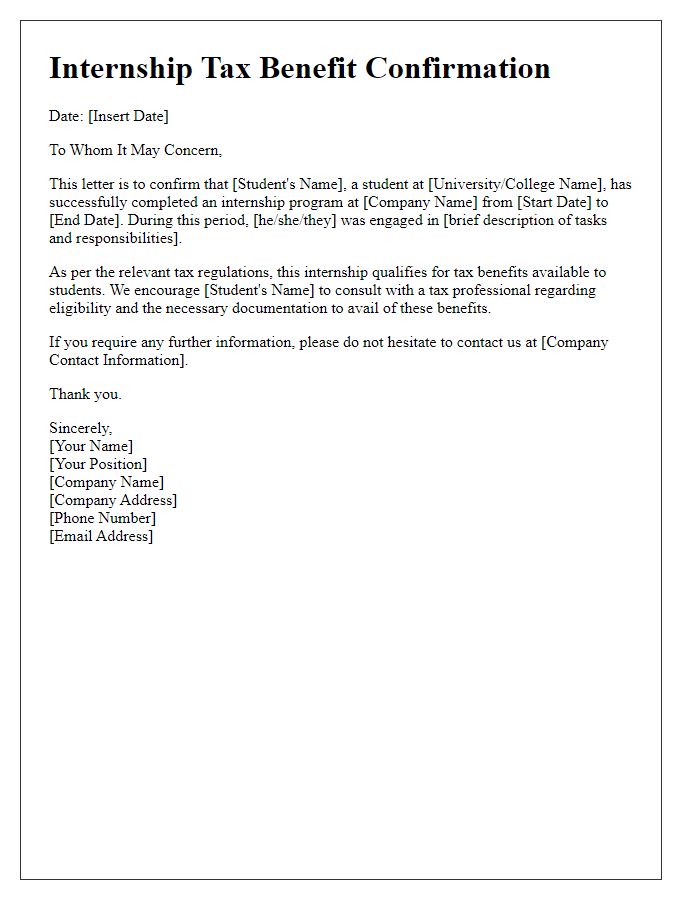

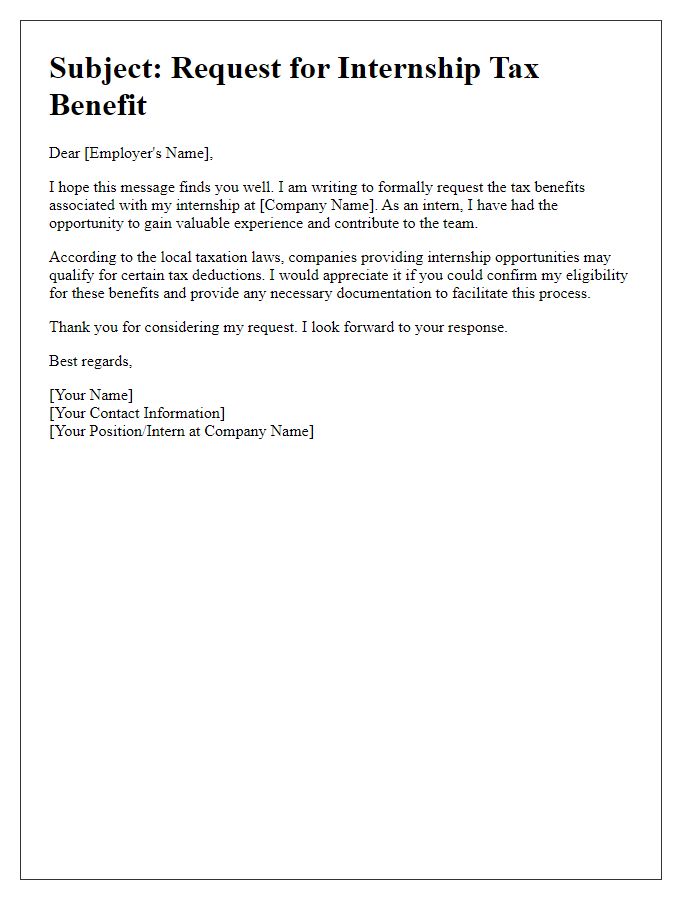

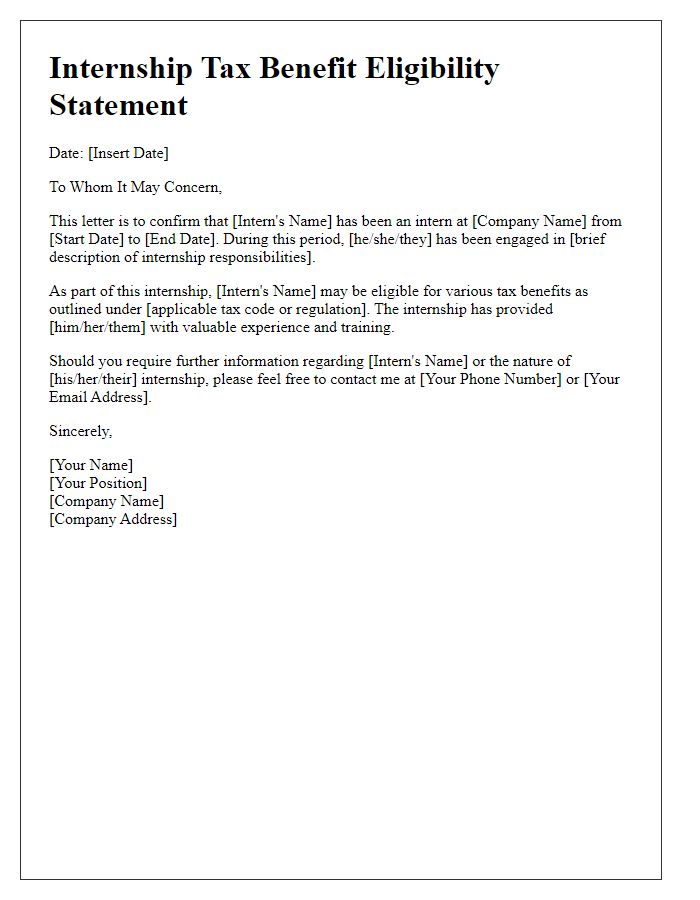

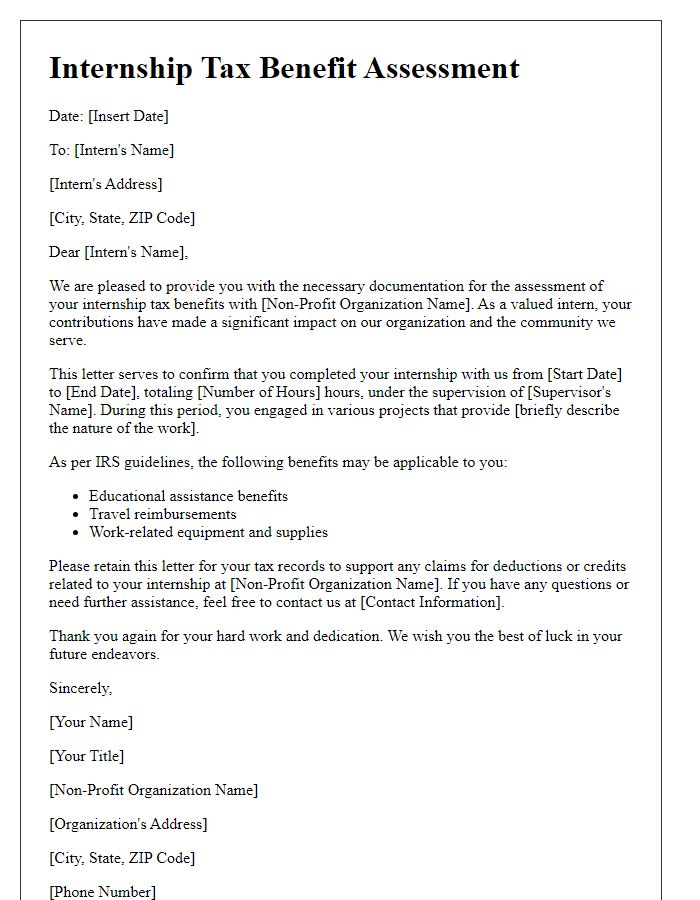

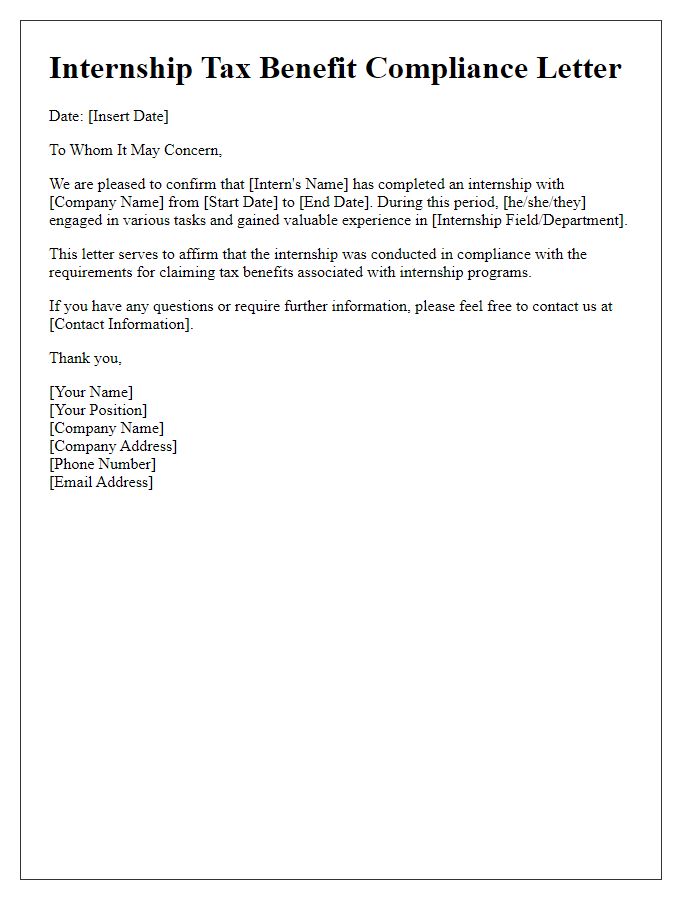

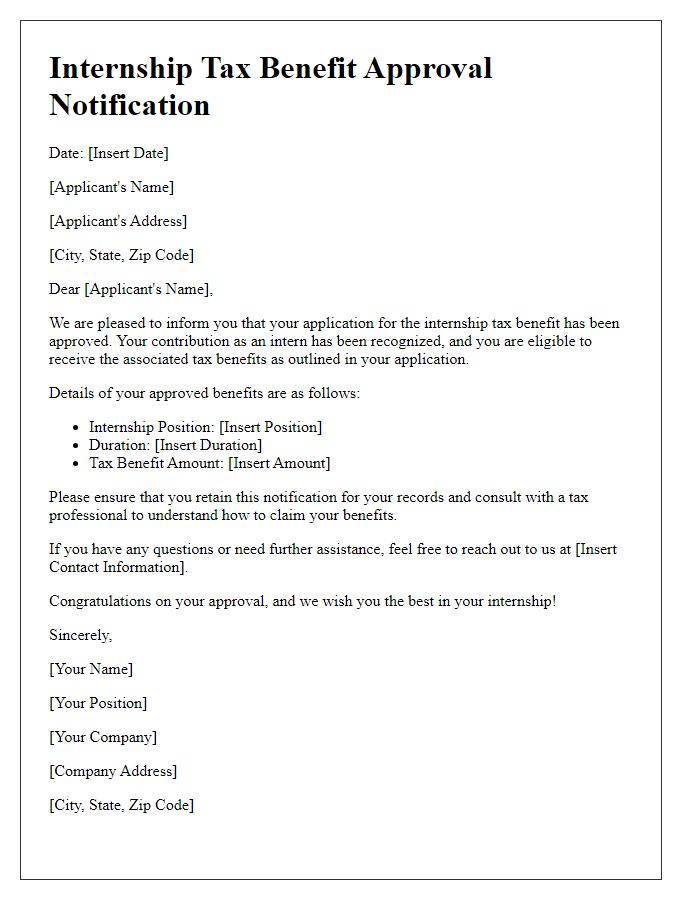

Are you considering applying for an internship and wondering about the tax benefits associated with it? This article will guide you through the process of verifying those tax benefits, ensuring you make the most of your experience while maximizing your financial return. We'll break down the essential steps and provide you with a handy letter template that simplifies the verification process. So, let's dive in and explore how you can navigate this crucial aspect of your internship journey!

Student's full name and contact information

Internship tax benefits verification requires accurate documentation of student participation and relevant details. Students must provide full names, which include first names, middle names, and surnames, along with current contact information including phone numbers and email addresses, to ensure seamless communication. These records are important for financial institutions and tax authorities to validate eligibility for tax deductions