Are you feeling overwhelmed by high consumer loan interest rates? You're not alone, as many borrowers are seeking ways to alleviate their financial stress. In this article, we'll explore effective strategies to negotiate a reduction in your loan interest rates, maximizing your savings and improving your overall financial health. So, let's dive in and discover how you can take control of your loans and potentially save big!

Personal Information and Loan Details

Many consumers seek relief from high interest rates on personal loans, which often carry annual percentage rates (APRs) ranging from 10% to 36%. Factors contributing to these rates include credit scores (usually below 650 for higher rates), loan amounts, and repayment terms (typically from 12 to 60 months). Personal loans may be secured or unsecured, affecting potential interest reductions. Refinancing options can exist through banks, credit unions, or online lenders, potentially facilitating rates as low as 5% for qualifying borrowers. Maintaining timely payments can also enhance credit scores, opening doors for future negotiations on lower interest rates.

Reason for Requesting Interest Reduction

High-interest rates on consumer loans, particularly those exceeding 25 percent APR, can significantly impact monthly budgets. Many borrowers face financial challenges, such as unexpected medical bills or job loss, leading to increased difficulty in making timely payments. A reduction in interest rates, even by a few percentage points, can lower monthly payment amounts and total repayment costs, ultimately aiding borrowers in regaining financial stability. Institutions like credit unions or lenders with customer-friendly policies often offer programs for interest reductions when proven financial distress is documented, benefiting both parties by promoting responsible lending practices.

Supporting Financial Documentation

Supporting financial documentation is essential for requesting a reduction in consumer loan interest rates, enabling lenders to assess borrowers' financial situations accurately. Pay stubs (typically reflecting the last two months) serve as proof of income stability, while bank statements (from the past three months) outline savings and regular transactions. A recent credit report reveals creditworthiness, highlighting existing debts and payment histories. Furthermore, tax returns (from the last two years) present a comprehensive overview of annual earnings and tax liabilities. Any relevant financial hardship documentation, such as medical bills or job loss letters, can also substantiate the need for reduced interest. Collectively, these documents facilitate informed decision-making, enhancing the potential for interest rate adjustments.

Agreement to New Terms and Conditions

Consumers seeking a reduction in loan interest can benefit from negotiating new terms. A consumer loan, typically offered by banks or credit unions, allows individuals to borrow money for various purposes. Reducing interest rates can significantly lower monthly payments and overall repayment costs. It is essential to clearly outline the request for new terms in a formal communication, referencing the specific loan agreement number and current interest rate. Emphasizing the borrower's payment history and any financial hardship may improve the chances of reaching a favorable agreement. Documenting the agreement of new terms and conditions ensures both parties are aware of their responsibilities and obligations moving forward.

Contact Information and Follow-Up Plan

In the landscape of personal finance, consumer loans often carry significant interest rates, impacting repayment costs over time. For example, a loan of $10,000 with a 15% annual percentage rate (APR) can accumulate over $4,000 in interest over a five-year period. Borrowers seeking interest reduction may consider contacting financial institutions, such as banks or credit unions, to negotiate lower rates. Establishing a follow-up plan is crucial for maintaining communication; potential steps include scheduling monthly check-ins or setting reminders for quarterly reviews of loan terms. It is important to document conversations and responses for reference. Understanding options such as loan refinancing or consolidation can yield substantial savings, allowing borrowers to retain more disposable income for essential expenses.

Letter Template For Consumer Loan Interest Reduction Samples

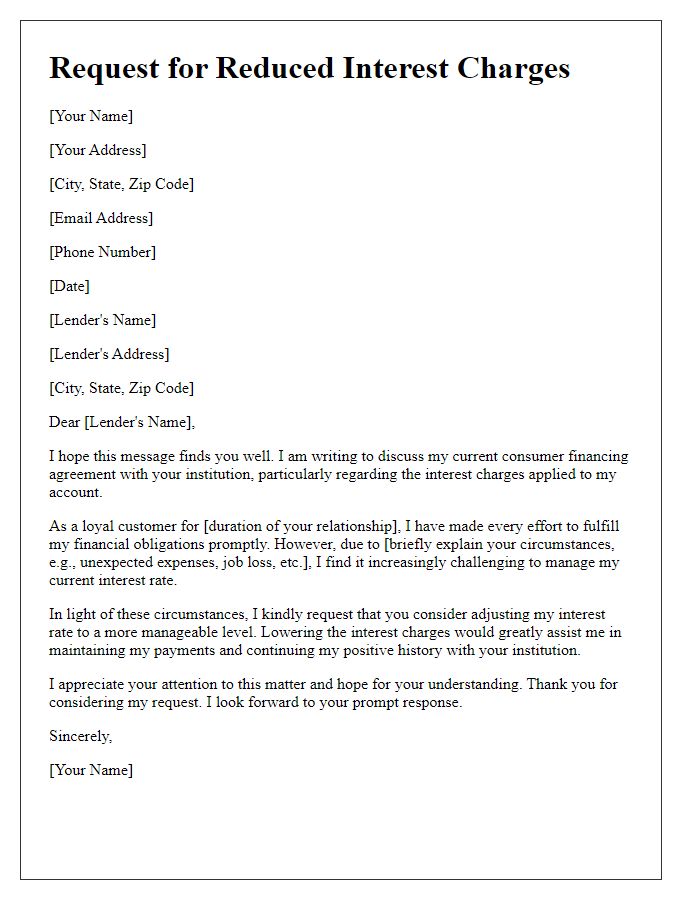

Letter template of solicitation for reduced interest charges on consumer financing

