Are you looking to navigate the often confusing world of tax exemption status verification? Understanding your eligibility and the proper documentation can feel overwhelming, but it doesn't have to be. In this article, we'll break down everything you need to know in a straightforward manner, ensuring that the process is clear and manageable. So, grab a seat and let's dive into the essentials of tax exemption status verificationâkeep reading to discover how to simplify this important aspect of your financial journey!

Organization Information

Nonprofit organizations, such as charities and educational institutions, often seek tax-exempt status under Internal Revenue Code Section 501(c)(3). This designation allows eligibility for federal income tax exemption and often state tax benefits. Essential information includes the organization's name, established date, and registered address, typically found in IRS documentation or state filings. Accurate details ensure compliance during verification processes. Tax-exempt organizations might also require their Employer Identification Number (EIN) for identification purposes, facilitating streamlined communication with the IRS. Regular updates of organizational status and documentation are crucial to maintain compliance and enhance transparency with stakeholders and the general public.

Tax Identification Number

Tax exemption status verification requires essential information linked to the Tax Identification Number (TIN) associated with a specific entity, such as a nonprofit organization or charitable institution. This unique number, often issued by the Internal Revenue Service (IRS) in the United States, plays a crucial role in identifying tax-exempt entities. Verification processes typically involve confirming details like the entity's name, formation date, and exemption type, which may include 501(c)(3) for charitable organizations. Accurate verification is critical for compliant fundraising activities and eligibility for various tax benefits, ensuring that organizations operate within legal frameworks while contributing to community welfare.

Reason for Tax Exemption

Nonprofit organizations, such as 501(c)(3) entities in the United States, often seek tax exemption status to further their charitable missions and comply with the Internal Revenue Service (IRS) regulations. This status allows eligible nonprofits to avoid federal income tax, thereby allocating more resources to their community service efforts. For example, charities providing educational support to low-income families can utilize saved funds for programs that offer tutoring, scholarships, and after-school activities. Tax-exempt organizations must maintain stringent adherence to IRS guidelines, submit Form 990 annually, and demonstrate that their operations align with the approved tax-exempt purposes to retain their status and benefit from tax-deductible donations.

