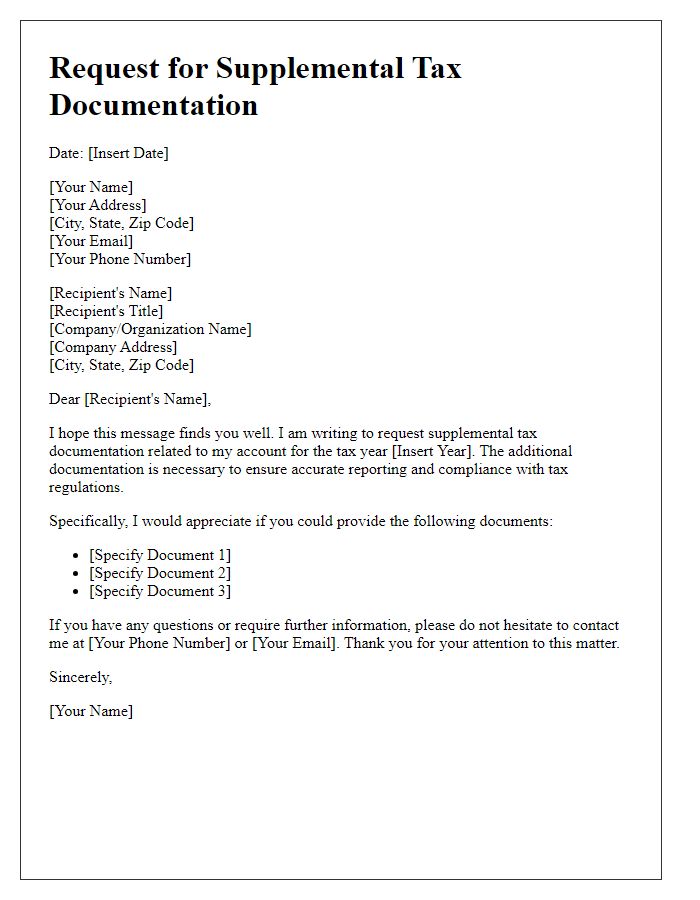

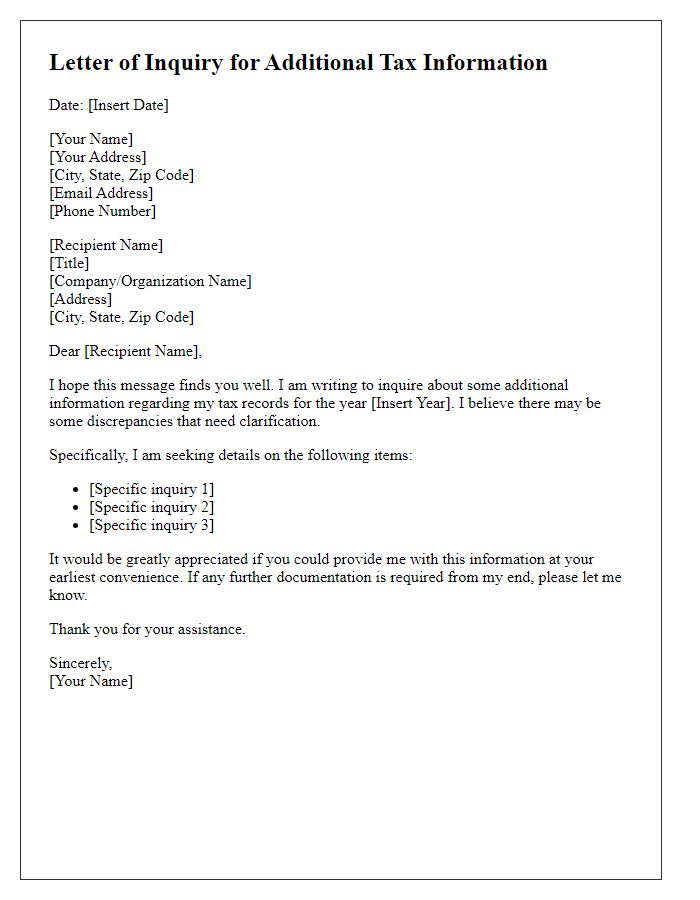

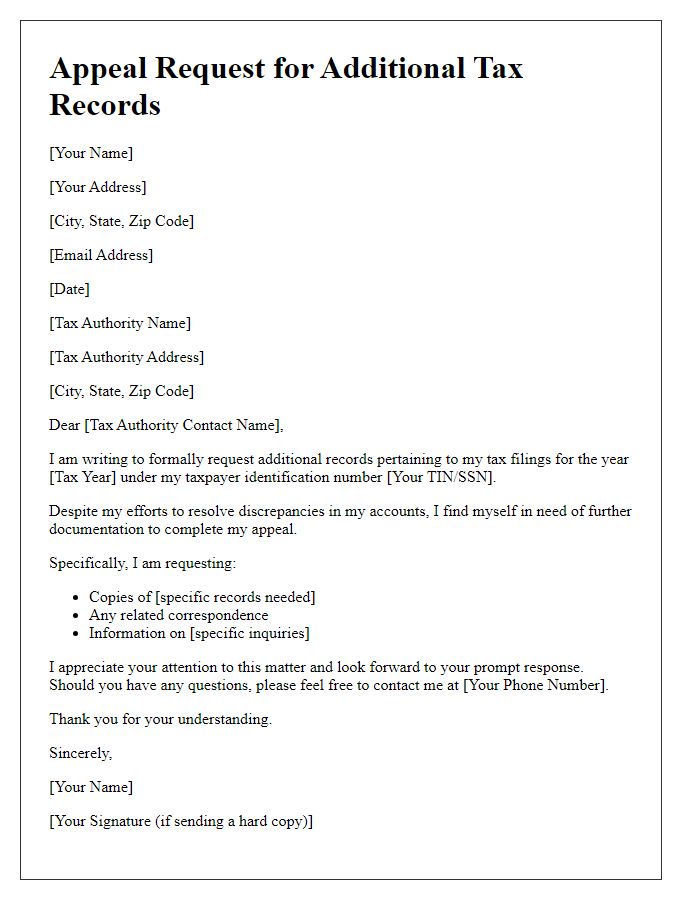

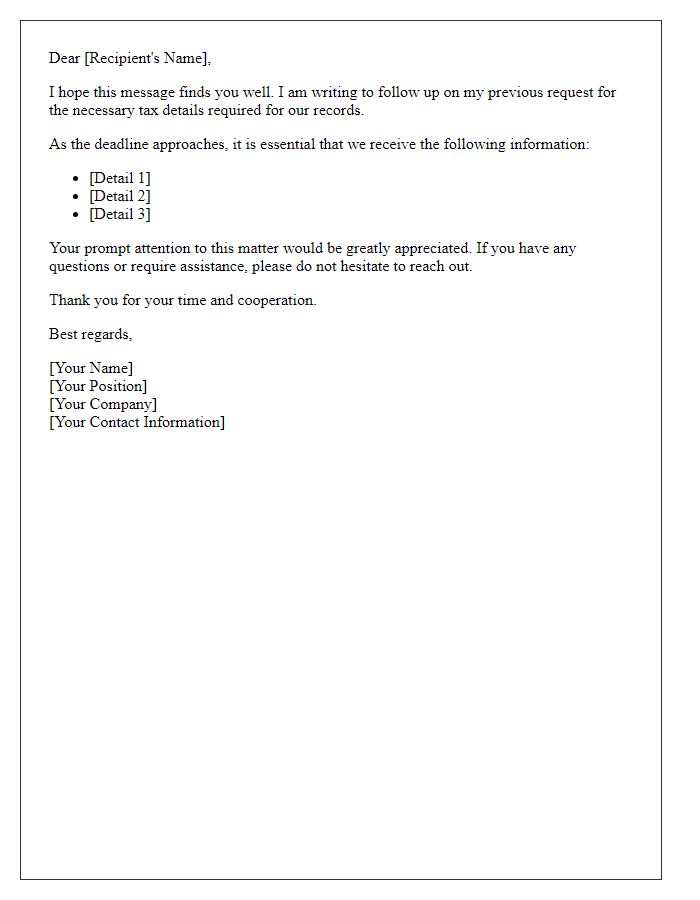

Hey there! Navigating the world of supplemental tax information can be a bit overwhelming, but it doesn't have to be. Whether you're a seasoned taxpayer or new to the process, understanding what documents are needed can make a world of difference. So, if you're curious about how to craft the perfect letter for a supplemental tax information request, keep reading for tips and templates that will simplify the process!

Personal Information

Supplemental tax information requests require precise personal details that facilitate the timely processing of tax issues. Essential data includes the taxpayer's full name, typically formatted as First Name and Last Name, Social Security Number (SSN), ensuring accuracy in identity verification, and date of birth, ideally in MM/DD/YYYY format for clarity. Additionally, the current address must include street address, city, state, and ZIP code, maintaining up-to-date residency information. Contact details such as phone number and email address are important for correspondence purposes, particularly if further information or clarification is needed during the tax review process. Last, references to the tax year in question help contextualize the supplemental information being requested, streamlining the evaluation by the tax authorities.

Tax Identification Number

