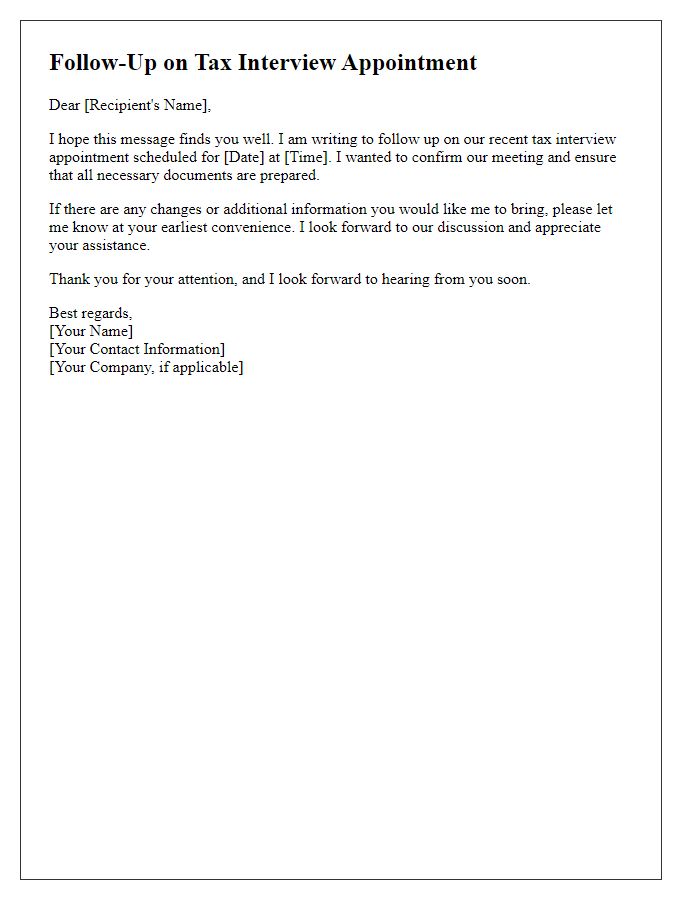

Are you gearing up for a tax office interview and feeling a bit overwhelmed? You're not alone! Navigating the ins and outs of tax regulations can be tricky, but having the right approach can make all the difference. Stick with us as we explore a reliable letter template that will help you secure your appointment with confidence and easeâread on to discover more!

