Are you navigating the complexities of agricultural tax relief applications? It can feel overwhelming, but we're here to simplify the process for you. In this article, we'll break down the essential steps and provide tips to ensure your application stands out. So, let's dive in and explore how you can maximize your benefits!

Applicant information and farm details

The agricultural tax relief application requires comprehensive details about the applicant and the farm operation for evaluation. The applicant's information includes the full name, contact telephone number, email address, and physical address of the applicant, ensuring the application is easily processed by the relevant tax authority. Farm details need to be specified, such as the farm's legal name, the location address (including county and state), total acreage (like 150 acres), type of farming operation (such as organic vegetable production or conventional dairy farming), and any relevant registrations (like USDA organic certification). Thorough information about crop types or livestock managed can enhance eligibility assessment for tax relief benefits.

Clear explanation of hardship

The agricultural tax relief application process often requires a clear explanation of financial hardships faced by farmers, particularly those in regions like the Midwest affected by severe droughts or excessive rainfall. For instance, in 2022, areas in states like Iowa experienced crop yield reductions exceeding 30%, significantly impacting revenues from cash crops such as corn and soybeans. Farmers may also face increases in operational costs due to inflation, with inputs like fertilizers seeing price surges of over 50% when compared to previous years. These factors exacerbated by volatile market conditions have led to diminished profit margins. Addressing these points in a tax relief application not only highlights the urgent financial difficulties but also strengthens the case for necessary relief measures.

Specific tax relief requested

Agricultural tax relief targeted at improving financial sustainability in farming practices plays a crucial role in supporting local economies. Specifically, the relief requested pertains to the reduction of property taxes on farmland utilized for crop production and livestock raising, as defined under Section 64 of the Agricultural Tax Relief Act of 2019. With many farmers facing rising operational costs due to inflation (averaging 8.6% in 2022) and supply chain disruptions, such relief could significantly alleviate financial burdens. This application seeks relief of 50% on property taxes assessed on parcels of agricultural land in Greene County, where over 2,000 farms operate, contributing to the local agribusiness sector valued at approximately $120 million annually.

Documentation supporting claims

Agricultural tax relief applications require extensive documentation to support claims for benefits, including forms, records, and certifications. A detailed list of necessary documents includes farm income statements, property tax assessments, and evidence of agricultural production, such as crop yield reports from the 2022 growing season. Additionally, receipts for purchased farming equipment, maintenance expenses, and labor costs should be included to demonstrate the operational expenses incurred. Soil health assessments and water usage permits, specific to the region like the Central Valley of California, can further substantiate claims. Certification from local agricultural extension offices may also be required to confirm involvement in sustainable farming practices or conservation efforts.

Contact information for follow-up

Agricultural tax relief applications require precise documentation and follow-up communication. Applicants must include essential contact information, ensuring accuracy. Include full name (for identification purposes), physical address (for correspondence), phone number (for direct communication), and email address (for prompt digital follow-up). Additionally, note the preferred contact method, which can expedite response times. Proper organization of this information enables efficient processing by tax authorities, potentially accelerating the approval of much-needed financial relief for farmers facing operational challenges.

