Are you feeling perplexed by the alternative minimum tax (AMT)? You're not alone; many taxpayers find themselves scratching their heads when faced with this often misunderstood tax system. In this article, we'll break down what the AMT is, who it affects, and how it might impact your financial situation. Dive in with us to uncover the ins and outs of the AMT and discover why understanding it is crucial for your tax planning!

Tax Calculation Methodology

The Alternative Minimum Tax (AMT) serves as a parallel taxation system designed to ensure that high-income individuals and corporations pay a minimum tax regardless of deductions or credits claimed. It involves a unique tax calculation methodology distinct from the regular income tax framework. Under AMT, taxpayers must calculate their Alternative Minimum Taxable Income (AMTI) by adding back certain deductions, such as state and local taxes or miscellaneous itemized deductions, which are not allowed under the AMT rules. After calculating AMTI, taxpayers apply the AMT tax rates of 26% and 28% on the adjusted income, with an exemption amount varying based on filing status, like single or married filing jointly. The resulting tax owed under the AMT is compared to the regular tax liability; if the AMT amount exceeds the regular tax, the taxpayer pays the higher amount. Notable events influencing AMT, such as the Tax Cuts and Jobs Act of 2017, modified various aspects of deductions and exemptions, impacting many taxpayers' calculations.

Exemption Thresholds

The Alternative Minimum Tax (AMT) is imposed to ensure that high-income taxpayers contribute a fair share to federal revenues, often referred to as the Tax Code of 1969. For the tax year 2023, the exemption threshold for individual taxpayers is set at $81,300, while married couples filing jointly can benefit from an exemption of up to $126,500. These exemption amounts are adjusted for inflation and ensure that lower and middle-income earners are less affected by this tax. Income levels above these thresholds require taxpayers to calculate their AMT, which involves adding back certain deductions and computing a separate tax liability. Significant deductions that could trigger AMT liabilities include state and local tax deductions and certain business expenses. Understanding these thresholds and how they impact taxable income is crucial for effective tax planning.

Taxable Income Adjustments

The Alternative Minimum Tax (AMT) applies to taxpayers, notably individuals and corporations, to ensure that they pay a minimum level of tax. Adjustments to taxable income can significantly affect AMT calculations. Key adjustments include the preference items, such as accelerated depreciation and tax-exempt interest from private activity bonds, which must be added back to regular taxable income. Recognized losses, specifically from the sale of appreciated assets, may also need to be adjusted. Overall adjustments could change the amount of income subject to AMT, impacting the final tax liability. Understanding the nuances of these adjustments is crucial for accurate tax reporting and compliance.

Tax Credit Implications

The Alternative Minimum Tax (AMT) may impact your tax credit eligibility significantly. The AMT system, established by the Tax Reform Act of 1969, is designed to ensure that individuals cannot avoid paying a minimum amount of taxes through deductions and credits. For tax year 2023, for example, the AMT exemption amount is $81,300 for single filers and $126,500 for married couples filing jointly. Tax credits such as the Child Tax Credit and the Earned Income Tax Credit are generally not applicable against AMT liability. Individuals may find their overall tax liability increased if their income exceeds specific thresholds, potentially affecting eligibility for significant credits. Consequently, taxpayers may face unexpected tax burdens as they navigate credit calculations, making preemptive tax planning essential for financial management.

Filing Requirements

The Alternative Minimum Tax (AMT) applies to individuals based on specific income thresholds and certain deductions. Taxpayers with an adjusted gross income (AGI) exceeding $200,000 for married filing jointly or $100,000 for single filers must evaluate their AMT liability. The AMT exemption amounts for 2023 are $81,300 for single filers and $126,500 for married couples filing jointly, impacting taxable income calculations. Moreover, various tax preferences and deductions, such as state and local tax deductions, may also come into play in determining AMT liability. Taxpayers should be aware of the Form 6251 requirement during filing to establish whether they owe additional taxes based on AMT rules.

Letter Template For Alternative Minimum Tax Explanation Samples

Letter template of Understanding the Alternative Minimum Tax Implications

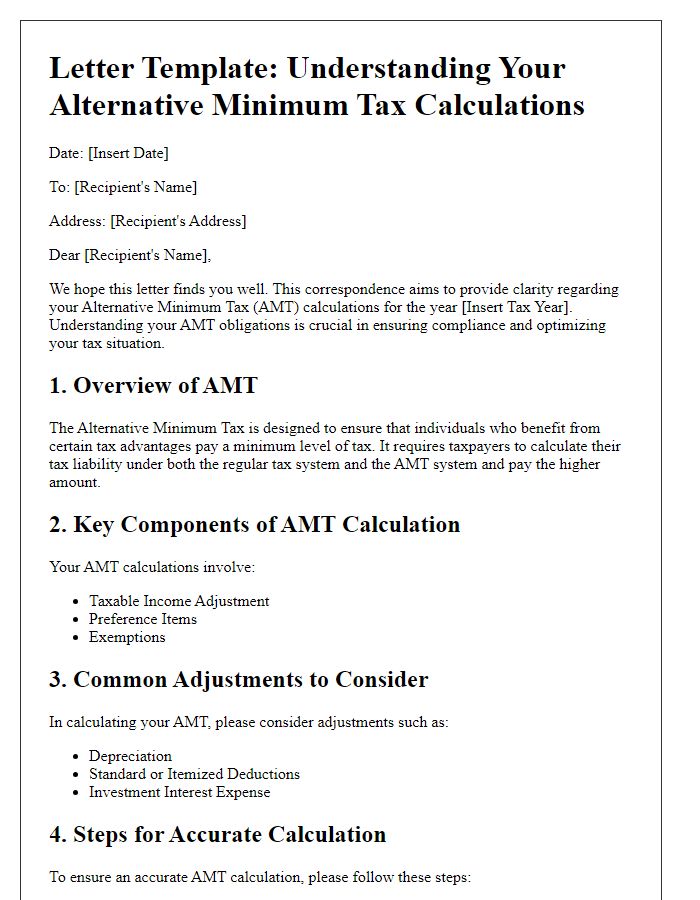

Letter template of Understanding Your Alternative Minimum Tax Calculations

Comments