Are you feeling overwhelmed by your current auto loan payments? You're not alone, and there are options available that can ease your financial burden. Adjusting your auto loan payments could be the key to regaining control over your budget and enhancing your financial wellbeing. To discover the steps you can take to modify your payments, keep reading!

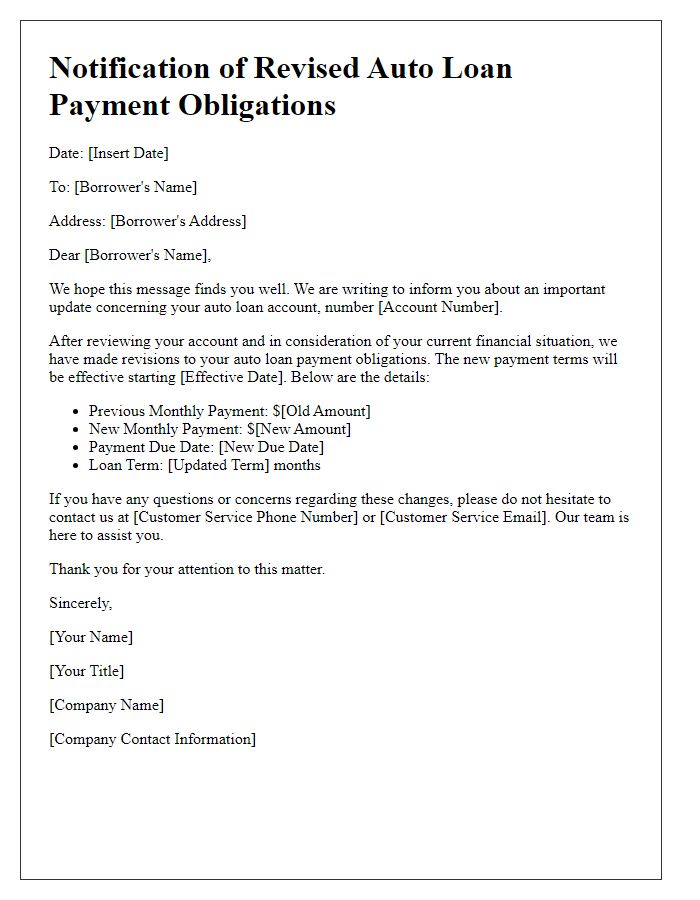

Loan account details

Adjusting auto loan payments can provide relief for borrowers facing financial challenges. Key details include the loan account number, which serves as the unique identifier for the specific loan agreement, typically consisting of 8 to 12 digits. The original loan amount reflects the total borrowed sum, often ranging from $10,000 to $50,000, while the interest rate, which can vary significantly based on credit scores, usually lies between 3% to 10%. Monthly payments, based on the loan term (either 36, 48, or 60 months), typically encompass principal and interest components. Additionally, any missed payments can influence the request for adjustment, emphasizing the necessity of clear communication with lenders to assess the options available, such as deferment, refinancing, or modifications to the payment plan.

Reason for adjustment request

Due to unforeseen financial circumstances, such as unexpected medical expenses or job loss, I need to adjust my auto loan payments. The current monthly payment amounts, which exceed $400, have become challenging to meet. Seeking a more manageable payment plan can help maintain loan compliance and avoid delinquency. By reducing payment obligations, I can stabilize my financial situation and continue making consistent payments, ensuring the loan remains in good standing.

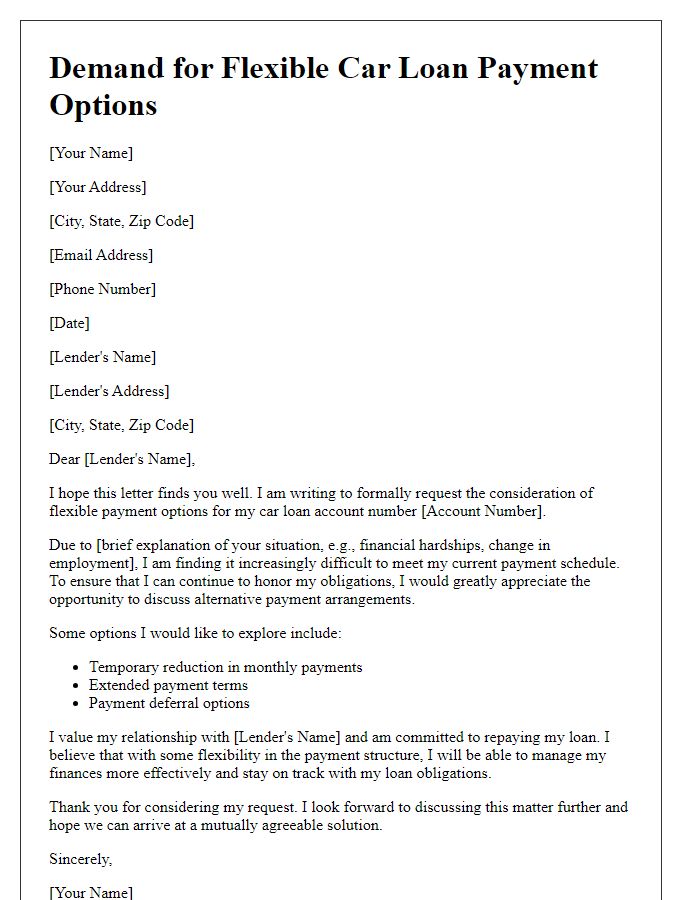

Preferred payment terms

Adjusting auto loan payments can enhance financial flexibility for borrowers facing economic challenges. Loan providers, such as credit unions or banks, often offer options like extended repayment terms or lowered monthly payments. Specifics can include adjusting the loan term duration from 60 months to 72 months, which can reduce monthly obligations significantly--potentially by hundreds of dollars depending on the initial loan amount. Choosing a variable interest rate instead of a fixed rate might appeal to those anticipating falling interest rates in the market over time. Additionally, borrowers may seek deferment options during periods of unemployment or other financial strains, allowing for temporary relief without impacting their credit scores. Open communication with lenders about preferred payment terms is essential for negotiating terms that align with personal financial goals.