Supplemental tax information requests often involve details pertaining to Tax Identification Numbers (TIN). TINs, which include Social Security Numbers (SSN) for individuals or Employer Identification Numbers (EIN) for businesses, play a crucial role in tax reporting and compliance. Tax authorities, such as the Internal Revenue Service (IRS) in the United States, require accurate TINs to ensure proper identification of taxpayers. Missing or incorrect TINs can trigger delays in processing tax returns or potential penalties. When seeking additional tax information, clarity in communication regarding the specific TIN required and its purpose will facilitate a seamless gathering of information for compliance purposes. Prompt response to these requests helps maintain accurate tax records and supports the integrity of the tax system.

Detailed Tax Documents Required

Supplemental tax information requests can be vital for ensuring accurate financial reporting. Tax documents such as W-2 forms, 1099 forms, and Schedule C (for self-employed individuals) provide essential insights into income sources and amounts. Important tax deductions like mortgage interest (reported on Form 1098), medical expenses, and education credits (e.g., Form 8863) must also be included for comprehensive assessment. Additionally, supporting documentation such as receipts for business expenses, charitable contributions, and investment property records can clarify financial situations and potential tax liabilities. Jurisdictions may also require local tax compliance documents, potentially varying by state or municipality, further complicating the process. Accurate and complete information is crucial to prevent discrepancies leading to audits or penalties.

Deadline for Submission

