Are you facing the overwhelming weight of debt and seeking a way to find relief? Understanding the debt settlement process can be the key to regaining your financial freedom, and crafting a well-researched proposal is an essential first step. In this article, we will guide you through the components of an effective beneficiary debt settlement letter, ensuring you present your case clearly and professionally. So, let's dive in and explore how you can take control of your financial future!

Clear Identification of Parties

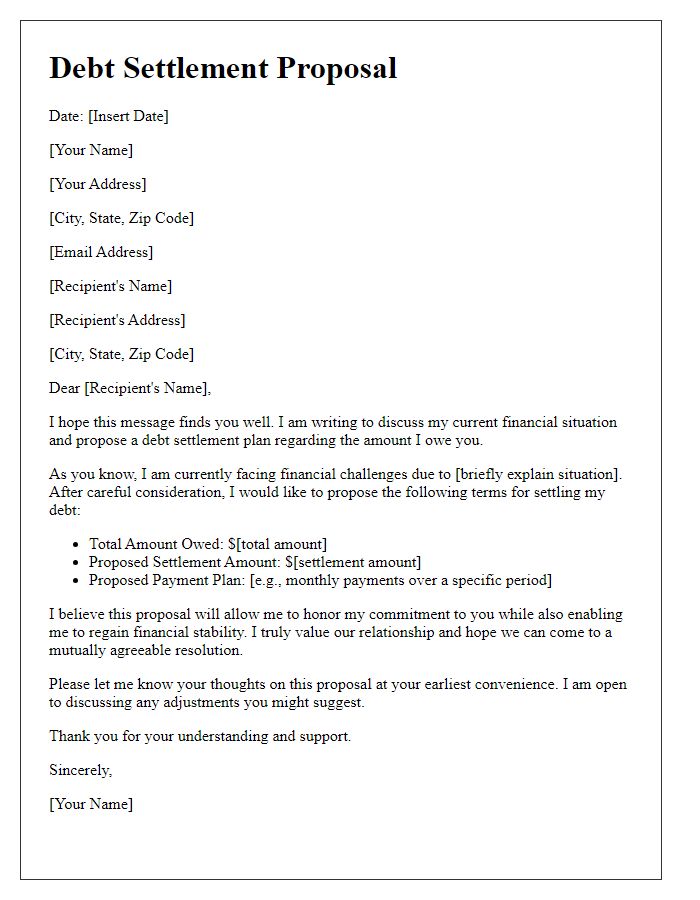

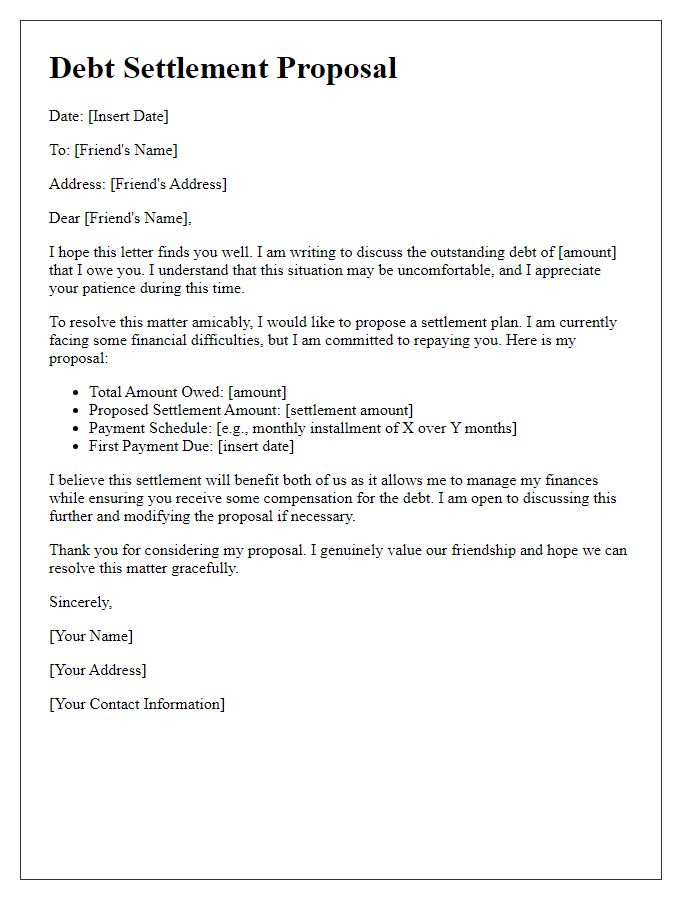

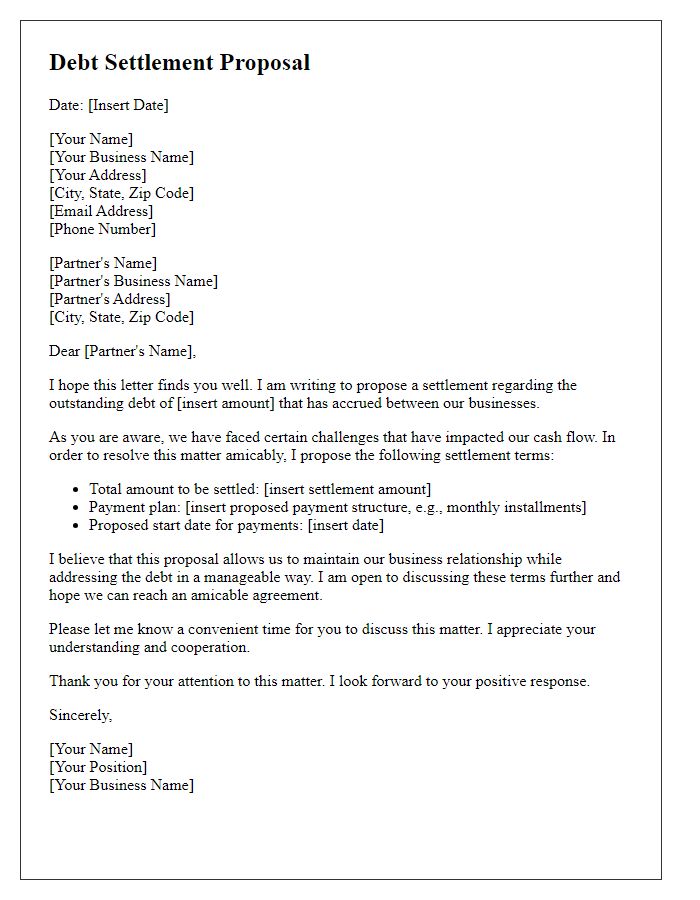

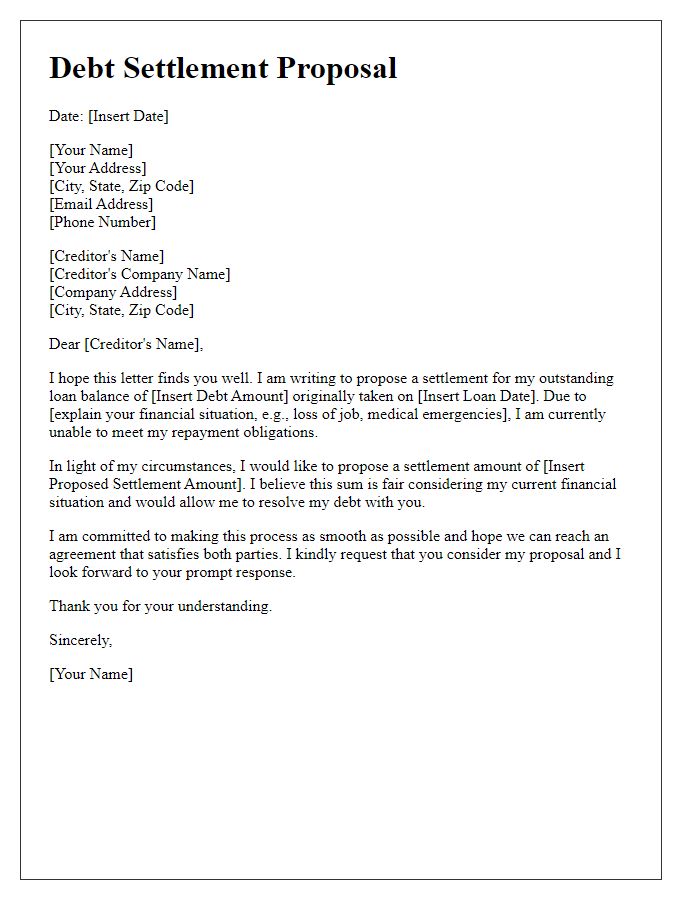

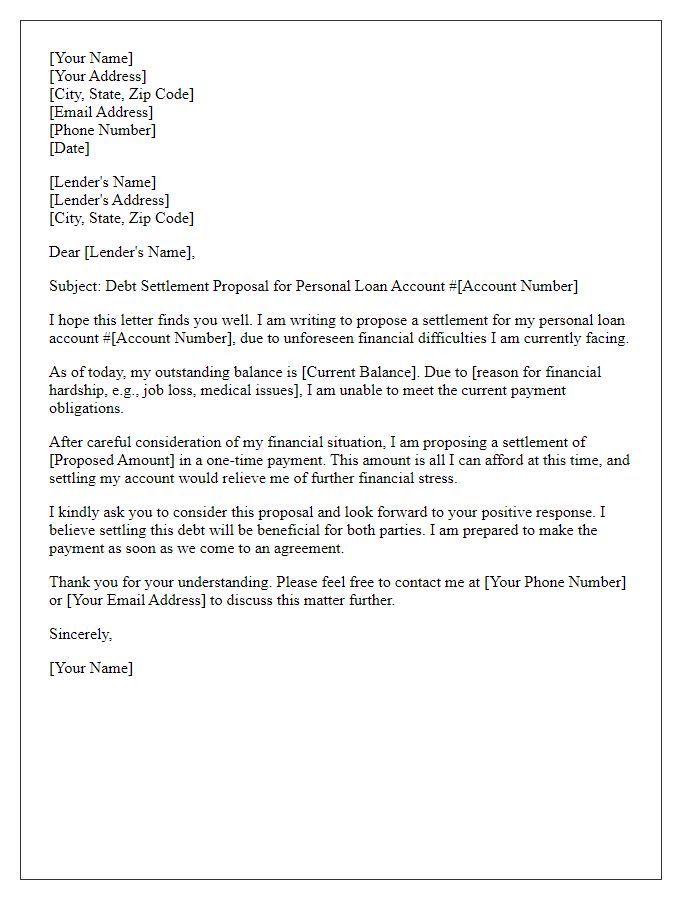

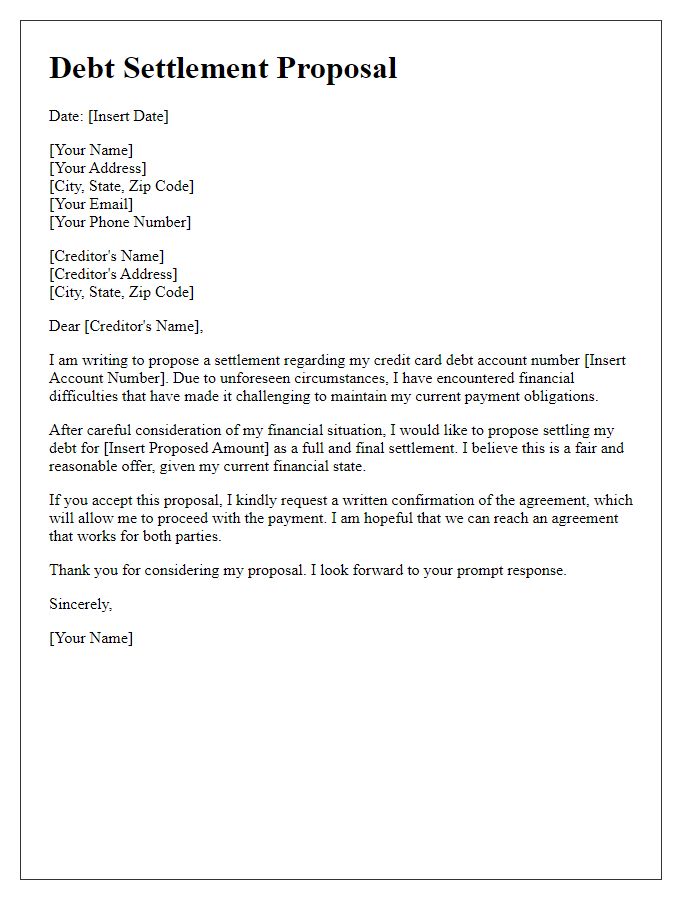

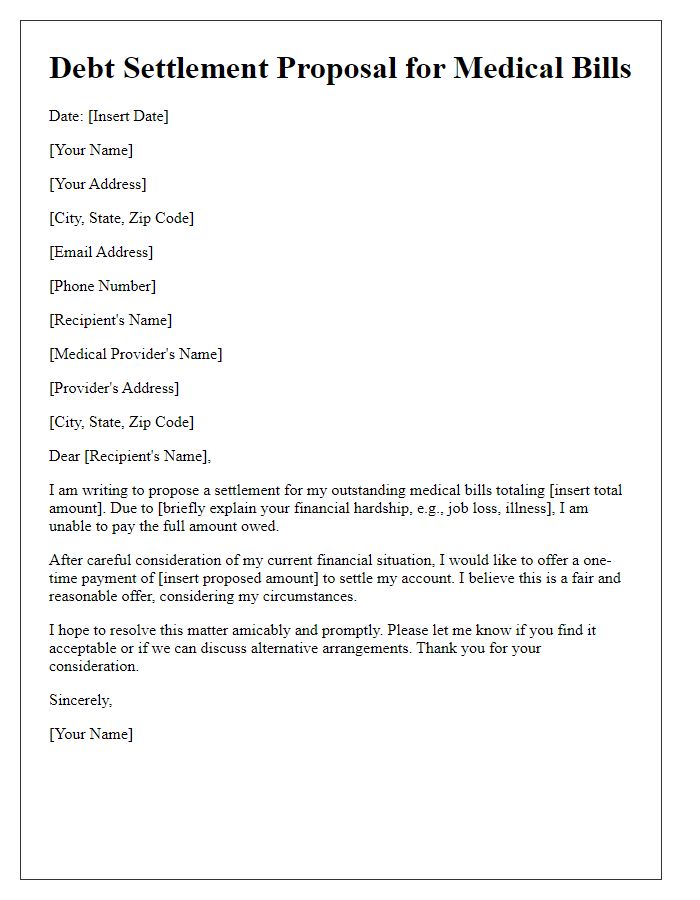

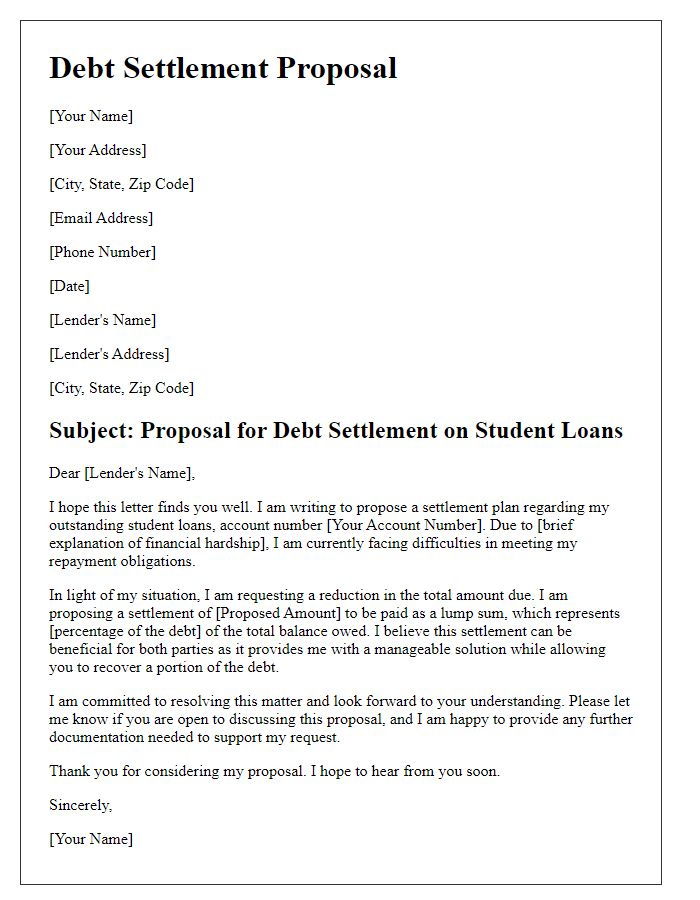

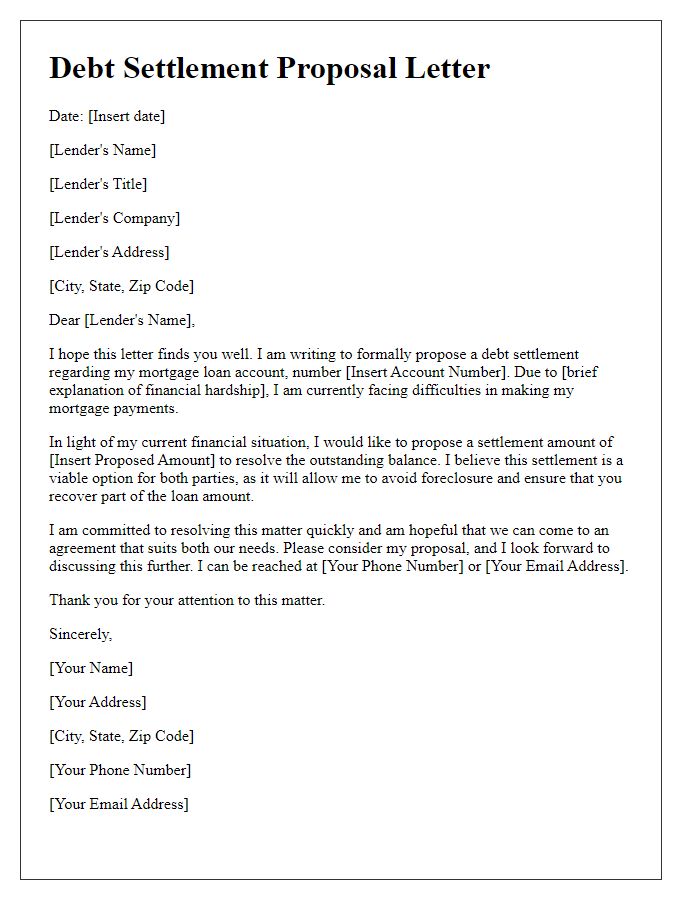

