Navigating the intricacies of business tax liability can sometimes feel overwhelming, but understanding the basics can make a world of difference. Whether you're a seasoned entrepreneur or just starting out, grasping your tax responsibilities is essential for maintaining financial health. This guide aims to simplify the assessment process, providing clarity and insights to help you make informed decisions. Curious to learn more? Let's dive in!

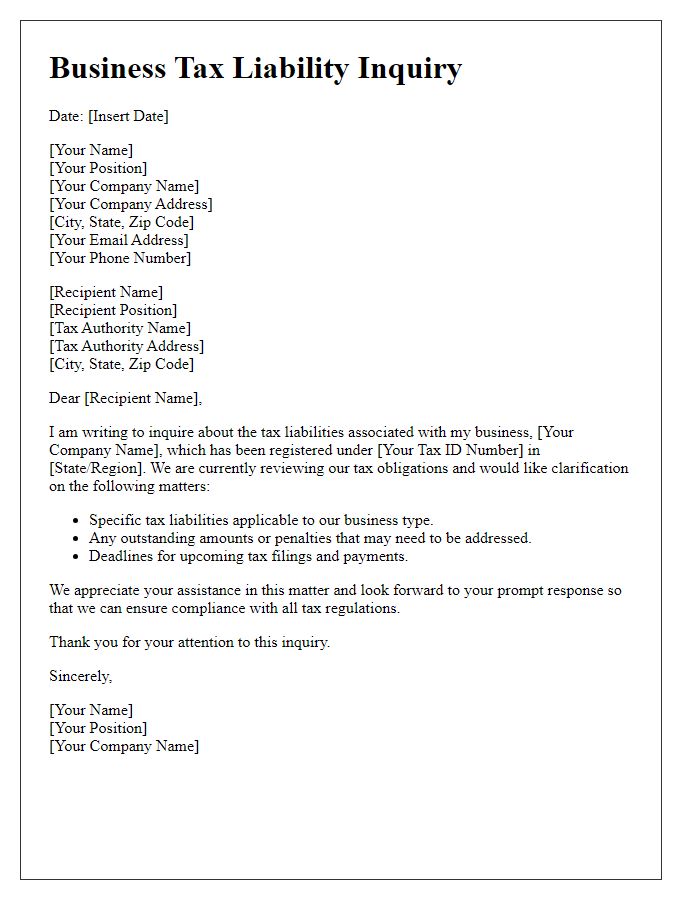

Business Name and Contact Information

When conducting a business tax liability assessment, it is crucial to gather comprehensive details about the specific enterprise. The assessment must include the Business Name, clearly identifying the company in accordance with its registered designation. Contact Information should encompass key elements, such as the business's physical address, including city and state, telephone number for direct communication, and a valid email address for correspondence. Additional details may be beneficial, such as the business's Employer Identification Number (EIN), type of business structure (e.g., LLC, Corporation), and the names of primary stakeholders or officers. This information is vital for ensuring accurate assessment of tax obligations and facilitating efficient communication with tax authorities.

