Are you feeling overwhelmed by debt and unsure of how to tackle it? A well-structured debt recovery plan can provide clarity and a path forward, enabling you to regain control of your finances. In this article, we'll explore a comprehensive outline that will guide you step-by-step through creating your personalized recovery strategy. So, if you're ready to take the first step towards financial freedom, read on!

Debtor's Personal and Financial Information

Debtor's personal and financial information gathers essential data for effective debt recovery strategies. Personal details include full name, known aliases, date of birth, and current residential address. Financial information encompasses employment status, monthly income, bank account details, and existing financial obligations, such as loans or credit card debts, providing a clear picture of the debtor's financial situation. Additional data points like credit score (typically ranging from 300 to 850), payment history, and any past bankruptcies (including Chapter 7 or Chapter 13 filings) further assist in tailoring recovery efforts. Understanding this landscape allows for informed decisions when negotiating repayment terms or considering legal actions in debt resolution processes.

Detailed Debt Overview and Breakdown

A detailed debt overview provides a comprehensive analysis of outstanding liabilities, highlighting the principal amounts owed, interest rates, and the respective creditors involved. For instance, a consumer may face credit card debt totaling $15,000 with an average interest rate of 18%, owed to major banks such as Chase and Bank of America. Additionally, a student loan of $30,000 may have a fixed interest rate of 5%, managed by the loan servicer Navient. Moreover, medical bills resulting from treatments may account for $2,500, leading to collections from healthcare providers like Blue Cross Blue Shield. This breakdown not only clarifies the financial obligations but also allows individuals to prioritize repayment strategies based on the types of debt and the severity of interest accumulation. Understanding each debt's terms and conditions enables effective negotiation for potential deferments or reduced payment plans, ultimately paving the way towards financial recovery.