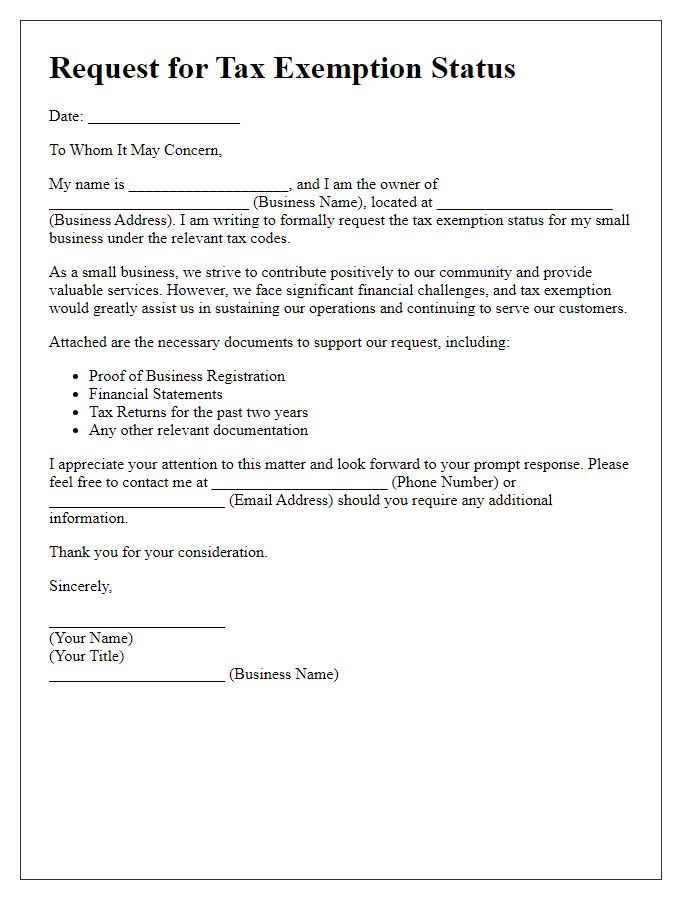

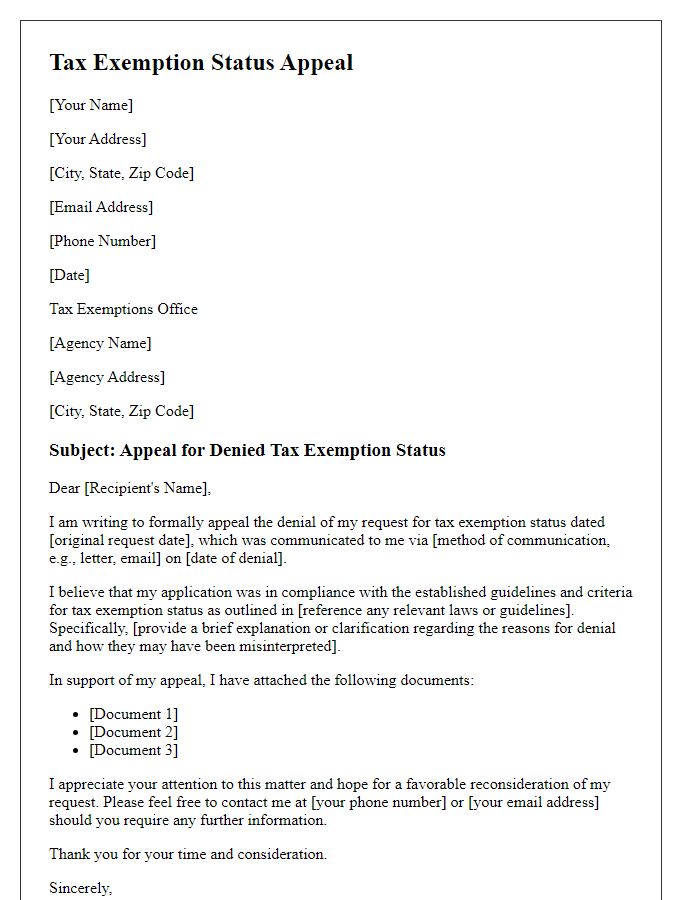

Verification Request Statement

Tax exemption status verification is crucial for non-profit organizations. This involves obtaining official confirmation from the Internal Revenue Service (IRS) regarding 501(c)(3) tax-exempt status. Organizations seeking verification often require specific documentation, including the determination letter from the IRS, which outlines their tax-exempt status as a charitable entity. The request may also involve providing relevant identification numbers, such as Employer Identification Number (EIN), to facilitate the verification process. Timely processing of verification requests is essential, especially for grant applications or other funding opportunities. Additionally, states may require proof of tax-exempt status for local tax exemptions or to qualify for certain financial benefits.

Contact Information for Follow-Up

Tax exemption status verification requires accurate and timely communication. Essential elements include the tax-exempt organization's name and Employer Identification Number (EIN), typically a nine-digit number assigned by the Internal Revenue Service (IRS). The primary contact person's name should include their title, such as Executive Director, along with their phone number and email address for efficient follow-up communication. Additionally, the organization's physical address, including street address, city, state, and zip code, is necessary for official correspondence. Recording the date of the request helps track the process timeline.