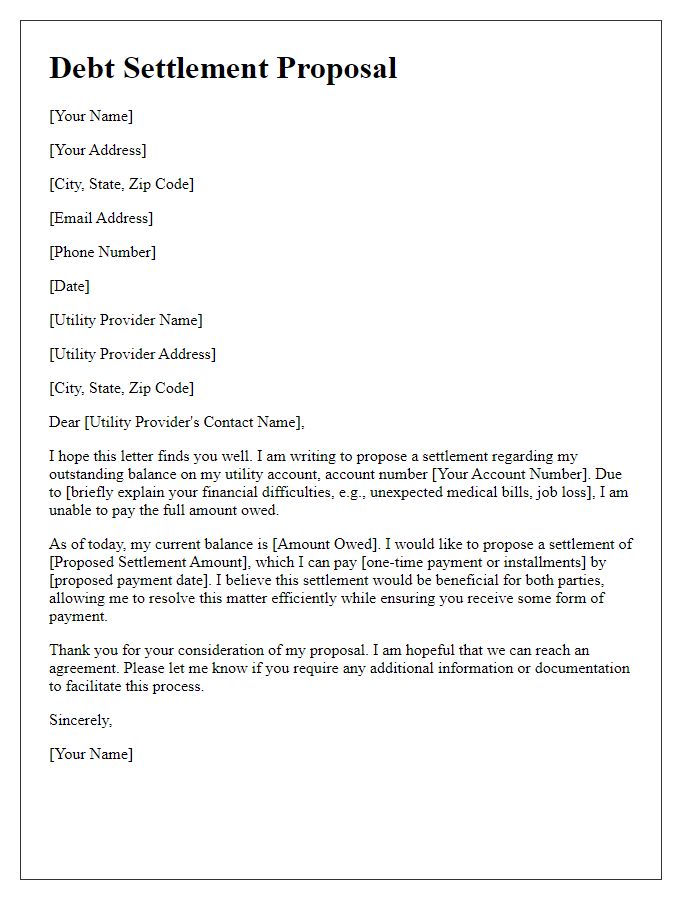

A beneficiary debt settlement proposal requires clear identification of parties involved in the agreement. This includes the debtor, defined as the individual or entity responsible for the outstanding debt, and the creditor, the individual or institution that is owed money. Both parties should be accurately named with their full legal names, addresses, and contact information to ensure that all documentation is legally binding and easily verifiable. Additionally, important entities such as financial institutions or collection agencies linked to the debt may be referenced to clarify their roles. This thorough identification helps ensure transparency and fosters trust between parties throughout the settlement process.

Detailed Debt Information

