Hey there! As we approach the end of the quarter, it's that time again to think about your estimated tax payments. Staying on top of your taxes can help you avoid any surprises come tax season, and it's easier than it seems. Want to ensure you're making timely payments and maximizing your deductions? Keep reading to discover helpful tips and important deadlines!

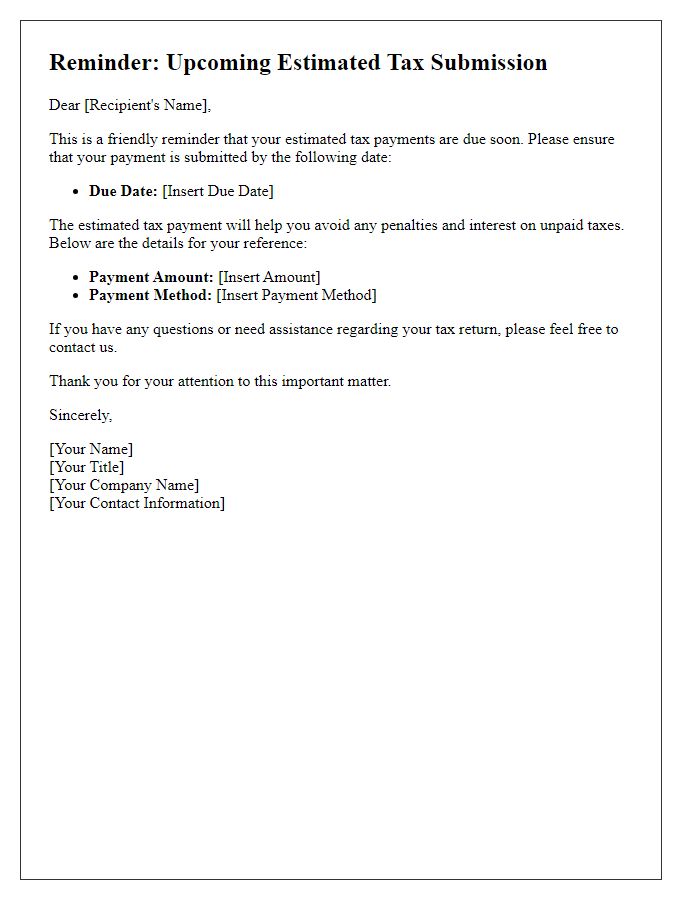

Clear and concise subject line

Quarterly Estimated Tax Payment Reminder: Due Date Approaching

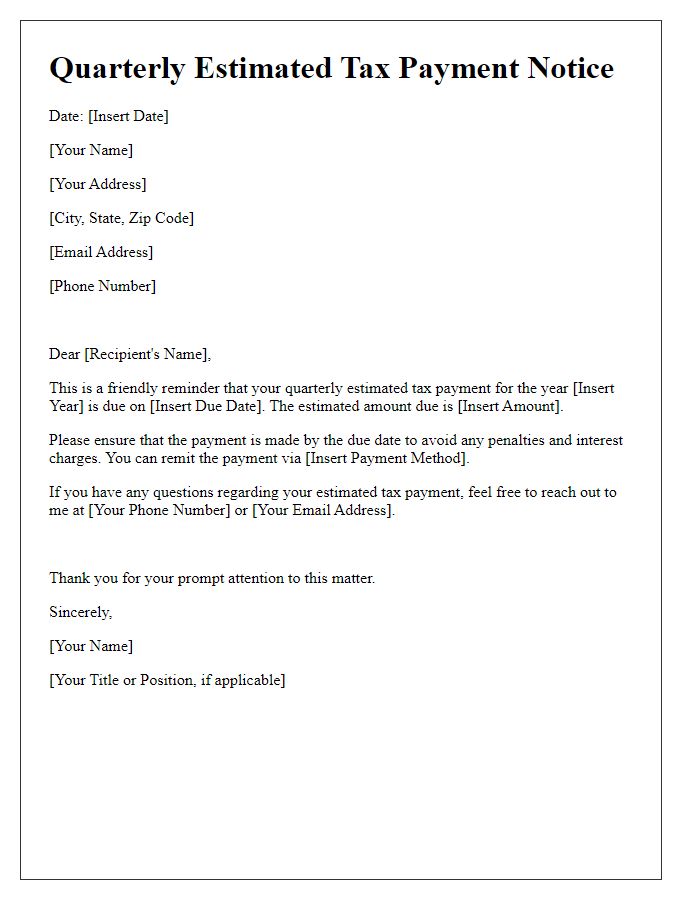

Personalized recipient information

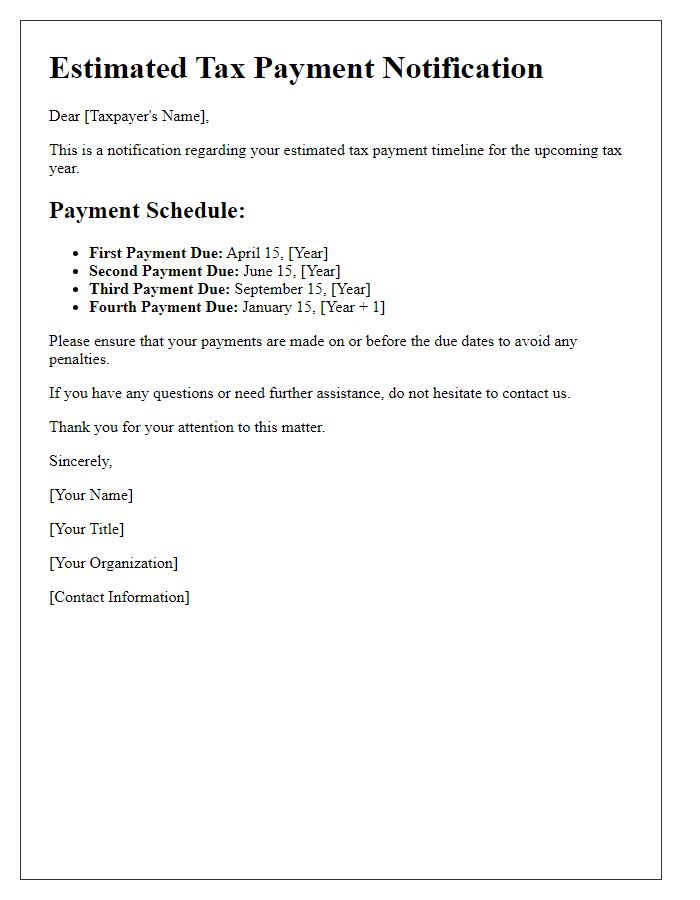

Quarterly estimated tax payments play a critical role in maintaining compliance with the federal tax system. For individual taxpayers, such as self-employed freelancers, professionals, or small business owners, the IRS mandates that these payments be made four times a year. Notably, the due dates for these payments typically align with April 15, June 15, September 15, and January 15 of the following year. Accurate calculations based on estimated income can prevent penalties and interest charges, providing clarity on tax obligations. Furthermore, the method of payment can vary, with options including electronic funds transfer, check, or credit card, emphasizing the need for taxpayers to budget effectively throughout the year. Taxpayers are encouraged to carefully track their income, deductions, and credits to ensure proper reporting and payment.

Detailed due date and payment methods

Quarterly estimated tax payments, crucial for self-employed individuals and business owners, are due four times a year. For the tax year 2023, the first payment is on April 18, the second on June 15, the third on September 15, and the fourth on January 16, 2024. Payment methods include electronic funds transfer through the IRS Direct Pay, which ensures secure transactions directly from a bank account. Additionally, taxpayers can utilize the Electronic Federal Tax Payment System (EFTPS) for scheduled payments and tracking. For those preferring traditional methods, IRS Form 1040-ES can be mailed with a check or money order, ensuring to send it to the correct address specified by the IRS for timely processing. Keeping accurate records of payments is essential for avoiding penalties and ensuring tax obligations are met.