Letter Template For Tax Exemption Status Verification Samples

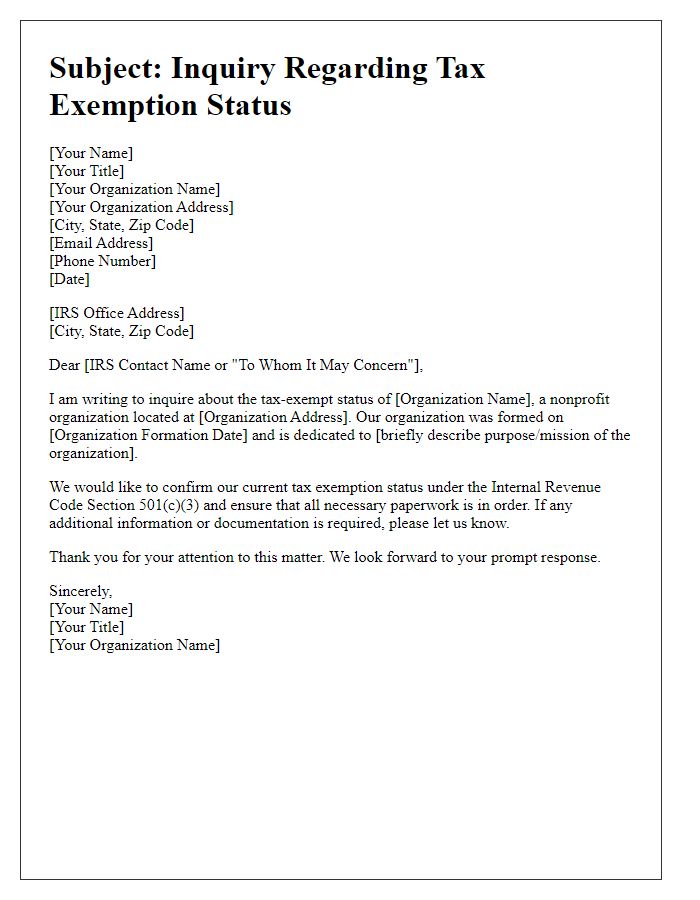

Letter template of tax exemption status inquiry for nonprofit organizations.

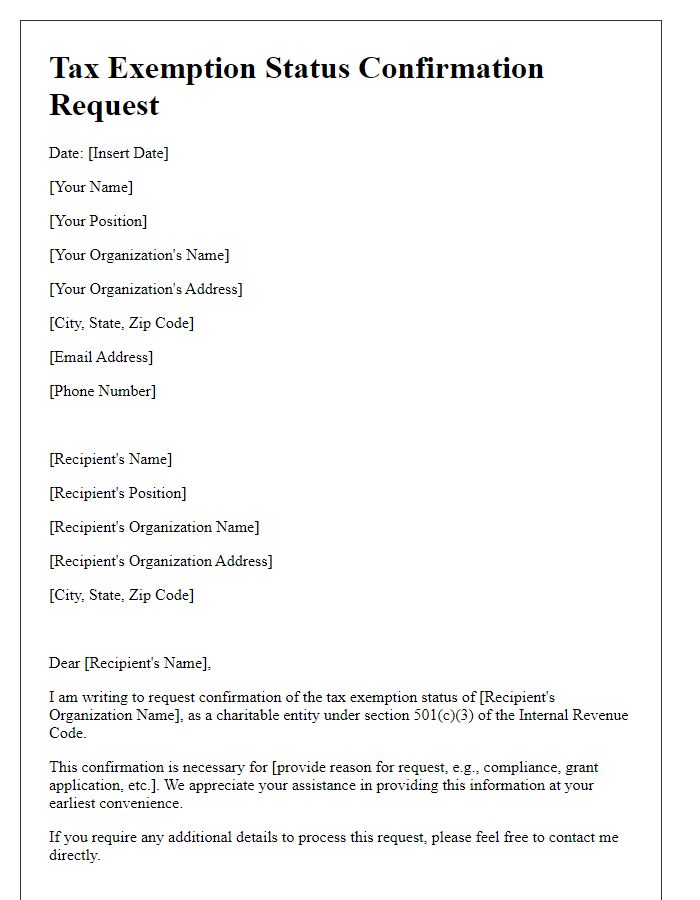

Letter template of tax exemption status confirmation request for charitable entities.