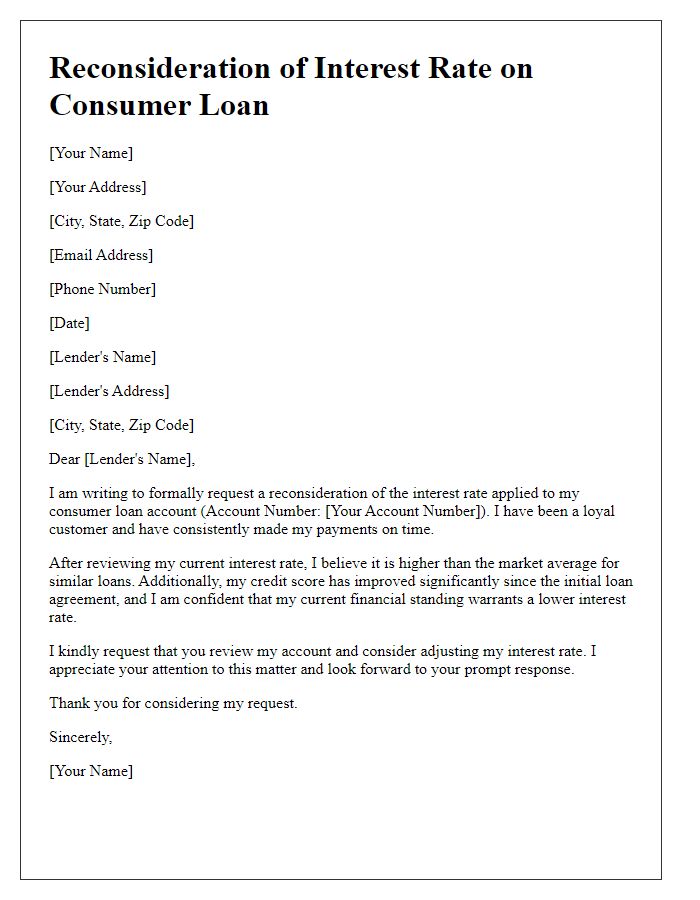

Letter template of demand for interest rate reconsideration on a consumer loan

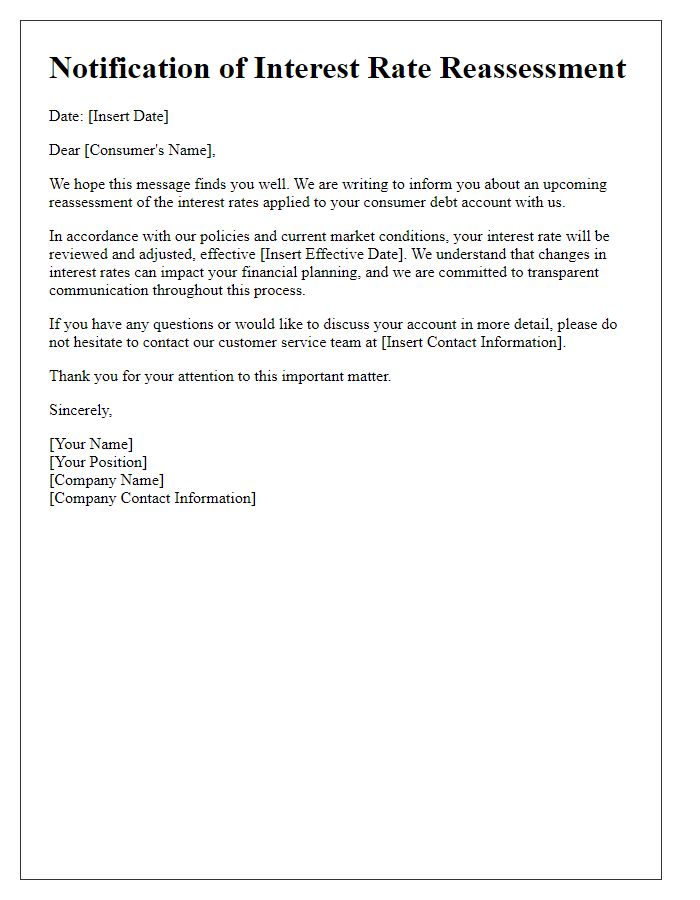

Letter template of notification for interest rate reassessment on consumer debt

Letter template of formal request for a lower interest rate on existing loan

Comments