Hey there! If you find yourself juggling loan paperwork and deadlines, you're not alone. Many people overlook the importance of submitting those loan documents on time, which can lead to unnecessary stress and delays. But don't worry, we've got a handy reminder template that will make the process smoother for youâso why not read on to discover how to ensure your submissions are always on point?

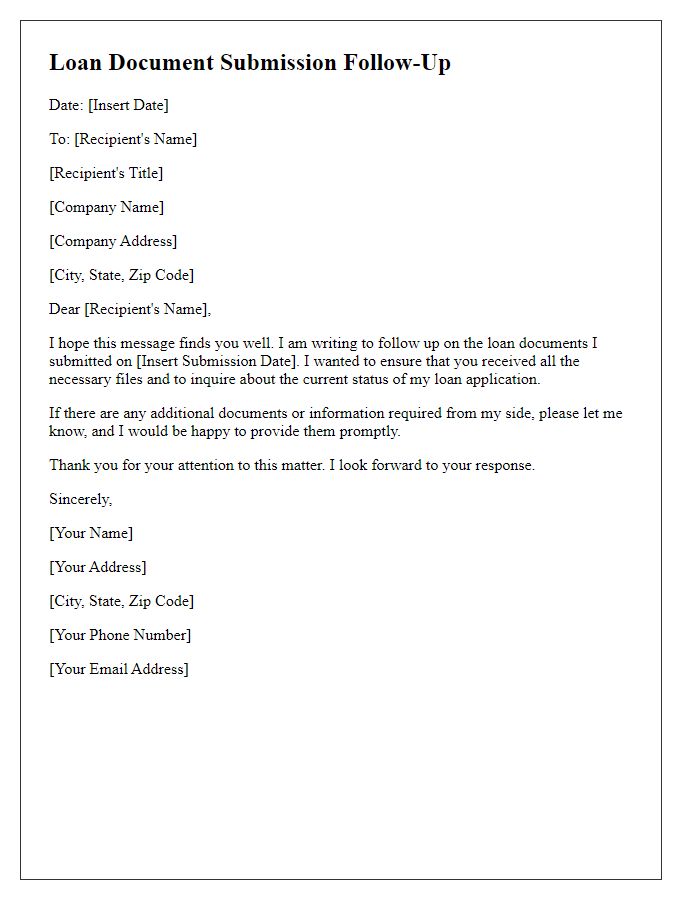

Recipient name and address

A reminder for submitting loan documents plays a crucial role in ensuring timely processing. The recipient's name, such as John Smith, along with the address, could include a street name like 123 Elm Street, a city name such as Springfield, and a zip code like 62701. This information helps personalize the reminder and ensures it reaches the correct individual. Loan documents typically needed might include income verification, tax returns, and identification, which are essential for the lender's verification process. Clarity in communication emphasizes deadlines, typically ranging from two weeks from the reminder date, enhancing the chance of prompt submission.

Polite opening and statement of purpose

Loan document submission is a critical step in securing financial assistance, such as mortgages or personal loans. Timely submission ensures efficient processing by institutions like banks or credit unions. Accurate documents--such as income verification, credit reports, and asset statements--must be gathered meticulously. Missing documents can delay approval and disbursement, impacting financial plans. Regular follow-ups on required submissions help maintain communication and foster a proactive approach. Institutions typically set deadlines for submissions, which, if missed, may result in restarting the process. Understanding these timelines is essential for a smooth borrowing experience.

