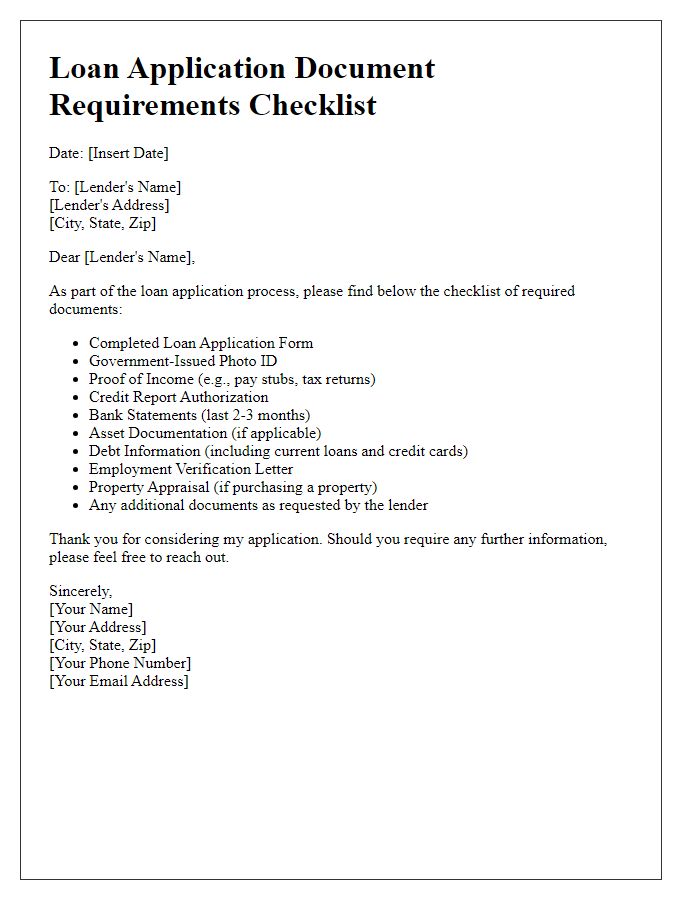

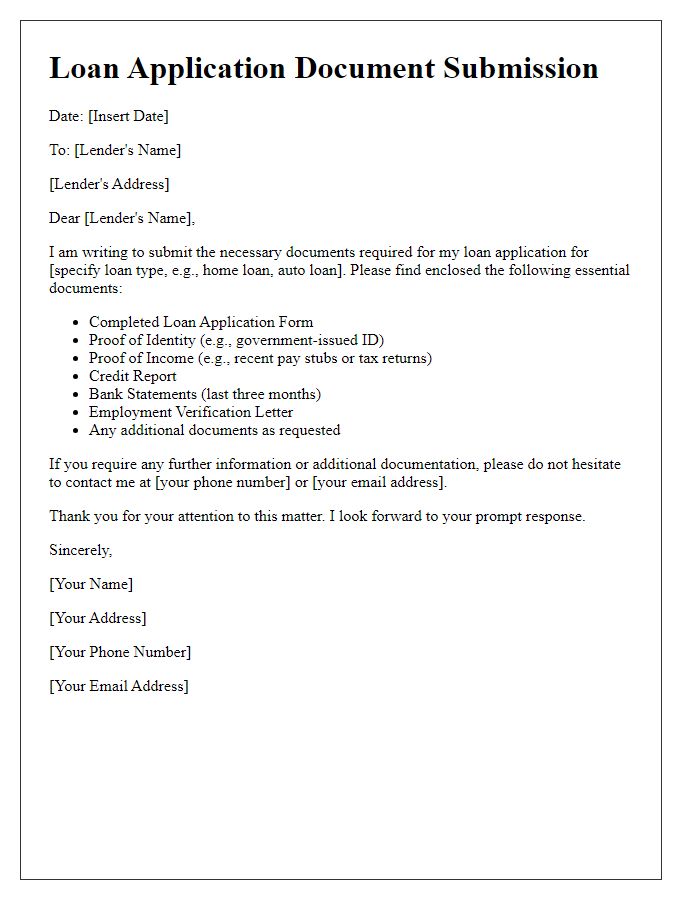

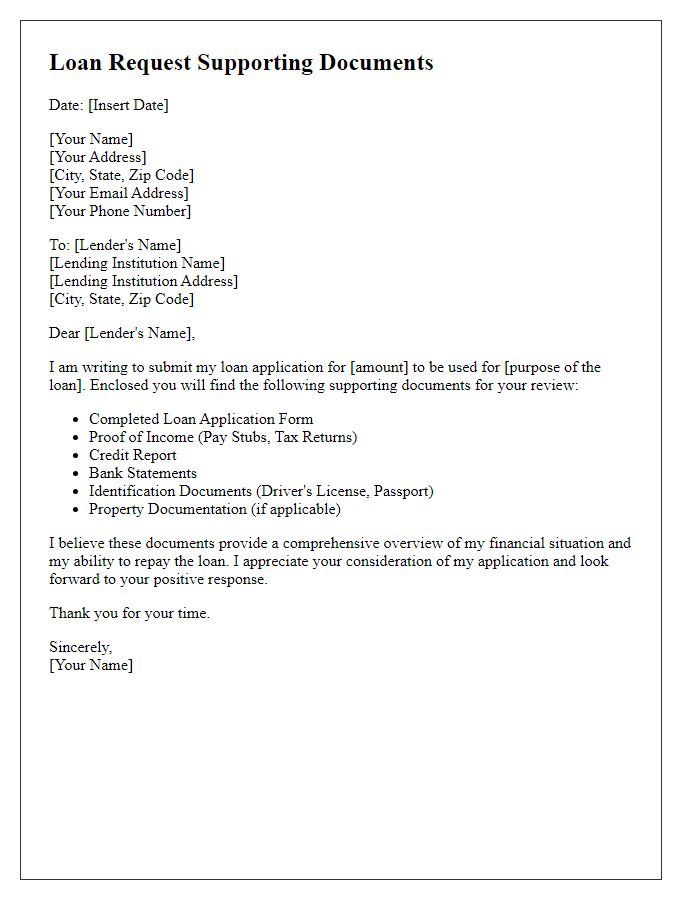

Are you ready to secure that much-needed loan but feeling overwhelmed by the documentation process? It's completely normal to feel a bit lost when it comes to gathering all the necessary paperwork. In this article, we'll break down a simple checklist to streamline your loan application experience and increase your chances of approval. So, let's dive in and make this process as easy as possible â read on to get started!