Financial documentation

Auto loan payment adjustments may be necessary due to various financial circumstances, including changes in income, unexpected expenses, or life events affecting financial stability. Documentation such as bank statements, pay stubs, and tax returns can be submitted to illustrate the current financial situation. Lenders, including major institutions like Wells Fargo or Chase, often require these documents to assess the borrower's ability to continue meeting payment obligations. A revised payment plan may involve extending the loan term or reducing monthly installments, ensuring that the borrower's financial health remains manageable while maintaining the vehicle, an essential asset valued at an average of $36,000 in 2023. By providing accurate financial documentation, borrowers can establish a case for adjusting their auto loan payments effectively.

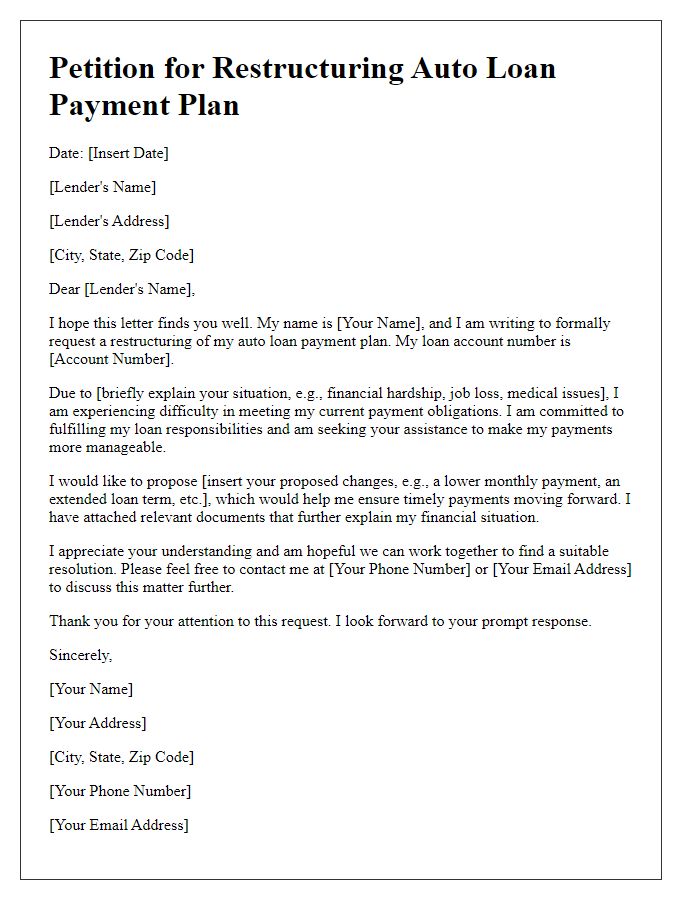

Contact information and signature

Auto loan payment adjustments can often stem from various financial situations, including changes in income, unexpected expenses, or seeking to refinance for better interest rates. Contact information for the loan provider usually includes a customer service hotline, email address, and physical mailing address, allowing borrowers to communicate through their preferred method. A complete signature line must typically contain the borrower's full name, date, and account number for reference, which facilitates the identification of the individual's loan details in the lender's system.

Letter Template For Adjusting Auto Loan Payments Samples

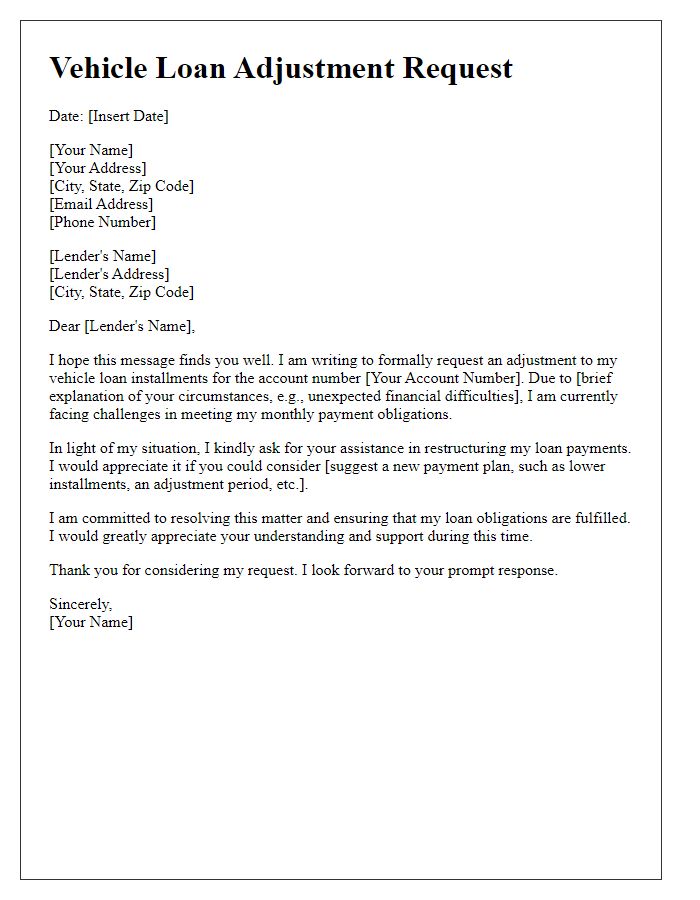

Letter template of correspondence for adjusting vehicle loan installments.

Comments