Are you navigating the complexities of withholding tax exemption certificates? It can feel overwhelming, but understanding the essentials can make the process smoother and more efficient. In this article, we'll break down everything you need to know about securing your exemption and provide you with a useful letter template to get started. So, let's dive in and simplify your tax journeyâread on to discover more!

Recipient's Name and Address

Withholding tax exemption certificates serve to clarify the tax responsibilities of recipients, often individuals or entities, engaged in financial transactions. A recipient's name (such as John Smith or ACME Corp.) and address (specific street names in a city or state) provide essential identification for official documentation. Accurate details on the certificate ensure compliant processing in tax jurisdictions, potentially influencing withholding rates applied during transactions. Properly issued certificates can streamline financial exchanges by reducing unnecessary tax deductions and expediting cash flow for businesses or individuals eligible for exemptions.

Subject Line: Withholding Tax Exemption Request

Withholding Tax Exemption certificates are crucial documents for entities seeking to minimize tax liability on payments received. In the United States, the Internal Revenue Service (IRS) issues these certificates to qualified individuals and organizations, like non-profits and foreign investors. The application process requires detailed information including taxpayer identification numbers (TIN), type of exemption claimed, and the nature of the payments. Specific thresholds may apply, such as a minimum payment amount or specific types of income, like dividends or interest, to qualify for exemption. Accurate documentation is necessary, as errors can lead to significant delays and potential tax penalties.

Tax Identification Number and Registration Details

The withholding tax exemption certificate serves as a crucial document for businesses seeking to reduce tax liabilities. This certificate, issued by the tax authority, typically requires the Tax Identification Number (TIN) to verify the entity's tax status. Additionally, registration details, such as the official business name, address, and incorporation number, are essential for proper identification. The application process may involve submitting financial statements, proof of tax payments, and specific forms to demonstrate eligibility for tax exemption under applicable laws, such as the Internal Revenue Code in the United States or the Income Tax Act in various countries. Obtaining this certificate can result in significant savings, allowing businesses to allocate funds more effectively towards growth and operational costs.

Explanation of Exemption Applicability and Legal References

Withholding tax exemption certificates are essential documents for individuals and businesses seeking relief from potential withholding taxes on various types of income. Exemption applicability often stems from specific legal provisions or treaties, such as the Income Tax Act (for countries like the United States) or double tax agreements, designed to prevent double taxation between nations. Entities eligible for exemptions typically include foreign investors, non-profit organizations, or particular types of interest income, often requiring comprehensive documentation to support claims. Legal references may include clauses relating to reduced tax rates or complete exemptions based on residency status, income type, or the nature of the payment involved. Providing clear evidence in alignment with specified jurisdictional regulations strengthens the case for exemption, ensuring compliance with legal standards while optimizing tax obligations.

Relevant Financial Institution or Authority Contact Information

Relevant Financial Institutions, such as banks or tax authorities, require clear communication for processing withholding tax exemption certificates. An example is the Internal Revenue Service (IRS) in the United States, which provides guidelines for non-resident aliens claiming exemptions under tax treaties. Ensure to include specific details like the institution's address (e.g., 1111 Constitution Ave NW, Washington, D.C.) and relevant contact numbers (e.g., 1-800-829-1040). Furthermore, mention the necessary forms, such as W-8BEN for individuals or W-8BEN-E for entities, to ensure accurate processing of the exemption request. Adding clear references to tax treaty articles relevant to specific countries can expedite approval.

