Are you feeling overwhelmed by your tax obligations? You're not alone! Many individuals and businesses are discovering the benefits of setting up a tax payment installment plan to ease financial stress and manage their payments effectively. Join us as we dive into the ins and outs of this helpful approachâread on to learn more!

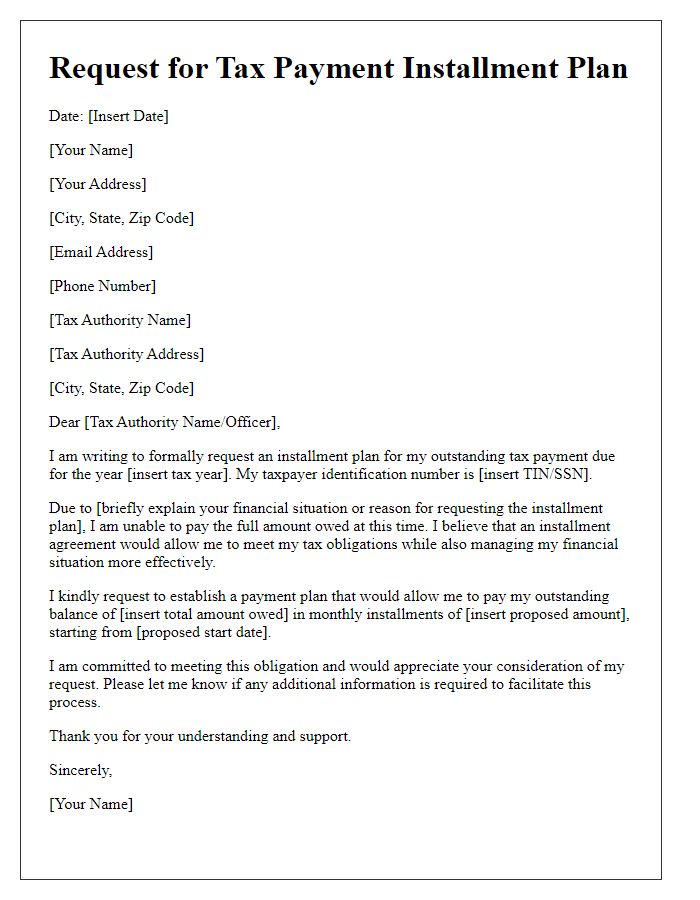

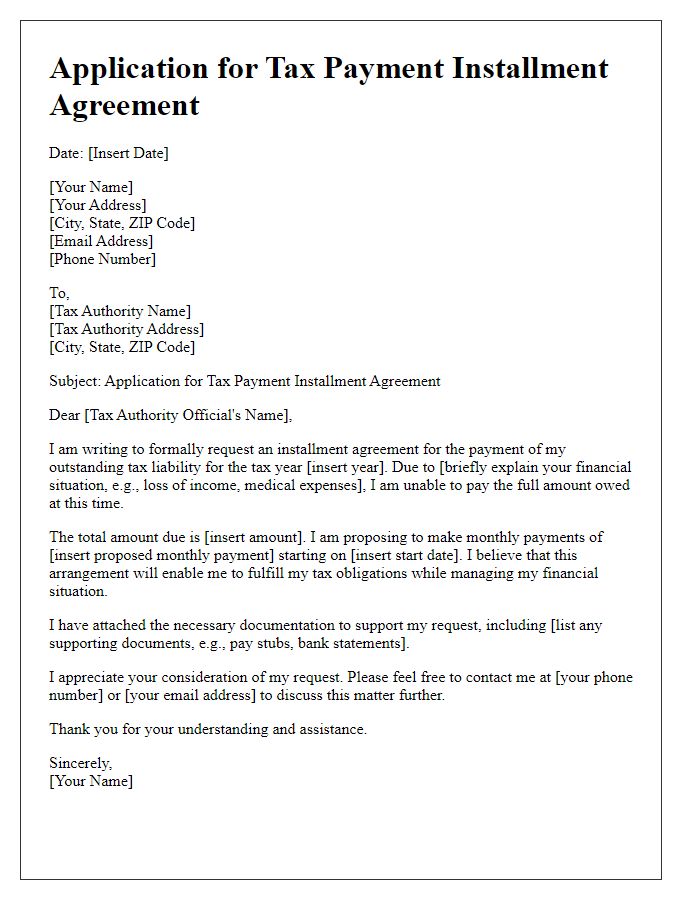

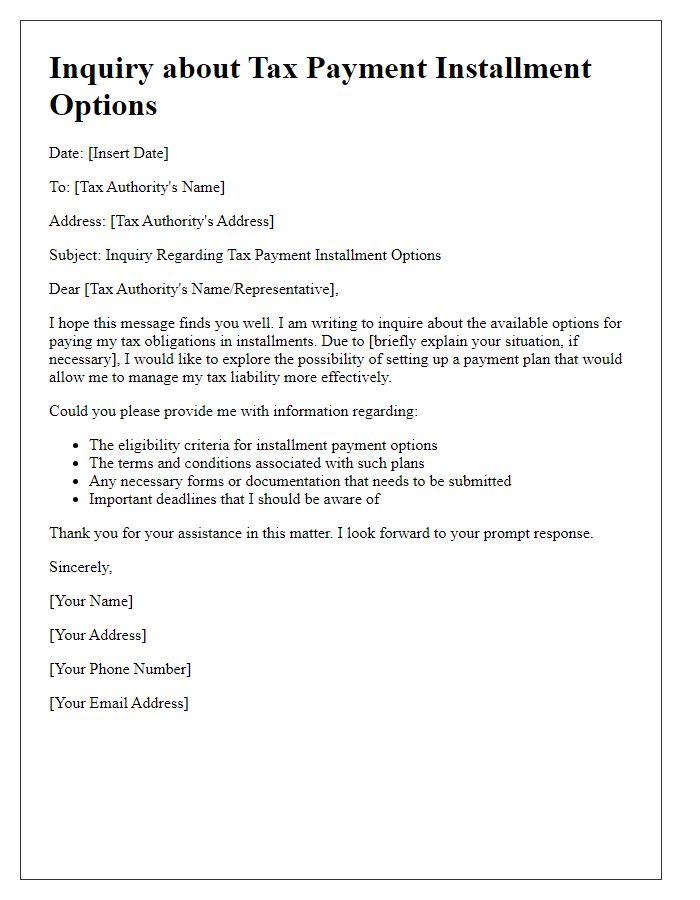

Subject Line and Introduction

Subject Line: Request for Tax Payment Installment Plan Introduction: This correspondence seeks to establish a manageable tax payment installment plan with the Internal Revenue Service (IRS) in response to the outstanding tax liability incurred for the 2022 tax year. The total amount due, which stands at $5,000, presents a financial challenge given recent economic conditions, and this plan is aimed at ensuring compliance while maintaining financial stability.

