Navigating the world of nonprofit tax exemption applications can feel a bit overwhelming, but it's a crucial step for organizations looking to make a positive impact. A well-crafted letter not only showcases your mission but also provides key information that the IRS and other agencies need to approve your status. Join me as we unpack the essential elements of this vital document and share tips to help you present your organization's goals clearly and effectively. Ready to learn how to draft the perfect letter for your nonprofit's tax exemption? Let's dive in!

Organization Name and Contact Information

The nonprofit organization, WellSpring Initiative, located at 4500 Maple St, Suite 300, Springfield, IL, serves the community through various outreach programs designed to combat homelessness and food insecurity. Established in 2018, WellSpring Initiative has provided over 10,000 meals and supported more than 200 families through its housing assistance program. The organization operates entirely with the help of volunteers and local donations, showcasing a commitment to transparency and community engagement. Its mission focuses on sustainable impacts, aiming for long-term solutions to alleviate poverty in the region. The organization seeks tax exemption status to enhance fundraising efforts and maximize resource allocation towards essential services.

Statement of Purpose and Activities

Nonprofit organizations, such as charitable foundations and advocacy groups, often emphasize their mission and activities in applications for tax exemption. A clear statement of purpose outlines the organization's goals, such as providing educational resources, supporting underprivileged communities, or promoting environmental sustainability. Specific activities might include community workshops, fundraising events, or environmental clean-up initiatives, all designed to fulfill the stated mission. Compliance with federal regulations, particularly Internal Revenue Code (IRC) Section 501(c)(3) standards, is crucial for maintaining tax-exempt status, which allows nonprofit organizations to attract donations without the burden of taxation. An impactful application highlights measurable outcomes and community impact related to these activities, fostering transparency and accountability to potential donors and stakeholders.

IRS Tax Code Reference (e.g., 501(c)(3))

The IRS Tax Code Reference, specifically 501(c)(3), pertains to nonprofit organizations that are exempt from federal income tax, allowing them to operate for charitable, religious, educational, scientific, or literary purposes. Qualifying organizations must adhere to strict guidelines, ensuring that their activities primarily benefit the public. This designation also permits donors to make tax-deductible contributions, encouraging philanthropy and support for the nonprofit's mission. Compliance with IRS regulations is crucial, as it includes operating exclusively for exempt purposes, avoiding political campaigning, and adhering to limitations on legislative activities. Organizations seeking this status must submit Form 1023, a comprehensive application outlining their missions, governance, and financial practices, ensuring transparency and accountability to both the IRS and the public.

Financial Information and Budget

Nonprofit organizations seeking tax exemption must provide comprehensive financial information that clearly outlines their revenue sources, expenses, and overall budget for the fiscal year. Accurate records of earned income, such as donations, grants, and membership dues, should be included, reflecting the organization's primary funding streams. Detailed expense reports that cover operational costs, program expenditures, and administrative fees are essential to showcase the financial management of the nonprofit, which may range in operational budgets from a few thousand to millions of dollars, depending on their scope of work. Additionally, projections for future financial stability or growth, including fundraising goals and anticipated funding sources, will strengthen the application by demonstrating sustainability. Including a well-structured budget summary, broken down by categories, will provide clarity to reviewers and highlight prudent financial planning.

Supporting Documents and Attachments

Supporting documents play a crucial role in nonprofit tax exemption applications, particularly under IRS Section 501(c)(3) for charitable organizations in the United States. Essential items include Articles of Incorporation, which outline the nonprofit's mission, purpose, and governance structure, typically filed with the Secretary of State. By-laws that govern the internal operations must also be included, detailing member roles, voting procedures, and the process for board meetings. A statement of activities provides a clear overview of the nonprofit's programs and initiatives, showcasing its community impact. Detailed financial statements, including projected budgets for the upcoming years and past financial records, support the organization's fiscal responsibility and planned expenditures. Additionally, letters of support from community leaders or beneficiaries strengthen the application by illustrating the local impact and need for the nonprofit's services. Finally, any relevant licenses, permits, or certifications demonstrate compliance with federal, state, and local regulations, further assuring the IRS of the organization's commitment to its charitable goals.