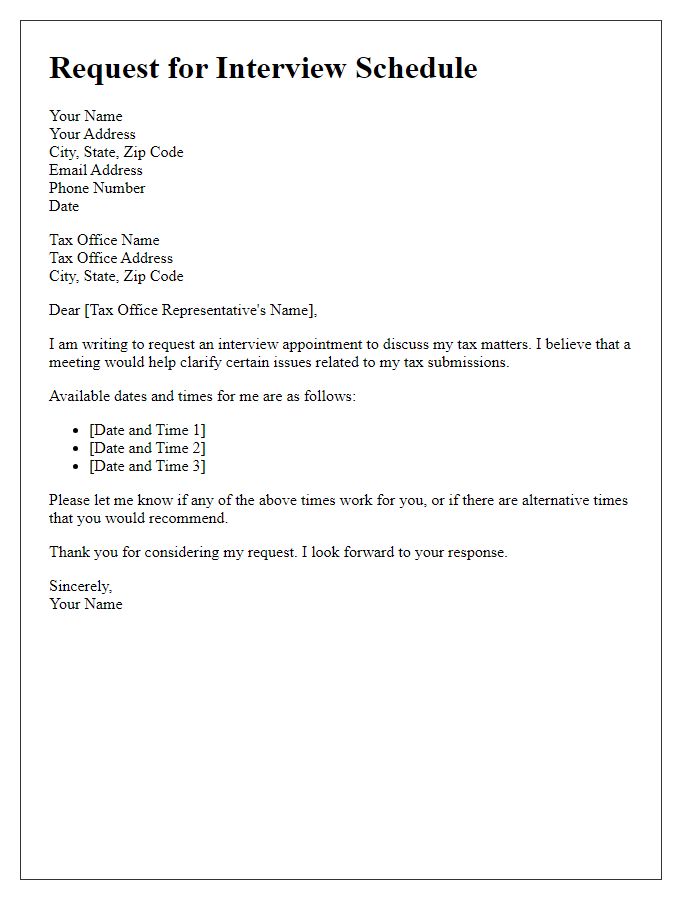

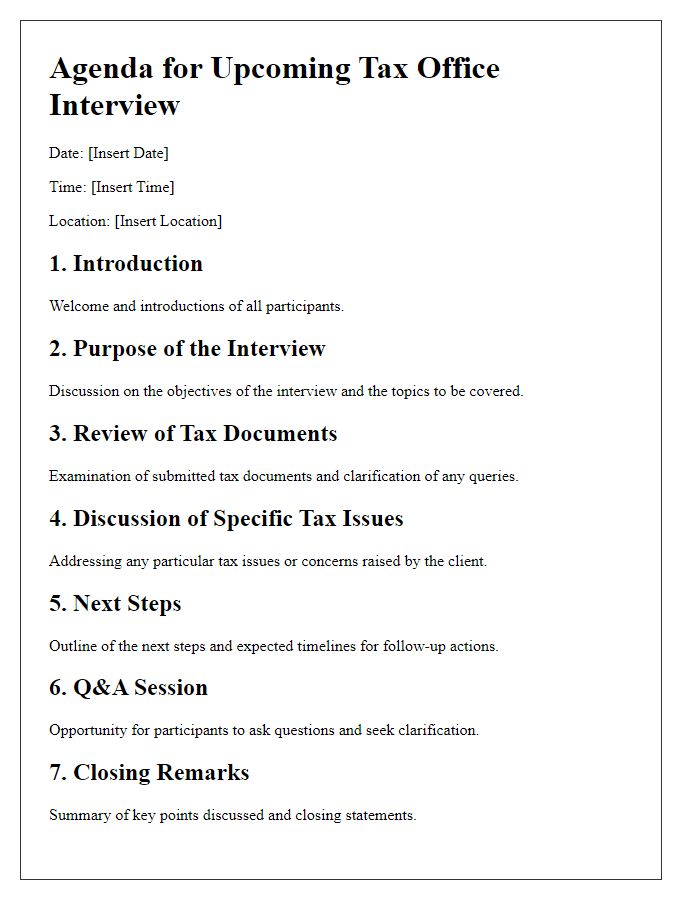

Clear subject line

Schedule Tax Office Interview Appointment: Request Confirmation and Details

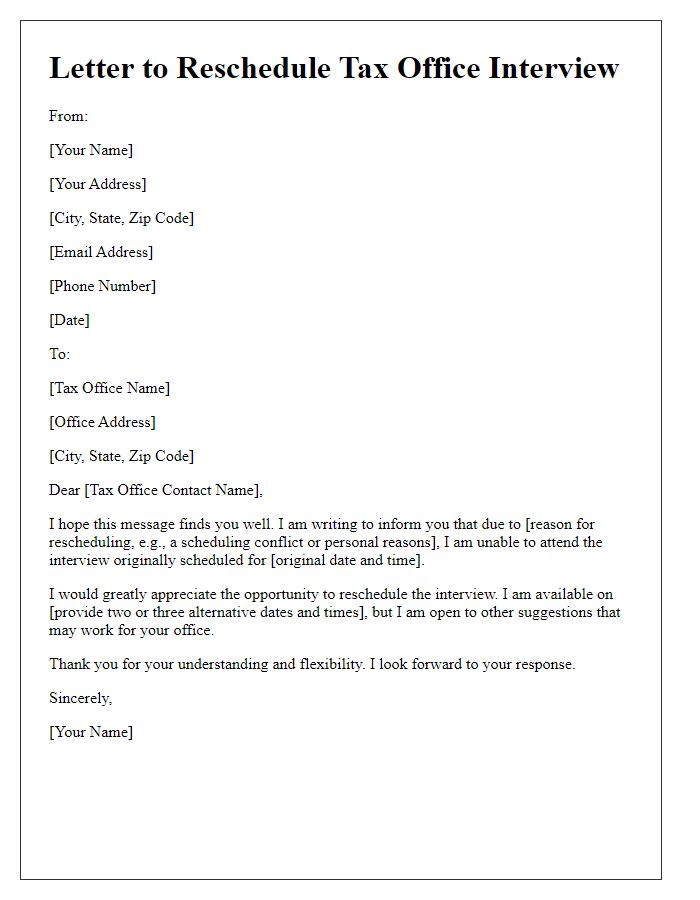

Formal salutation

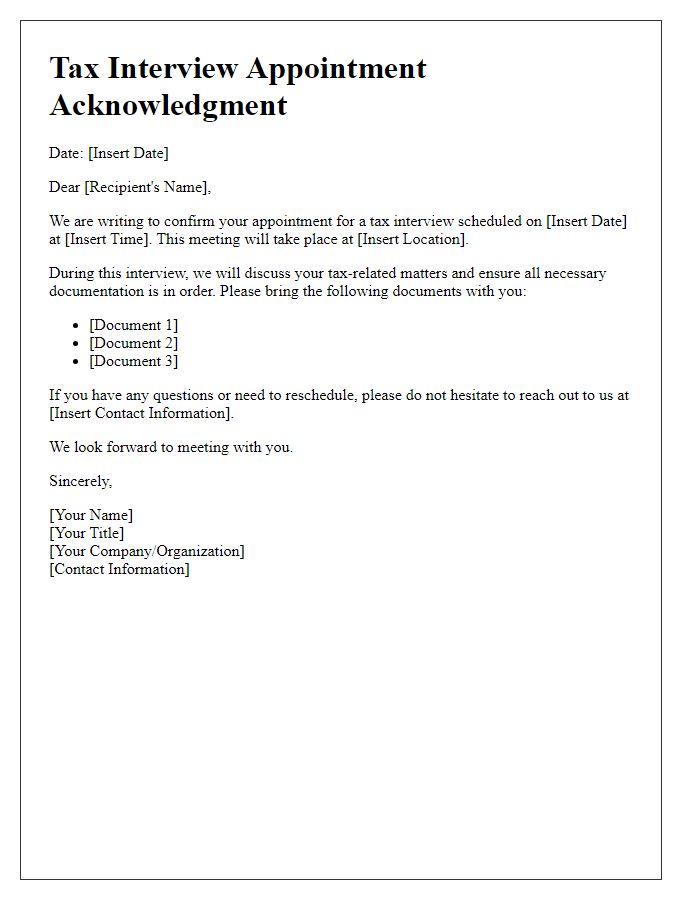

A structured and formal salutation is essential for initiating correspondence with offices such as tax authorities. Addressing the entity directly, such as "Dear [Name or Title of the Tax Officer/Department]," establishes a professional tone. Including specific details such as the tax office's name, office address, and any relevant reference numbers ensures clarity and distinction, facilitating efficient processing of the appointment request. Maintaining formality and politeness throughout the greeting reflects respect for the tax office's role, thereby reinforcing positive communication.

