Are you feeling overwhelmed by the sales tax refund application process? You're not aloneâmany people find it tricky to navigate the necessary steps and paperwork. Thankfully, with the right guidance and a solid letter template, you can simplify your application and maximize your chances of receiving your refund. So, if you're ready to get started on reclaiming what's rightfully yours, keep reading to discover the essential components of a successful letter!

Applicant Information

The applicant's information for a sales tax refund application, typically includes essential details such as the applicant's full name, address, contact number, and email address. The applicant's name should match official identification to prevent processing delays. The address must be accurate to ensure correspondence reaches the applicant promptly, often requiring a street address, city, state, and ZIP code. Contact numbers should include area codes for clarity, while an email address provides an additional point of contact for updates regarding the application status. Depending on the jurisdiction, the applicant may also need to provide a taxpayer identification number or social security number for verification purposes. Proper completion of this information is crucial for a successful application process in regions like California or Texas, where tax regulations can vary significantly.

Description of Transaction

The sales tax refund application process requires a detailed description of the specific transaction, including the date of purchase (e.g., January 15, 2023), total amount spent ($250.00), and the items purchased (e.g., office furniture including desks and chairs) from a particular vendor (e.g., Office Depot located in Austin, Texas). It is crucial to include the sales tax charged (e.g., 8.25%), invoice number (e.g., 123456789), and the reason for the refund request (e.g., returned items due to product defects). Clarity and completeness in this description ensure compliance with state regulations governing sales tax refunds.

Tax Amount Paid

Filing for a sales tax refund involves submitting an application that includes key details about the tax amount paid. For example, in 2022, businesses across the United States collectively paid approximately $500 billion in sales taxes. When seeking a refund, applicants should specify the exact tax amount, such as a specific percentage like 6% of an item purchased, and include relevant invoices or receipts that document the payment. Certain states, like California and Texas, have specific forms, known as Sales Tax Refund Claims, which must be completed and submitted to the state's Department of Revenue. Timeliness is crucial, as many jurisdictions impose deadlines for refund applications, typically ranging from 90 to 180 days post-transaction.

Justification for Refund

Businesses operating in various industrial sectors sometimes incur overpaid sales tax amounts due to discrepancies in tax rates or erroneous calculations. In such cases, submitting a sales tax refund application is essential for reclaiming excess payments made to the taxing authority. Proper justification for this refund is necessary, detailing specific transactions, tax identification numbers, invoice dates, and amounts paid. Documentation such as receipts and tax filings may serve as supporting evidence to validate the refund request. By accurately presenting the rationale behind the overpayment, businesses can expedite the processing of their claim and ensure compliance with local tax regulations.

Supporting Documentation

A sales tax refund application requires comprehensive supporting documentation to ensure a smooth review process by state tax authorities. Key documents include purchase receipts detailing items bought, including item descriptions and prices, displaying the sales tax amount. Business registration certificates provide proof of valid operation within the state, establishing eligibility for refunds. Additionally, exemption certificates (if applicable) confirm tax-exempt status for specific purchases. A copy of the previous year's sales tax return may demonstrate compliance with state tax regulations, aiding in validating the refund claim. Transaction records from accounting software highlight financial activity, while bank statements corroborate the legitimacy of purchases made. Each document should be organized chronologically, ensuring clarity for auditors processing the refund request.

