Hey there! If you've ever found yourself confused about a taxation error or received a notice from the tax authorities, you're not alone. Many individuals face this situation, and it's essential to understand how to address it effectively. In this article, we'll provide you with a handy letter template that simplifies the process of correcting those pesky errors, ensuring your communication is clear and professional. So, grab a cup of coffee and let's dive into the details to help you tackle any tax discrepancies with ease!

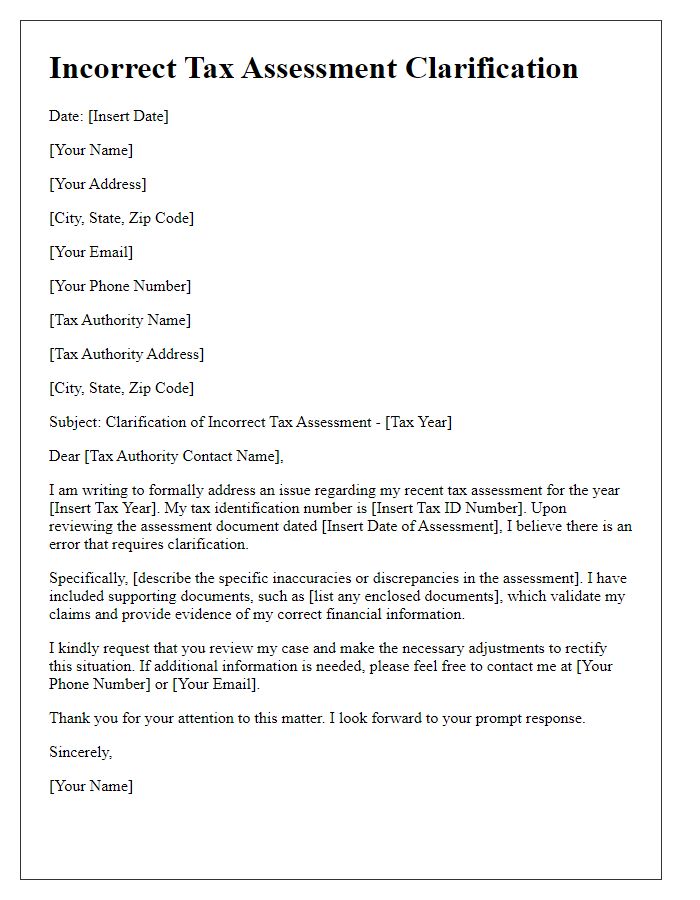

Taxpayer Identification Details

Taxpayer Identification Details encompass critical information essential for accurate tax processing and correspondence. This includes the Taxpayer Identification Number (TIN), a unique nine-digit identifier assigned by the Internal Revenue Service (IRS) to individuals and businesses. Accurate records are crucial to avoid discrepancies in tax liabilities, especially in cases of errors such as misreported income or miscalculated deductions. Additional elements include the taxpayer's name, address, and filing status, which contribute to the overall clarity of the taxpayer's account. Such details are vital for ensuring effective communication regarding tax liabilities and adjustments, preventing potential penalties or delays in processing.