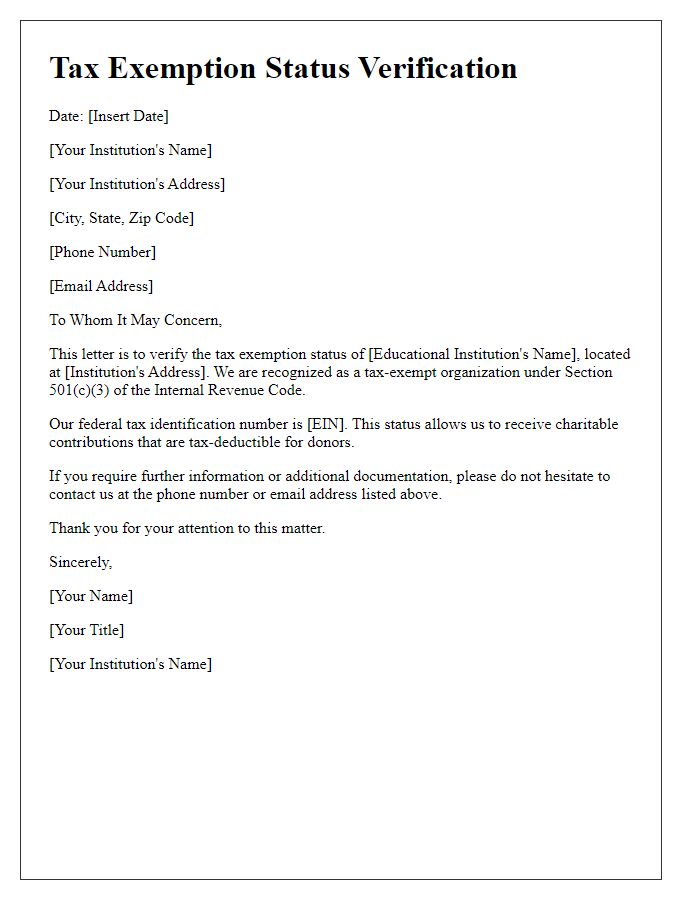

Letter template of tax exemption status verification for educational institutions.

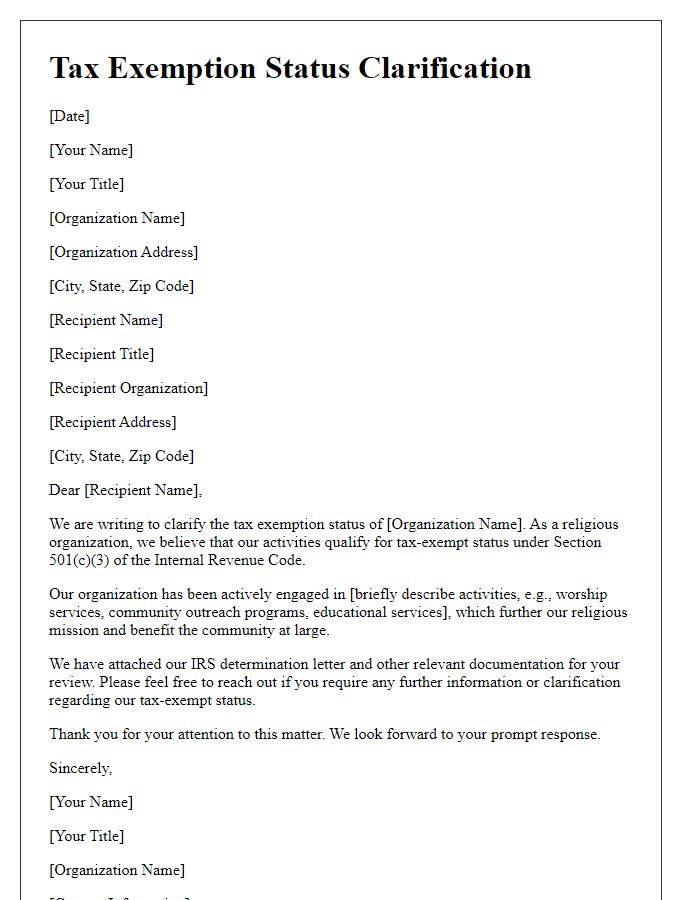

Letter template of tax exemption status clarification for religious organizations.