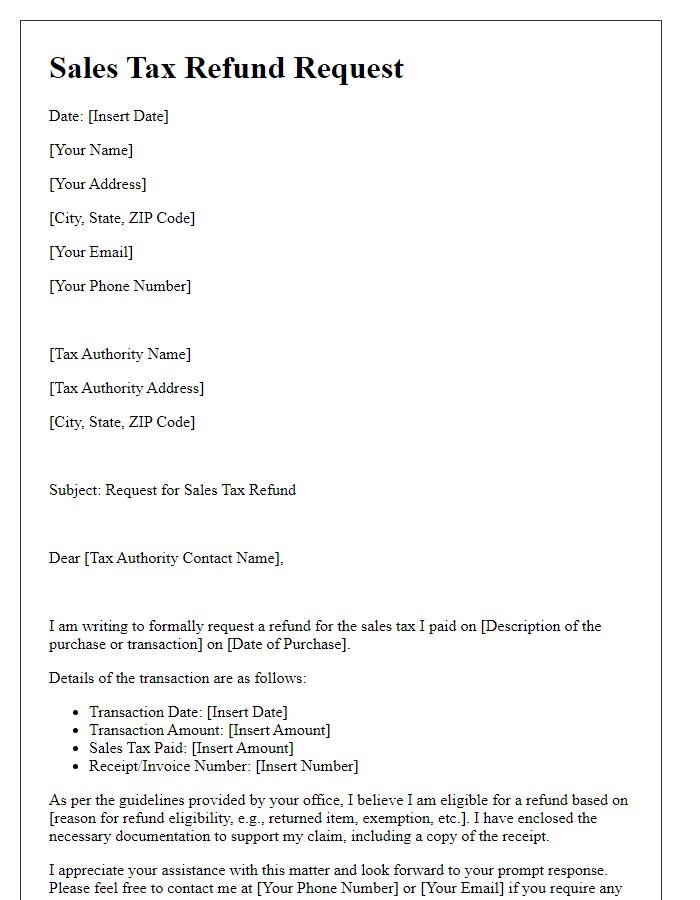

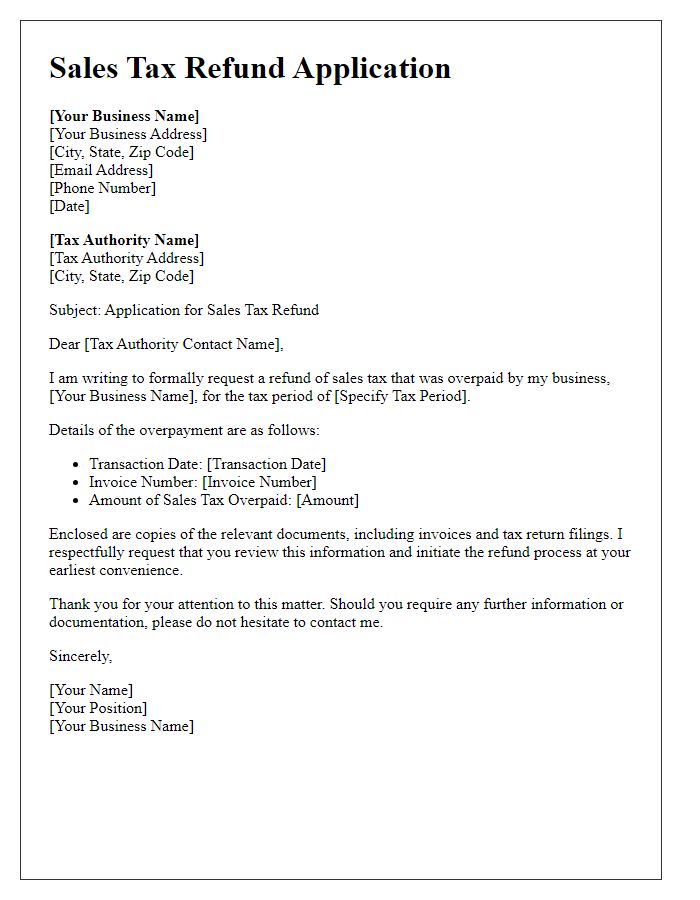

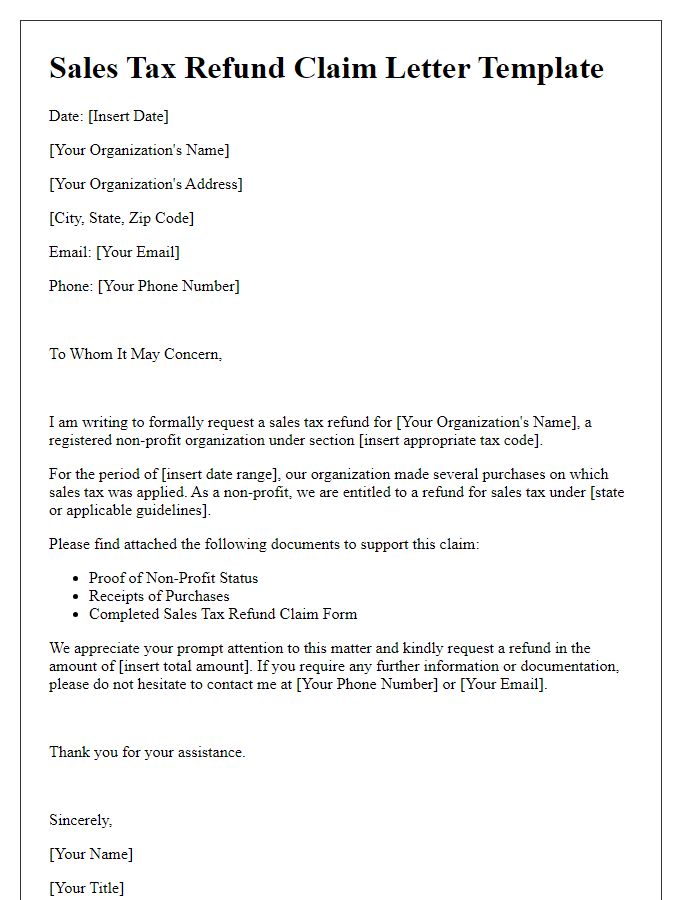