Letter Template For Withholding Tax Exemption Certificate Samples

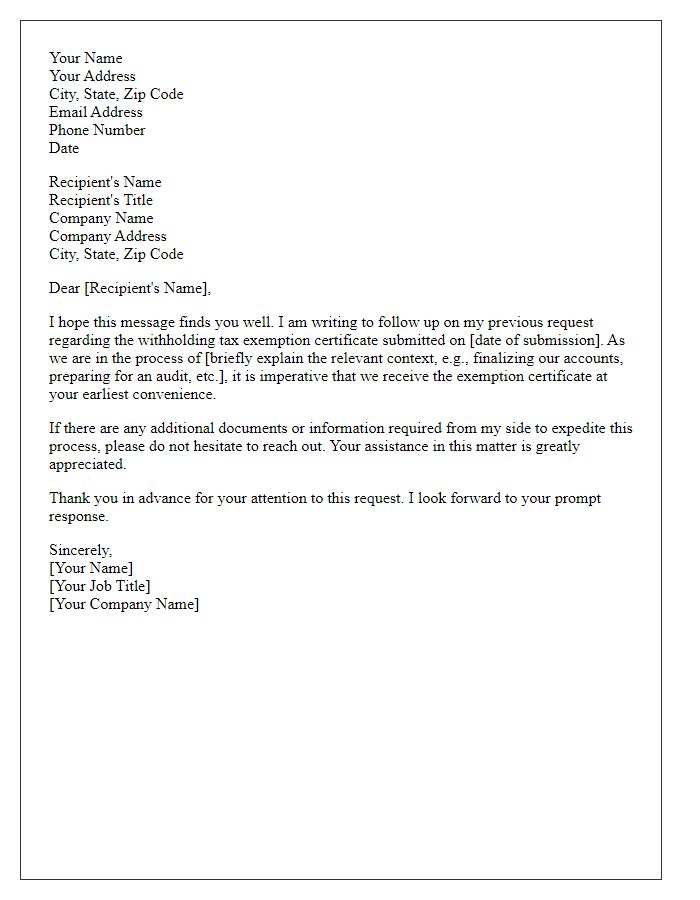

Letter template of application for withholding tax exemption certificate

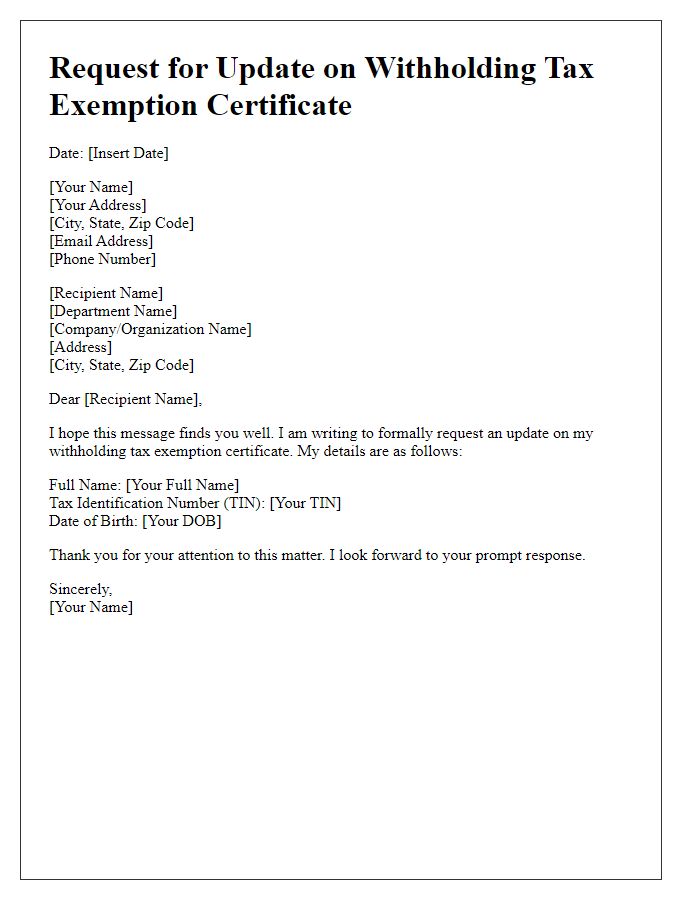

Letter template of inquiry regarding withholding tax exemption certificate

Letter template of confirmation for withholding tax exemption certificate

Letter template of notification for withholding tax exemption certificate

Letter template of clarification on withholding tax exemption certificate

Comments