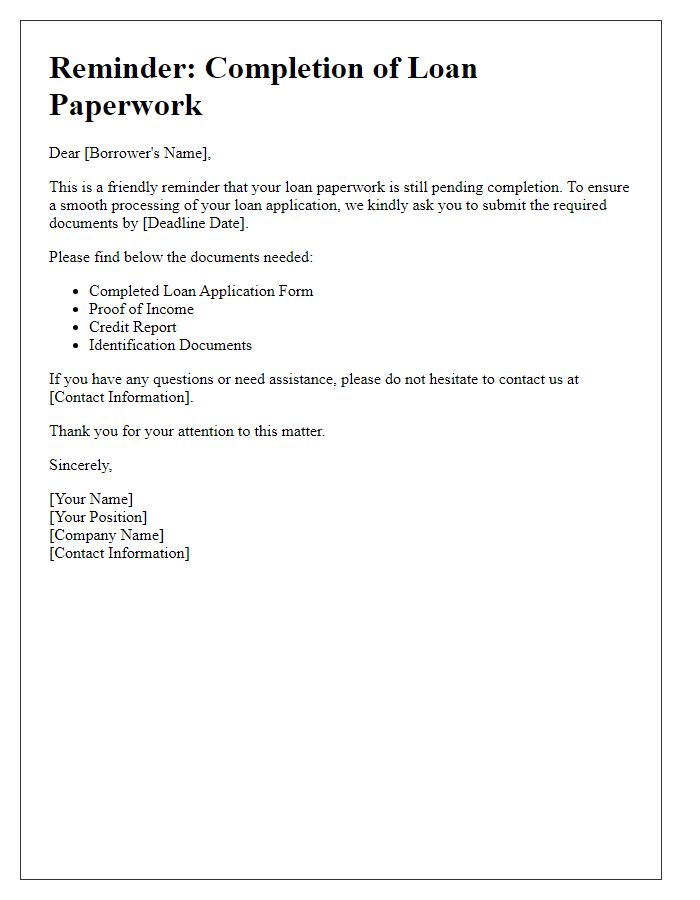

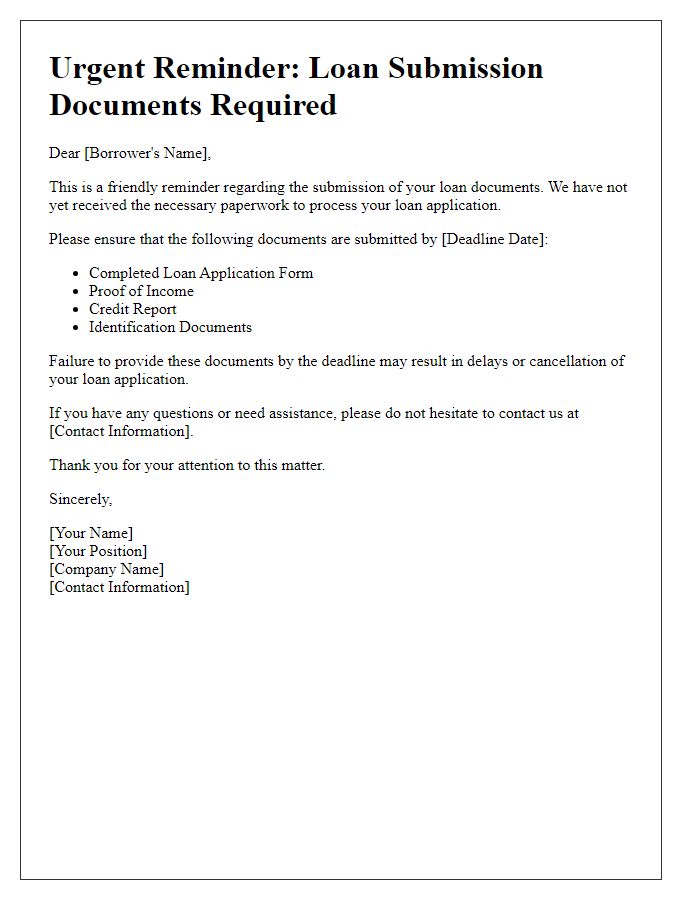

Details of outstanding documents

The loan application process involves several critical documents that must be submitted to the lending institution before approval can be granted. Key documents typically include a completed loan application form, proof of income such as pay stubs or tax returns from the previous two years, bank statements covering the last three months, a valid government-issued identification card, and any relevant property documentation for secured loans, such as purchase agreements or title deeds. Additionally, the lender may require credit history access authorization. Each document serves to verify the applicant's financial status, ensuring compliance with lending criteria and contributing to the final decision-making process. Timely submission of outstanding documents is essential to avoid delays in loan processing and to facilitate a smooth approval workflow.

Submission deadline and consequences

Submission deadlines for loan documents are critical to avoid delays in processing applications. For instance, a typical submission date may involve a 30-day window following initial approval notifications. Missing the deadline could result in the termination of the loan offer, leading to complications in obtaining funds for personal or business needs. Lenders such as banks and credit unions often emphasize the importance of timely submissions, as incomplete documentation can hinder credit evaluations, potentially affecting interest rates or eligibility. It is advisable to review all required documents, including income verification and asset statements, to ensure that all submissions meet lender criteria by the specified deadline.

Contact information for assistance

Submitting a loan document involves critical steps to ensure approval, especially in financial institutions such as banks or credit unions. Contact information for assistance becomes essential during this process. For example, a borrower might need to reach out to the loan officer assigned to their case, often accessible via email or direct phone numbers (typically formatted as (XXX) XXX-XXXX). In many institutions, customer service hotlines are available, providing support during business hours (generally from 9 AM to 5 PM local time) and offering real-time help to clarify document requirements. Access to this information streamlines the submission process and reduces delays, ultimately improving the chance of successful loan acquisition.

Comments