Are you curious about tax deduction eligibility and how it can work in your favor? Understanding the rules and documentation required can seem overwhelming, but it's essential for maximizing your financial benefits. In this article, we'll break down everything you need to know about confirming your eligibility for tax deductions and provide you with a handy letter template to make the process easier. So, let's dive in and make tax season a little less dauntingâread on to learn more!

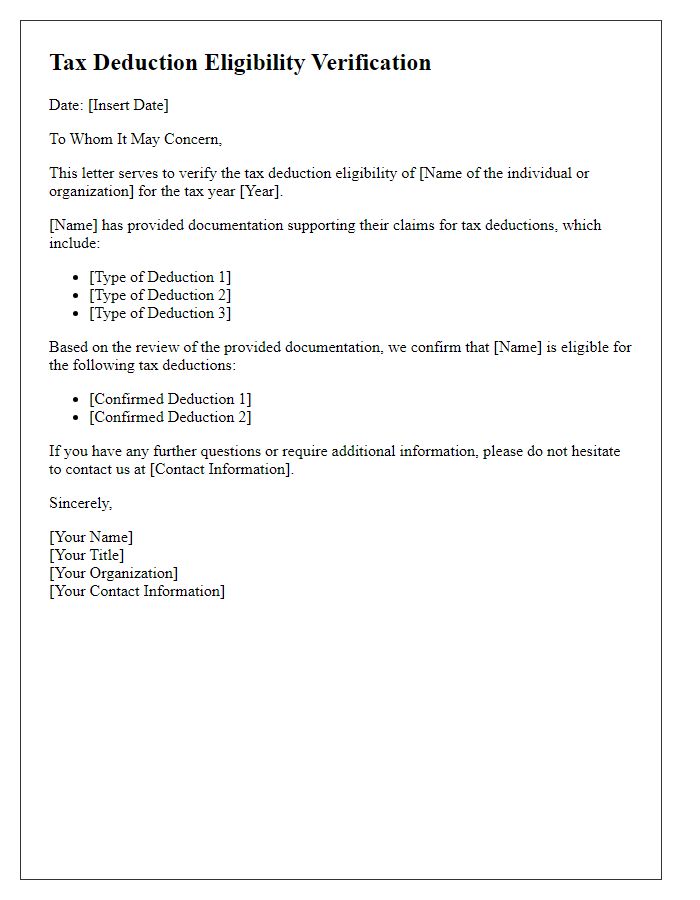

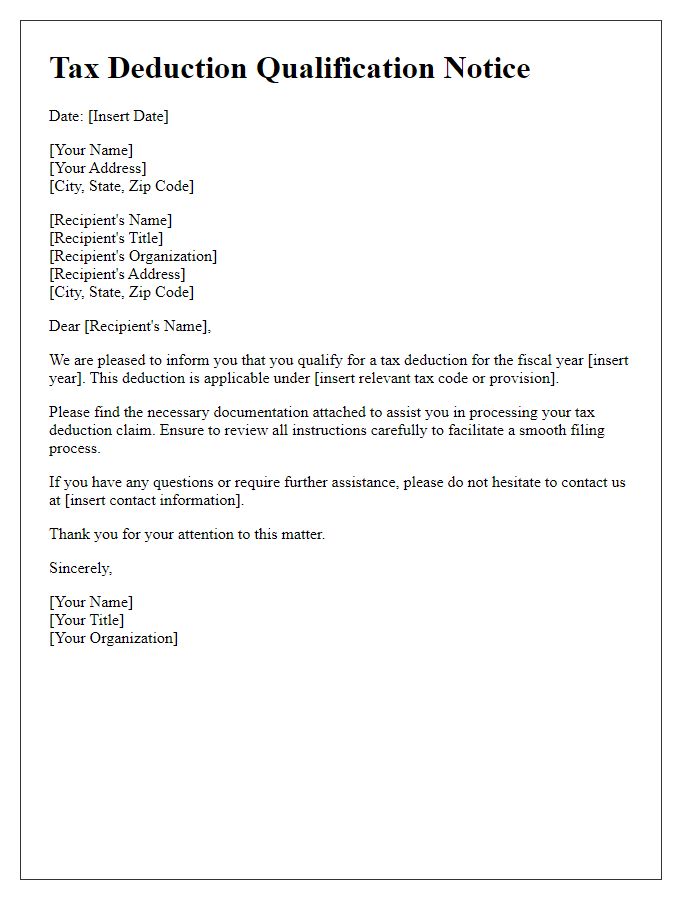

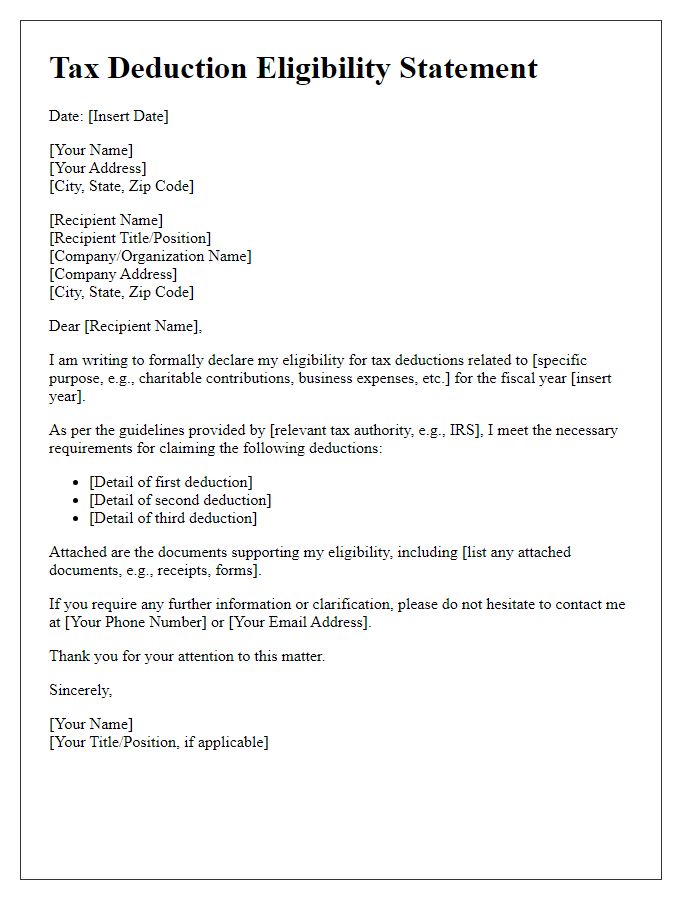

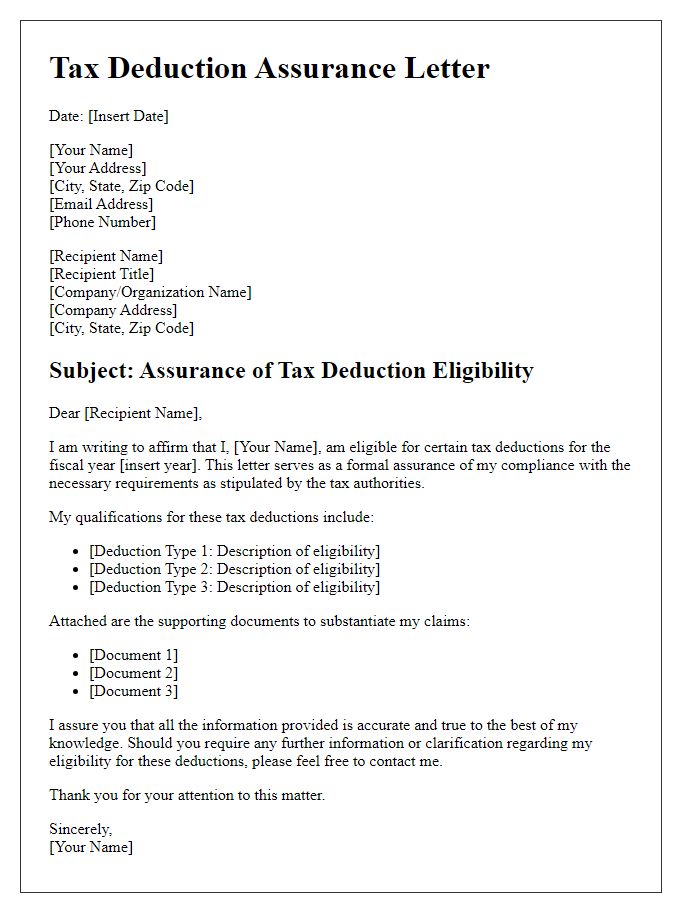

Clear Subject Line

