Navigating the complexities of income tax declarations can feel overwhelming, especially when it comes to reporting funds raised through crowdfunding campaigns. Many individuals may find themselves uncertain about how to accurately document these contributions and what deductions might be applicable. Understanding the nuances of this process not only ensures compliance but can also help maximize your tax benefits. Curious to learn more about how to approach your crowdfunding income tax declaration? Dive into our article for detailed guidance!

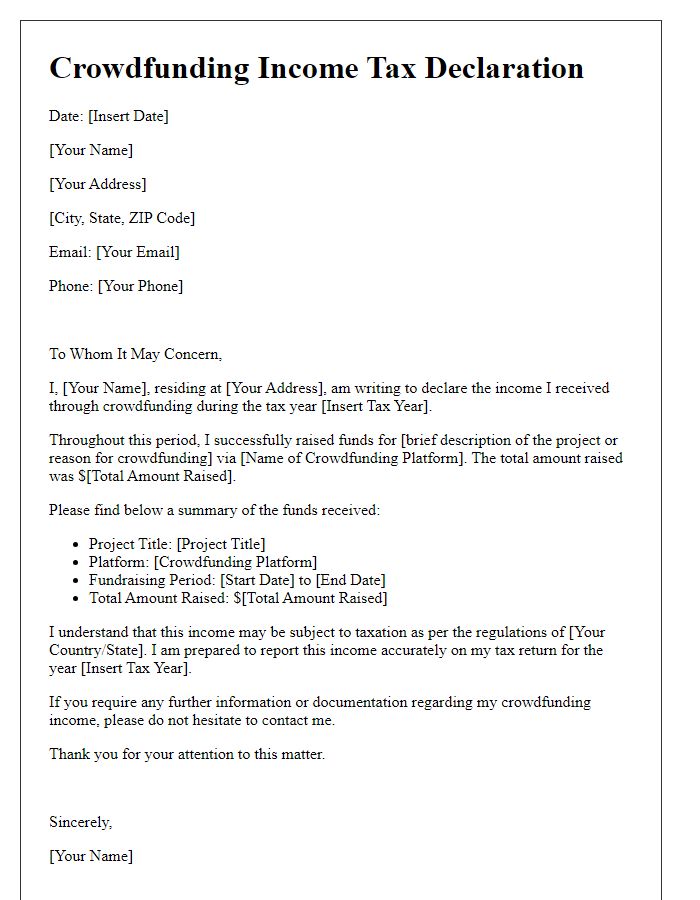

Personal Information

Personal information is essential for crowdfunding income tax declaration. This includes identifying details such as name (occurred in formal records), Social Security Number (important for tax identification), mailing address (where official correspondence will be sent), and contact information (such as phone numbers or email addresses). Additionally, any relevant crowdfunding platform details (like Kickstarter or Indiegogo), including the project title and unique project ID number, must be provided to differentiate between multiple income sources. Collectively, this information facilitates accurate reporting and compliance with the Internal Revenue Service regulations (IRS) in the United States.

