proposed new repayment terms

Restructuring loan repayments can significantly ease financial burdens for borrowers experiencing difficulty meeting existing obligations. A proposed new repayment term might include extending the loan duration from five years to ten years, resulting in lower monthly payments. An interest rate adjustment from 6% to 4% can also help reduce the overall cost of borrowing over time. Implementing a grace period of six months before the new terms take effect can offer temporary relief to borrowers. Additionally, including options for partial forgiveness based on payment history can encourage timely payments, fostering a cooperative relationship between lenders and borrowers.

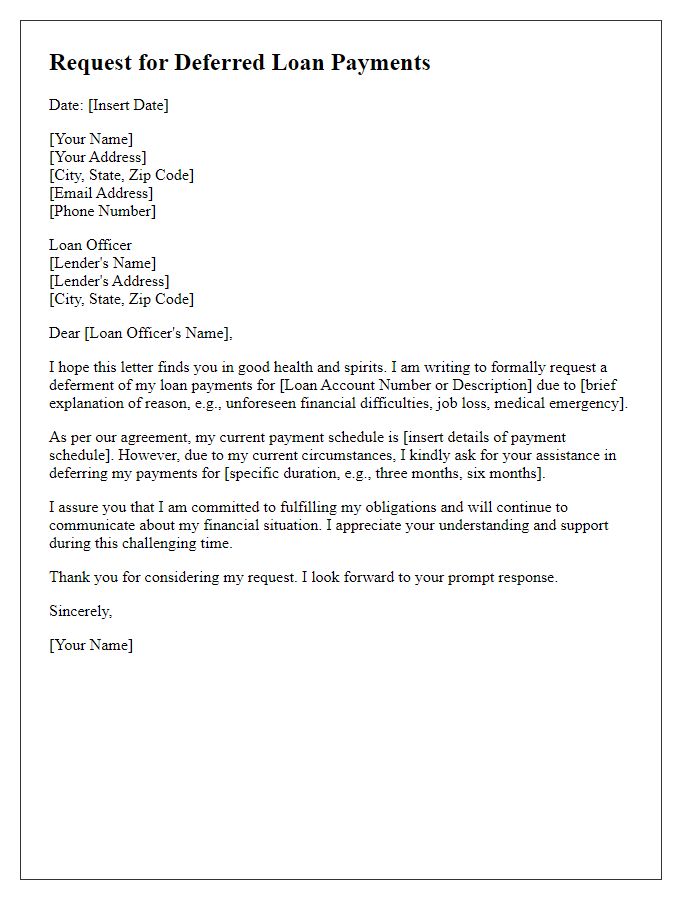

Contact information for further discussion

Restructuring loan repayments involves the possibility of revising existing terms to better accommodate financial circumstances. Contact points such as a financial advisor or loan officer become essential for discussions, allowing clients to articulate their situations clearly and seek feasible solutions. Gathering documentation, including income statements, outstanding balances, and existing loan agreements, aids in presenting a comprehensive view of financial health. Institutions like banks or credit unions may offer various restructuring options, including extended payment periods or adjusted interest rates, depending on individual circumstances. Effective communication with these entities can lead to tailored repayment plans that alleviate financial strain while maintaining credit standing.

Comments