Tax deduction eligibility confirmation requires detailed documentation. Essential criteria include filing status, income brackets defined by the IRS, and deductible expenses such as mortgage interest and medical costs. Supporting documents like W-2 forms from employers, 1099 forms for freelance income, and receipts for charitable donations must be compiled. Review forms 1040 or 1040A, as they detail the required information for personal exemptions and standard deductions. Accurate record-keeping ensures compliance with tax regulations and maximizes potential refunds. Consulting a tax professional becomes valuable for navigating complex eligibility requirements and changes in tax laws.

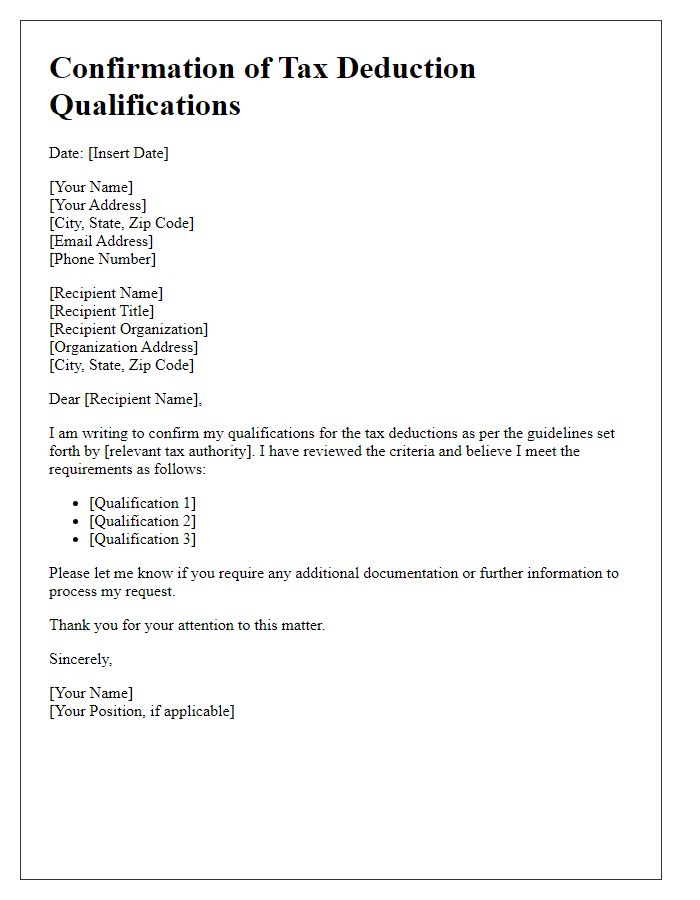

Personalized Greeting

Tax deduction eligibility confirmation involves verifying specific financial criteria, such as income brackets, charitable contributions, and allowable expenses. Potential deductions may include mortgage interest payments up to $10,000, student loan interest up to $2,500, and contributions to retirement accounts like 401(k) plans. Eligibility can also depend on factors such as filing status (single, married, or head of household) and specific tax legislation changes published by the Internal Revenue Service (IRS). It's essential to gather all necessary documentation, including W-2 forms from employers, 1099 forms for freelance income, and receipts for deductible expenses to ensure an accurate assessment of tax obligations and maximization of deductions.

