Are you feeling a bit overwhelmed with the complexities of tax season? You're not alone, and that's precisely why having a knowledgeable tax adviser by your side can make all the difference. Our dedicated team is here to guide you through every step of the process, ensuring your financial peace of mind. Ready to learn more about how we can assist you?

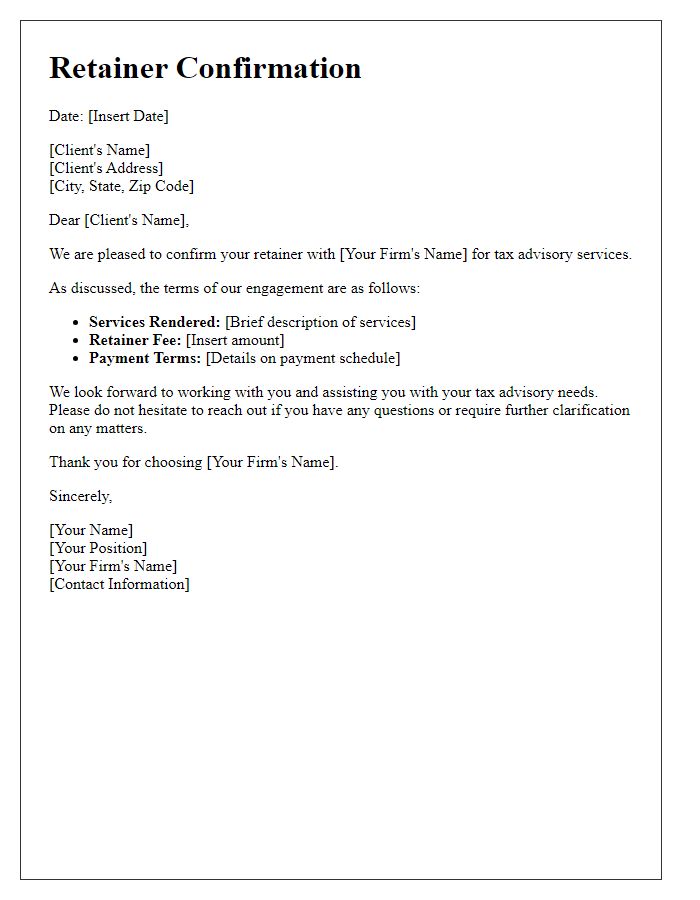

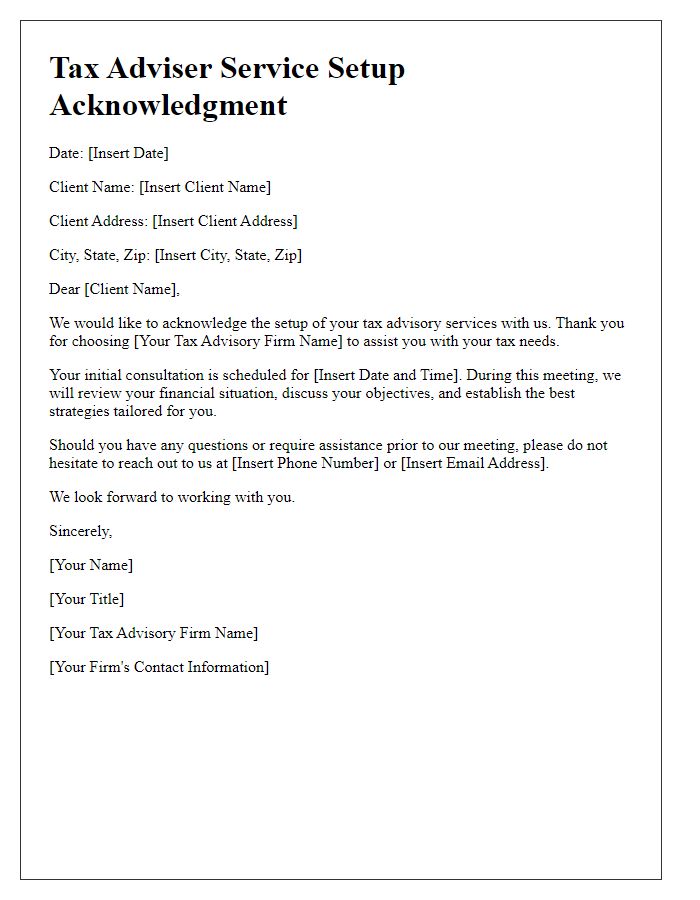

Personalization

Tax adviser services offer personalized consultations tailored to individual financial circumstances. Experienced professionals analyze specific tax situations, guiding clients through complexities such as deductions, credits, and tax liabilities, ensuring compliance with local laws like the Internal Revenue Code in the United States. Personalized services often include strategies for maximizing returns and minimizing payments, reflecting current tax brackets and regulations in various states. Additionally, advisers frequently utilize software tools for accurate calculation and filing, ensuring timely submissions before deadlines such as April 15th for federal income tax. Building a close relationship with clients allows for ongoing support and tax planning throughout the year.

