Are you in need of a tax identification number (TIN) for your business or personal use? Understanding the importance of a TIN can seem overwhelming, but it's a crucial step in ensuring compliance with tax regulations. This letter template will guide you through the process of requesting your TIN seamlessly. Curious to learn more about how to effectively use this template? Let's dive in!

Applicant's Full Name

Acquiring a tax identification number (TIN) is essential for individuals like John Doe, facilitating legal compliance with tax regulations in the United States. This unique nine-digit number, assigned by the Internal Revenue Service (IRS), is vital for various tasks such as filing tax returns, opening bank accounts, and securing loans. Proper documentation, including proof of identity like a Social Security card or birth certificate, is required during application. The TIN ensures that each taxpayer is accurately tracked, preventing tax fraud and ensuring fair contributions to government revenue. Timely reception of the TIN can significantly impact the applicant's financial dealings and tax responsibilities.

Purpose for Tax Identification

Obtaining a Tax Identification Number (TIN) is essential for individuals and businesses to comply with tax regulations in various countries. A TIN serves as a unique identifier assigned by government tax authorities, like the Internal Revenue Service (IRS) in the United States, to track taxpayer obligations. Essential for filing tax returns, the TIN facilitates the accurate reporting of income, ensuring compliance with tax laws. Businesses utilize it for employee payroll, while individuals need it for tax filings and certain financial transactions. Various situations, such as applying for loans or government benefits, also necessitate a TIN. Failure to acquire this number can lead to penalties, including fines and increased scrutiny by tax authorities.

Contact Information

Tax identification number (TIN) allocation requires accurate contact information to ensure efficient processing. Essential details include taxpayer name (individual or business), residential or business address (with city, state, and ZIP code), phone number (local area code), and email address for communication. Additionally, including secondary contact details (alternative phone or email) can facilitate prompt resolution of any inquiries related to the application. Providing a complete and clear contact profile is critical, as the tax authority may reach out for further information or clarification during the TIN allocation process.

Supporting Documents List

Submitting a tax identification number (TIN) application requires accompanying documents to substantiate identity and eligibility. Essential documents typically include a government-issued photo identification such as a passport or driver's license (indicating identity), proof of address (e.g., utility bill or lease agreement with current residence), and a completed TIN application form (specific to your country's revenue service). Additional supporting documents could consist of business registration papers (if applying as a business entity) and tax forms from previous years (if applicable). Ensuring all documents are current and accurate expedites the processing of the TIN allocation request.

Signature and Date

The allocation of a Tax Identification Number (TIN) is crucial for individuals and businesses operating within tax jurisdictions. The TIN serves as a unique identifier for tax purposes, allowing government entities, such as the Internal Revenue Service (IRS) in the United States, to track tax obligations. Proper documentation and signature are required, usually including official forms like Form W-7 for non-residents. The date of application influences processing times, typically taking anywhere from 4 to 6 weeks. Accuracy in details such as name, address, and date of birth directly impacts the approval process. Note: Ensure to keep a record of correspondence and allocated TIN for future filings and legal compliance.