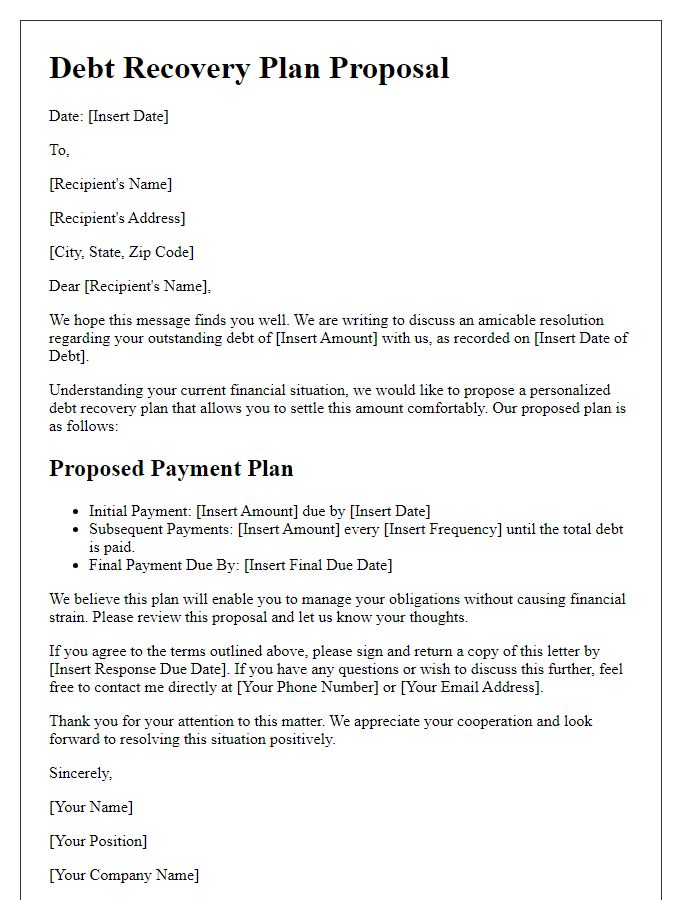

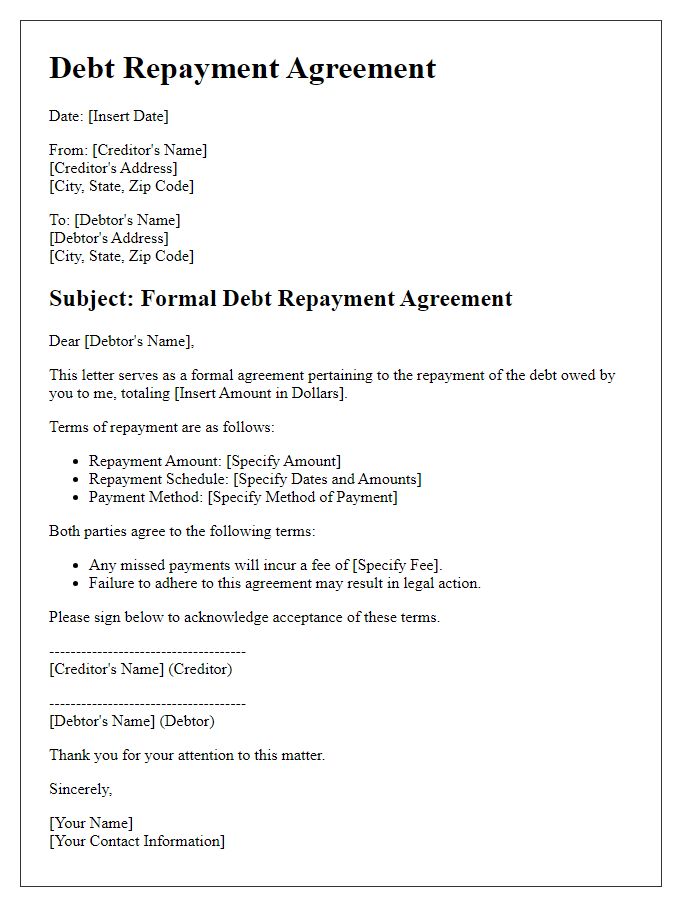

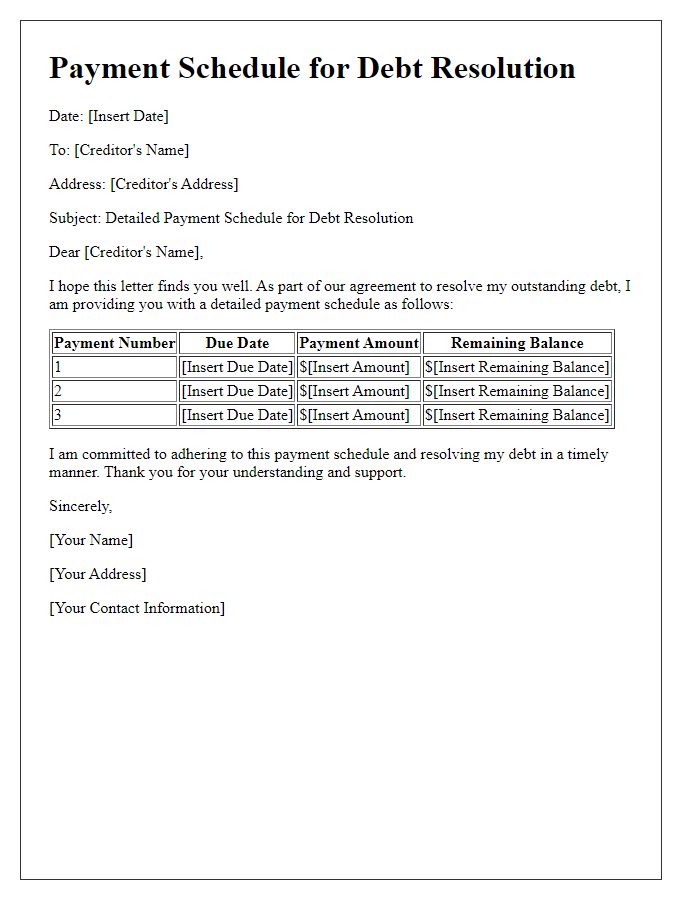

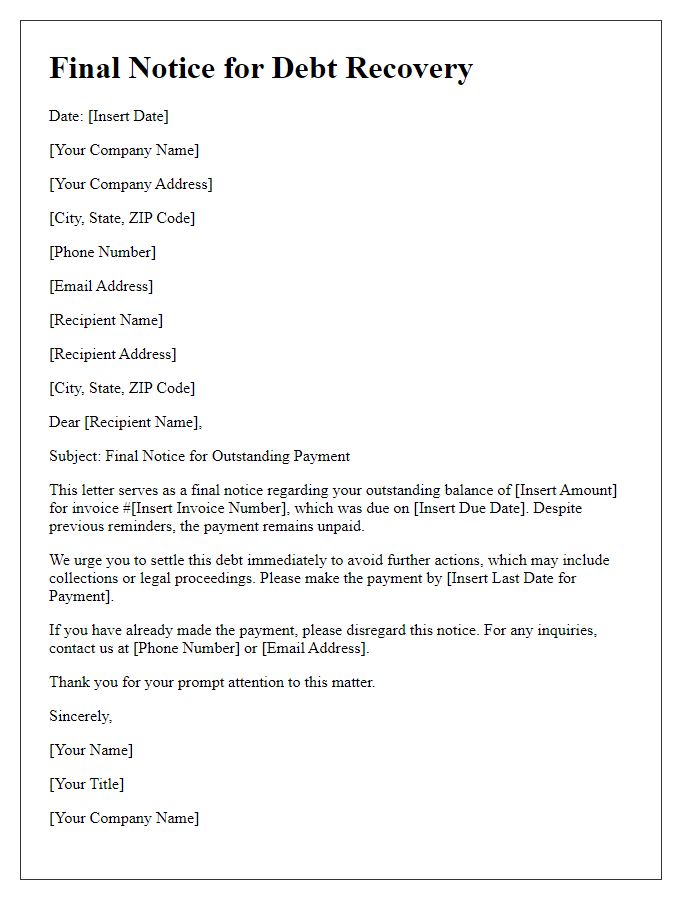

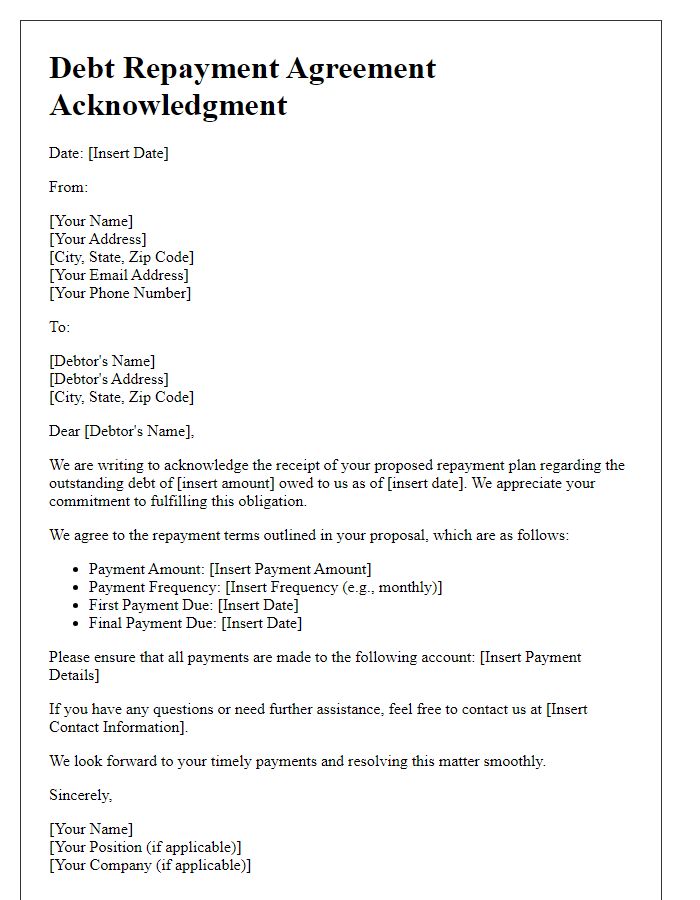

Proposed Repayment Schedule and Terms

A well-structured debt recovery plan outlines a proposed repayment schedule and terms for settling outstanding debts, such as credit card balances or personal loans. The schedule typically includes specific monthly payment amounts, due dates, and total debt to be repaid, ensuring clarity on obligations. For instance, a plan might designate payments of $200 per month for a total outstanding debt of $5,000, aiming to eliminate the debt over 25 months. Additionally, terms might specify interest rates, such as a reduced rate of 5% during the repayment period, and guidelines for missed payments, which may incur penalties or affect credit scores. Establishing a clear communication protocol for updates and adjustments fosters transparency and accountability, crucial for both creditor and debtor in managing repayment responsibilities.

