Are you tired of missing payment deadlines or juggling multiple due dates? Setting up recurring payments can simplify your life and ensure your bills are paid on time, every time. In this article, we'll walk you through the easy steps to establish a recurring payment setup that fits your needs. So grab a cup of coffee and let's dive in!

Payment schedule and frequency

Recurring payment setups often include specific payment schedules and frequencies tailored to customer needs. A typical setup may involve weekly, bi-weekly, or monthly payment intervals. For instance, a monthly payment schedule could align with the first day of each month, impacting billing cycles significantly. Payment frequencies might vary based on services such as subscription plans, gym memberships, or utility bills. Key considerations involve the total amount due (e.g., $49.99), payment method (credit card, bank transfer), and the duration of the agreement (e.g., 12 months). Additionally, automated reminders (via email or SMS) can help ensure timely payments, reducing the risk of late fees or service interruptions.

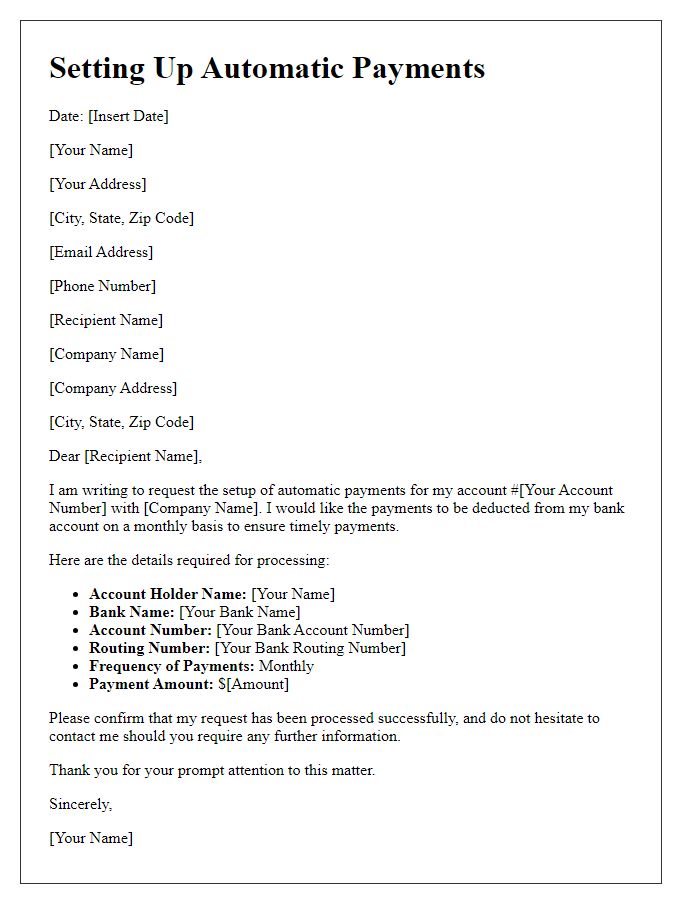

Bank account details and information

Setting up recurring payments can simplify financial management for both individuals and businesses. Typically, this process involves providing specific bank account details, including the account number, routing number, and the bank's name. For instance, users might be required to fill out a direct debit authorization form to authorize automatic withdrawals. Important information such as payment frequency (weekly, monthly, or annually) and amounts should also be clearly specified. Security measures, such as encryption and secure transfer protocols, protect sensitive information during the setup. Keeping a record of all transactions is essential for ensuring accountability and managing budgets effectively.

Authorization and consent statements

Recurring payment setups require clear authorization and consent from the account holder to ensure compliance with various financial regulations. Authorization may include a detailed description of the payment amount, frequency (weekly, monthly, annually), and duration of the agreement. The account holder must provide personal information such as name, bank account details (account number, routing number), and payment method. Consent statements should highlight the right to revoke authorization at any time with appropriate notice, typically 30 days. Additionally, organizations must disclose any fees associated with the recurring payments, such as transaction fees or penalties for insufficient funds. Clear communication regarding how the account holder can access payment history and contact customer service for inquiries can enhance trust and transparency in the process.

Contact information for queries

Recurring payment setup instructions provide essential guidance for users wishing to automate their billing. Users typically need to navigate to their account settings on the payment platform, such as PayPal or Stripe, to enable this feature. They must select the billing frequency, which can range from weekly to monthly, and input relevant payment details, including bank account or credit card information. For any inquiries or support, users should contact customer service directly via the help center or designated email address, often found in the platform's contact section. Additionally, phone support may be available for urgent issues, providing another avenue for assistance.

Terms and conditions of recurring payment

Recurring payment setups often involve automatic transactions that occur at defined intervals, such as monthly or annually, between a payor and a payee. These transactions usually require clear terms and conditions to ensure both parties understand the financial obligations. Key aspects include payment methods (credit card, bank account), frequency of payments (monthly on the 1st, quarterly), cancellation policies (30 days' notice), and conditions regarding price changes (notification period). Clear definitions regarding billing statements, due dates, and failure to pay policies can prevent misunderstandings. Transparent communication promises a smooth financial relationship, encouraging trust and compliance.

Comments