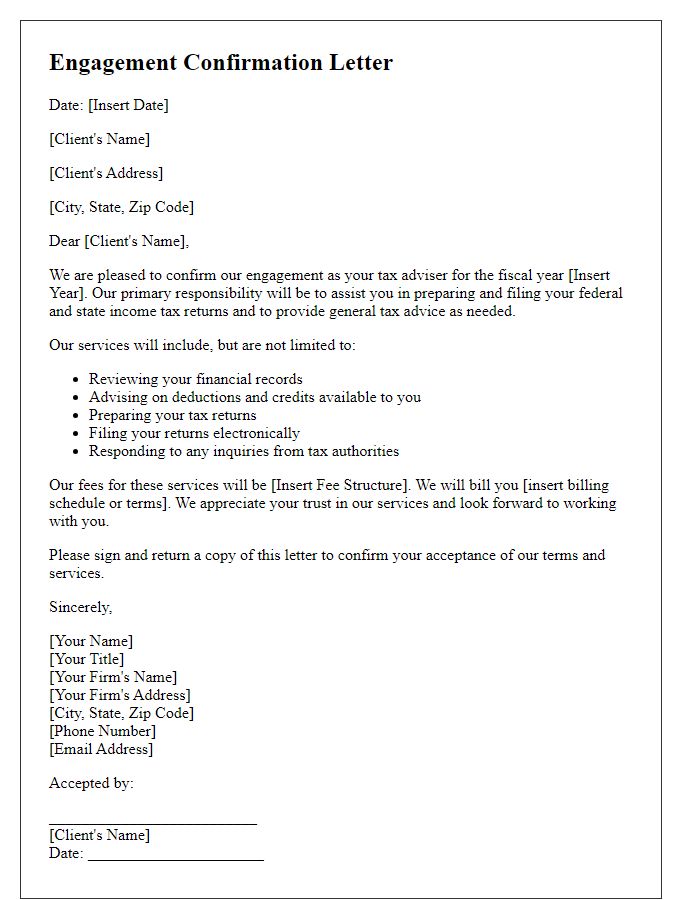

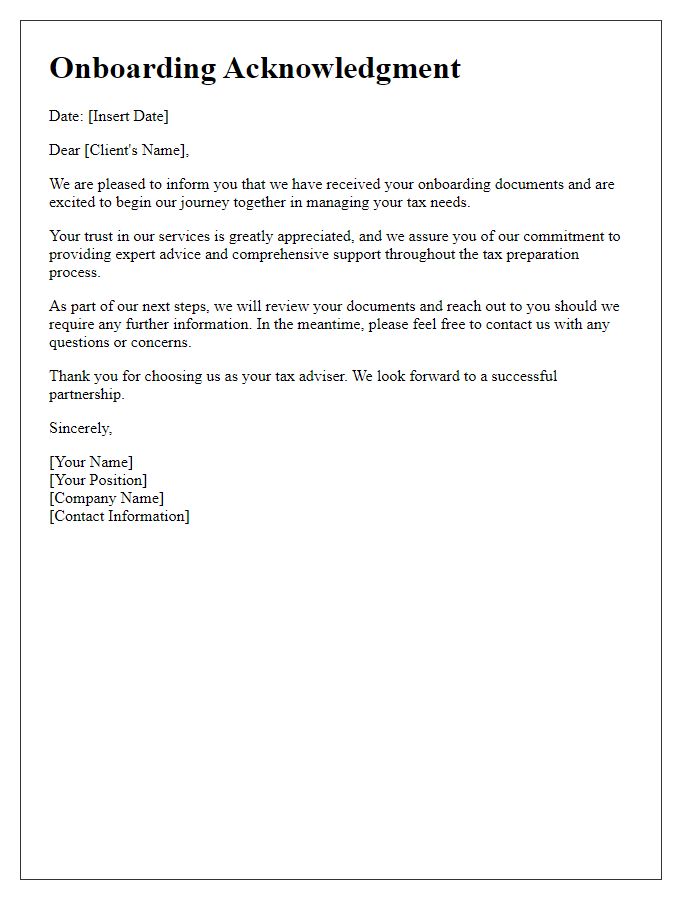

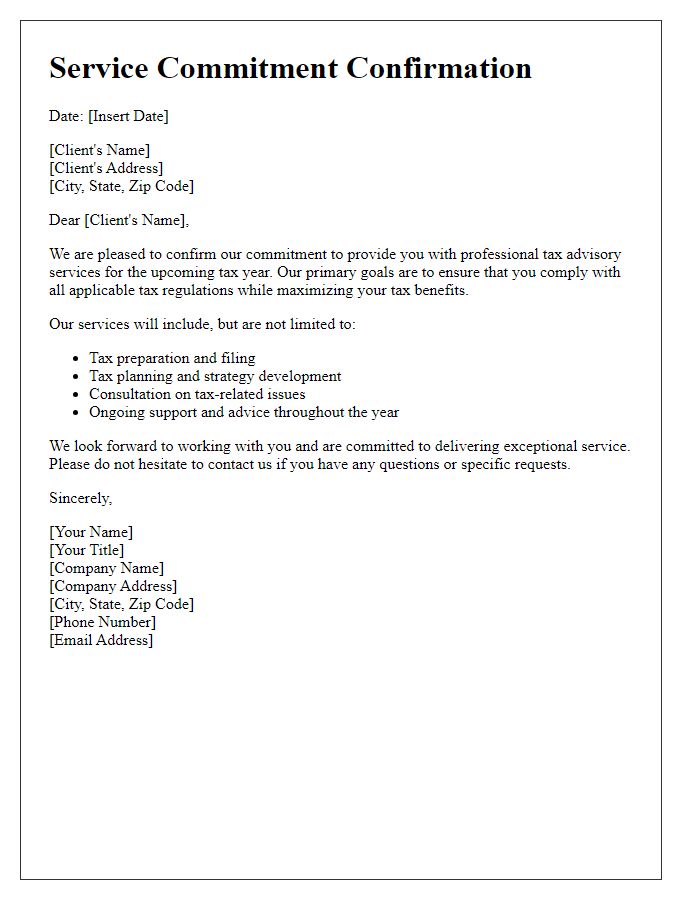

Service Scope and Details

Professional tax advisory services encompass a detailed analysis of financial situations, strategic tax planning, and compliance assistance. In 2023, the focus is on navigating complex tax codes and regulations, ensuring clients maximize deductions while minimizing liability. Services typically include preparation of federal and state tax returns, audit support, representation before the Internal Revenue Service (IRS), and advice on tax-efficient investment strategies. Key considerations involve deadlines such as April 15 for individual returns and corporate tax filings, as well as emerging tax reforms and credits available under recent legislation. Furthermore, personalized consulting sessions often occur on a quarterly basis to adjust strategies as clients' financial landscapes change throughout the year.

