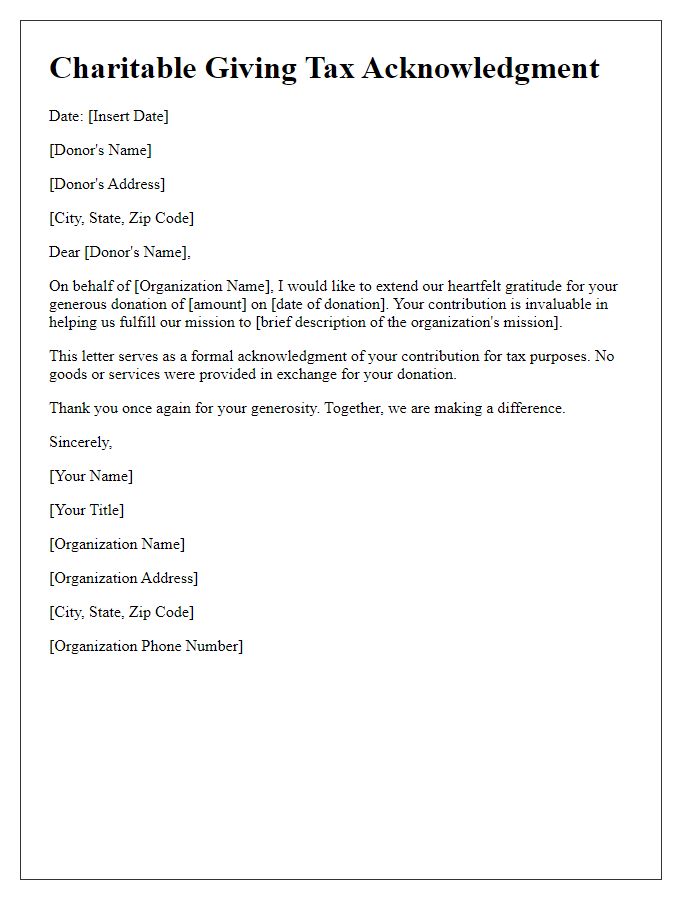

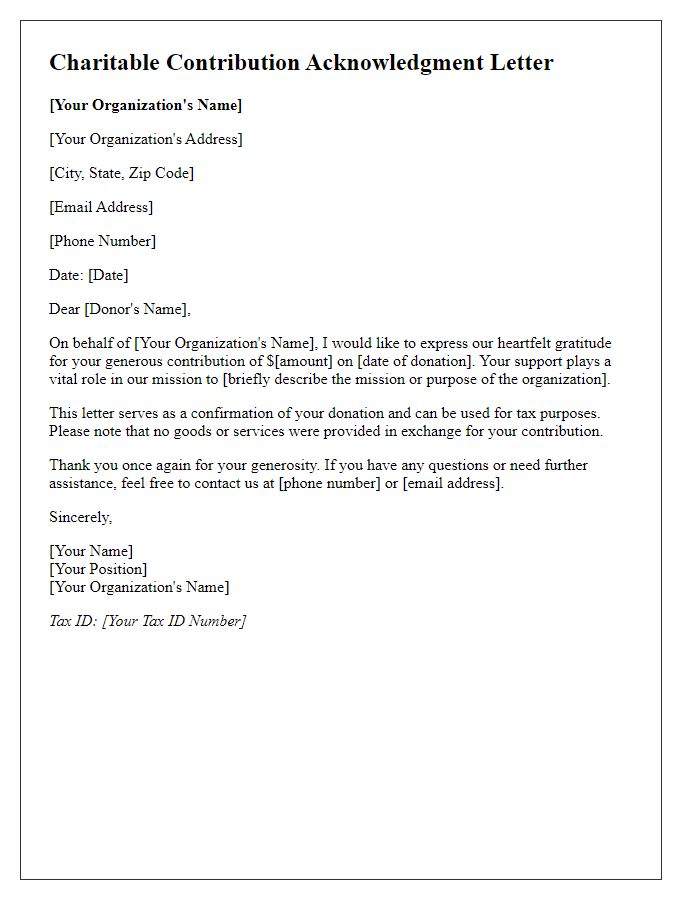

When it comes to charitable giving, understanding the tax benefits can be just as rewarding as the act of generosity itself. A charitable tax deduction acknowledgment letter serves as a crucial document, affirming the contributions made and helping donors navigate their tax returns with ease. This simple yet impactful letter not only recognizes the donor's support but also ensures they have the necessary details to maximize their tax deductions. Ready to learn how to create an effective acknowledgment letter? Let's dive in!