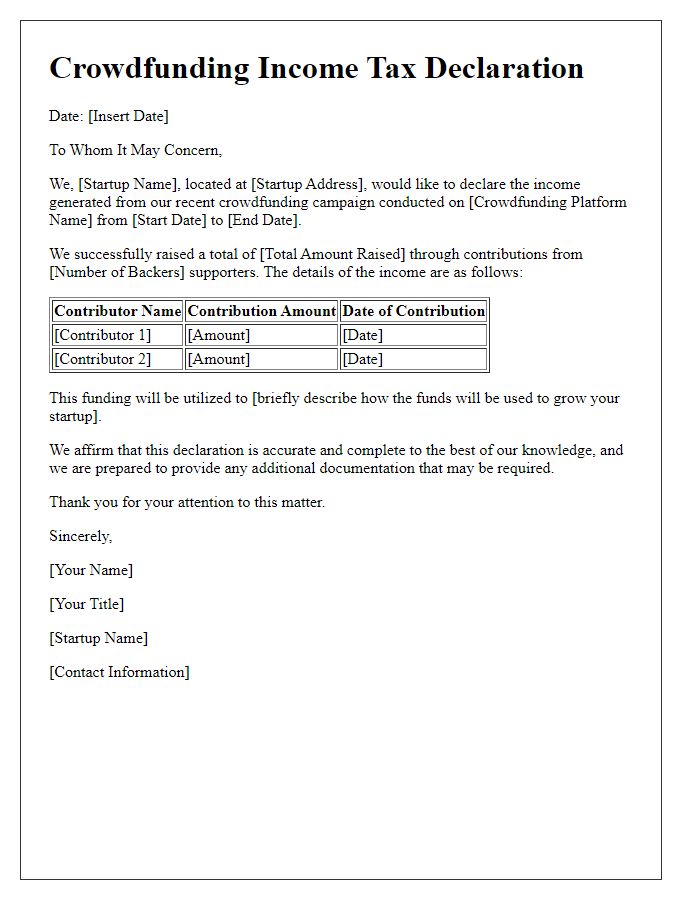

Funding Details

Crowdfunding platforms have emerged as innovative avenues for raising funds for various projects, from creative endeavors to entrepreneurial ventures. Many individuals and organizations utilize platforms like Kickstarter, Indiegogo, or GoFundMe, attracting contributions from backers globally. In the context of taxation, funds raised through crowdfunding in the United States may be classed as income, especially when contributions exceed specific thresholds, such as $600, necessitating tax declarations for the Internal Revenue Service (IRS). Depending on the nature of the project and the funding model used--reward-based, equity-based, or donation-based--different tax implications may arise. Tax regulations require proper documentation and record-keeping of all contributions received, including donor information and amounts, to ensure compliance during annual tax filings.

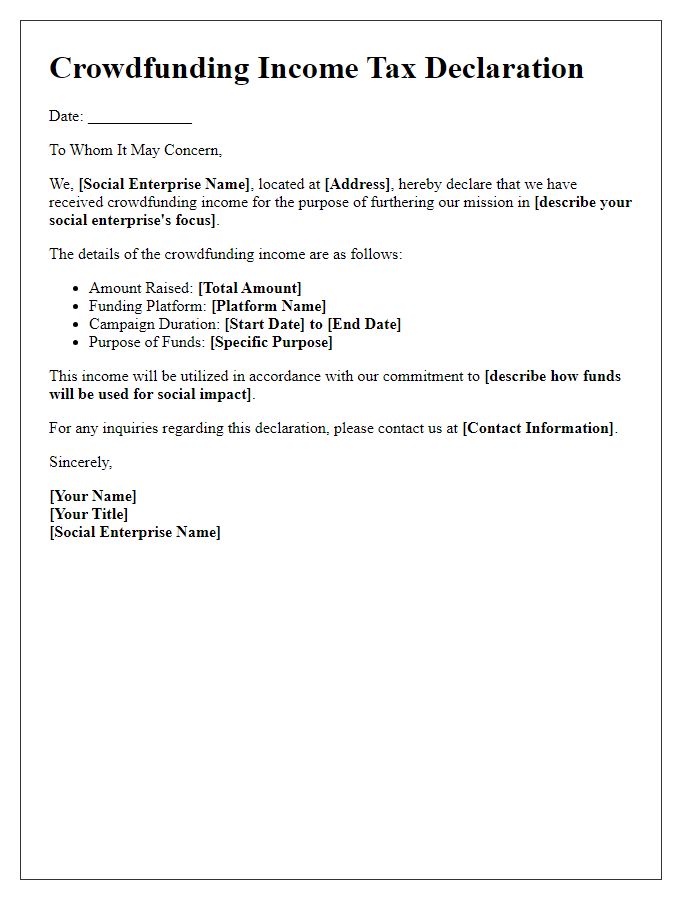

Project Description

Crowdfunding campaigns can provide significant financial support for various creative projects, such as community art installations, innovative technology developments, or social initiatives. Successful campaigns often utilize platforms like Kickstarter or Indiegogo, attracting backers interested in the project's vision. For example, a recent campaign aimed at creating an eco-friendly water filtration system raised over $100,000 in just one month, showcasing the potential of community engagement. Additionally, tax implications arise as funds received may be considered income, depending on jurisdiction. Proper documentation, including detailed project descriptions and financial reporting, is crucial for compliance and transparency, ensuring that supporters are informed and the project's goals are effectively communicated.