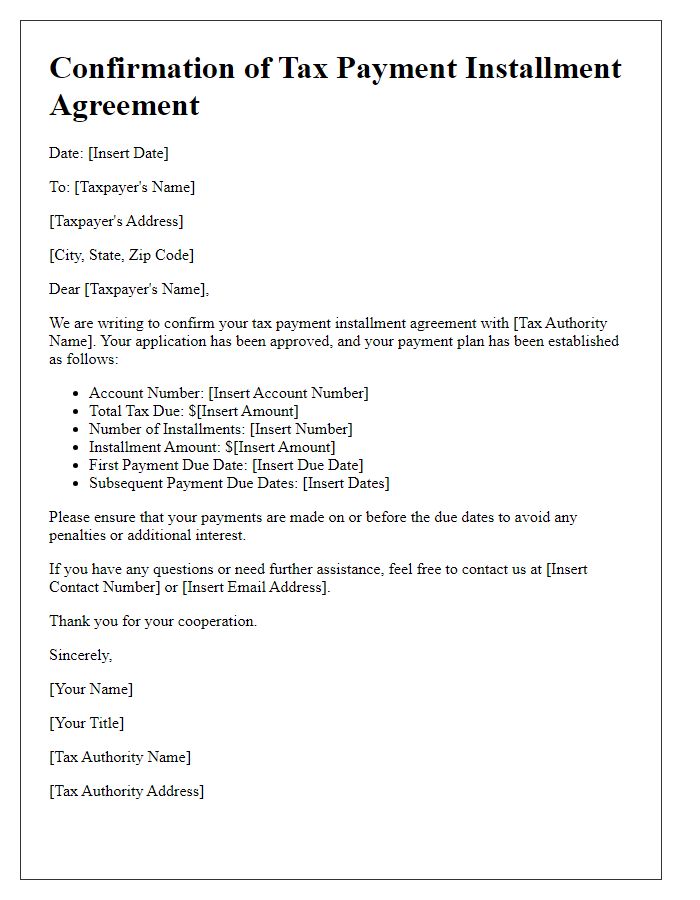

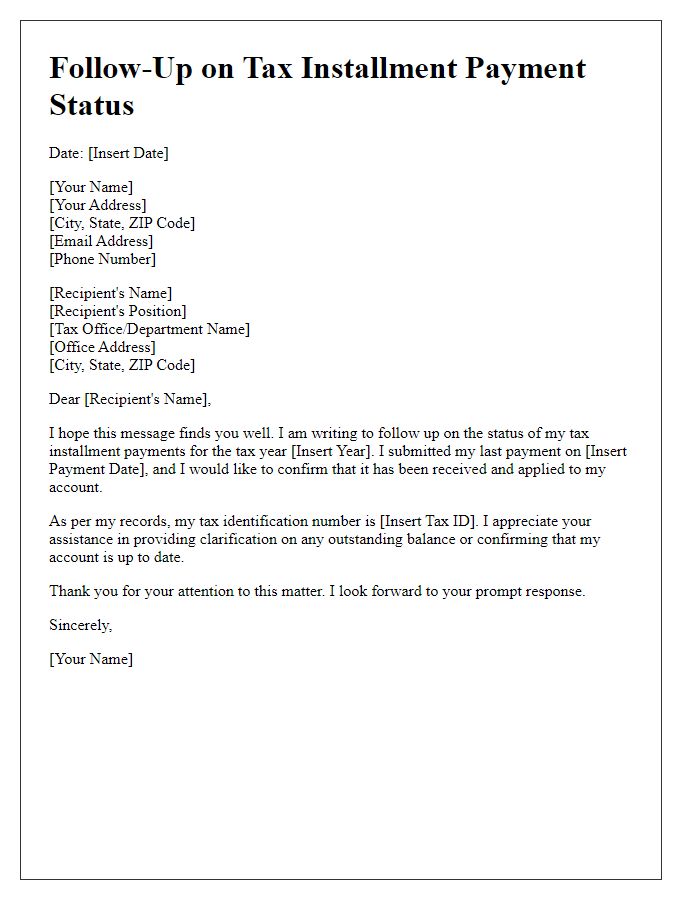

Account Information and Payment History

Account information for tax payment installment plans includes essential details such as the taxpayer's identification number (TIN), which uniquely identifies individuals or businesses within the tax system. Payment history records previous payments made, significant dates such as the due dates, amounts paid, and any outstanding balances. Relevant events, such as penalty assessments for late payments or interest accruals on unpaid taxes, provide insight into a taxpayer's compliance over time. Local tax authority regulations in specific jurisdictions may also influence installment plans, affecting terms and eligibility based on consistent payment patterns and the timeliness of prior submissions. Accurate record-keeping is crucial for maintaining eligibility and understanding potential impacts on future tax liabilities.