Tax-exempt status verification

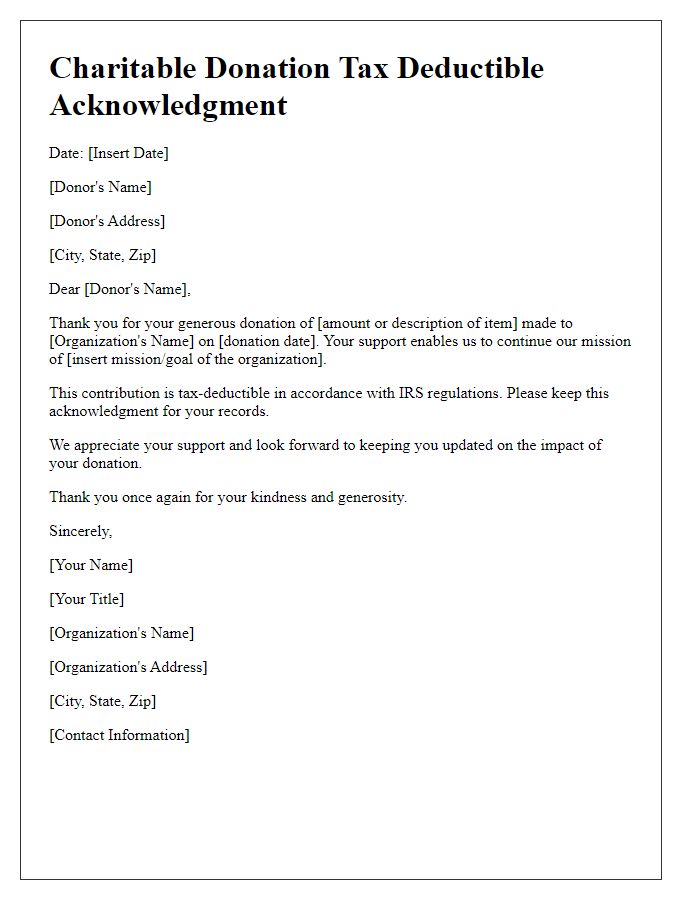

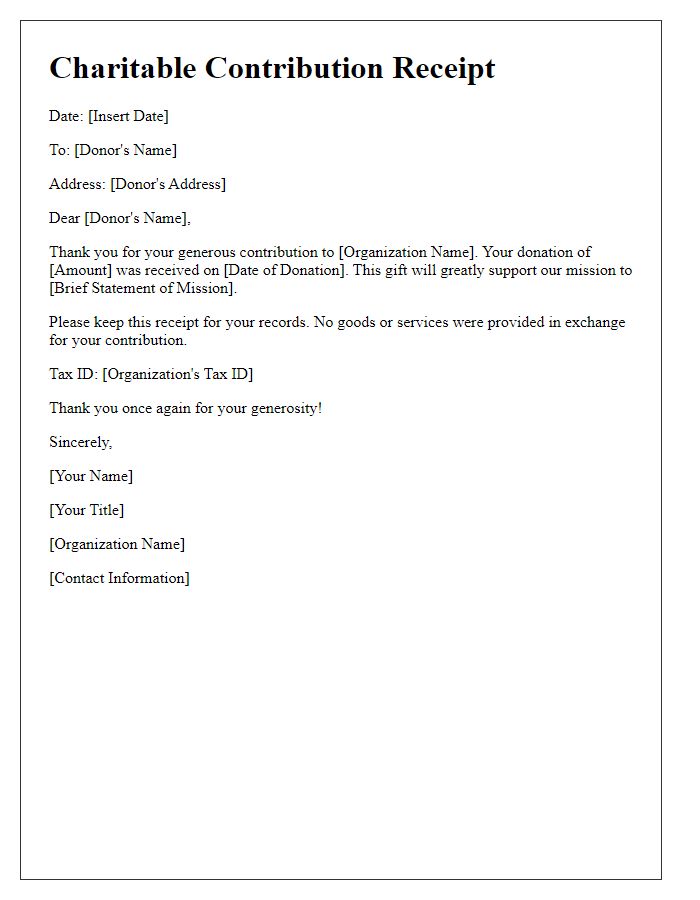

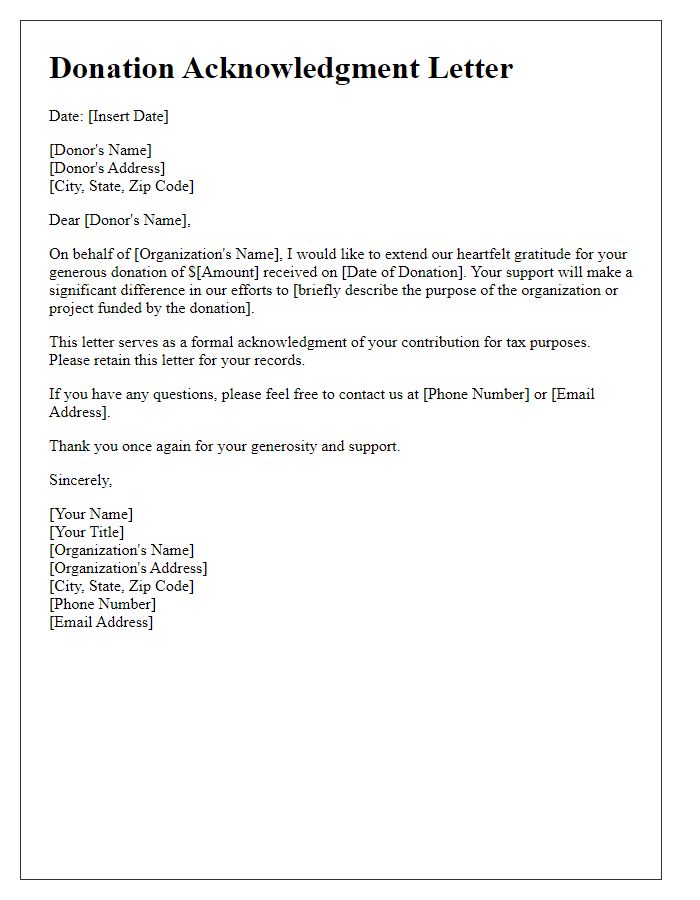

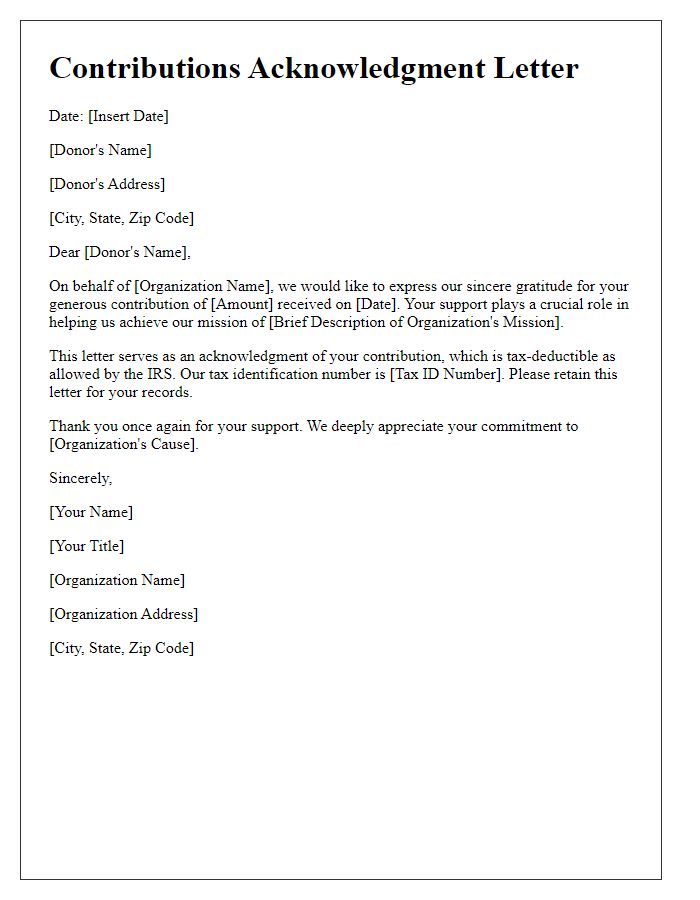

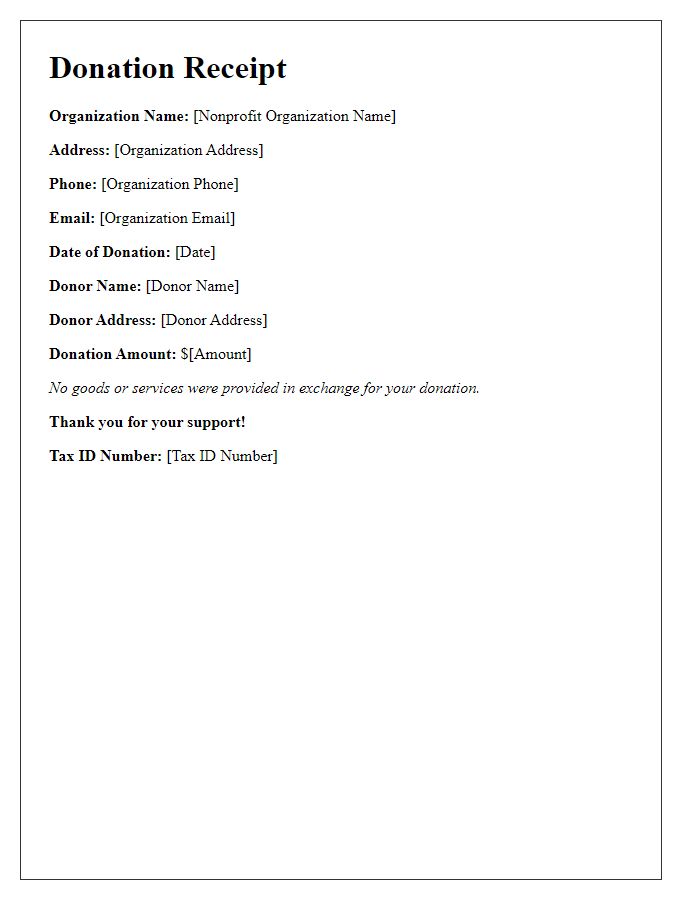

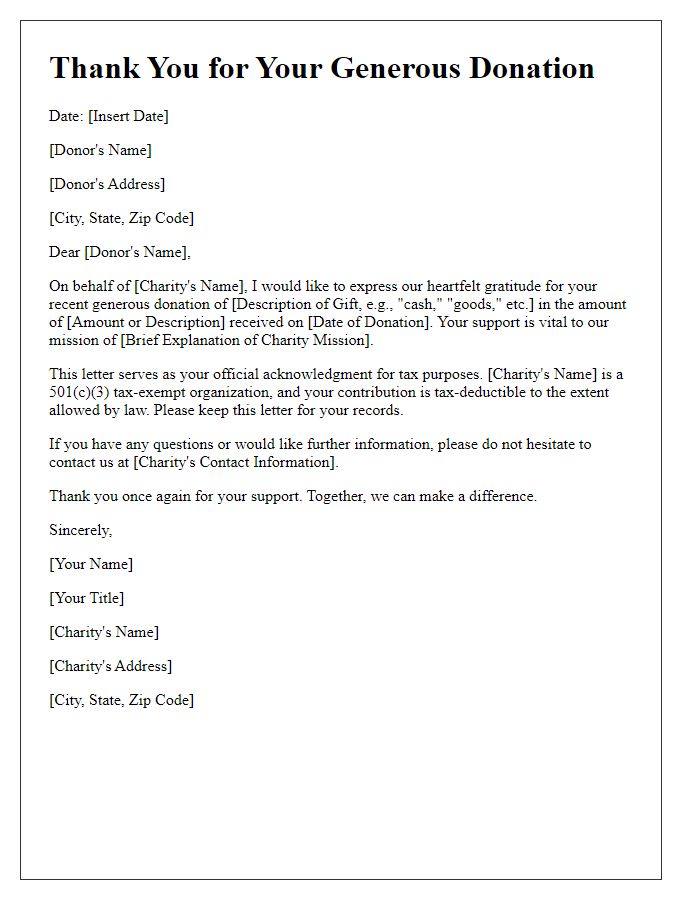

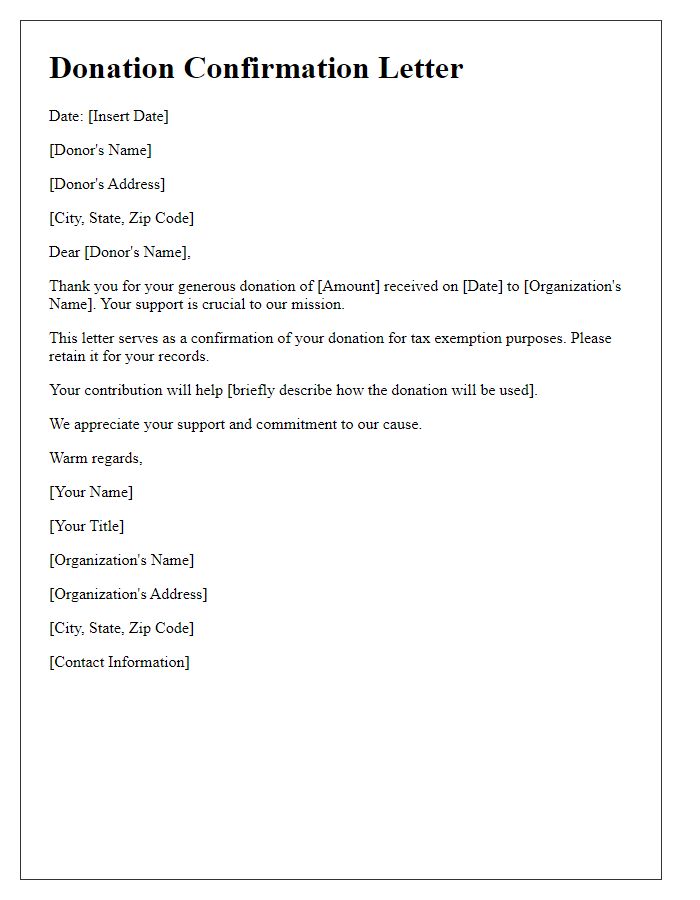

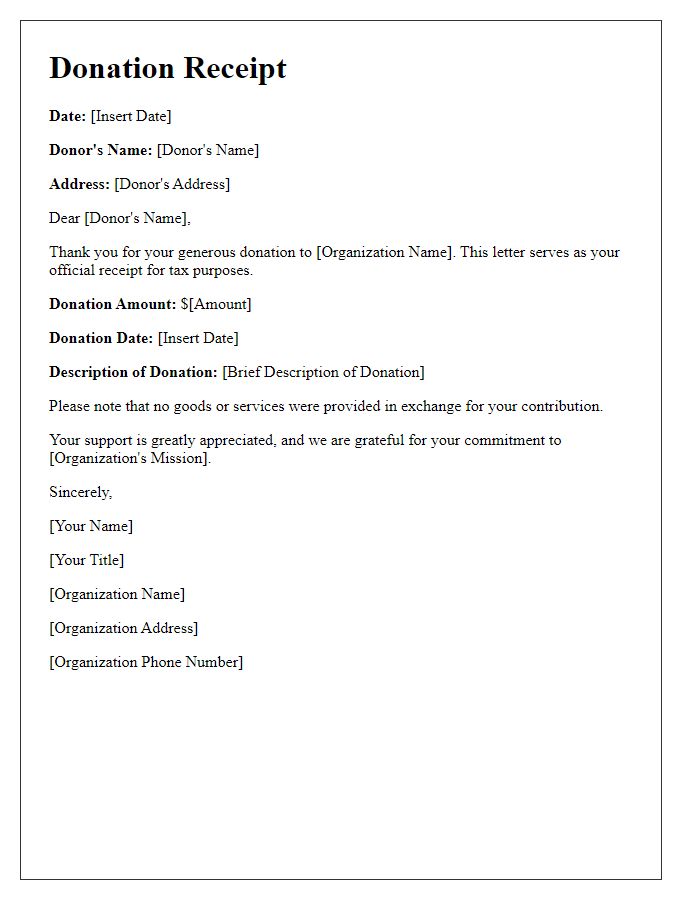

Charitable organizations often provide tax deduction acknowledgment letters to donors for their contributions. These letters serve as official documentation for tax purposes, validating the donor's generous support. Essential elements of the acknowledgment include the organization's name, such as the American Red Cross or Habitat for Humanity, the date of the donation, and a clear statement indicating the tax-exempt status under IRS section 501(c)(3). Also, the letter must mention the amount of the contribution--whether it is a monetary donation (including specific