Are you feeling a bit bewildered by the tax implications of your bonus this year? You're not alone! Understanding how bonus tax withholding works can help you maximize your take-home pay and make informed financial decisions. Dive in with us as we explore essential tips and considerations, ensuring you're well-prepared come tax season!

Jurisdiction-specific tax regulations

Bonus payments often face varying tax implications depending on jurisdiction-specific tax regulations. In the United States, the IRS mandates federal income tax withholding on bonuses at a flat rate of 22%, but states like California impose additional taxes, with combined state and federal rates reaching over 30% for higher earners. Employers must also consider local taxes, such as New York City's additional income tax, which can exceed 3.876%. These complexities highlight the importance for payroll departments in organizations to accurately calculate withholding amounts to ensure compliance with IRS guidelines and local laws. Understanding the nuances of these regulations is crucial for preventing unexpected tax liabilities for both employers and employees.

Employee's tax bracket

Bonus payments often entail specific tax withholding considerations that can significantly impact employees' take-home amounts. For example, if an employee falls within a 22% federal income tax bracket, applicable for annual incomes ranging from $44,726 to $95,375 in the United States, the bonus may be subject to a flat withholding rate of 22% as mandated by the IRS. This means that for a $1,000 bonus, $220 would be withheld for federal taxes. Additionally, state tax rates vary; for instance, California applies a withholding rate of 9.3% on supplemental wages, leading to a further deduction of $93 from the same bonus. Social Security and Medicare taxes also apply, cumulatively amounting to an additional 7.65%. Understanding these implications helps employees gauge their net bonus amounts and plan their finances accordingly.

Type of bonus (e.g., performance, holiday)

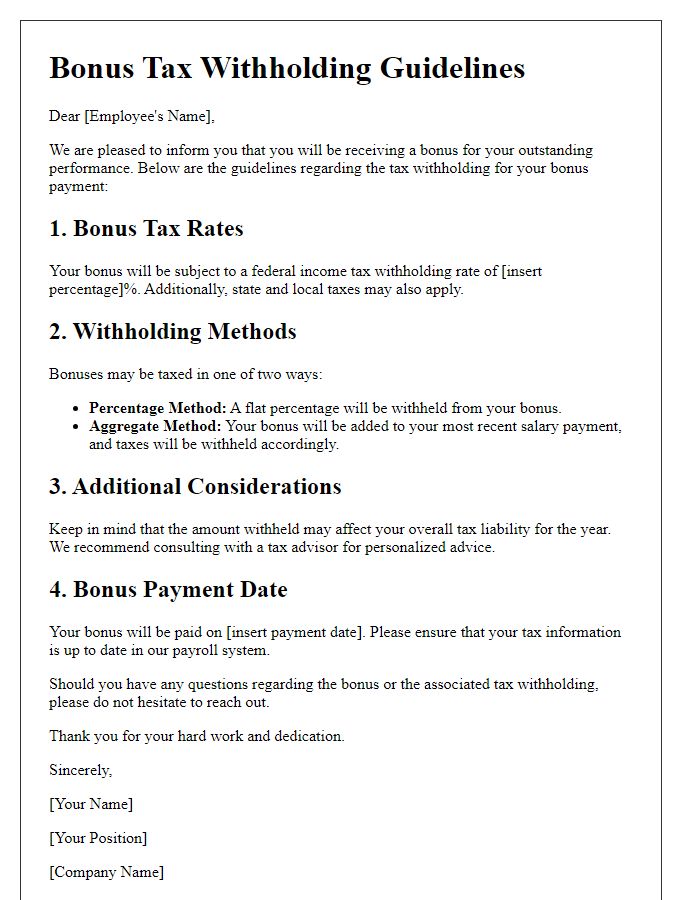

Performance bonuses, often awarded for achieving specific targets or exemplary work, may be taxed differently than regular income. The IRS requires employers to withhold a flat percentage of 22% on bonuses classified as "supplemental wages," affecting employees' take-home pay significantly. For holiday bonuses, which are typically given around seasonal festivities, employers might opt for a percentage method or aggregate withholding method, depending on how these bonuses are structured within payroll systems. Understanding the implications of bonus taxation is crucial for employees to anticipate variations in their net pay, especially around financial planning for expenses or savings.