Letter Template For Tax Identification Number Allocation Samples

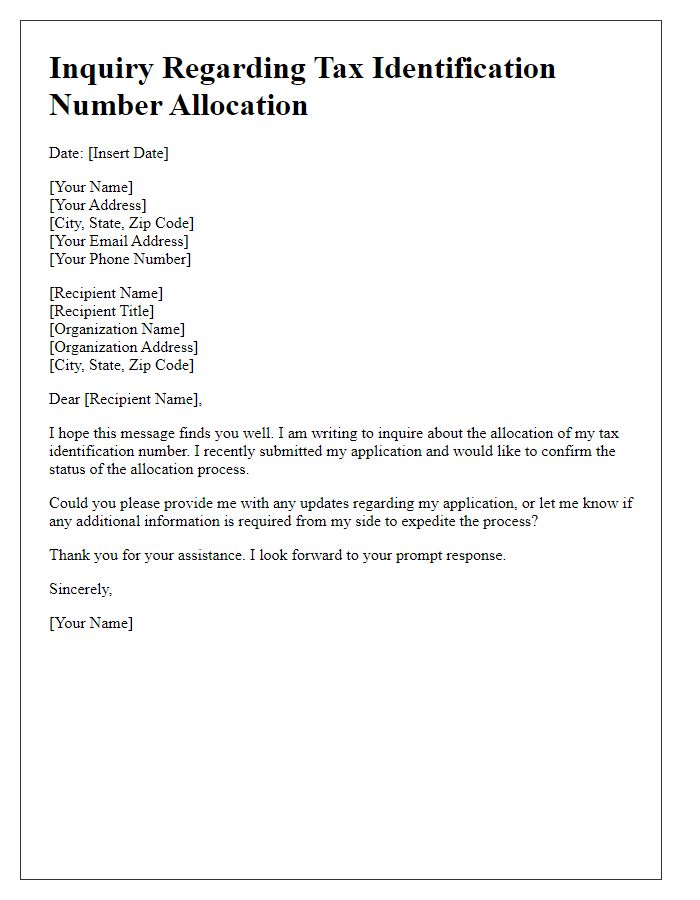

Letter template of inquiry regarding tax identification number allocation.

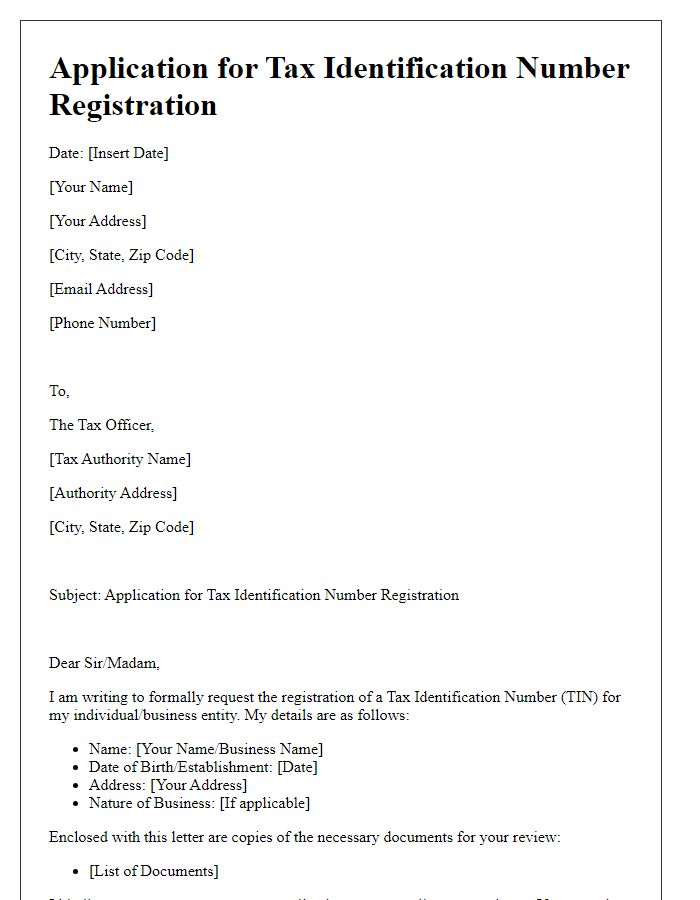

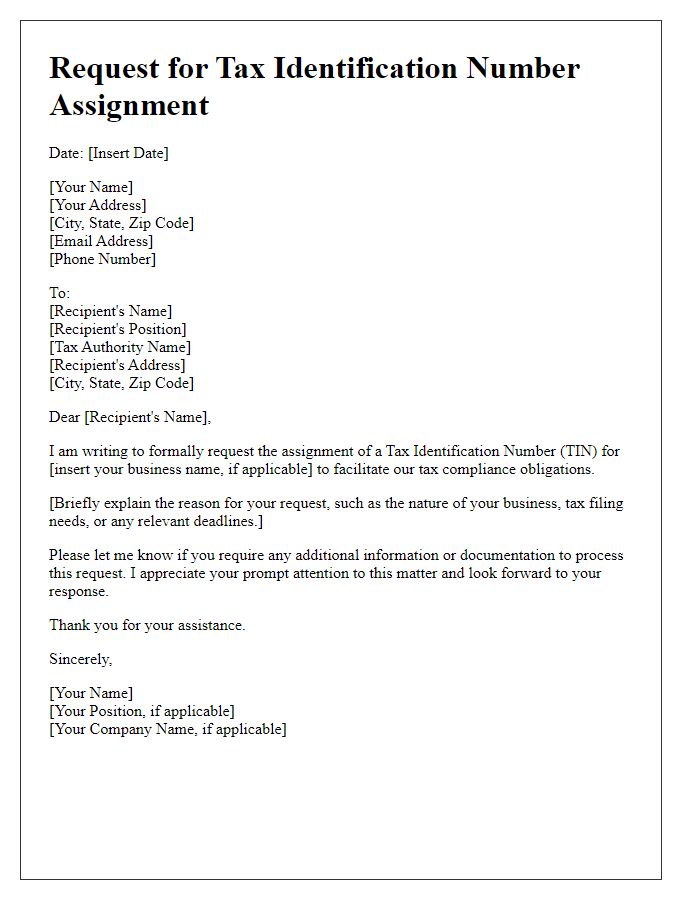

Letter template of application for tax identification number registration.

