Are you feeling a bit confused about graduated tax brackets? You're not aloneâmany people find the concept a little tricky to navigate. Essentially, a graduated tax bracket means that the more you earn, the higher the percentage of tax you pay on your income. If you're curious to dive deeper into how these brackets work and what they mean for your wallet, keep reading to unravel the details!

Clear Identification of Recipient

Graduated tax brackets refer to the progressive taxation system where income ranges are taxed at different rates. For instance, in the United States, the 2023 federal tax brackets for singles include 10% on income up to $11,000, 12% on income from $11,001 to $44,725, and progressively higher rates up to 37% for incomes exceeding $523,600. Each bracket delineates specific income thresholds, impacting overall tax liability based on total annual income. Understanding these tiers is crucial for effective tax planning, as it allows individuals to forecast their tax obligations and strategize deductions or credits. Accurate identification of income sources and potential adjustments can lead to significant savings in tax payments.

Detailed Explanation of Tax Brackets

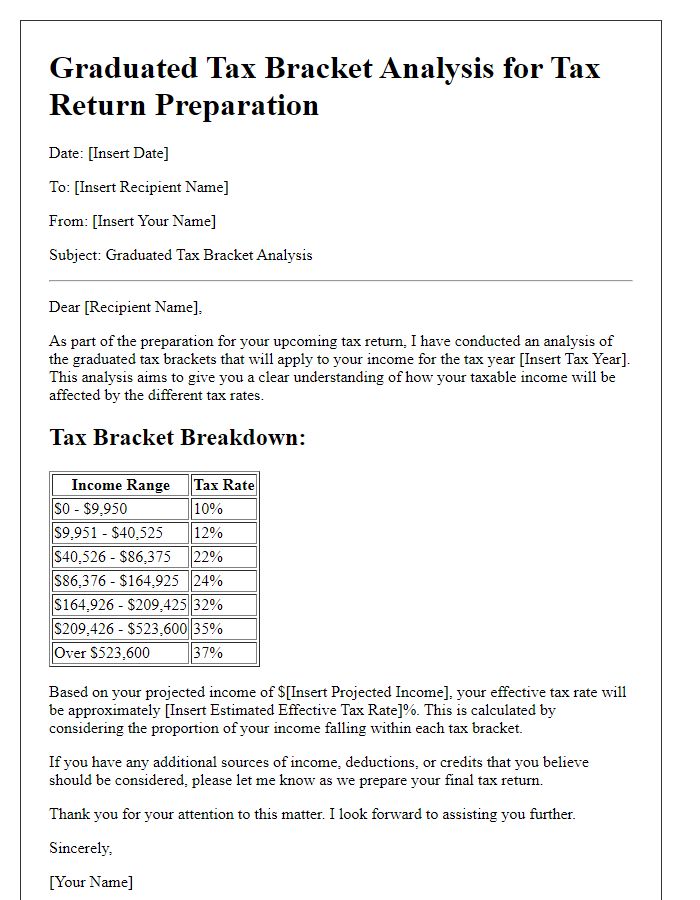

Graduated tax brackets represent a system where tax rates increase with higher income levels. In the United States, this system is structured with multiple tiers, each having a specific tax rate. For example, income up to $10,000 may be taxed at 10%, while income between $10,001 and $40,000 is taxed at 12%. Higher income ranges, such as $40,001 to $85,000, may face a 22% tax rate. This structure ensures that individuals contribute a fair share based on their earnings, promoting equity within the tax system. Each year's adjustments, influenced by inflation and economic conditions, can modify these brackets, impacting taxpayers differently. Understanding these ranges is essential for effective financial planning.