dollar amounts) or a non-cash gift (such as clothing or furniture with estimated values), ensuring compliance with IRS guidelines. Including a statement emphasizing that no goods or services were provided in exchange for the contributions is crucial for the donor's records.

Donor's information

Charitable organizations play a crucial role in providing support to communities, often relying on generous donations from individuals and businesses. Acknowledgment letters serve as essential documentation for both donors and organizations. These letters typically include detailed information such as the donor's full name, complete mailing address, and, where applicable, the business name (for corporate donations). Additionally, the date of the contribution is important to confirm tax deduction eligibility, which pertains to the donor's ability to claim the donation on their annual tax returns. The organization's official name, its IRS status (usually 501(c)(3) for nonprofits), and the specific amount donated (in monetary form or the fair market value of goods) help outline the specifics of the transaction while reinforcing the transparency and reliability of the charitable act.

Description of the donation

Generous donations, such as monetary contributions or goods, benefit various charitable organizations, including food banks like the Greater Chicago Food Depository. For instance, a donation of $500 can provide approximately 1,500 meals to those in need. Clothing donations, such as gently used coats to organizations like Goodwill Industries, support employment training programs, impacting local communities significantly. Items should be in good condition and have a fair market value determined by IRS standards. Charitable contributions can also include volunteer time, which may be valued at around $25 per hour, supporting nonprofit missions and programs effectively. Accurate documentation of these donations is essential for tax deduction claims under IRS regulations.