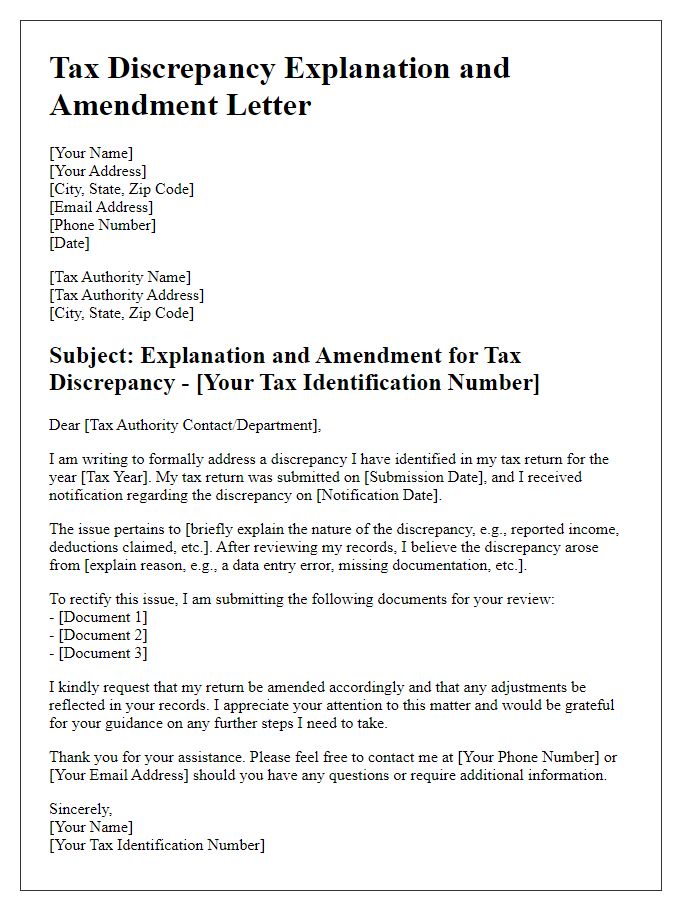

Description of Error and Correction

Taxation error corrections are essential for ensuring accurate financial reporting and compliance with the Internal Revenue Service (IRS) regulations. Common errors include discrepancies in reported income, miscalculations in deductions, or incorrect filing statuses. For instance, an error in reported income may arise from a missed W-2 form, which can significantly impact the total tax liability. Corrections typically involve submitting an amended return, such as Form 1040-X, providing a clear explanation of the error, and detailing the adjustments made. Timely submissions of these corrections can minimize potential penalties and interest charges, and ensure the taxpayer remains in good standing with the IRS. Accuracy in tax reporting is crucial, as it affects creditworthiness and overall financial health.

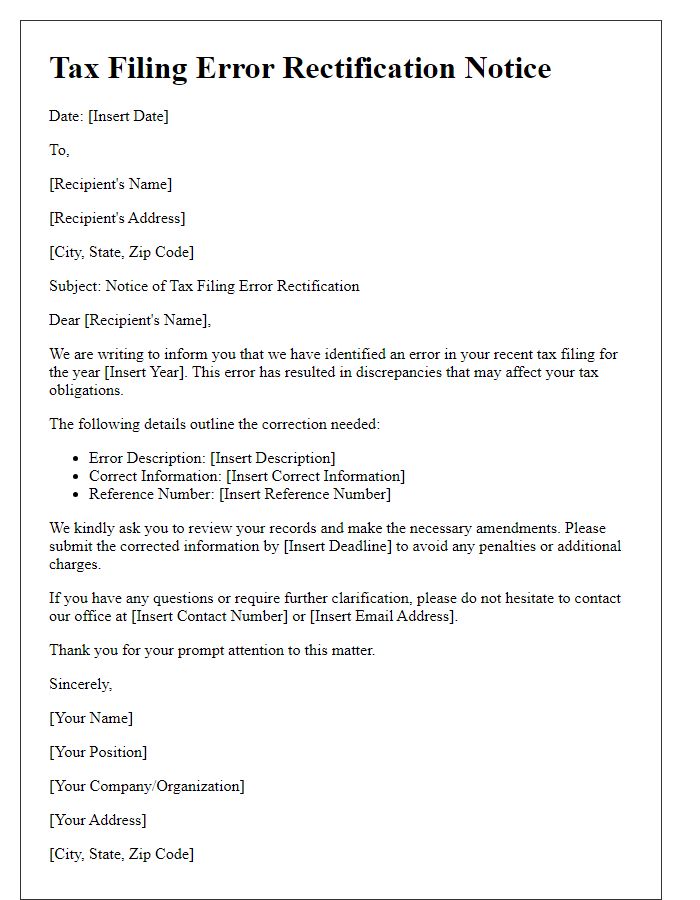

Request for Supporting Documentation

Taxation inaccuracies, often resulting from miscalculations or misinterpretations of tax laws, can lead to significant financial repercussions for individuals and businesses alike. The Internal Revenue Service (IRS), established in 1862 to manage federal tax collection, may issue a notice requesting supporting documentation to rectify discrepancies identified in filed returns. This process usually occurs within a designated review period, often ranging from 30 to 90 days. Key documents typically required include W-2 forms (reporting income from employers), 1099 forms (used for reporting various types of income), and receipts for deductible expenses. Ensuring prompt and accurate submission of these documents helps expedite the correction process, preventing potential penalties and interest that may accrue during prolonged disputes.