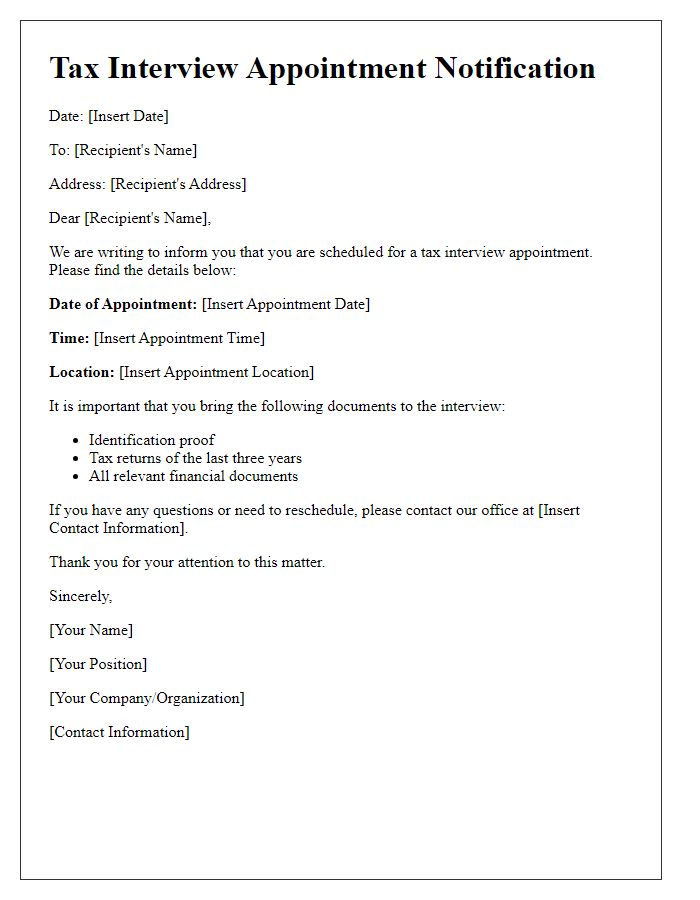

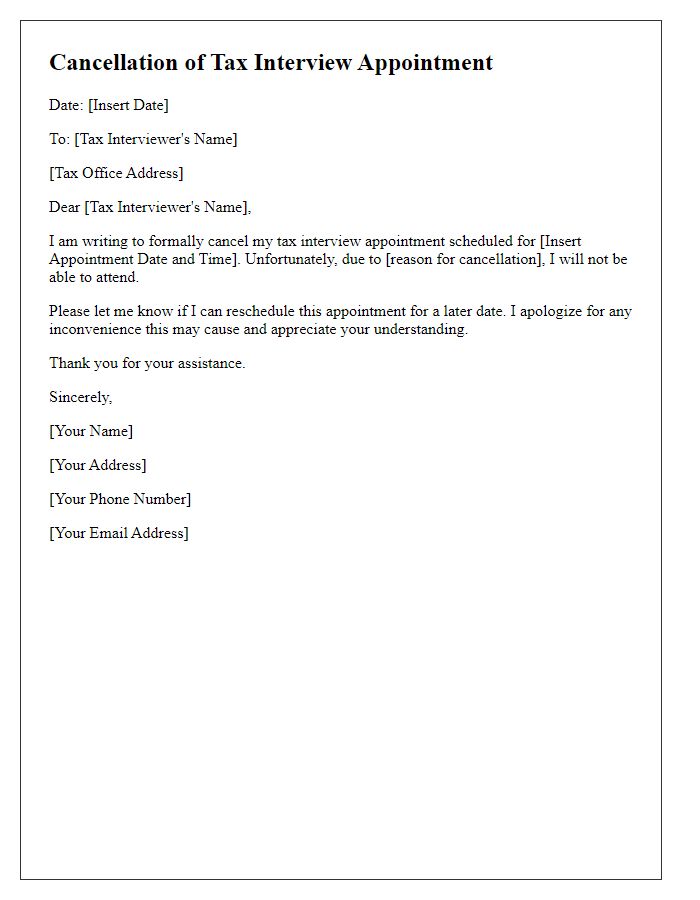

Purpose and details of the interview

Tax office interviews, typically conducted at local IRS (Internal Revenue Service) offices, serve the purpose of clarifying tax matters related to individual or business tax returns. During these appointments, taxpayers can discuss specific issues like audits, discrepancies, or payment arrangements. Interview sessions may vary in length based on the complexity of the case, often lasting 30 minutes to an hour. Tax professionals, such as Certified Public Accountants (CPAs) or enrolled agents, frequently accompany individuals to ensure accurate representation of financial information. Key documents required for the interview include tax returns for previous years, W-2 forms, 1099s, and any correspondence received from the tax authority. Ensuring that all necessary paperwork is organized ahead of time can facilitate a smoother experience and lead to effective resolution of tax-related queries.