Tax Obligation Statements

Crowdfunding platforms have become increasingly popular for supporting a range of projects, from innovative startups to artistic endeavors. In the United States, contributors may be required to report their donations as income under certain circumstances. For instance, if an individual contributes to a crowdfunding campaign on sites like Kickstarter or GoFundMe, and the project generates revenues exceeding $600, the platform must issue a Form 1099-K. This form reports gross payment transactions, indicating tax obligations for the recipient based on their earnings. Contributors should maintain clear records of their donations, considering that states may vary in taxation rules. Understanding these obligations promotes compliance and prepares individuals for potential tax liabilities from their crowdfunding activities.

Legal Disclaimers

Crowdfunding platforms operate under various legal frameworks, often requiring contributors and organizers to understand their tax implications. Legal disclaimers typically address income tax responsibilities under programs like IRS regulations in the United States or similar entities worldwide. It is crucial to recognize that any funds received through crowdfunding campaigns may be categorized as taxable income unless proven otherwise. Contributors should maintain accurate records of their donations (including amounts and dates) for their personal tax returns. Organizers must also be aware of their obligations concerning reporting income and potential sales tax on funded projects. Additionally, disclaimers may highlight that tax advice from certified professionals is recommended to ensure compliance with local and federal tax laws, preventing future liabilities. Failure to adhere to these guidelines could lead to penalties or audits by tax authorities, stressing the importance of being well-informed and prepared.

Letter Template For Crowdfunding Income Tax Declaration Samples

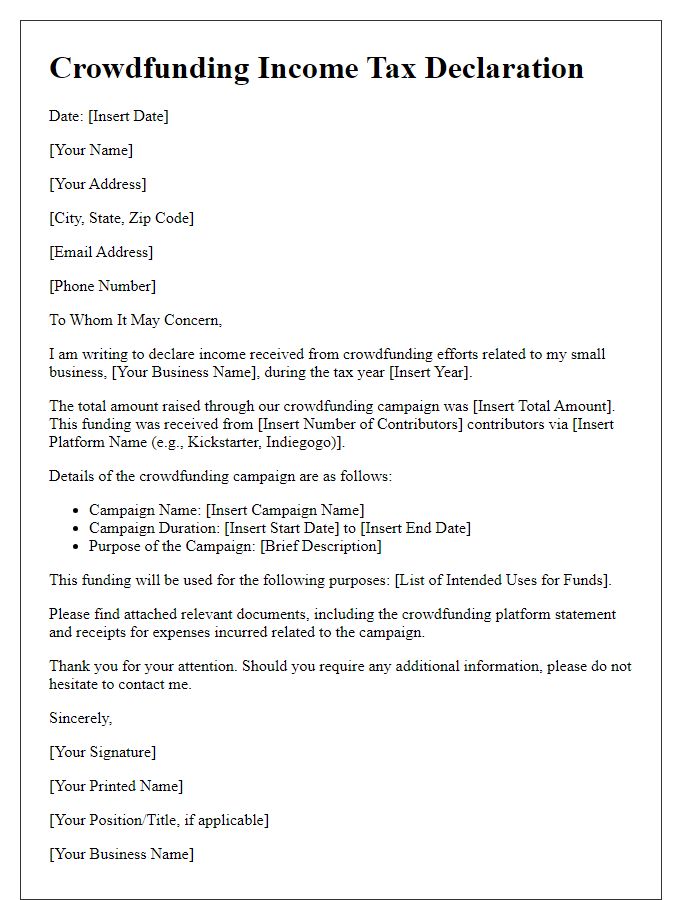

Letter template of crowdfunding income tax declaration for small businesses.

