Are you considering the best way to grow your savings? If so, understanding the fixed deposit reinvestment option could be a game changer for your financial plans. This approach not only allows you to earn interest on your investment but also provides a seamless way to compound your returns over time. Let's dive deeper into how this option works and why it might be the perfect fit for your future savings strategy.

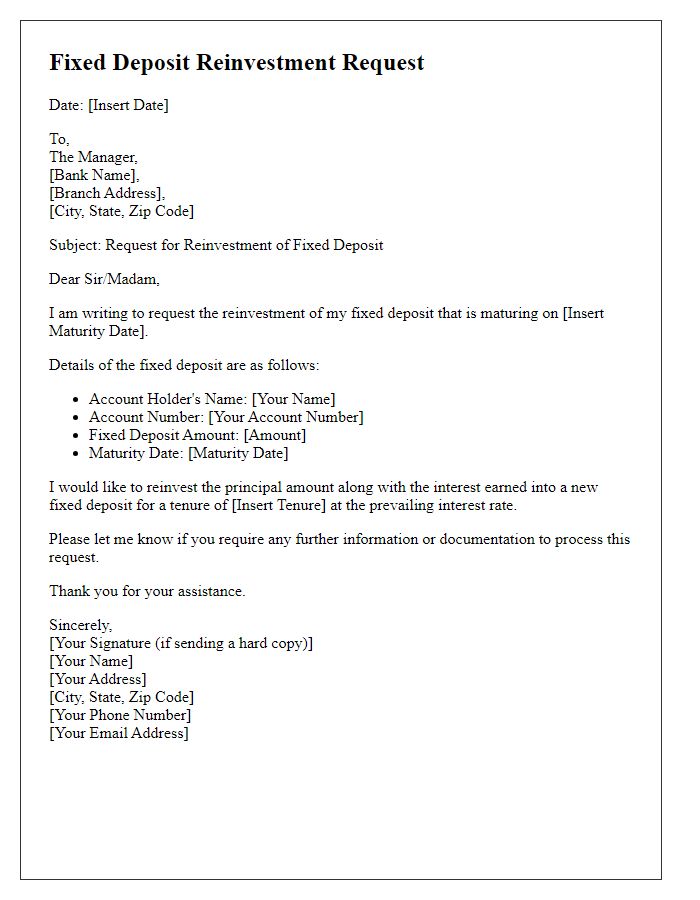

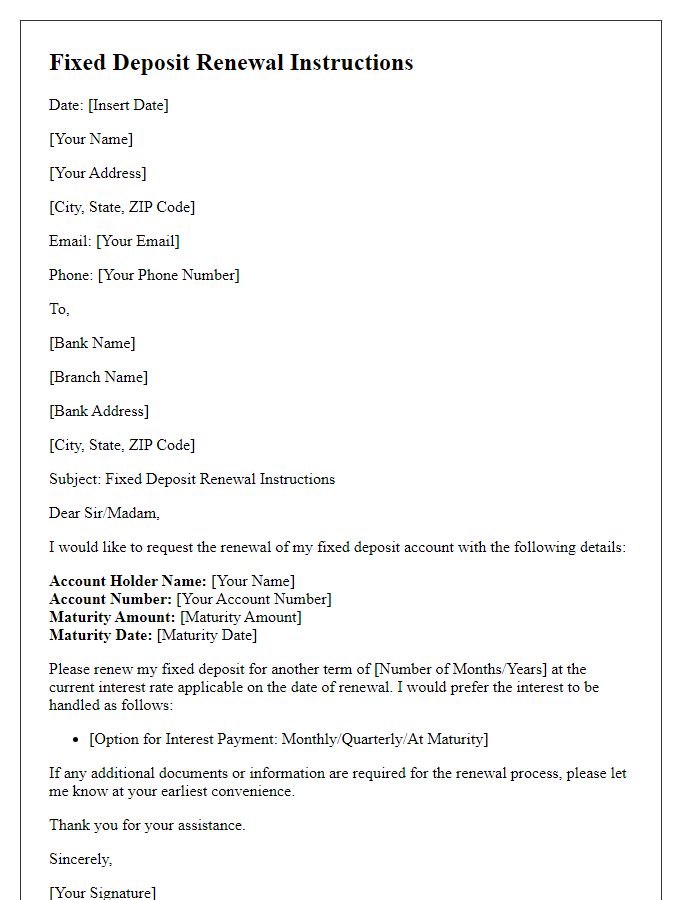

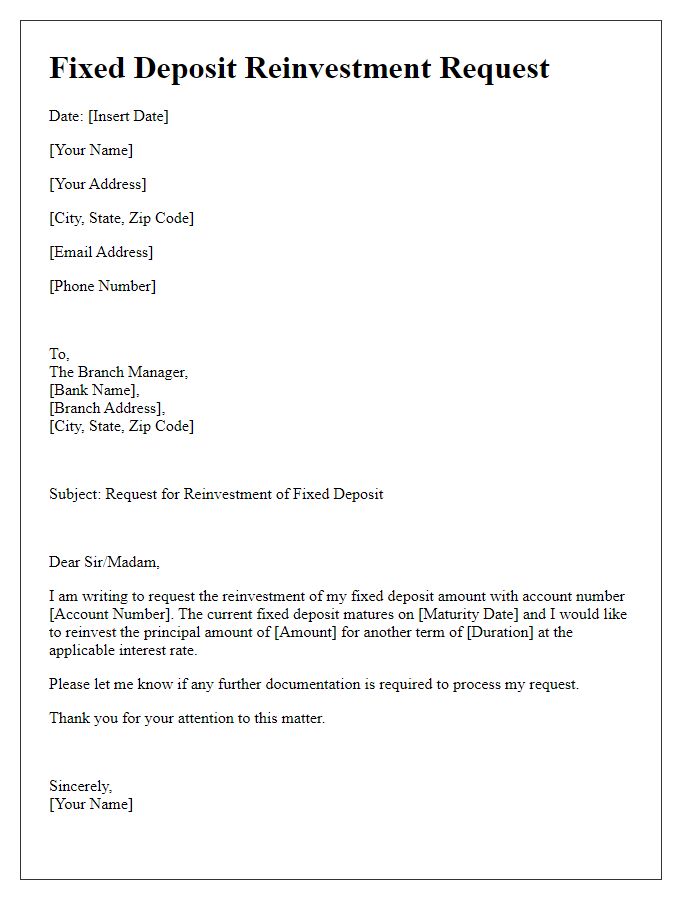

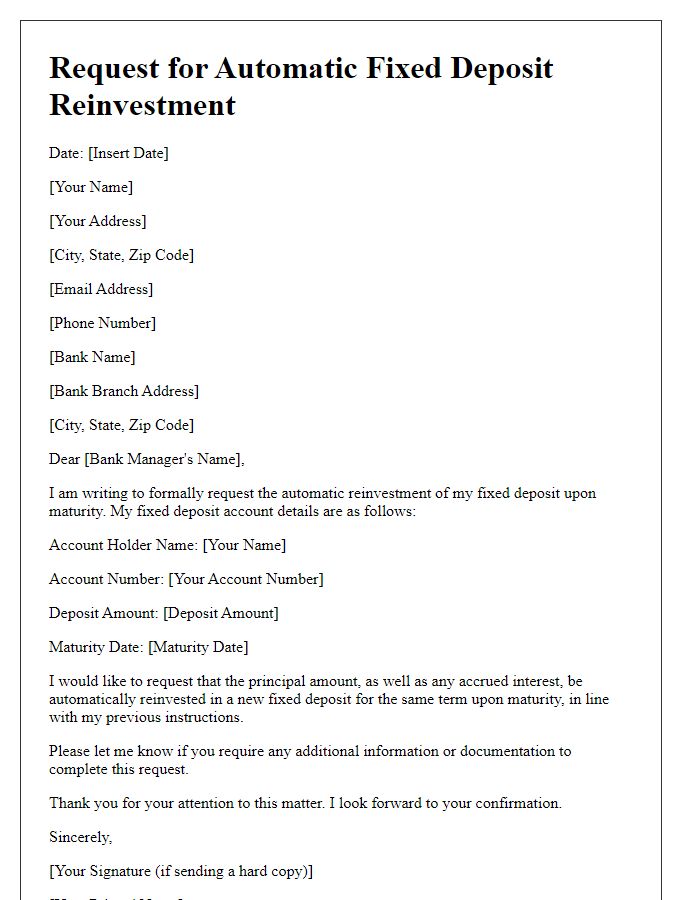

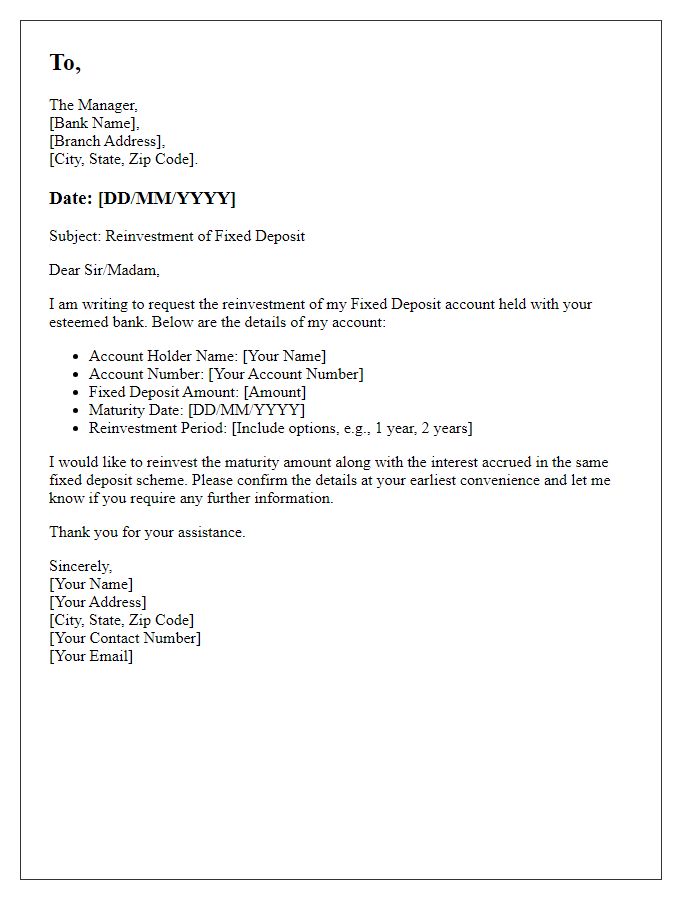

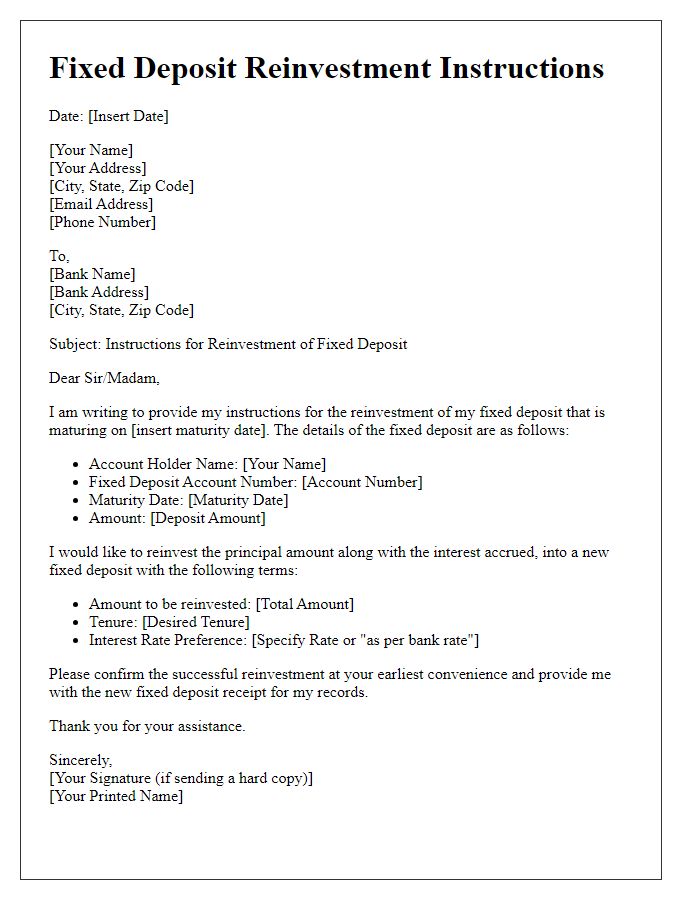

Account Holder's Information