Details of Taxpayer's Information

Tax deduction eligibility often involves comprehensive details about a taxpayer's financial situation and personal information. Taxpayer identification number (TIN) must be included for accurate processing. Financial records from the tax year, such as income statements (W-2 or 1099 forms), home mortgage interest statements, and medical expenses must be assembled. Documentation of any charitable contributions can enhance deduction claims, including receipts or acknowledgment letters from non-profit organizations. Additional details such as filing status (single, married filing jointly, etc.) and number of dependents also play a crucial role in assessing tax deduction eligibility. Gathering relevant documents ensures compliance with regulations set forth by the Internal Revenue Service (IRS).

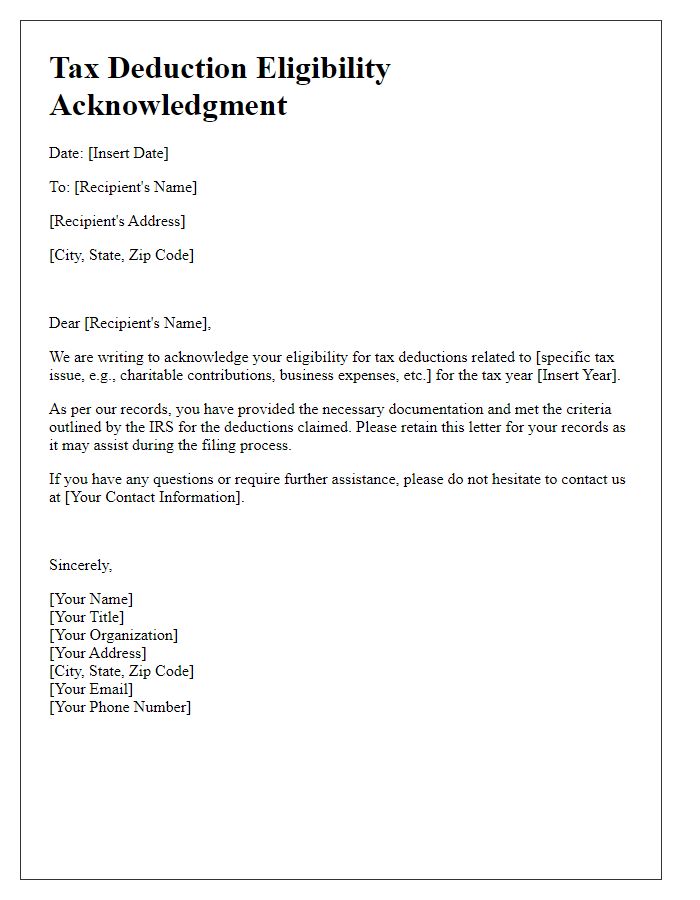

Explanation of Eligibility Criteria

Tax deduction eligibility often depends on several criteria, including income levels, filing status, and specific expenses incurred during the tax year. In the United States, taxpayers must adhere to the guidelines set by the Internal Revenue Service (IRS), which outlines qualifying deductions such as mortgage interest, medical expenses exceeding 7.5% of adjusted gross income (AGI), and contributions to recognized charitable organizations. Additionally, taxpayers may be eligible for deductions based on educational expenses, such as student loan interest, which can provide significant tax relief. Business owners or self-employed individuals also qualify for deductions related to business expenses, including operational costs and home office deductions, provided they meet specific requirements set forth in IRS publications. Understanding these eligibility criteria is crucial for taxpayers aiming to maximize their deductions and effectively reduce their taxable income.

Contact Information for Further Inquiries

Tax deduction eligibility confirmation requires specific documentation and contact information for further inquiries. Individuals may need to reference the Internal Revenue Service (IRS) guidelines, such as Publication 526, detailing charitable contributions eligibility criteria. Tax professionals can assist in navigating eligibility, ensuring compliance with regulations. For questions, contact the IRS helpline at 1-800-829-1040 during business hours. State tax authorities also provide assistance; for example, the California Franchise Tax Board offers resources at 1-800-852-5711. Comprehensive documentation, including receipts and acknowledgment letters from charitable organizations, supports claims and verifies deductions during audits.

Comments