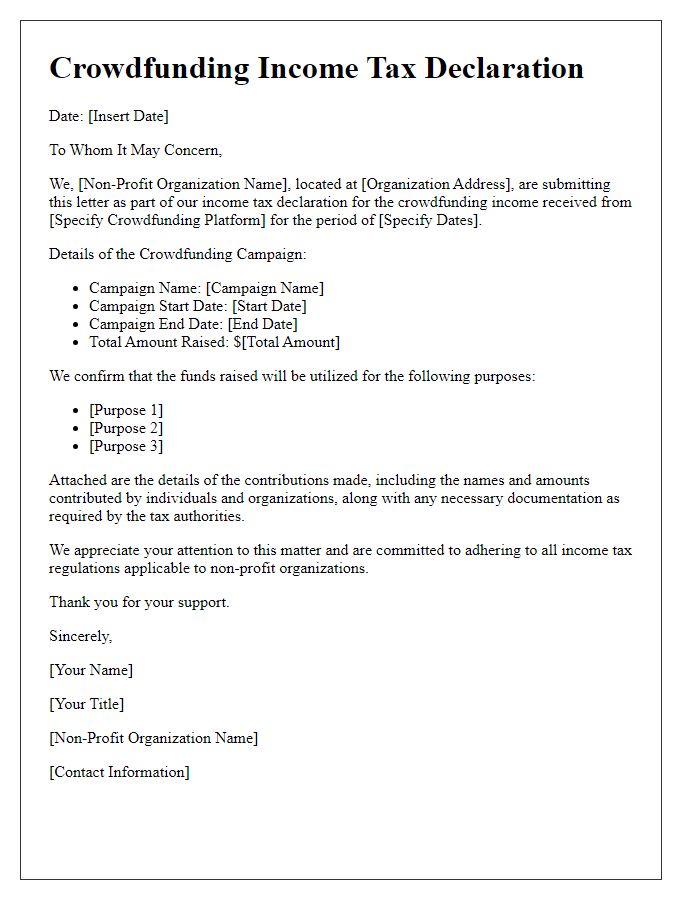

Letter template of crowdfunding income tax declaration for non-profit organizations.

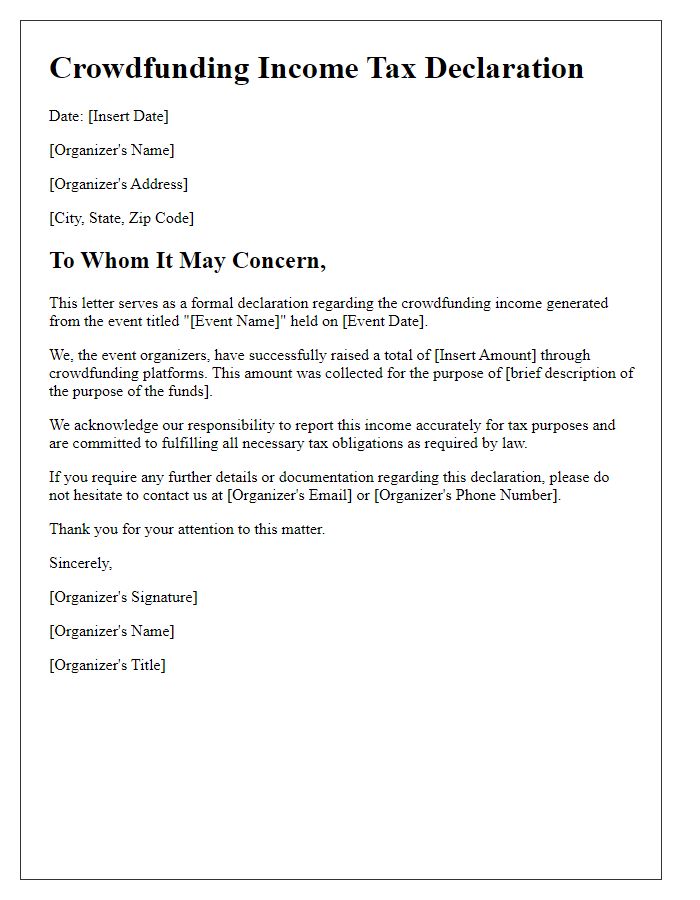

Letter template of crowdfunding income tax declaration for event organizers.

Letter template of crowdfunding income tax declaration for online creators.

Letter template of crowdfunding income tax declaration for community projects.

Letter template of crowdfunding income tax declaration for artists and performers.

Letter template of crowdfunding income tax declaration for educational initiatives.

Comments