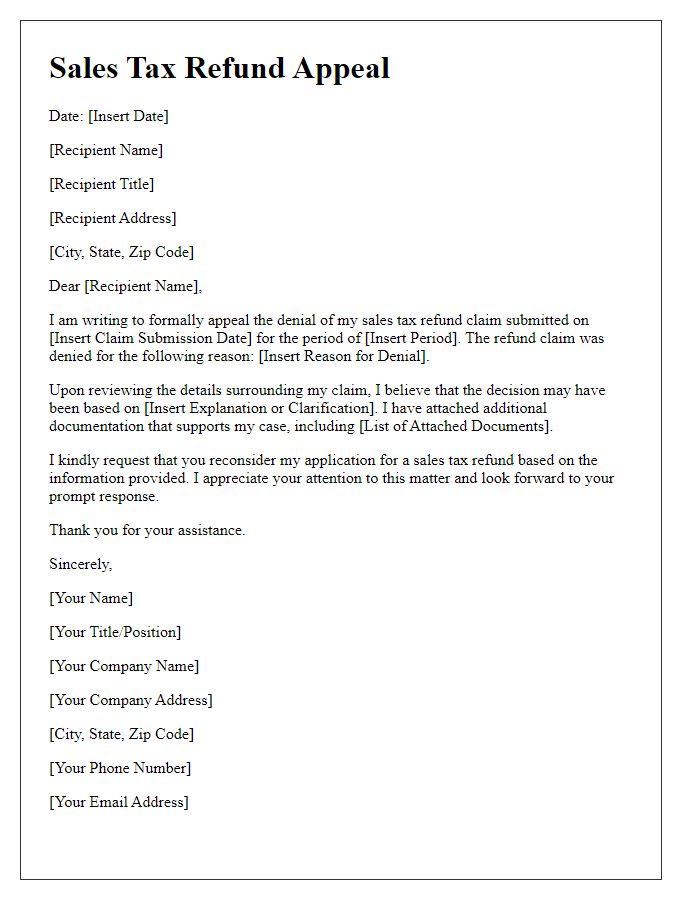

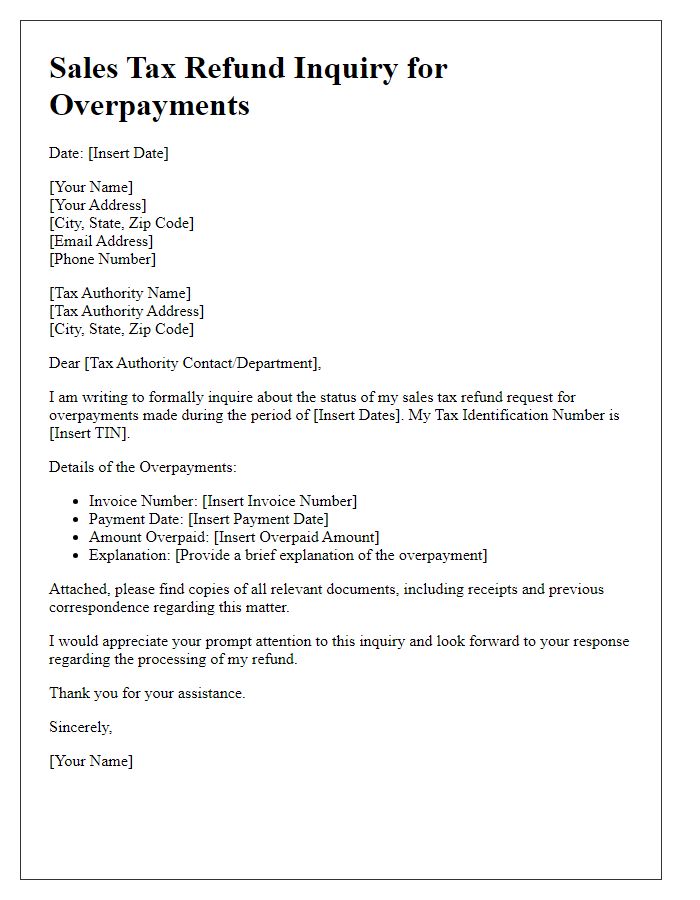

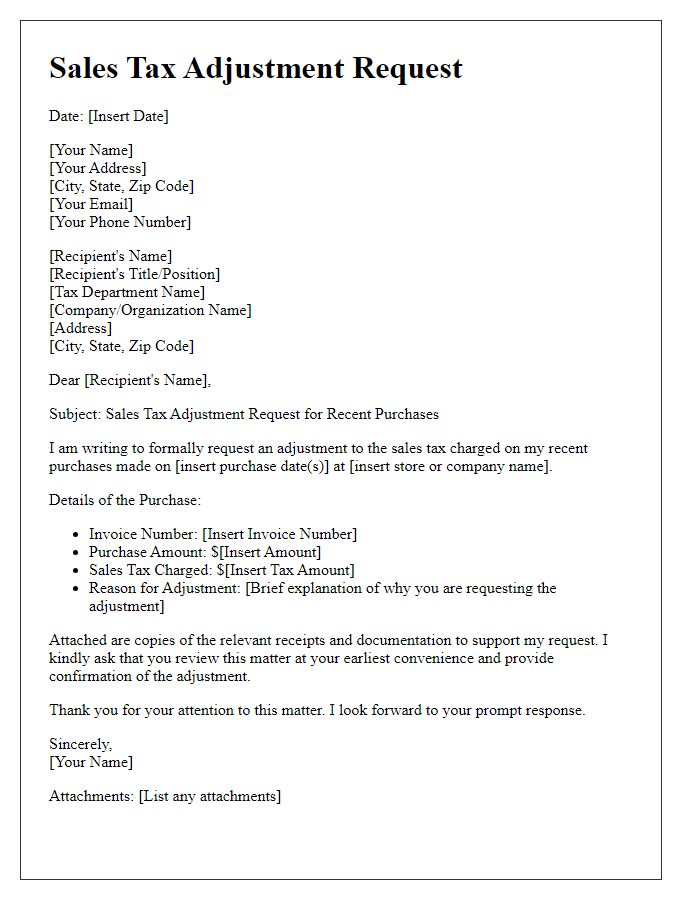

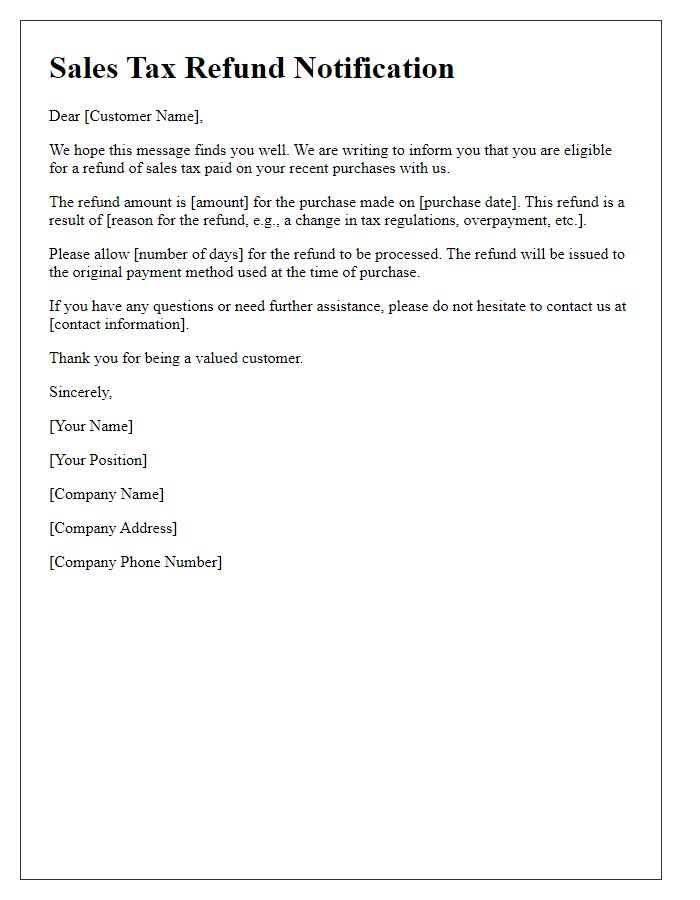

