Are you considering applying for the Research and Development (R&D) Tax Credit but unsure where to start? Navigating through the requirements and documentation can be daunting, but it doesn't have to be. This tax incentive is designed to reward innovation, helping businesses like yours capitalize on their research efforts. Keep reading to discover a helpful letter template that will make your application process smoother and more efficient!

Detailed project description

The research and development (R&D) tax credit has proven invaluable for technology firms pursuing innovative projects, particularly in sectors such as software development and biotechnology. For instance, a project developing a new artificial intelligence algorithm aimed at improving data analysis capabilities could involve extensive programming efforts, experimental validations, and iterative testing phases spanning several months. This initiative may warrant tax relief due to factors like increased personnel costs for highly skilled software engineers and researchers, which can reach annual salaries exceeding $100,000. Additionally, the project's resource allocation might include advanced computational resources, potentially totaling over $50,000, further substantiating the financial investment in R&D activities. Detailing such efforts will enhance the credibility of the application for the tax credit, reflecting adherence to the IRS guidelines on qualifying research activities and associated expenditures.

Qualifying R&D activities

Research and Development (R&D) activities encompass innovative processes and experiments aimed at developing new products or improving existing ones. These activities, often occurring in specialized facilities like laboratories or tech incubators, include designing software algorithms tailored for machine learning applications. Testing prototypes in controlled environments ensures compliance with industry standards, particularly in sectors such as biotechnology and information technology. Additionally, collaboration with universities or research institutions can enhance the scope of R&D, enabling access to advanced resources and expertise. Detailed documentation of trials, methodologies, and results is critical for substantiating eligibility for the R&D tax credit. This tax incentive, available to businesses across multiple sectors, fosters continued innovation and economic growth, contributing significantly to advancements in technology and productivity.

Cost breakdown and budget

The research and development tax credit (R&D tax credit) plays a crucial role in supporting innovative businesses by providing financial incentives for eligible R&D activities. Detailed cost breakdown demonstrates the allocation of financial resources towards projects, including wages for personnel (scientists, engineers) engaged in research, materials and supplies (chemicals, prototypes), contract research expenses (consultants, third-party research firms), and overhead costs (utilities, rent) directly related to R&D projects. A well-structured budget showcases planned expenditures over the fiscal year, highlighting projected labor costs estimated at $500,000, raw materials expenditure of $200,000, and consulting fees around $100,000. This structured approach not only reinforces the validity of the R&D claims but also outlines the strategic investment in innovation, contributing to advancement in technologies and processes that significantly benefit the industry.

Technical challenges and uncertainties

The pursuit of research and development (R&D) tax credits often involves navigating complex technical challenges and uncertainties, particularly in industries like biotechnology and software development. For example, creating a new pharmaceutical compound may face hurdles such as achieving efficacy in clinical trials (usually Phase I to Phase III) and navigating regulatory approvals by entities like the FDA (U.S. Food and Drug Administration). Likewise, software development projects may encounter uncertainties regarding the integration of artificial intelligence algorithms or real-time data processing capabilities, often leading to unpredictable outcomes in performance metrics. These challenges necessitate rigorous testing and iterations, typically documented through experimental data and project logs, to validate the innovative techniques employed and to ensure meaningful advancements in technology or processes.

Compliance with tax regulations

Research and Development (R&D) tax credits provide significant financial benefits for businesses engaging in innovative projects. Companies must maintain detailed documentation to demonstrate compliance with tax regulations, ensuring eligibility for credits. Qualified Research Activities (QRA) include experimentation, prototype development, and improvements to existing products or processes. Accurate record-keeping, encompassing project descriptions, employee time tracking, and associated costs is crucial for substantiating claims. Furthermore, adherence to specific IRS guidelines, such as the four-part test for R&D qualification, mitigates the risk of audits and penalties. Engaging tax professionals with expertise in R&D credits can enhance compliance efforts and maximize potential savings.

Letter Template For Research And Development Tax Credit Samples

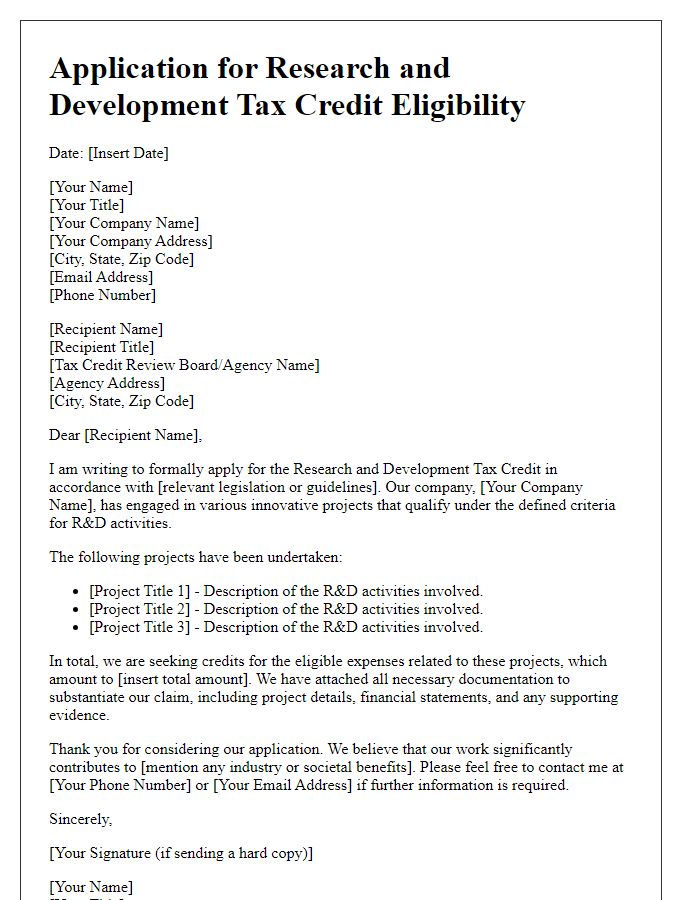

Letter template of application for research and development tax credit eligibility.