Benefits of Adhering to Plan and Consequences of Default

Adhering to a debt recovery plan offers numerous benefits, including improved financial stability and the potential for a healthier credit score. Engaging in a structured repayment schedule fosters discipline and accountability, enabling individuals to regain control over their financial situation. For example, timely payments can lead to lower interest rates on future loans, saving hundreds of dollars over time. Conversely, defaulting on a debt recovery plan can result in severe consequences, such as legal action and wage garnishment. Additionally, missed payments may lead to higher interest rates, thereby exacerbating financial struggles and making the path to recovery more challenging. In extreme cases, defaults can lead to bankruptcy filings, significantly impacting one's financial health for years to come.

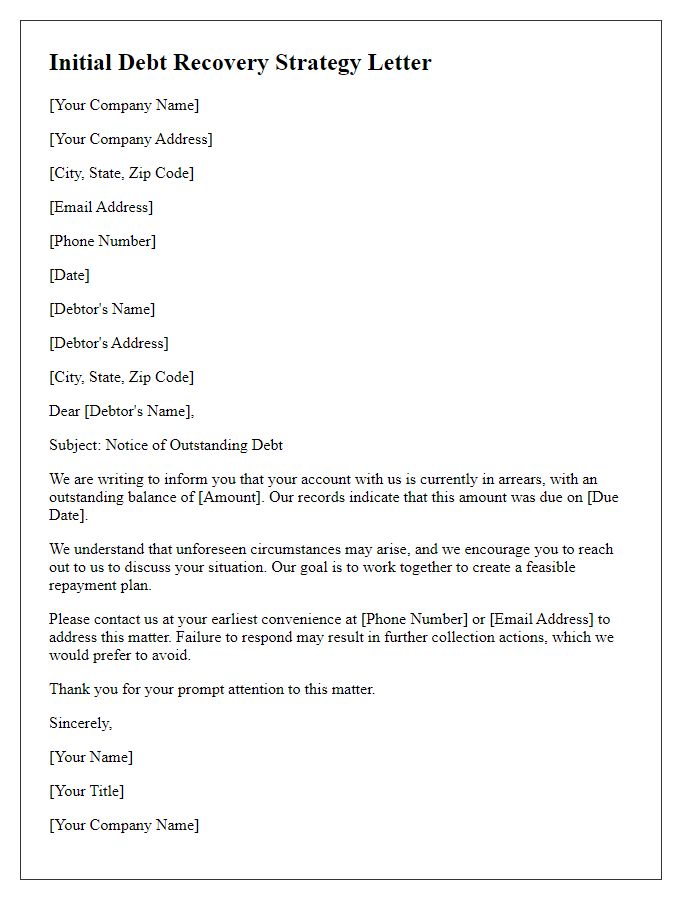

Contact Information for Assistance and Negotiation

A debt recovery plan necessitates clear contact information to facilitate assistance and negotiation regarding outstanding debts. Including a primary point of contact, such as a dedicated collections officer based at a specified location like the corporate office in New York City, ensures efficient communication. Providing multiple channels, such as a direct phone line (e.g., +1 212-555-0199) and an official email address (e.g., recovery@companyname.com), allows for various avenues of outreach. Additionally, listing alternative representatives, available during different business hours, can enhance accessibility. Each representative should possess detailed knowledge of the company's policies regarding financial recovery as well as the specific situation of the debtor to ease negotiations and encourage prompt resolution.

Comments