Letter Template For Sales Tax Refund Application Samples

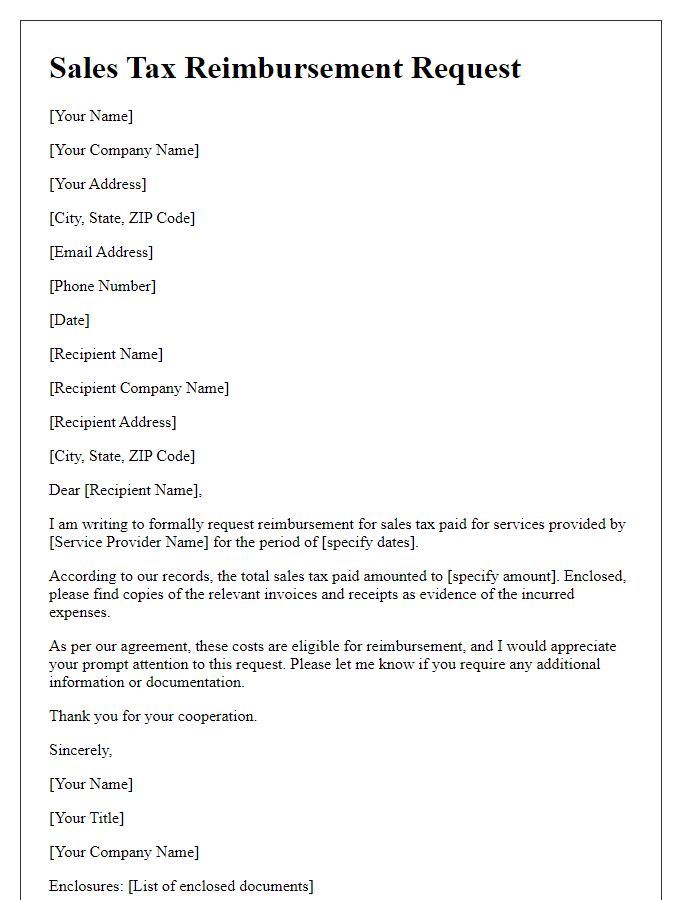

Letter template of Sales Tax