Statement of no goods or services provided

Charitable organizations often provide donors with acknowledgment letters for tax deduction purposes, ensuring that contributions qualify under IRS regulations. A proper acknowledgment letter includes the organization's name, tax-exempt status (501(c)(3)), and the date of the contribution. The letter explicitly states that no goods or services were provided in exchange for the donation, underscoring its status as a qualified charitable contribution. This documentation is vital for donors, as it helps them claim deductions on their federal income tax returns accurately. The acknowledgment must also include the donor's name and the amount of the contribution, with the organization's signature, enhancing its legitimacy during IRS audits. Effective communication within this context fosters transparency and trust between the organization and its supporters.

Charitable organization's identification

A charitable organization's identification, such as the International Rescue Committee (IRC), serves as a vital reference for donors seeking tax deductions under Section 501(c)(3) of the Internal Revenue Code. Organizations like IRC provide crucial humanitarian assistance worldwide, aiding refugees and displaced persons through programs in over 40 countries. Federal Tax Identification Number (TIN) for verification (e.g., 13-5660870) confirms the eligibility status, ensuring that donations made prior to December 31 are eligible for tax treatment in the current financial year. Proper acknowledgment letters include donors' names and addresses, date of contribution, and the amount given, establishing clear documentation for tax purposes while reinforcing the impact of the donation.

Comments