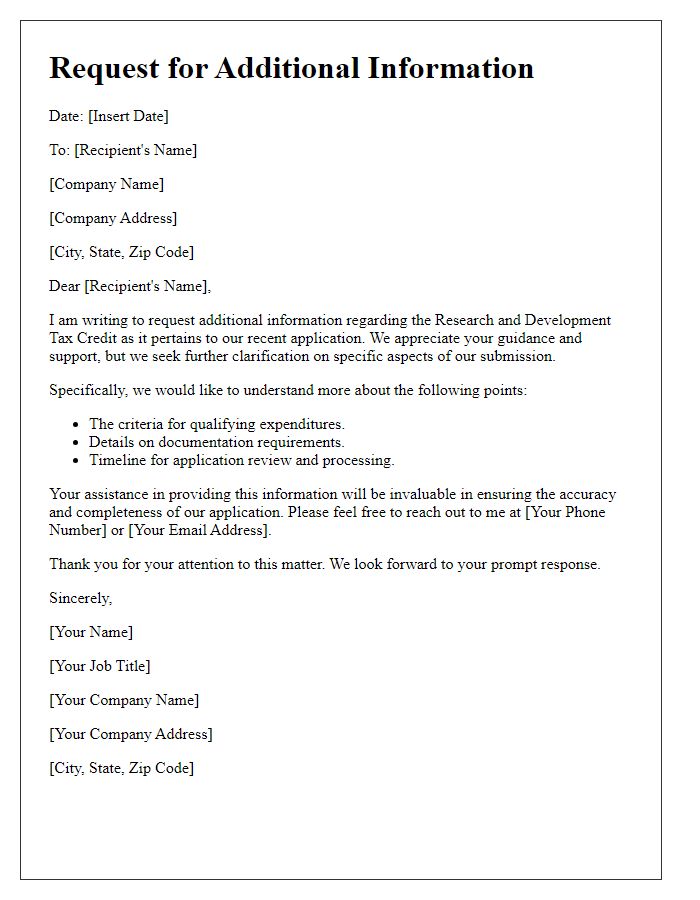

Letter template of request for additional information on research and development tax credit.

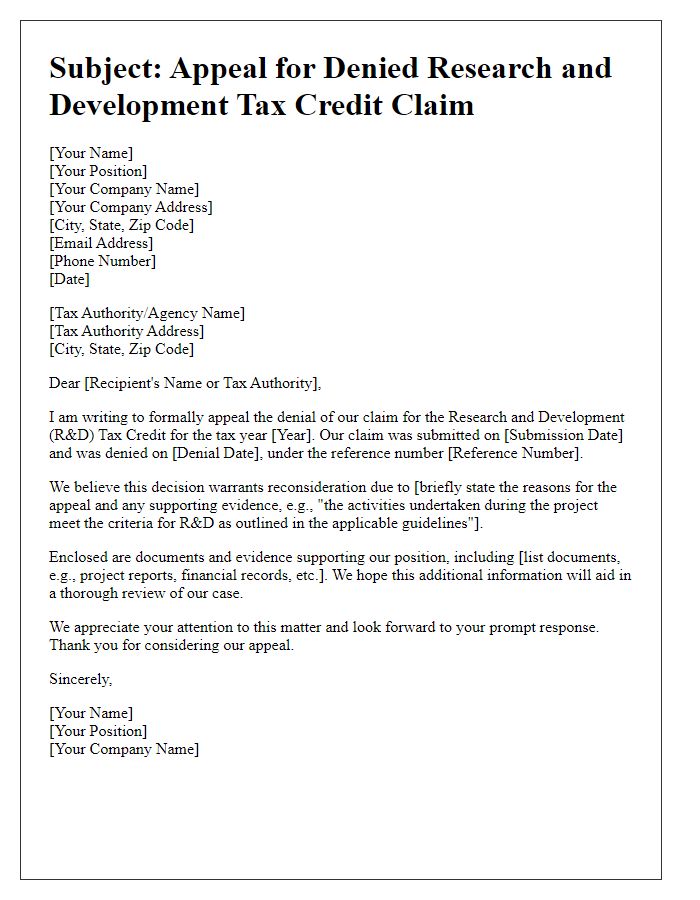

Letter template of appeal for denied research and development tax credit claim.

Letter template of notification for successful research and development tax credit application.

Letter template of inquiry regarding status of research and development tax credit refund.

Letter template of guidance request for maximizing research and development tax credit benefits.

Letter template of clarification on research and development tax credit regulations.

Letter template of submission for documentation supporting research and development tax credit.

Letter template of collaboration proposal for joint research and development tax credit initiatives.

Comments