Reimbursement Request for Service Providers

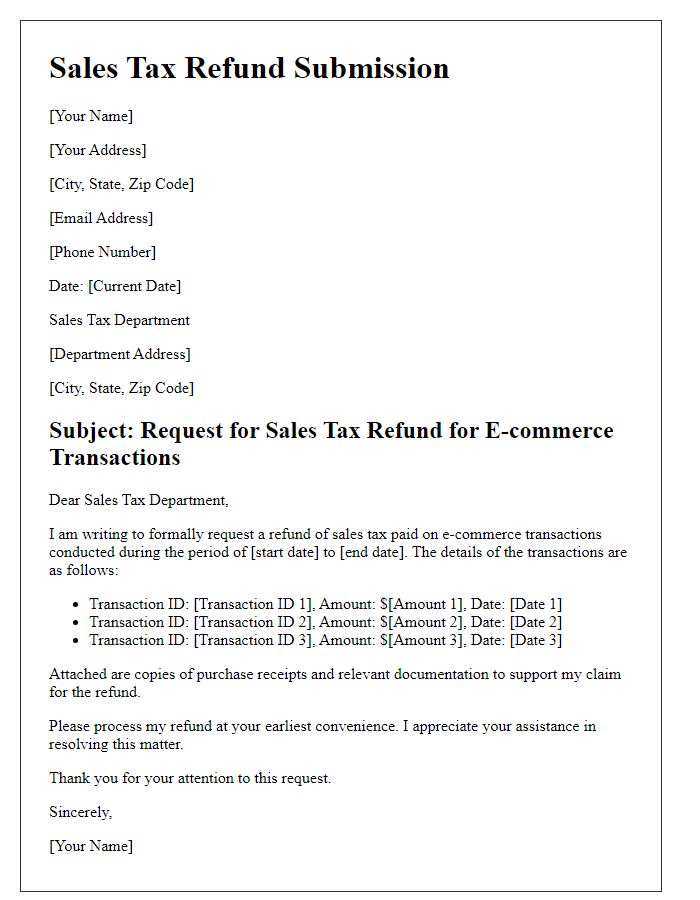

Letter template of Sales Tax Refund Submission for E-commerce Transactions