Proof of Identification

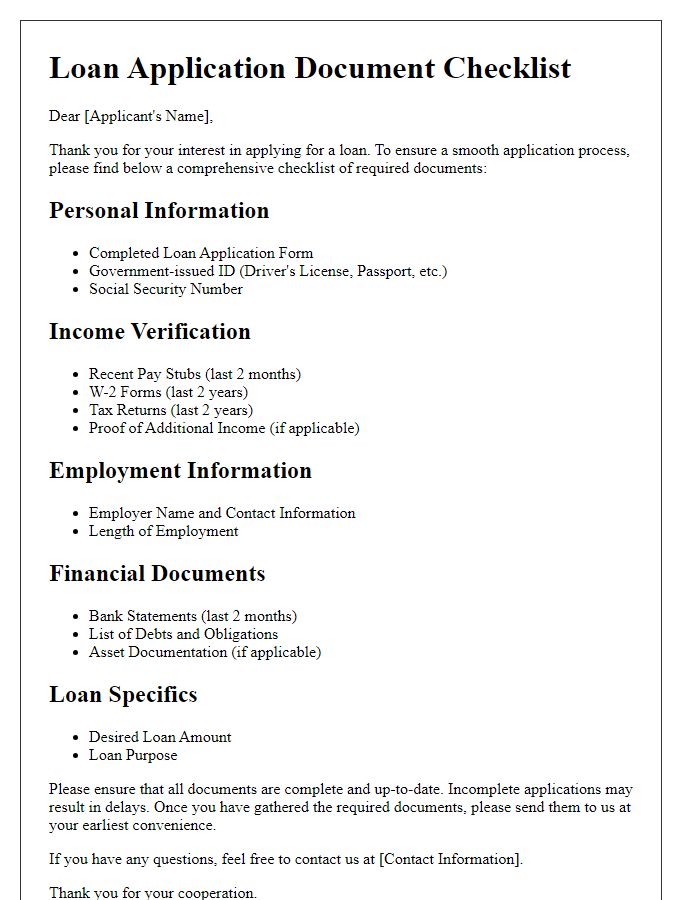

A robust loan application process typically requires essential documentation to verify the applicant's identity. Proof of identification can include government-issued ID cards such as a driver's license or passport, which contain critical information like the applicant's full name, date of birth, and photograph. Some lenders might also accept secondary forms of identification, which could encompass a Social Security card or a recent utility bill showing the applicant's current address. In many cases, identification must be valid and not expired, ensuring compliance with regulations. Accurate and prepared documentation can expedite loan processing, reducing potential delays and facilitating smoother transactions.

Income Verification Documents

Income verification documents serve as crucial proof of financial stability and reliability in loan applications. These include recent pay stubs (usually the last two or three consecutive pay periods), W-2 forms from the previous year (tax forms reflecting employee wages), and tax returns (1040 forms for individuals, often for the last two years). Self-employed individuals might require profit and loss statements (detailed records of income and expenses) along with 1099 forms (reports of income earned from various sources). Additionally, bank statements (typically the last two or three months) showcase regular deposits and financial behavior. Each document helps lenders assess borrowing capacity and repayment ability, ensuring informed lending decisions.

Employment Verification

Employment verification is a critical step in the loan application process, especially when financial institutions assess borrowers' creditworthiness. Essential details include the borrower's current employer name, such as "XYZ Corporation," along with the contact number, typically a direct line to the human resources department. Verification letters should confirm employment status, including duration--often requiring a minimum of two years--job title, and annual income, which might be requested on a standard form or business letterhead. Additional documentation may encompass recent pay stubs or tax returns to substantiate income claims. Incomplete or inaccurate employment verification can delay loan processing, potentially impacting the borrower's ability to secure financing.

Credit History Report

A comprehensive credit history report serves as a critical document in the loan application process, detailing an individual's creditworthiness. This report typically includes essential information such as outstanding debts, payment history, credit inquiries, and public records like bankruptcies or foreclosures. Lenders utilize this information to assess risk and determine loan approval and interest rates. Credit history reports are available from major credit bureaus like Equifax, Experian, and TransUnion, which maintain extensive data on consumer credit activities. Accurate reports are vital for borrowers, as discrepancies can lead to unjust loan denial or unfavorable terms, necessitating regular monitoring and dispute resolution when needed.

Collateral Documentation

Collateral documentation is essential for securing loans against assets, such as property, vehicles, or equipment. A comprehensive collateral documentation checklist includes essential items like property deeds (legal documents evidencing ownership), vehicle titles (official certificates of ownership for cars, trucks), and inventory lists (detailed records of business assets with estimated values). Supporting documents should also encompass appraisals (professional evaluations determining the market value of an asset), insurance policies (documents guaranteeing the protection and value of secured assets), and financial statements (records detailing the borrower's overall financial health). Additionally, liens (claims against assets due to unpaid debts) must be disclosed to ensure transparency and assess the priority of claims. This thorough approach safeguards the interests of lenders and borrowers during the loan process.

Comments