Specific Income Levels and Rates

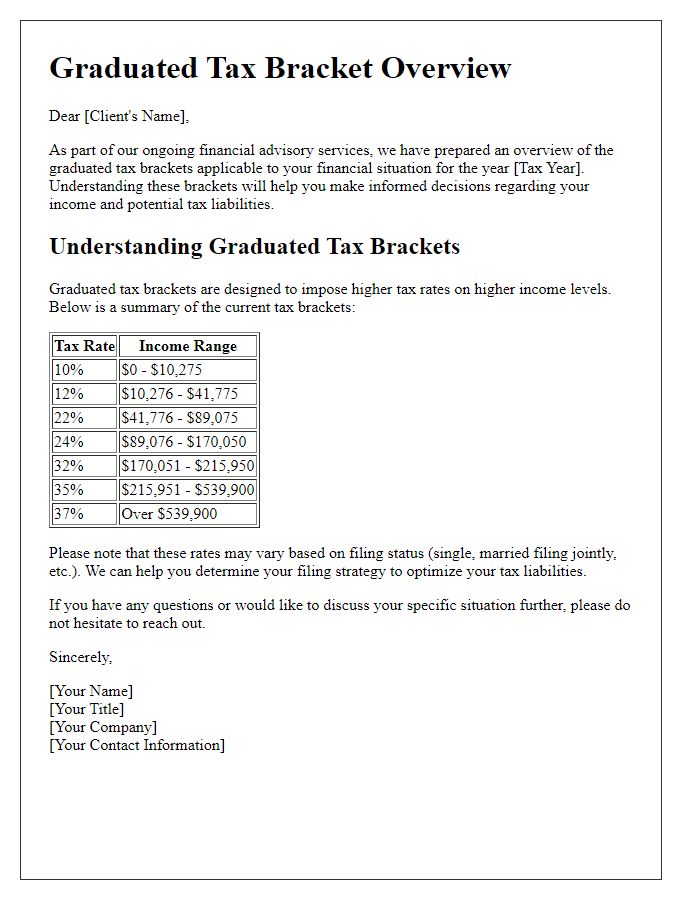

Graduated tax brackets are structured to impose varying tax rates on different levels of income, which allows for a fairer distribution of the tax burden. For example, in the United States, the federal income tax system typically includes multiple brackets, such as 10%, 12%, 22%, and higher percentages for incomes exceeding specific thresholds. The threshold for the 10% bracket may apply to individual filers earning up to $10,275, while married couples filing jointly see that limit increase to $20,550 in 2023. As taxable income rises, individuals may transition into higher brackets, meaning that only the income exceeding certain limits is taxed at the higher rates, creating a progressive structure. Understanding these specific income levels and rates is crucial for effective financial planning and tax compliance, especially for those earning significant amounts or managing various income streams, such as from investments or self-employment.

Clarification of Deductions and Exemptions

Graduated tax brackets determine the tax rate based on income levels, enabling a more equitable taxation process. Specific deductions such as mortgage interest, student loan interest, and charitable contributions can significantly lower taxable income, influencing the effective tax rate applied. Exemptions, which may differ based on filing status (single, married filing jointly), allow taxpayers to reduce their taxable income further, providing relief for dependent family members. Understanding these nuances in tax policy is crucial for accurate tax calculations and financial planning, ensuring individuals fully utilize available benefits to optimize their tax obligations.

Contact Information for Further Inquiries

Graduated tax brackets determine the tax rate applied to various levels of income, impacting individuals in regions like the United States, Canada, and the United Kingdom. These tax policies, effective from the beginning of the fiscal year, aim to impose higher rates on more substantial income amounts while protecting lower earners. For example, in the United States, the 2023 tax brackets range from 10% for income up to $11,000 for single filers to 37% for income exceeding $578,125. Individuals seeking clarification about their specific tax situation, deductions, or eligibility can contact local tax authorities or consult certified public accountants (CPAs) for personalized assistance and guidance based on their income brackets and financial circumstances.

Letter Template For Graduated Tax Bracket Clarification Samples

Letter template of graduated tax bracket inquiry for personal financial planning

Letter template of graduated tax bracket explanation request for estate planning

Letter template of graduated tax bracket clarification for a business tax strategy

Letter template of graduated tax bracket information request for academic research

Letter template of graduated tax bracket overview for client financial advisory

Letter template of graduated tax bracket analysis for tax return preparation

Letter template of graduated tax bracket discussion for nonprofit organization funding

Letter template of graduated tax bracket policy clarification for legislative feedback

Letter template of graduated tax bracket update request for investment recommendations

Comments