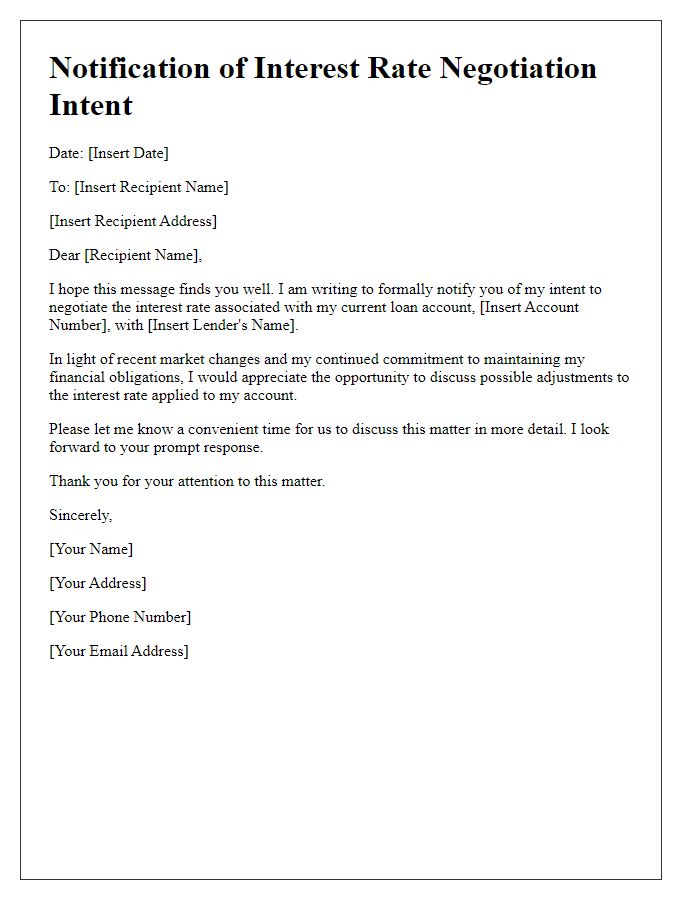

Are you looking to negotiate a better interest rate on your loans or credit agreements? It can be daunting, but with the right approach, you can achieve significant savings. In this article, we'll provide you with a comprehensive letter template that outlines your proposal clearly and effectively. So, let's dive in and discover how you can take charge of your financial future!

Purpose and Context

Interest rate negotiation proposals, essential in financial transactions, often arise in contexts such as mortgage agreements, business loans, and credit cards. With current average rates for 30-year fixed mortgages hovering around 7.3% across the United States, understanding market fluctuations is crucial for borrowers. Negotiating lower interest rates can potentially save thousands of dollars in repayment, making the proposal process vital for stakeholders involved. Key factors such as credit scores, repayment history, and competitive offers from different lenders play significant roles during negotiations. Ensuring clarity in purpose, articulating specific financial needs, and demonstrating commitment to favorable loan terms create a solid foundation for successful interest rate negotiations.

Current Interest Rate and Terms

Current interest rates for loans, especially from banks like JPMorgan Chase and Bank of America, have shown significant fluctuations in 2023, hovering around 6-7% for fixed-rate mortgages. Negotiating better terms can result in substantial savings over the loan's duration, often translating into thousands of dollars saved. Effective negotiation strategies might involve presenting documentation of timely payments, comparing offers from competing lenders, and demonstrating a strong credit score above 700. Specific financial documents, such as pay stubs and tax returns, will strengthen the proposal, as they provide evidence of financial stability and capacity to repay. Engaging in this dialogue with the lender can establish a mutually beneficial agreement, ensuring favorable repayment conditions.

Comparison and Market Analysis

The interest rate negotiation proposal requires a comprehensive market analysis, highlighting current trends and comparative rates across similar financial institutions. Recent data from the Federal Reserve shows that the average interest rate for a standard mortgage in September 2023 is approximately 6.5%. Major banks, such as JPMorgan Chase and Bank of America, offer rates between 6.25% and 6.75%. Small credit unions often provide competitive rates, sometimes as low as 5.9%. Additionally, regional differences play a significant role; for instance, interest rates in metropolitan areas like San Francisco and New York typically exceed national averages due to demand fluctuations and housing market dynamics. Presenting this detailed analysis can substantiate the negotiation stance and potentially secure more favorable terms.

Proposal for New Terms

In the rapidly evolving financial landscape, businesses frequently engage in interest rate negotiation proposals to secure more favorable terms for their loans. A comprehensive proposal typically outlines specific financial metrics, including current interest rates ranging from 3% to 7% based on credit assessments. The document references key financial events such as quarterly earnings reports, which can influence the lender's decision-making process. It cites relevant economic indicators, such as the Federal Reserve's recent adjustments to the federal funds rate, which currently stands at 5.25%. Location is also significant in these negotiations; for instance, businesses situated in urban centers may have different leverage compared to rural counterparts due to varied market conditions. Furthermore, the proposal should suggest potential terms, such as a fixed rate to maintain stability or a variable rate depending on the prime rate fluctuations, enhancing its attractiveness to the lender while reinforcing the borrower's financial strategy moving forward.

Benefits and Justification

Interest rate negotiation can lead to cost savings for borrowers, especially when dealing with personal loans or mortgages. A reduction of even a small percentage, such as 0.5% on a $300,000 mortgage, translates to significant financial savings over the loan term, potentially exceeding $50,000 in interest payments. Justifying this request involves highlighting timely payments (such as those made over the last five years) and improved credit scores exceeding 700, reflecting reliability and reduced risk to lenders. Economic conditions, such as the current Federal Reserve's interest rate policy (as of October 2023), further support a favorable negotiation climate, encouraging lenders to consider lower rates. Emphasizing long-term relationships with financial institutions enhances negotiation positioning, showcasing potential for future business engagements or referrals.

Comments