Letter Template For Nonprofit Tax Exemption Application Samples

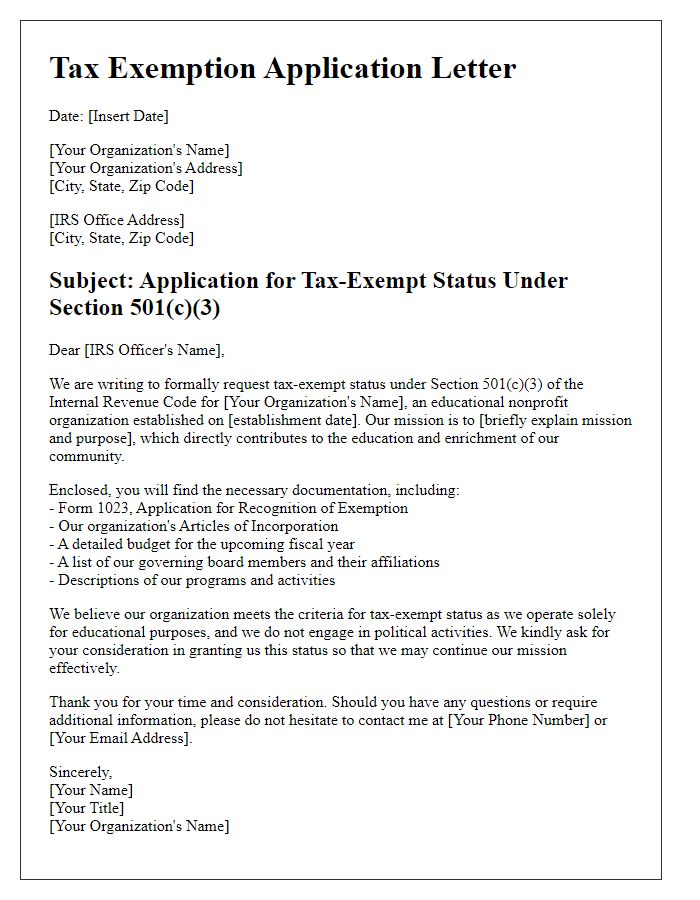

Letter template of nonprofit tax exemption application for educational organizations