Fixed deposit reinvestment options can provide an effective way to grow savings over time. For account holders, such as individual savers or corporate entities, selecting to reinvest fixed deposits (FDs) often enables the capital to benefit from compound interest. Typically, banks offer different FD schemes, with tenures ranging from 7 days to 10 years, depending on customer preferences. The prevailing interest rates, often influenced by the repo rate set by the central bank, are critical in determining potential earnings. Moreover, timely reinvestment upon maturity, usually at the preferred branch, ensures that the interest accumulation continues without interruption. In some institutions, quarterly or monthly interest payouts may be an option, offering flexibility in cash flow management. This approach can lead to maximized returns, especially when the customer opts for the cumulative interest plan, where interest is reinvested along with the principal.

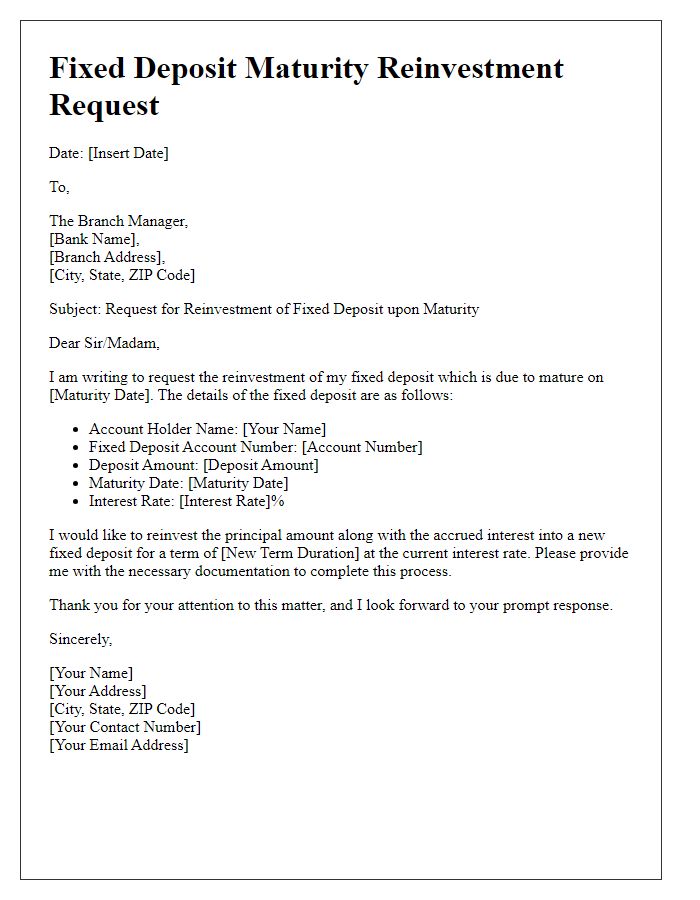

Fixed Deposit Account Details

A fixed deposit account offers a secure investment option for individuals seeking stable returns. Commonly associated with banks and financial institutions, fixed deposits typically require a minimum investment amount, such as $1,000. The tenure can range from a few months (3-6 months) to several years (3-5 years), with interest rates often varying depending on market conditions, currently averaging between 4% to 7% per annum, depending on the financial institution. When opting for reinvestment, interest accrued is added back into the principal investment, compounding the returns over time. This strategy is particularly advantageous in maximizing yields, as it enables the investor to benefit from higher interest calculations as the principal grows. Additionally, fixed deposits are often insured up to a certain limit, providing an extra layer of security for investors in countries like the United States where the Federal Deposit Insurance Corporation (FDIC) covers deposits up to $250,000 per depositor per bank.