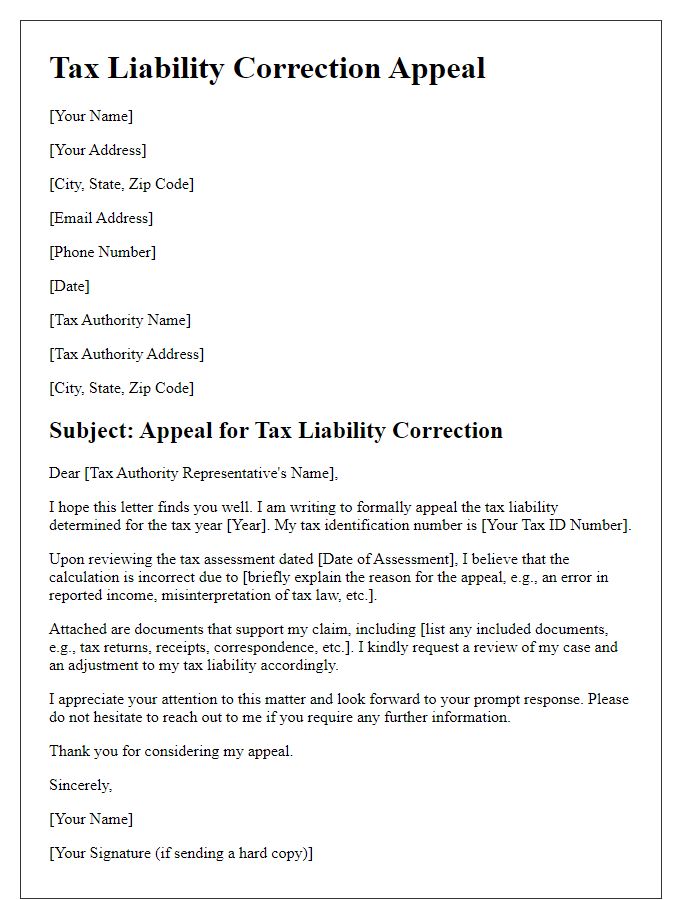

Deadline for Response

A taxation error correction notice is essential for ensuring accuracy in tax records, particularly for individuals and businesses subject to federal regulations, such as the Internal Revenue Service (IRS) in the United States. This notice typically outlines specific discrepancies, often pertaining to reported income or deductions, which may result in an adjustment of the payable tax amount. Recipients must adhere to the response deadline, often set at 30 days from the date of the notice issuance, to avoid penalties or interest accrual; timely action can rectify the situation and amend any possible overpayment or underpayment of taxes owed. Accurate documentation, such as W-2 forms or 1099 statements (issued for non-employment compensation), should accompany the response to facilitate proper correction of records.

Contact Information for Queries

The Taxation Error Correction Notice serves as an important communication document when addressing discrepancies in tax filings. Individuals or businesses receiving this notice should carefully review the outlined information regarding the identified errors, which may pertain to misreported income or incorrect deductions. For further clarification or assistance, the notice typically contains vital contact information, including phone numbers, email addresses, and office addresses of the tax authority responsible for the notice. Responding promptly and accurately to these inquiries helps ensure compliance with tax regulations and enables a smooth resolution process. Essential details, such as case numbers or reference codes, are crucial for efficient tracking of the correction process, making timely communications with tax officials imperative.

