Are you curious about how special economic zones (SEZs) can boost your business through enticing tax benefits? Whether you're a startup or an established company, understanding these advantages can transform your operational strategy. SEZs offer a unique environment designed to foster economic growth, providing incentives that can significantly reduce your tax burden. Dive into our article to explore the various tax benefits available in SEZs and discover how they can elevate your business potential!

Eligibility Criteria

Special Economic Zones (SEZs) offer various tax benefits to encourage investment and economic growth in targeted areas. Eligible entities typically include businesses engaged in manufacturing, services, or export activities. To qualify for tax incentives such as income tax exemptions or reduced customs duties, businesses must operate within designated SEZ boundaries, which are officially recognized by the government. Additionally, companies need to meet minimum investment thresholds, often specified in local currency, to access these benefits. Compliance with regulatory requirements, including maintaining proper documentation and adhering to specific operational guidelines, is mandatory. The eligibility process may also involve obtaining necessary approvals from regulatory bodies overseeing the SEZ.

Tax Exemptions and Incentives

Special Economic Zones (SEZs) offer significant tax exemptions and incentives to stimulate economic growth. These zones, designated by governments, provide a favorable business environment through reduced corporate income tax rates, sometimes as low as 0% for specific years. Import duties on imported raw materials can also be exempted, facilitating cost-effective manufacturing. Additional benefits may include tax holidays, where companies are freed from taxes for an extended period, often up to 10 years. SEZs in countries like India, China, and the United Arab Emirates have attracted foreign direct investment (FDI), enhancing local job creation and technological advancement. Essential services and infrastructure, including electricity and transport facilities, are often included at reduced rates, further appealing to businesses seeking to optimize operational costs.

Application Process

The application process for special economic zone (SEZ) tax benefits involves several crucial steps that must be meticulously followed to ensure compliance with regulatory requirements. Companies must first prepare a detailed business proposal, outlining their investment plans, projected employment figures, and overall economic impact within the designated SEZ area. Submission of this proposal typically occurs to the regional development authority based in the SEZ, which evaluates the potential benefits to local economic growth, job creation, and investment stimulation. Necessary documentation includes tax identification numbers, proof of corporate registration, and financial statements. Once submitted, an assessment period of approximately 30 to 60 days is standard, during which the authority conducts due diligence. Upon approval, businesses receive a certificate that outlines specific tax incentives available, including reduced corporate income tax rates, exemption from import duties, and leniency on value-added tax (VAT) obligations. Ongoing compliance reports must be submitted annually to maintain eligibility for these benefits, ensuring that the intended economic impact persists over time.

Compliance Requirements

Special Economic Zones (SEZ) in countries like India provide significant tax benefits aimed at boosting investment and trade. Companies operating within these designated areas must adhere to strict compliance requirements, including maintaining proper documentation of exports and imports, submitting regular performance reports, and fulfilling specific investment commitments that may vary by SEZ, such as the Delhi-Mumbai Industrial Corridor. Regular audits by regulatory bodies, such as the Directorate General of Foreign Trade (DGFT), ensure adherence to these guidelines. Additionally, companies must also comply with labor laws and environmental regulations to maintain their status within the SEZ framework. Understanding such requirements is crucial for companies to benefit from income tax exemptions for up to 15 years and other fiscal incentives.

Duration and Renewal Conditions

Special Economic Zones (SEZs) often offer tax benefits that have specific durations, typically ranging from five to twenty years, depending on the country and local regulations. During this initial period, companies can enjoy reduced corporate tax rates, often as low as 0% to 10%, compared to the standard national tax rates, which can reach up to 30%. After the initial duration, renewal conditions may necessitate compliance with performance benchmarks, such as export requirements, employment thresholds, or capital investment levels. Failure to meet these conditions can result in the revocation of tax incentives, necessitating companies to maintain a strategic focus on growth and development within the SEZ framework to benefit from ongoing advantages.