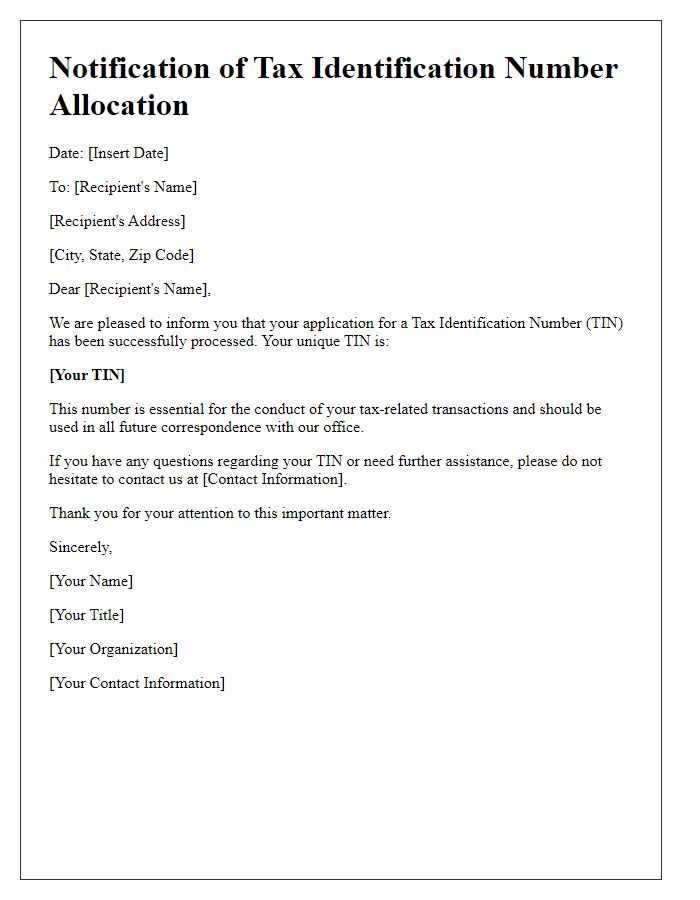

Letter template of notification for tax identification number allocation.

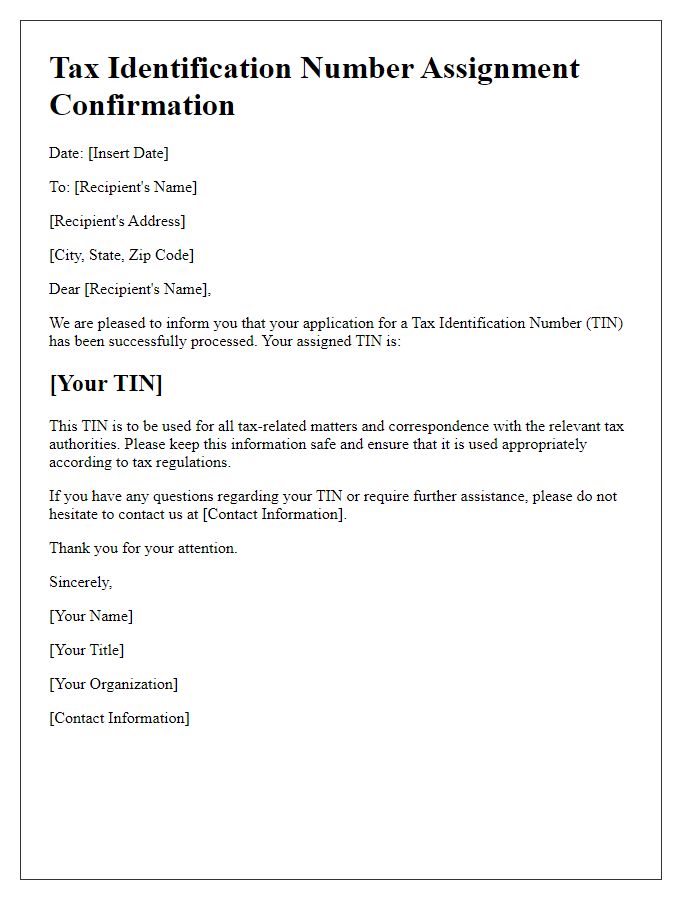

Letter template of confirmation for tax identification number assignment.