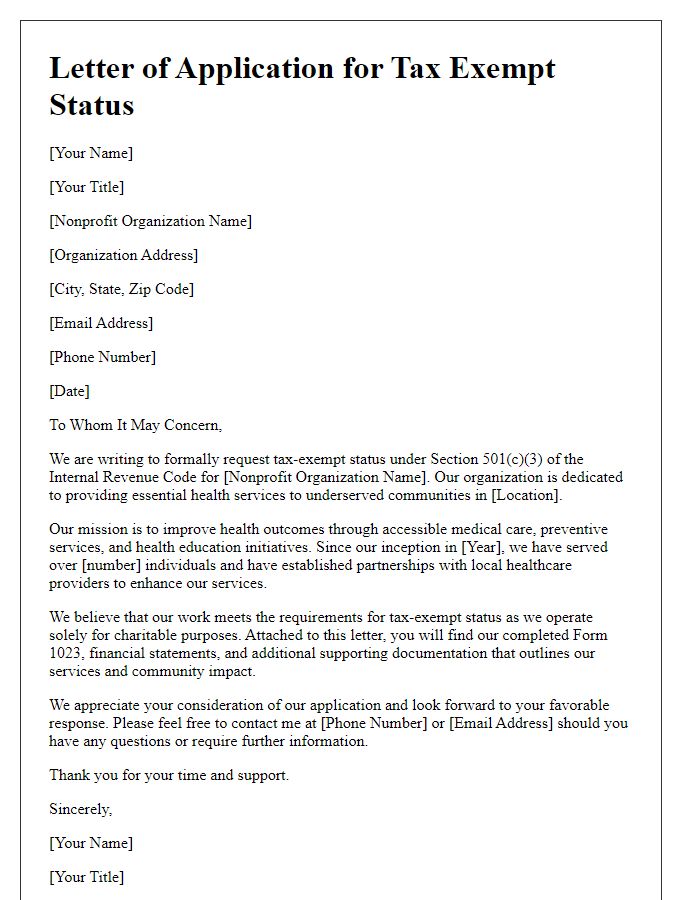

Letter template of nonprofit tax exemption application for health services

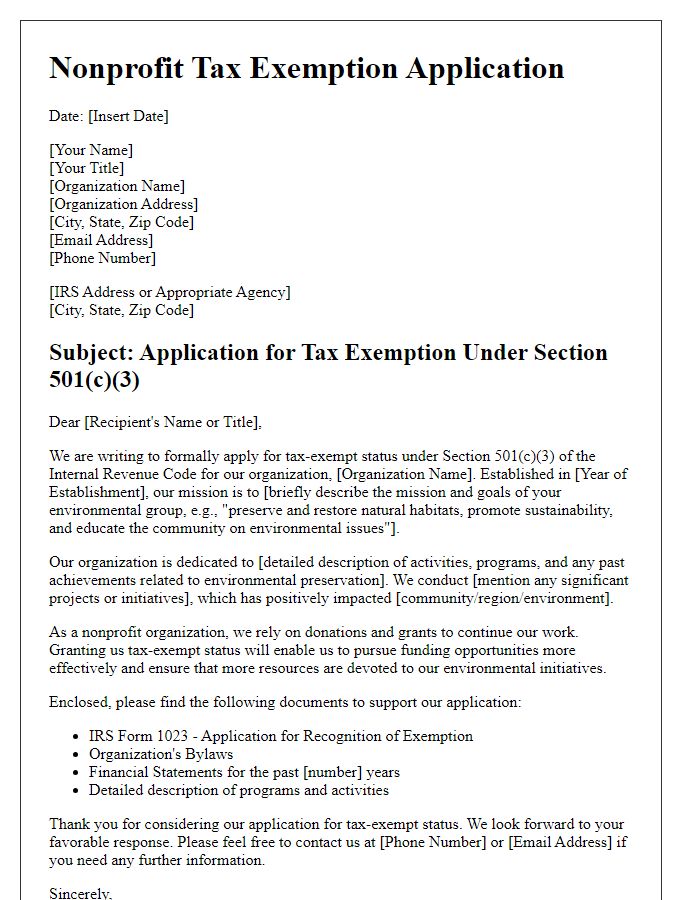

Letter template of nonprofit tax exemption application for environmental groups

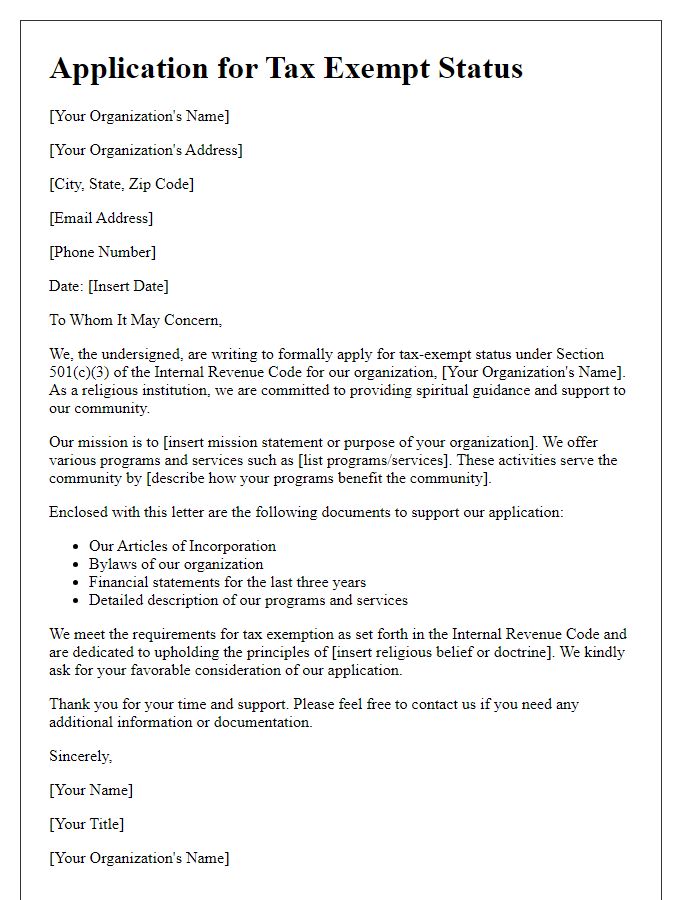

Letter template of nonprofit tax exemption application for religious institutions

Letter template of nonprofit tax exemption application for community development projects

Letter template of nonprofit tax exemption application for arts and culture organizations

Letter template of nonprofit tax exemption application for animal welfare organizations

Letter template of nonprofit tax exemption application for youth programs

Letter template of nonprofit tax exemption application for international aid organizations

Comments