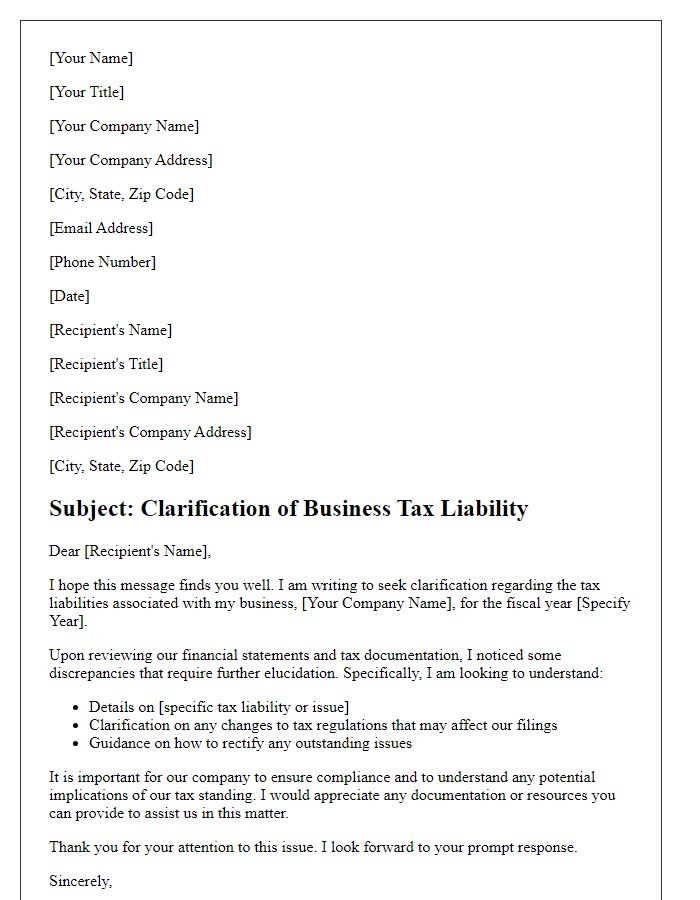

Tax Assessment Summary

The Tax Assessment Summary provides an outline of a business's tax liabilities, detailing specific financial figures and obligations for the fiscal year. This report highlights key elements such as gross income, deductible expenses, and the resulting taxable income, which serves as the basis for calculating tax owed. Tax rates applicable to the business entity type, for example, S-Corporation or Limited Liability Company (LLC), are included to clarify the potential financial impact. Important deadlines, such as quarterly estimated tax payment dates (April 15, June 15, September 15, January 15), are emphasized to ensure compliance with federal and state tax regulations. This summary also notes significant changes in tax law or relevant credits that may affect the overall tax burden, enhancing the understanding of current business obligations.

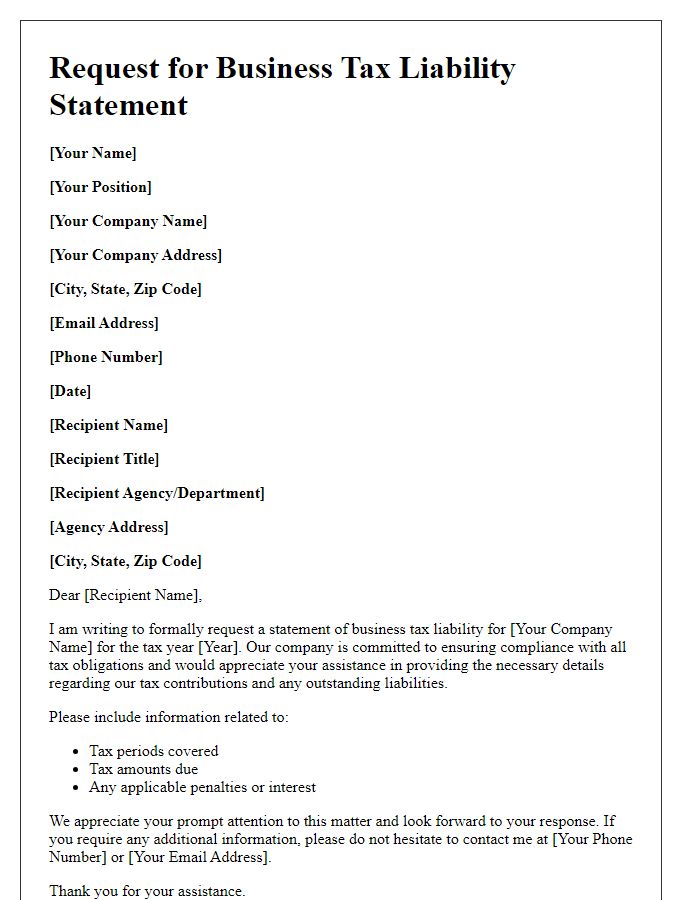

Payment Instructions and Deadlines

For business tax liability assessment, the clear communication of payment instructions and deadlines is crucial. Businesses must remit payments according to the guidelines stipulated by the Internal Revenue Service (IRS) or respective state revenue agencies. Federal tax payments, such as estimated taxes, are typically due quarterly: April 15, June 15, September 15, and January 15 of the following year. Clients can utilize the IRS Direct Pay system for electronic transactions. Moreover, checks must be postmarked by the designated due date to avoid penalties. Additionally, businesses operating in specific states like California or New York face unique deadlines and payment methods, tailored to local regulations. Staying informed about filing requirements, often changing yearly, ensures compliance and mitigates future liabilities.

Legal Obligations and Consequences

Conducting a business tax liability assessment requires awareness of various legal obligations imposed by government entities, notably the Internal Revenue Service (IRS) in the United States. Businesses, regardless of structure--such as sole proprietorships, partnerships, LLCs (Limited Liability Companies), or corporations--must understand and adhere to tax laws governing income reporting, sales tax obligations, and payroll taxes. For instance, corporations are subject to a federal corporate tax rate of 21%, while self-employed individuals face a self-employment tax rate of 15.3%. Failure to comply with these obligations can lead to severe consequences, including penalties that can reach up to 25% of unpaid taxes, interest on overdue amounts, and even legal action resulting in liens against business property. The assessment process often requires thorough record-keeping and the use of relevant forms, such as Schedule C for sole proprietors or Form 1120 for corporations. Understanding these nuances ensures businesses operate within the law while minimizing potential liabilities.

Contact Information for Queries and Assistance

Business tax liability assessments can often require clarification or assistance regarding specific details. For any queries related to tax obligations, business owners should reach out to the Internal Revenue Service (IRS), the federal agency responsible for tax collection in the United States. The IRS provides a dedicated helpline, allowing direct access to tax specialists trained in business tax issues. Alternatively, local tax offices such as the State Department of Revenue can offer assistance specific to state, sales, and corporate taxes. Furthermore, consulting a certified public accountant (CPA) can provide tailored advice and support, ensuring compliance with all regulations and potentially minimizing tax liabilities.

Comments