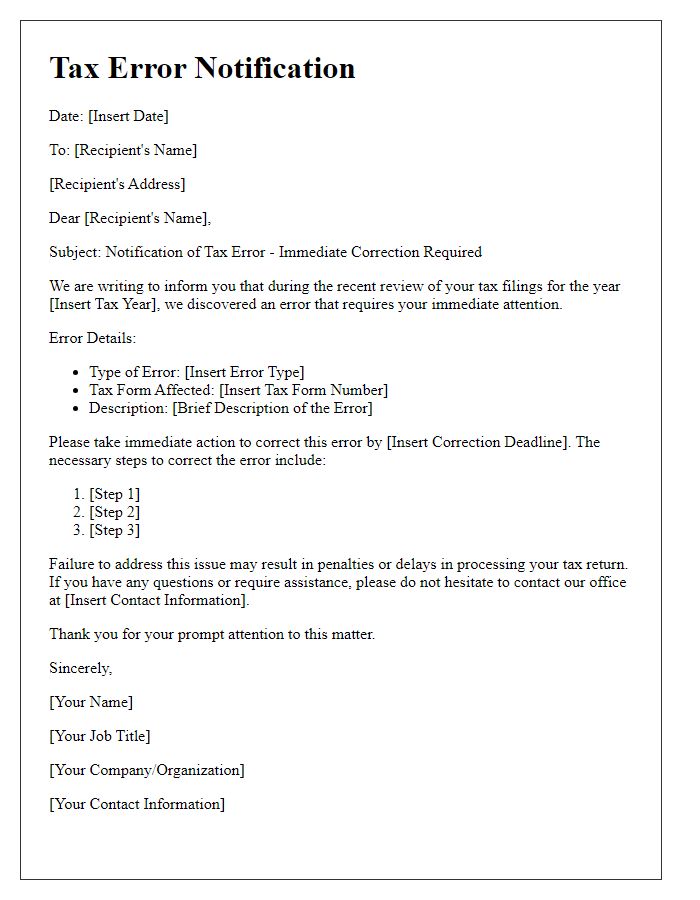

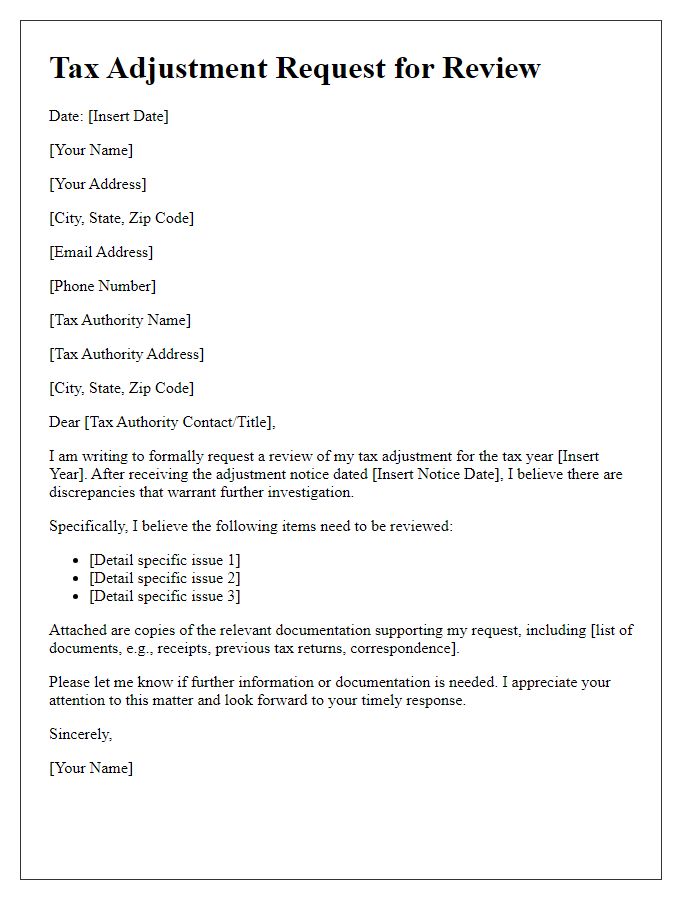

Letter Template For Taxation Error Correction Notice Samples

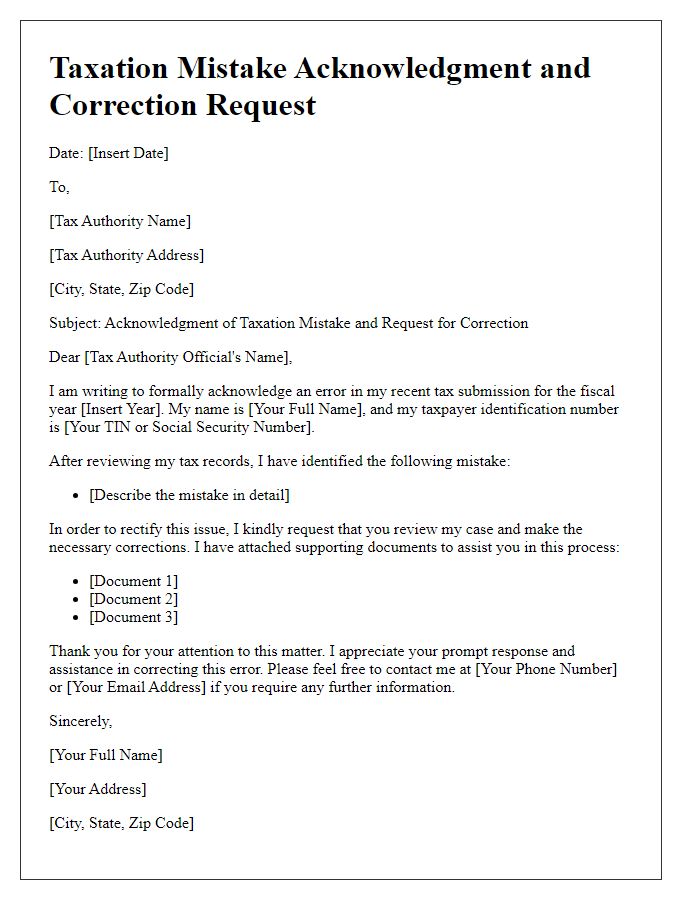

Letter template of Taxation Mistake Acknowledgment and Correction Request

Comments