Are you feeling a little lost when it comes to understanding your family trust? Navigating the ins and outs of beneficiary rights and responsibilities can be quite daunting, especially when it involves such an important matter as family assets. In this article, we'll break down the key elements of family trusts, covering everything from how they work to how they can benefit you and your loved ones. So, grab a cup of coffee and join me as we dive deeper into this topic!

Personal and Trust Information

Beneficiary family trusts serve to manage and protect assets for designated heirs or family members. Such trusts often include intricate personal information, including the names of beneficiaries, specific roles of trustee guardians, and essential tax identification numbers. Relevant trust documents may include the administration details, often specified on the declaration of trust, which outlines the governance of the family estate. Furthermore, information such as the location of the trust, often established in states like California or Florida for favorable tax regulations, plays a critical role in the trust's operational framework. Queries surrounding personal and trust information typically revolve around distribution timelines, asset valuation procedures, and duties of the appointed trustee, ensuring transparency and adherence to legal obligations.

Purpose of the Query

This query regarding the beneficiary family trust seeks clarification on the distribution process and eligibility criteria for beneficiaries entitled to inherit assets and provisions from the trust established in 2022. Concerns focus on the recent changes made by the trustee in the management of funds, specifically the amendments in Section 5B regarding disbursement policies, which may affect quarterly distributions. Additionally, information on the status of the trust's investments in real estate properties, valued at $500,000, located in Los Angeles, and their impact on overall trust performance is requested. Understanding these details is essential for ensuring that all beneficiaries remain informed and have equitable access to the trust assets as intended by the trustor.

Specific Questions or Concerns

A family trust, such as a discretionary trust established in 2020, can serve to provide financial stability and estate planning flexibility. Beneficiaries often have specific queries regarding distributions and tax implications. Understanding the trustee's responsibilities is crucial for transparency in financial matters. For instance, knowing how the trust's income is calculated helps beneficiaries assess potential distributions. Additionally, concerns related to changes in trust laws, such as modifications in tax regulations, can impact beneficiaries differently based on their relationship to the trust. Engaging with a legal professional specializing in trusts can clarify these complexities and ensure that beneficiaries are well-informed about their rights and responsibilities within the trust framework.

Contact and Response Details

Beneficiary family trusts involve specific legal structures and responsibilities for asset management. The Trust Document outlines the obligations of trustees and beneficiaries, detailing how income and principal distributions are managed. Contact details typically include the name of the trust, trustee information, and official mailing addresses for correspondence, ensuring queries are directed correctly. Response details should indicate timelines for inquiries, often specified within 30 days, to provide clarity and efficiency for beneficiaries seeking information. Transparent communication fosters trust among family members and ensures accurate understanding of trust operations and benefits.

Enclosures or Supporting Documents

Beneficiary family trusts require detailed documentation to ensure compliance with legal and tax obligations. Supporting documents may include the trust deed, outlining the specific terms and conditions of the trust, and the List of beneficiaries, detailing all individuals or entities entitled to benefits. Tax returns from the previous year may also be necessary to assess the trust's tax status and obligations. Identification documents, such as social security numbers or tax identification numbers, are essential for all beneficiaries to facilitate accurate reporting. Bank statements may be required to track trust distributions, ensuring transparency and accountability. Lastly, any correspondence related to the trust management or changes in beneficiary status must be included to maintain accurate records.

Letter Template For Beneficiary Family Trust Query Samples

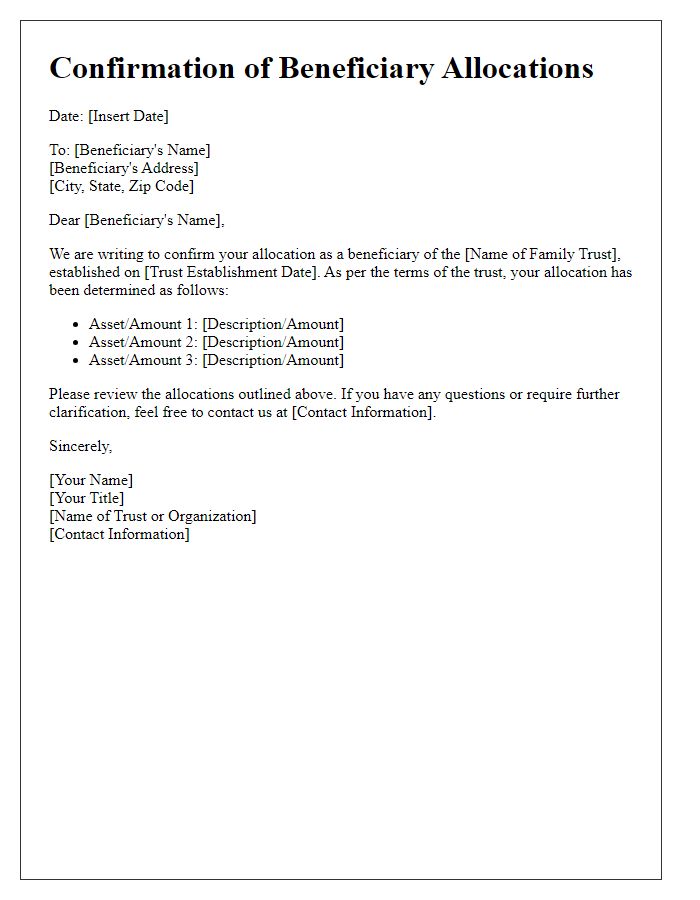

Letter template of confirmation needed for family trust beneficiary allocations.