Terms and Conditions

Tax adviser service confirmation involves detailed agreements and guidelines to ensure clarity between clients and tax consultants. Key components typically include confidentiality clauses protecting sensitive financial data, fee structures outlining hourly rates or flat fees, and service scope detailing the specific tax preparation tasks performed, such as income tax return preparation in accordance with local tax laws. Additionally, terms often specify timelines for service delivery, including deadlines for information submission and client responses. It is also common to include liability disclaimers addressing the limits of advisory responsibility and potential audit support provisions, especially relevant for clients navigating complex IRS regulations. Understanding and agreeing to these conditions are crucial for a transparent and effective adviser-client relationship.

Contact Information

Tax advisers play a critical role in managing finances and ensuring compliance with regulations. Tax returns often involve complex calculations and deadlines, with the average U.S. citizen spending around 13 hours annually on tax preparation. Consulting a qualified tax adviser can streamline this process, potentially leading to significant savings. In 2022, the IRS reported more than 151 million individual income tax returns filed, highlighting the importance of professional assistance. Properly organized contact information is essential for effective communication, enabling timely updates and personalized advice tailored to unique financial situations.

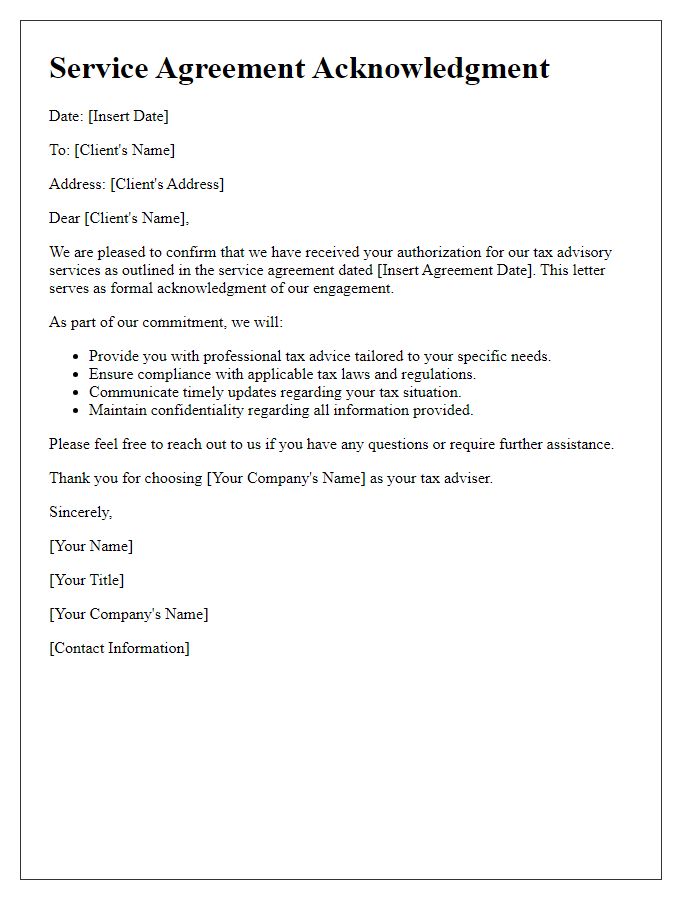

Affirmation and Client Acknowledgment

Professional tax advisory services ensure compliance with IRS regulations and maximize potential refunds or minimize liabilities. Experienced tax advisers specialize in areas such as individual (Form 1040) and corporate taxes (Form 1120), ensuring accurate reporting of income and deductions. In 2022, taxpayers reported a collective credit of over $1.4 trillion, emphasizing the importance of skilled tax preparation. Client acknowledgment is crucial; it validates understanding of service fees, deadlines (April 15 for individual returns), and documentation requirements (e.g., W-2 forms, 1099 forms). Clear communication about tax laws, deductions like mortgage interest, and credits such as the Earned Income Tax Credit enhances financial well-being and mitigates risks of audits.

Comments