or credits associated with internships, like the Student Loan Interest Deduction or the American Opportunity Tax Credit. Proper verification enables students to maximize potential financial benefits while complying with regulations set by the Internal Revenue Service (IRS).

Educational institution's details and contact information

Internship tax benefit verification often requires specific details from educational institutions. The name of the institution, such as Harvard University or University of California, along with the state and city locations, must be accurately stated. Important contact information includes phone numbers (e.g., (555) 123-4567) and official email addresses (e.g., info@university.edu) for the admissions office or financial aid department. Furthermore, the institution's taxpayer identification number (TIN) plays a crucial role in confirming its status for tax exemption purposes. Enclosing relevant details that highlight programs related to internships, such as career development offices or partnerships with businesses, can enrich the verification process.

Internship company's name and address

Tax benefit verification is essential for interns seeking financial assistance during their educational experience. Internship Company ABC, located at 123 Main Street, Anytown, USA, plays a vital role in providing students with real-world exposure in marketing and finance. Established in 2010, this company offers a structured internship program designed specifically for college students. Interns can gain critical insights into industry practices while contributing to ongoing projects. In the year 2023, the company has hosted over 50 interns from various academic institutions, ensuring a diverse environment that fosters learning and development. Verification of these internships can assist in securing tax benefits for both the interns and the hosting company, incentivizing future collaborations.

Description of internship role and duration

An internship role typically involves hands-on experience in a professional environment, allowing individuals to apply academic knowledge to real-world tasks. For example, an internship at a financial firm may last three months, from June 1 to August 31, 2023, focusing on areas such as tax preparation and client consultation. Interns often assist with data entry, analysis of financial documentation, and research related to current tax regulations that impact clients, enhancing their understanding of fiscal strategies and compliance. During this period, interns may work alongside seasoned professionals, participating in meetings and learning about various tax benefit programs available to individuals and corporations. This practical experience is invaluable for developing skills essential for a career in finance or accounting.

Verification of student's enrollment and eligibility for tax benefits

Internship tax benefits verification involves assessing a student's enrollment status and eligibility for tax incentives. Educational institutions maintain comprehensive records for students attending accredited programs, such as colleges or universities like Harvard or Stanford. Establishing eligibility often requires confirmation of course load, typically 12 credit hours for full-time students, and program duration, usually spanning 4 years for a bachelor's degree. Tax incentives may apply under regulations such as IRS Form 8863 for education credits, enabling students to claim up to $2,500 per year. Furthermore, documentation must include the institution's tax identification number (TIN) and the student's identification information for accurate processing.

Comments