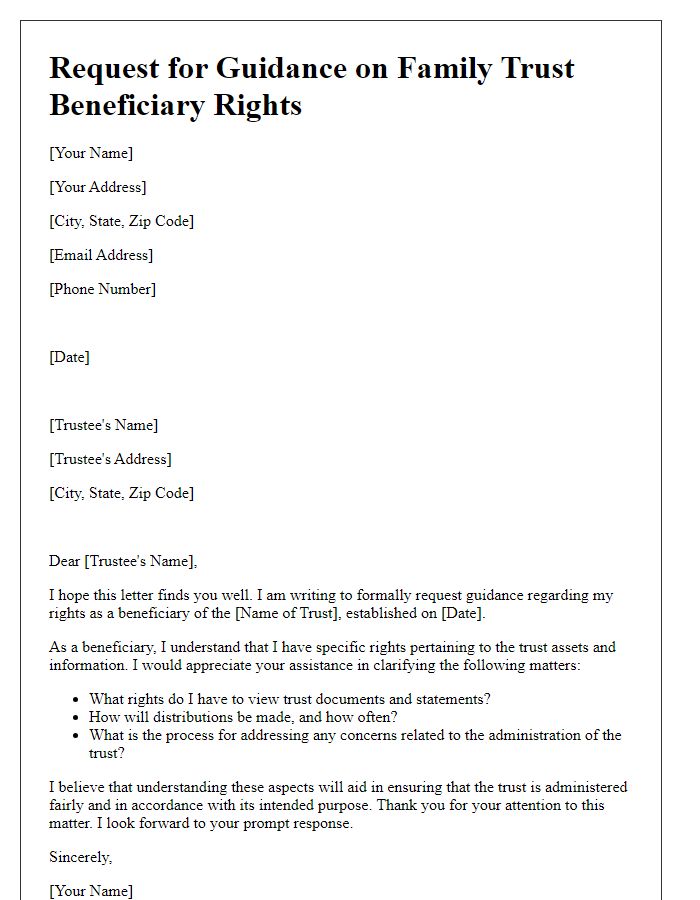

Letter template of guidance request for family trust beneficiary rights.

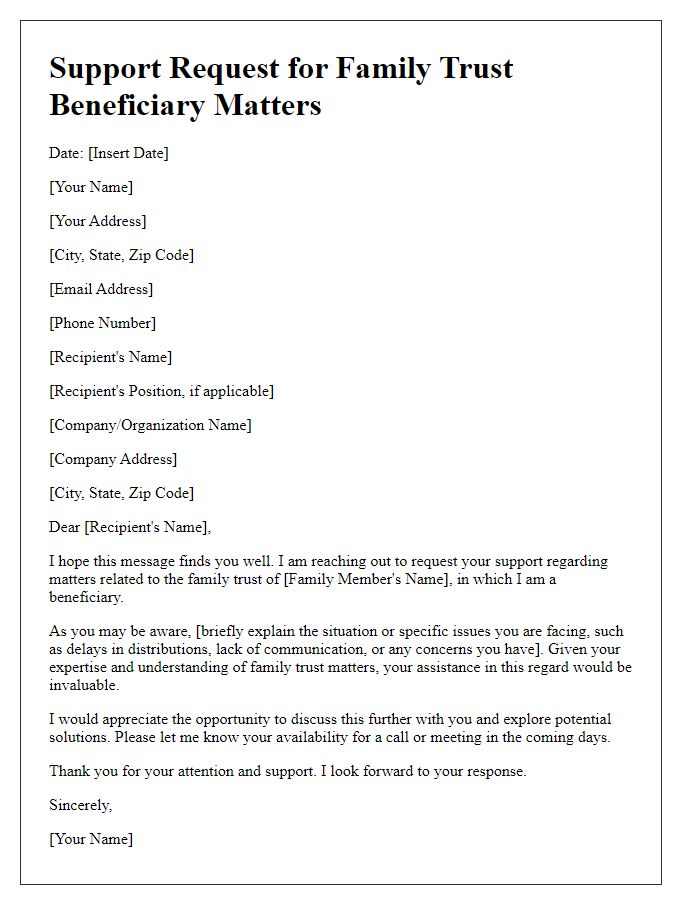

Letter template of support request for family trust beneficiary matters.

Comments