Withholding tax rate

Bonus payments often require specific withholding tax considerations to ensure compliance with federal and state tax regulations. The IRS provides guidance on withholding rates that may differ from standard wages, generally ranging from 22% for federal tax withholding on supplemental wages up to $1 million. In cases of larger bonuses, employers might need to apply the higher aggregate or percentage method, depending on their payroll system. State taxes can also affect total withholding, with rates varying significantly by jurisdiction, such as California's 9.3% or New York's 6.85%. Employers must consider additional factors like employee-specific withholding allowances or additional voluntary contributions, ensuring accurate tax remittance. Proper adherence to withholding tax guidelines guarantees reduced tax liabilities during the annual tax filing period for employees.

Payroll processing deadlines

Navigating bonus tax withholding necessitates awareness of payroll processing deadlines to ensure compliance and accuracy. Employers must adhere to the specific dates set by the Internal Revenue Service (IRS) for the 2023 tax year, as bonuses may qualify for supplemental tax withholding rates of 22% for federal income tax. State tax considerations also vary; for example, California's supplemental rate stands at 9.3%, while New York has a flat rate of 9.9%. Proper documentation of employees' withholding allowances via IRS Form W-4 is essential, as changes in allowances can impact withholding calculations. Employers should finalize payroll entries for bonuses at least one payroll cycle before the distribution date to avoid delays. Additionally, maintaining clear communication with the payroll department ensures all employees receive their bonuses with accurate tax deductions, aligning with the organization's financial planning and compliance obligations.

Letter Template For Bonus Tax Withholding Considerations Samples

Letter template of bonus tax withholding explanation for payroll inquiries

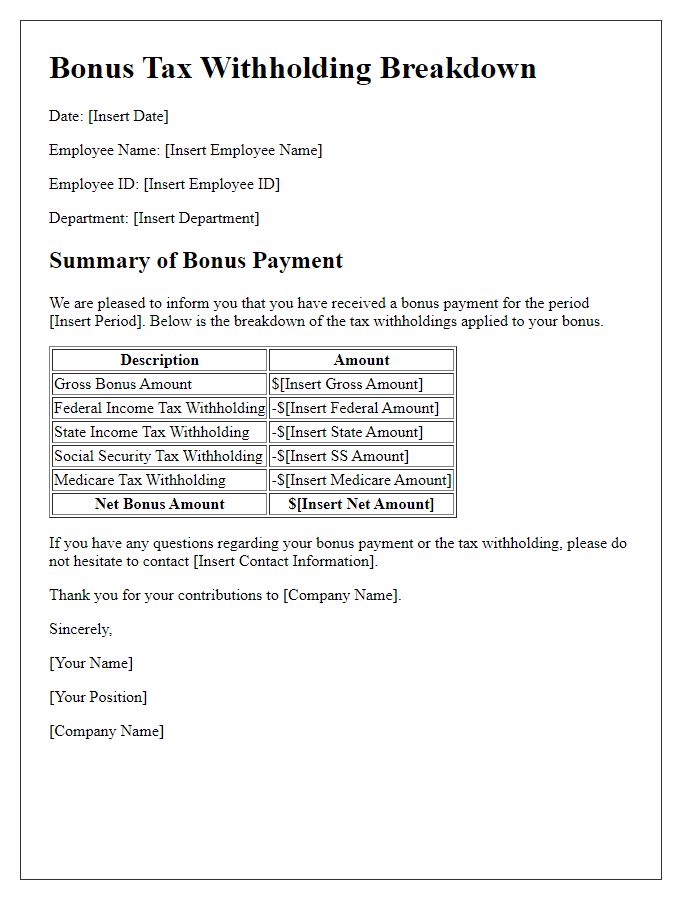

Letter template of bonus tax withholding breakdown for annual statements

Comments