The Supplemental Tax Information Request is a crucial document for tax compliance, typically required by jurisdictions like the Internal Revenue Service (IRS) in the United States. This request usually specifies a Deadline for Submission, often set at 30 to 90 days from the date of issuance. Failure to submit the required information by this deadline can lead to penalties, including interest on unpaid taxes, or potential legal repercussions. Affected taxpayers should ensure thorough collection of documents, such as W-2s, 1099s, or other relevant income statements, to provide accurate and complete data. Timely response not only aids in fulfilling legal obligations but also facilitates smoother processing of tax returns and potential refunds.

Contact Information for Inquiries

The supplemental tax information request process requires clear communication and response channels. Taxpayers should have accessible contact information for inquiries. Federal and state tax agencies typically provide dedicated helplines, often available during regular business hours. For instance, the Internal Revenue Service (IRS) in the United States, reachable at 1-800-829-1040, assists individuals with tax-related questions. Additionally, agencies may require an online portal for document submission or tracking, such as the IRS's e-portal for electronic filing. Ensure correspondence includes relevant details such as tax identification numbers, forms, and specific inquiries to facilitate efficient assistance. Taxpayers must also keep secure the contact information of tax professionals, such as Certified Public Accountants (CPAs), who can offer expert guidance throughout the tax process.

Comments