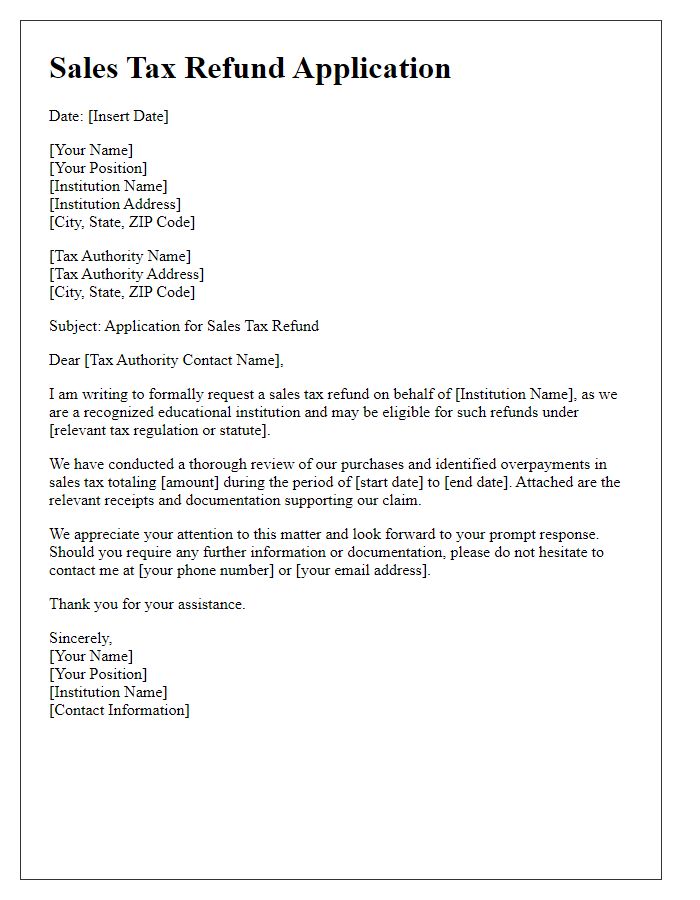

Letter template of Sales Tax Refund Application for Educational Institutions

Comments