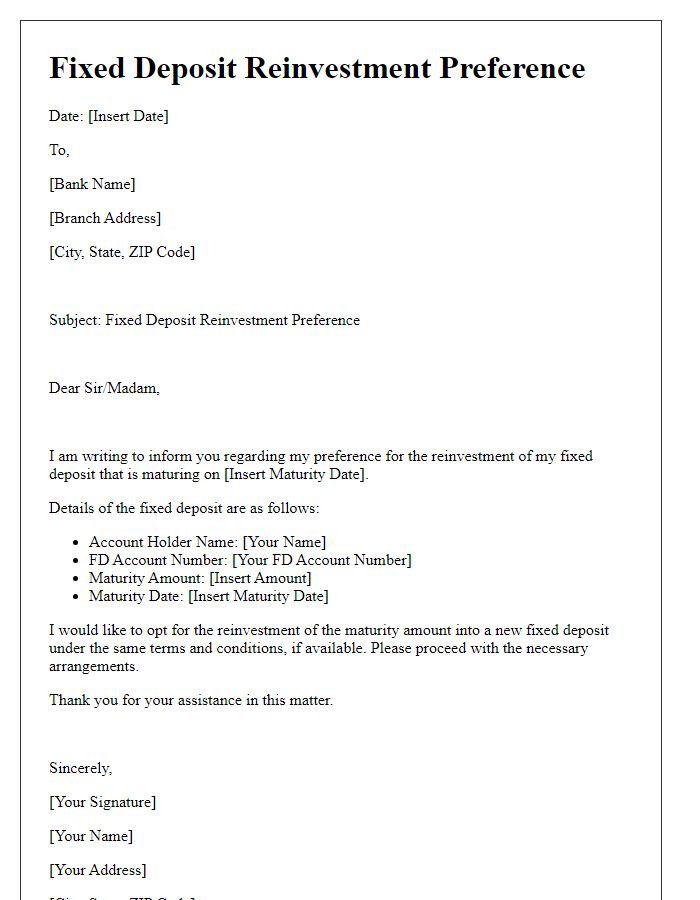

Reinvestment Option Choice

Fixed deposit reinvestment options provide investors with flexibility and potential growth opportunities. Financial institutions, like banks, often offer fixed deposit accounts with varying tenures, interest rates, and reinvestment features. Choosing the reinvestment option allows interest earnings to be added back into the principal amount, compounding growth over time. Typically, the interest rate for reinvestment can be more favorable compared to regular payouts, enhancing the investment's overall yield. Account holders should review policies regarding reinvestment periods, as many banks (like State Bank of India or HDFC Bank) may require specific timeframes for such options to be activated. Effectively, this decision can significantly influence future financial goals, especially when considering inflation and market volatility impacts.