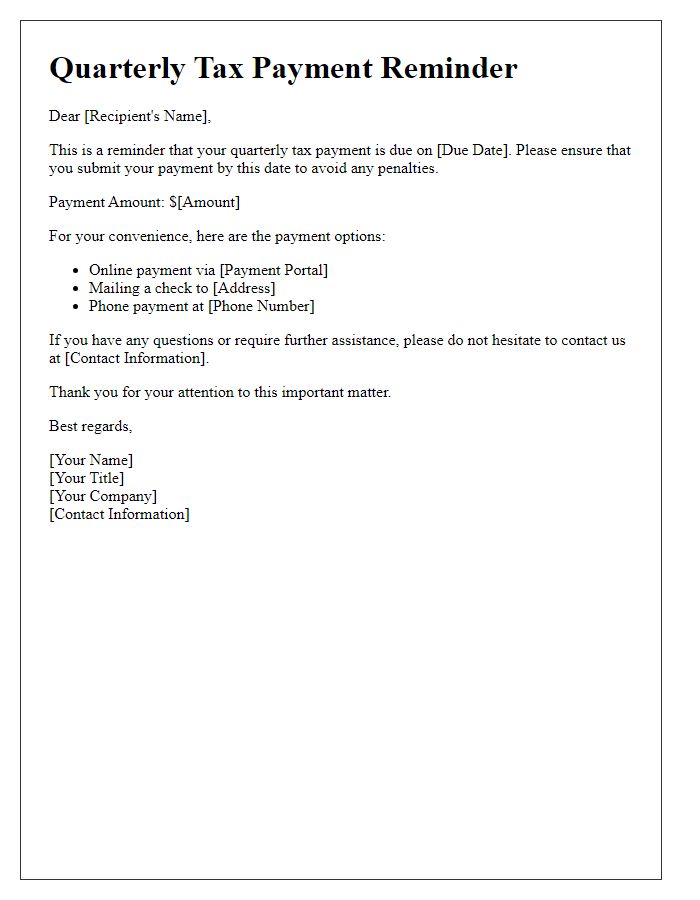

Penalties for late payment

Quarterly estimated tax payments are critical for self-employed individuals and businesses, avoiding penalties associated with underpayment. The IRS (Internal Revenue Service) imposes a penalty of 5% on the amount due for each month or part of a month the payment is late, capped at 25%. Late payment can occur if the due date for the quarterly payment on April 15, June 15, September 15, and January 15 is missed. Additionally, if the total estimated tax owed for the year is 1,000 dollars or more, timely payments must be made to avoid interest charges and additional penalties. Failure to pay at least 90% of the current year's tax liability or 100% of the prior year's tax liability can result in further consequences. Placing timely estimated tax payments in priority can help maintain financial integrity and prevent unnecessary fees with the IRS.

Contact information for assistance

Timely payments of quarterly estimated taxes (like IRS Form 1040-ES in the United States) are crucial for avoiding late fees and penalties. Each quarter, typically April 15, June 15, September 15, and January 15, taxpayers must calculate their estimated tax liability based on their full year's income. These payments apply to various income sources, including self-employment earnings, rental income, and dividends, which often undergo less withholding. For assistance regarding the estimated tax payment process or to address specific taxing questions, many resources are available, including the IRS website, local tax offices, or licensed tax professionals. Contacting a certified public accountant (CPA) can provide tailored guidance and ensure compliance with federal and state tax regulations.

Comments