Letter Template For Special Economic Zone Tax Benefits Samples

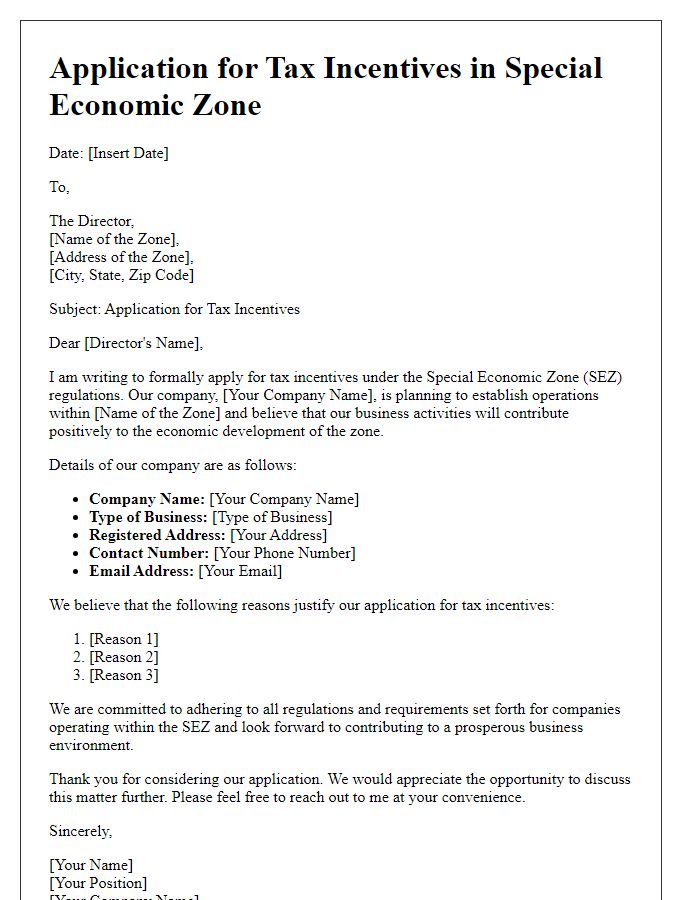

Letter template of application for tax incentives in a special economic zone

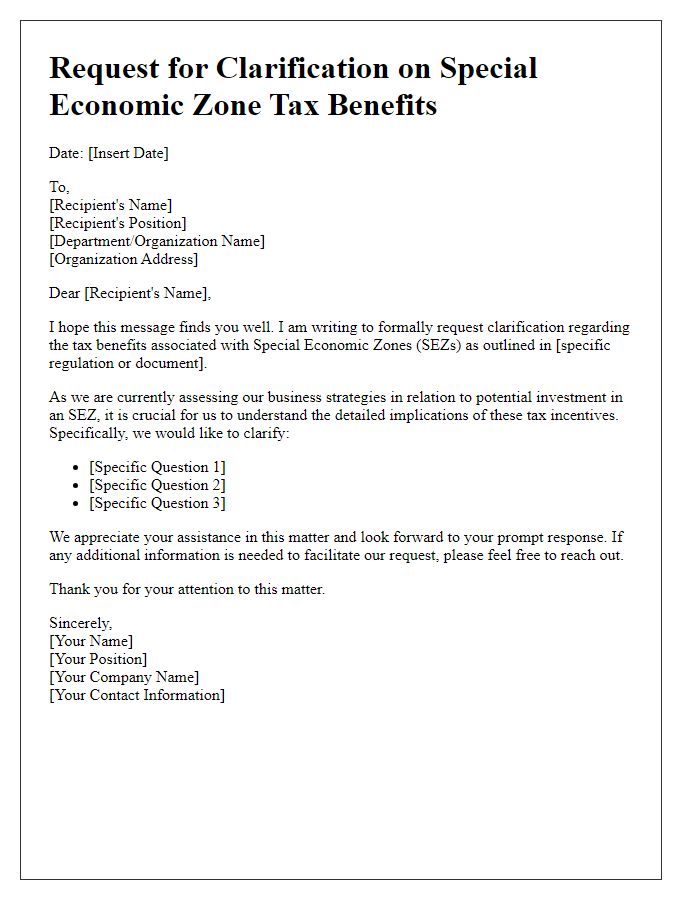

Letter template of request for clarification on special economic zone tax benefits

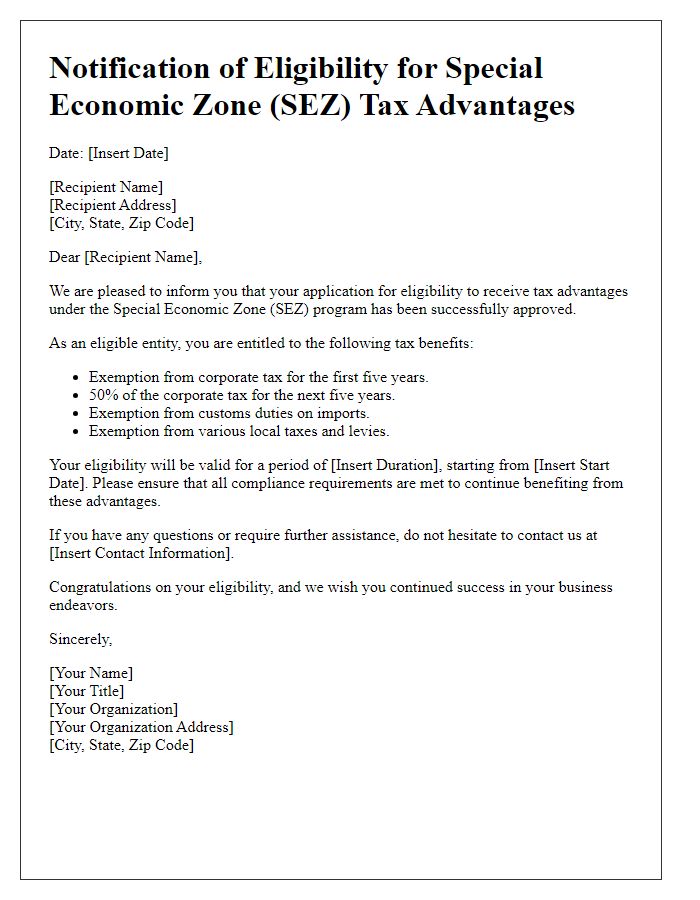

Letter template of notification of eligibility for special economic zone tax advantages

Letter template of appeal for denied tax benefits in special economic zones

Letter template of confirmation for receiving tax incentives in a special economic zone

Letter template of inquiry regarding compliance for special economic zone tax exemptions

Letter template of feedback on special economic zone tax benefit application process

Letter template of proposal for additional incentives in special economic zones

Letter template of update on tax benefits received in special economic zones

Comments