Letter Template For Agricultural Tax Relief Application Samples

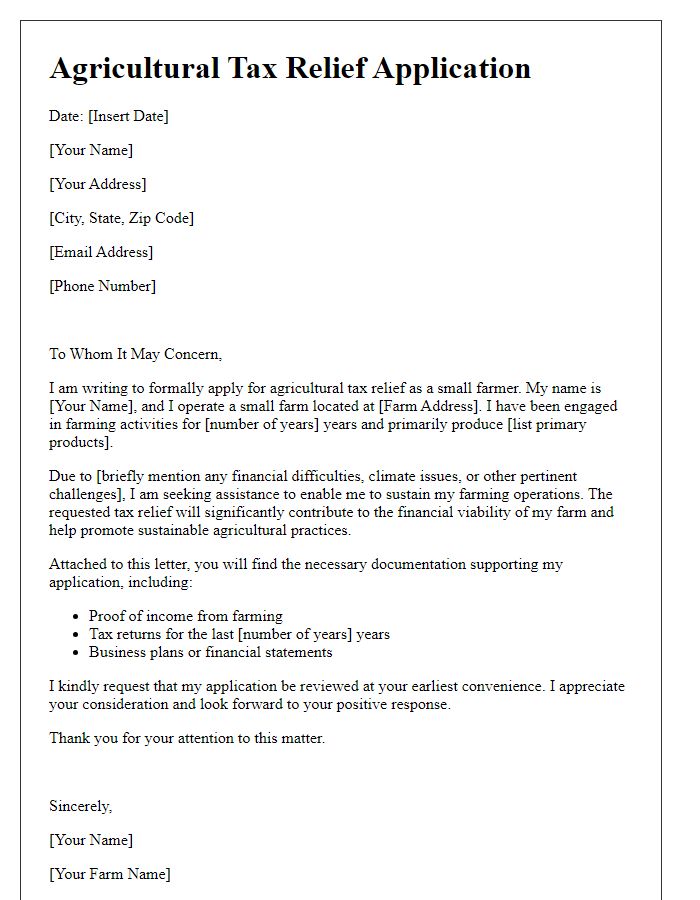

Letter template of agricultural tax relief application for small farmers

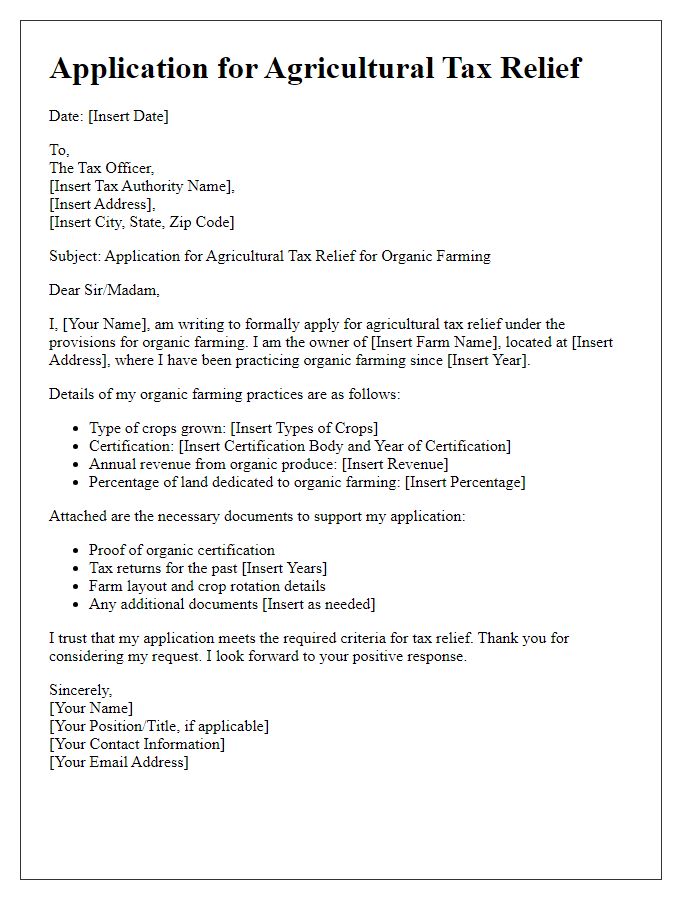

Letter template of agricultural tax relief application for organic farming

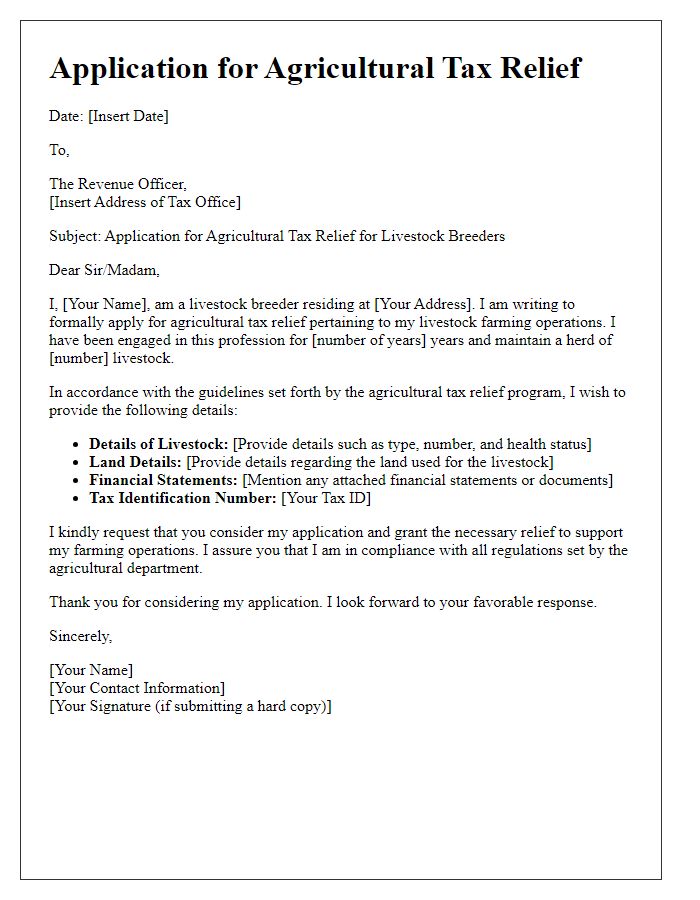

Letter template of agricultural tax relief application for livestock breeders

Letter template of agricultural tax relief application for crop producers

Letter template of agricultural tax relief application for sustainable agriculture initiatives

Letter template of agricultural tax relief application for community-supported agriculture

Letter template of agricultural tax relief application for family-owned farms

Letter template of agricultural tax relief application for agritourism operations

Letter template of agricultural tax relief application for specialty crop growers

Comments