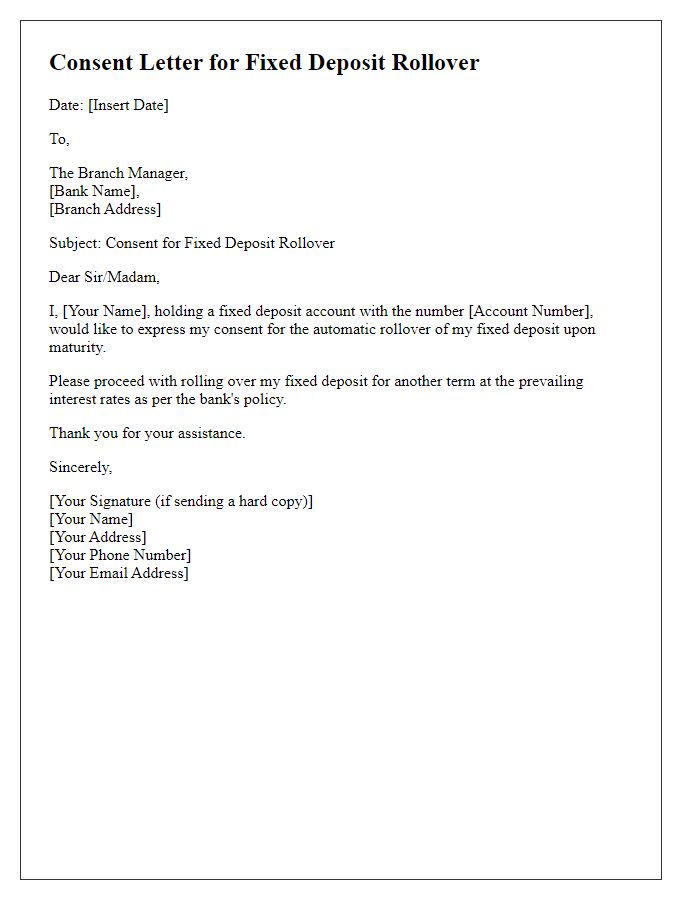

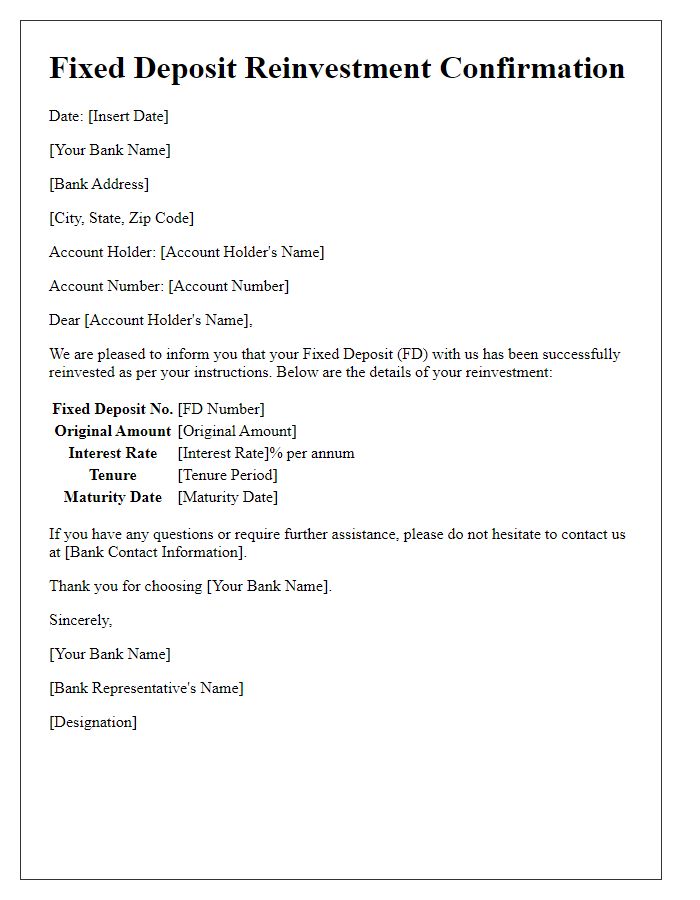

Authorization and Signature

To ensure fixed deposit reinvestment options are seamless, customers must provide clear authorization and signature. The fixed deposit account (FD account) number serves as identification, typically a six to twelve-digit reference, allowing banks to verify details. The reinvestment option generally allows compounding interest benefits over a tenure ranging from one month to ten years. Clients should specify the preferred tenure for reinvestment, which influences interest rates applicable to the new deposit. Signature verification against the bank's records ensures accountability and protects against unauthorized changes. Proper completion of these formalities enhances financial security and aligns with banking regulations.

Contact Information

Fixed deposit reinvestment options allow investors to maximize returns on interest generated from their deposits. Financial institutions, such as banks or credit unions, typically offer this feature, allowing customers to reinvest the accrued interest into additional fixed deposits. For example, a fixed deposit with a tenure of 5 years at an interest rate of 6% per annum could yield significant returns when compounded yearly. Contact information is essential for processing reinvestment requests, ensuring efficient communication between customers and institutions. Typically, contact methods include phone numbers, email addresses, and physical branch locations, allowing customers to inquire about terms, conditions, and rates associated with reinvestment.

Comments