Detailed debt information is crucial for negotiating a debt settlement proposal, particularly for individuals facing financial difficulties. Total amount owed often includes principal balances, late fees, and interest rates, which can vary from lender to lender. For instance, credit card debt can be compounded monthly, with rates ranging from 15% to 25% annually, leading to significant increases in the total outstanding balance. In California (with debt settlements often averaging around 40% of total debt), it is essential to list specific accounts, including the creditor's name, account number, and current outstanding balance for transparency. Additionally, documenting any previous payment arrangements or settlement offers can strengthen the proposal negotiation process by showcasing good faith efforts. Collecting this information prepares individuals to present a comprehensive picture to creditors, increasing the likelihood of achieving favorable settlement terms.

Settlement Offer Terms

A debt settlement proposal outlines the terms of an agreement between a debtor and a creditor, aimed at resolving outstanding financial obligations. Key components include the total outstanding debt amount, often reflecting sums exceeding $10,000, the proposed settlement figure, usually a fraction of the original debt, such as 30-50%, and the suggested payment timeline, commonly spanning three to six months. Essential details must include the debtor's name, creditor details, and associated account numbers. Additionally, the proposal may contain specific contingencies, such as the requirement for written confirmation of the settlement and the assurance that the creditor will update credit reports to reflect the settled status. Clear communication regarding any potential tax implications, based on IRS guidelines on forgiven debt exceeding $600, is also critical.

Payment Method and Schedule

A well-structured beneficiary debt settlement proposal outlines a clear payment method and schedule to ensure timely and organized repayment. The proposal should specify the total amount owed, detailing any agreements on reduced payment amounts, and the rationale behind these terms. It should include a proposed payment plan, for example, monthly installments over six months, providing specific dates such as the first of each month for consistency. Furthermore, acceptable payment methods must be outlined, including bank transfers, checks, or digital payment services like PayPal. Clarity around fees or penalties for late payments can also be beneficial, while an emphasis on open communication channels for questions or concerns enhances trust between parties involved.

Request for Written Agreement

In the debt settlement process, a definitive agreement is essential for establishing clear terms and conditions between the creditor and the debtor. A well-drafted proposal ensures that both parties understand the obligations and expectations involved. The letter should detail the total amount owed (for example, $10,000), the proposed settlement figure (perhaps a reduced amount of $6,000), and the payment timeline (over 6 months). Additionally, it must include a request for a written agreement to formalize the settlement arrangement. Such an agreement protects against future disputes, ensuring that once the agreed payment has been completed, the creditor will not pursue the remaining balance. Thorough documentation of all communication, including the date of the initial agreement and any relevant account numbers, is crucial for maintaining a clear record of the settlement.

Comments