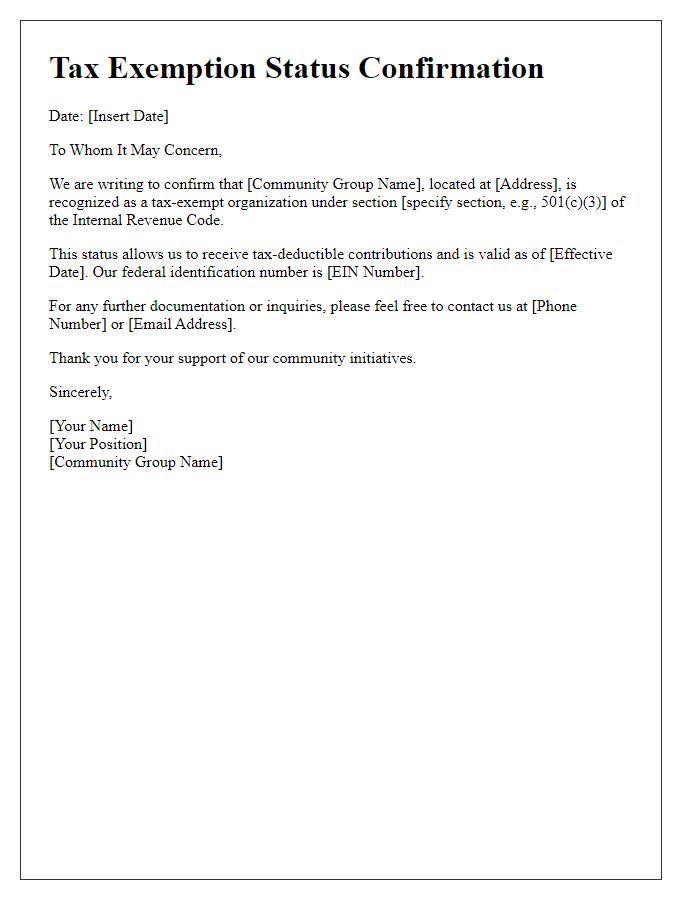

Letter template of tax exemption status documentation for community groups.

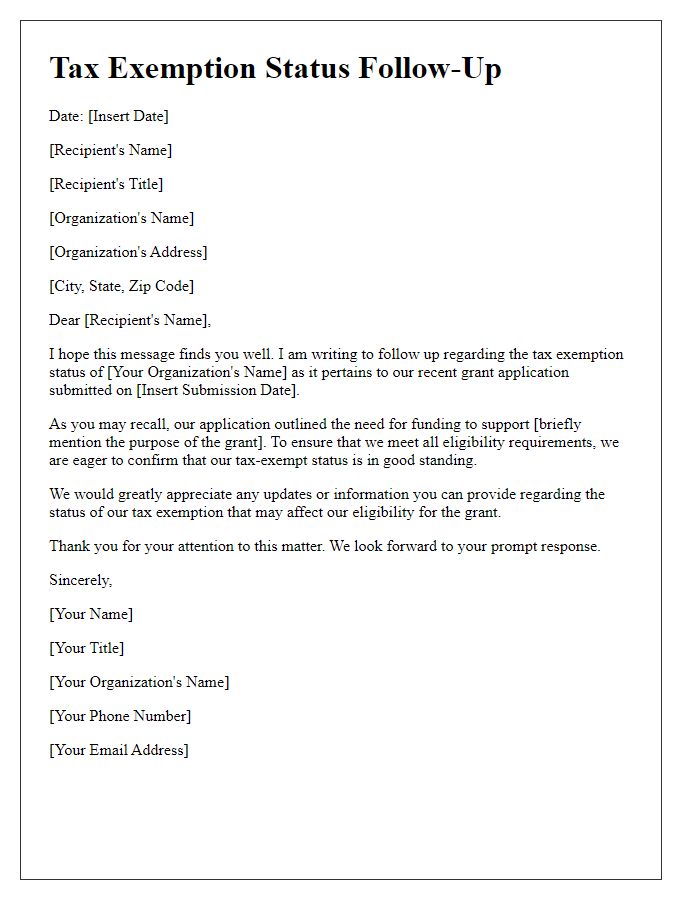

Letter template of tax exemption status follow-up for grant applications.

Comments