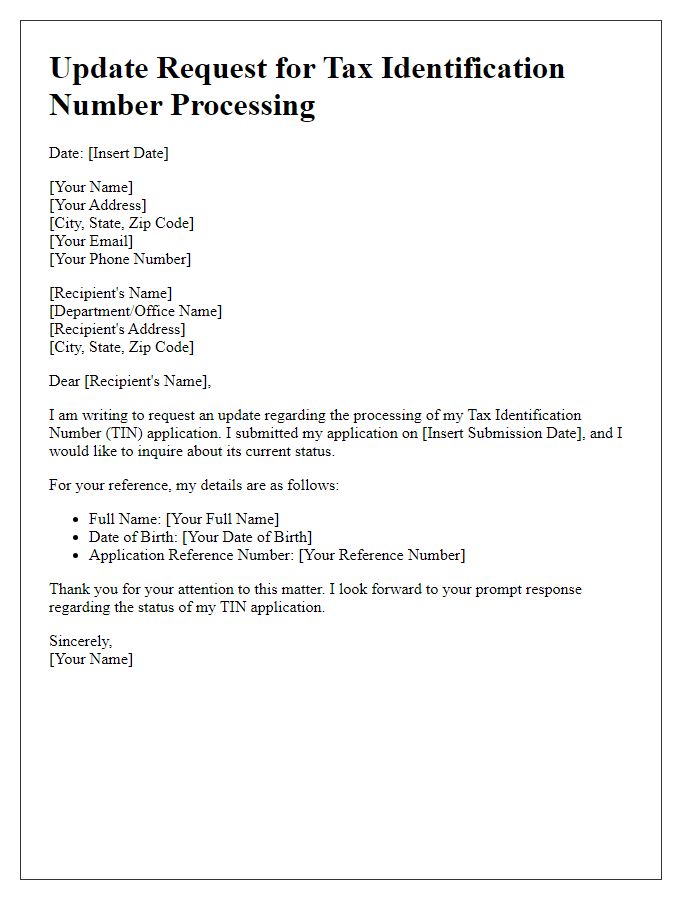

Letter template of update request for tax identification number processing.

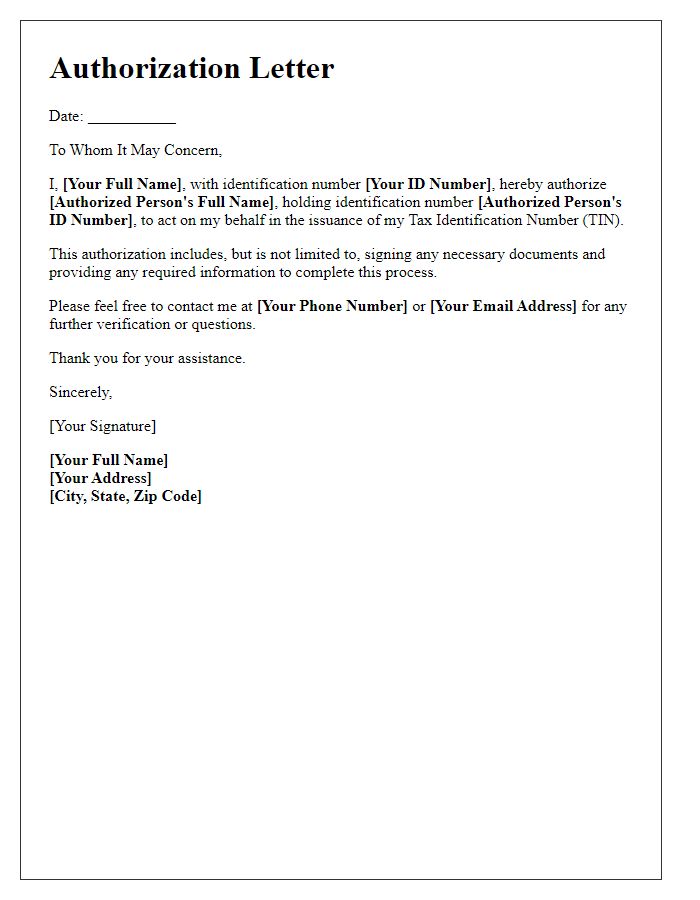

Letter template of authorization for tax identification number issuance.

Comments