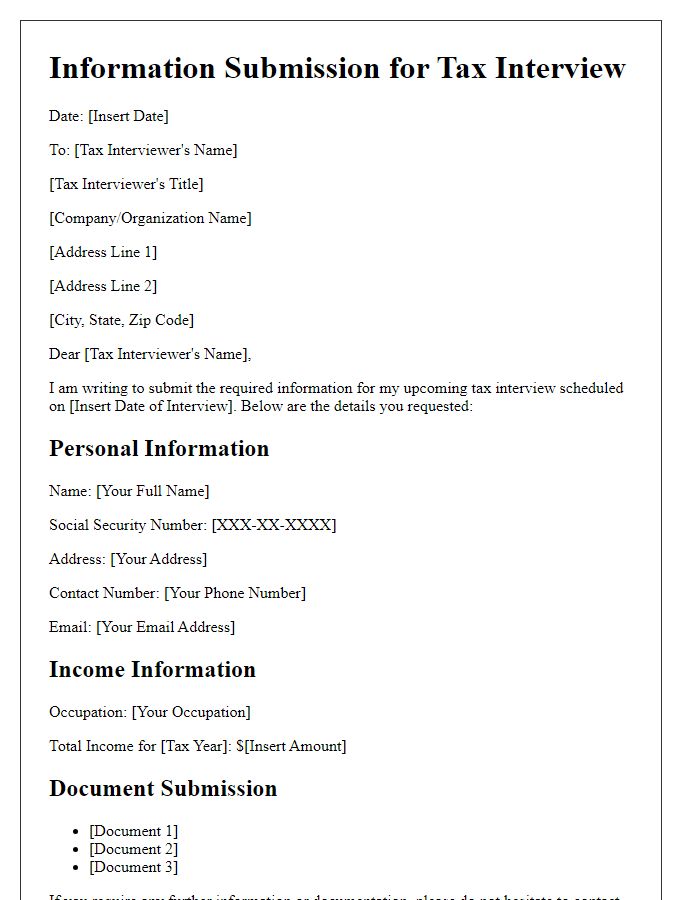

Required documents and preparation

Preparing for a tax office interview requires careful attention to detail and organization. Essential documents include your completed tax return forms (e.g., IRS Form 1040 for individuals), W-2 statements from all employers detailing annual earnings, 1099 forms for freelance or investment income, and any relevant receipts for deductions or credits claimed. Identification documents such as a government-issued photo ID (driver's license or passport) should be prepared to verify identity. Financial documents including bank statements, retirement account information, and records of any estimated tax payments made throughout the year will be crucial for assessing your financial situation. Additionally, reviewing past tax returns may provide context and assist in answering questions regarding discrepancies or claims. Organizing these documents in a clear, logical manner will facilitate a smooth interview process and demonstrate your preparedness to the tax office personnel.

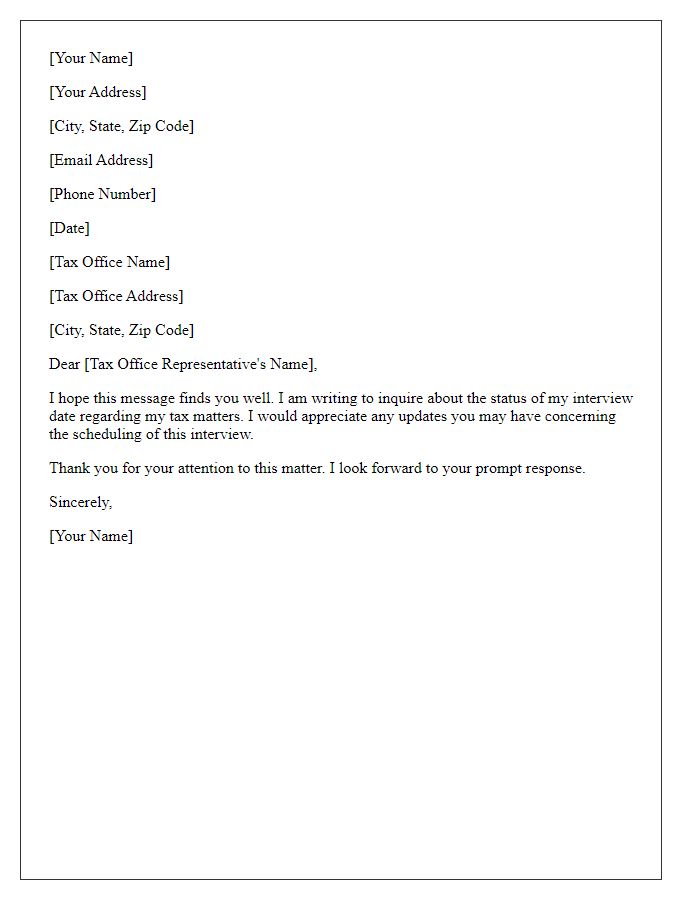

Contact information for queries

During a tax office interview appointment, individuals should provide relevant contact information to facilitate effective communication regarding queries. Essential details include full name, residential address (including city and postal code), phone number (preferably a mobile number for immediate contact), and email address (ensuring account access is current). Clear and concise information aids tax officers in addressing concerns promptly. Inquiries may range from eligibility criteria for deductions to clarification on filing statuses for the previous tax year, emphasizing the importance of accurate documentation and timely communication.

Comments