Proposed Payment Terms

Tax payment installment plans allow individuals or businesses to manage their tax liabilities more effectively. For example, these plans often involve monthly installments typically over 6 to 24 months, depending on the total tax due. The Internal Revenue Service (IRS) may charge a user fee, which averages around $30, to set up the plan. Additionally, taxpayers must provide updated financial information to qualify for a payment plan, including income, expenses, and assets. Individuals can apply online through the IRS website or by submitting Form 9465, and the approval process usually takes about 30 days. Keeping current with future tax obligations is necessary while on an installment plan to avoid default.

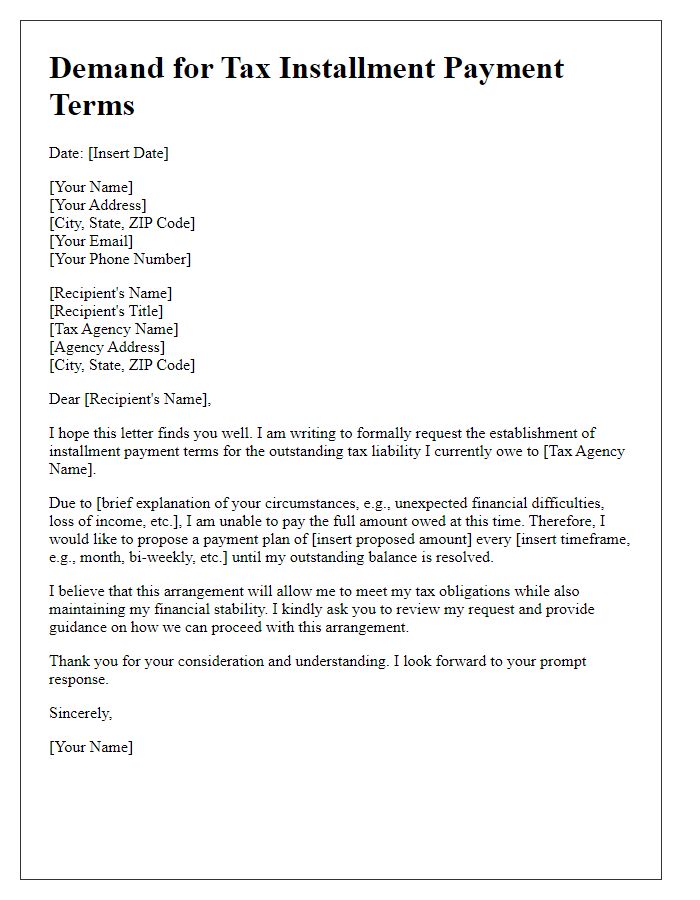

Reason for Request

Taxpayers often seek an installment plan to manage financial obligations during economic hardship. Factors such as unexpected medical expenses, job loss, or significant reduction in income can strain personal finances. By requesting an installment plan, taxpayers aim to break down their total tax liability into manageable monthly payments. Clear communication with the tax authority, including a detailed explanation of circumstances, can facilitate approval. Providing supporting documents, such as income statements or medical bills, strengthens the case for an installment plan, reflecting the taxpayer's commitment to resolving their tax obligations responsibly.

Contact Information and Next Steps

For taxpayers considering an installment plan, accurate contact information is crucial. The Internal Revenue Service (IRS) provides essential guidelines and resources for IRS Form 9465. Taxpayers should ensure to include their Social Security number (SSN) or Employer Identification Number (EIN) when requesting. Next steps involve submitting the completed form to the appropriate IRS address, specific to the taxpayer's region. Approval can take a few weeks, often resulting in a notice outlining scheduled payment dates and amounts. It is vital to maintain all payment records, as failure to comply with the agreement can lead to penalties, including interest accumulation or account levies.

Comments