Are you feeling overwhelmed by the complexities of cooperative tax filing? You're not aloneânavigating the myriad of tax regulations can be daunting for both individuals and businesses alike. This article will break down essential tips and provide guidance to help you tackle tax season with confidence. So, grab a cup of coffee and join me as we explore the ins and outs of cooperative tax filing assistance!

Personalized greeting

Cooperative tax filing assistance programs provide invaluable support to individuals navigating the complexities of tax documentation. Local community centers (such as the Neighborhood Tax Assistance Program in Chicago) offer free workshops and one-on-one consultations for taxpayers, especially targeting low-income families. Tax professionals volunteer their expertise, ensuring participants understand deductions, credits, and filing deadlines, which typically fall on April 15th each year. Additionally, resources like the IRS Free File program enable qualified taxpayers to file their federal tax returns online for free, streamlining the process. Collaboration among various organizations fosters a sense of community, empowering citizens to achieve financial literacy and compliance.

Clear purpose and objectives

Cooperative tax filing assistance programs aim to simplify the tax preparation process for individuals and small businesses, especially those unfamiliar with complex tax regulations. These initiatives focus on educating participants about tax obligations, ensuring compliance with the Internal Revenue Service (IRS) guidelines, and maximizing eligible deductions and credits. By providing resources such as workshops, one-on-one consultations, and access to tax software, these programs seek to empower taxpayers. Additionally, they aim to reduce anxiety associated with tax filing, encourage timely submissions, and foster a sense of community support during peak tax seasons. Collaboration with local organizations, such as community centers and libraries, enhances outreach efforts, ensuring that underserved populations receive necessary assistance. Overall, the goal is to facilitate an efficient and stress-free tax filing experience for all participants.

Necessary documents and information

To successfully navigate cooperative tax filing assistance, individuals must gather essential documents and information. Key items include the 1099 forms, which report income from various sources like freelance work or investments. W-2 forms are crucial for those with traditional employment, detailing wages and withholdings from employers. Identification documents, such as Social Security cards or personal identification numbers, verify taxpayer identity and ensure accurate filing with the Internal Revenue Service (IRS). Additionally, expense records related to business operations, like receipts and invoices, are necessary for maximizing deductions. Also, previous years' tax returns provide a historical reference for current filings. Accurate bank account information is crucial for potential refunds or payments. Lastly, knowledge of any tax credits or deductions, like the Earned Income Tax Credit or education credits, is imperative for optimizing tax liabilities.

Deadline for submission

Cooperative tax filing assistance programs provide crucial support for individuals and businesses during tax season, particularly before critical deadlines like April 15 in the United States. Local tax assistance centers, often affiliated with organizations such as the IRS's Volunteer Income Tax Assistance (VITA) or AARP Foundation Tax-Aide, offer free or low-cost services to ensure accurate filing. Participants should prepare necessary documents, including W-2 forms, 1099s for self-employment income, and receipts for deductible expenses. These programs aim to alleviate the stress of tax preparation, helping communities meet obligatory submission dates while maximizing potential refunds or credits.

Contact information and support availability

Cooperative tax filing assistance offers resources for individuals looking to navigate the complexities of filing their taxes, particularly during the annual tax season, usually from January to April. Dedicated support teams, available during weekdays from 9 AM to 5 PM, provide guidance on federal and state tax codes, deductions, and credits. Assistance is accessible via phone at (123) 456-7890, or email at support@taxcooperative.org, ensuring prompt responses to queries. Additionally, in-person consultations at local offices, such as the Downtown Tax Help Center at 456 Main St., provide personalized support for those requiring hands-on assistance with tax returns or related forms.

Letter Template For Cooperative Tax Filing Assistance Samples

Letter template of request for cooperative tax filing assistance for families

Letter template of inquiry about cooperative tax filing assistance for small businesses

Letter template of application for cooperative tax filing assistance for freelancers

Letter template of notification regarding cooperative tax filing assistance for non-profits

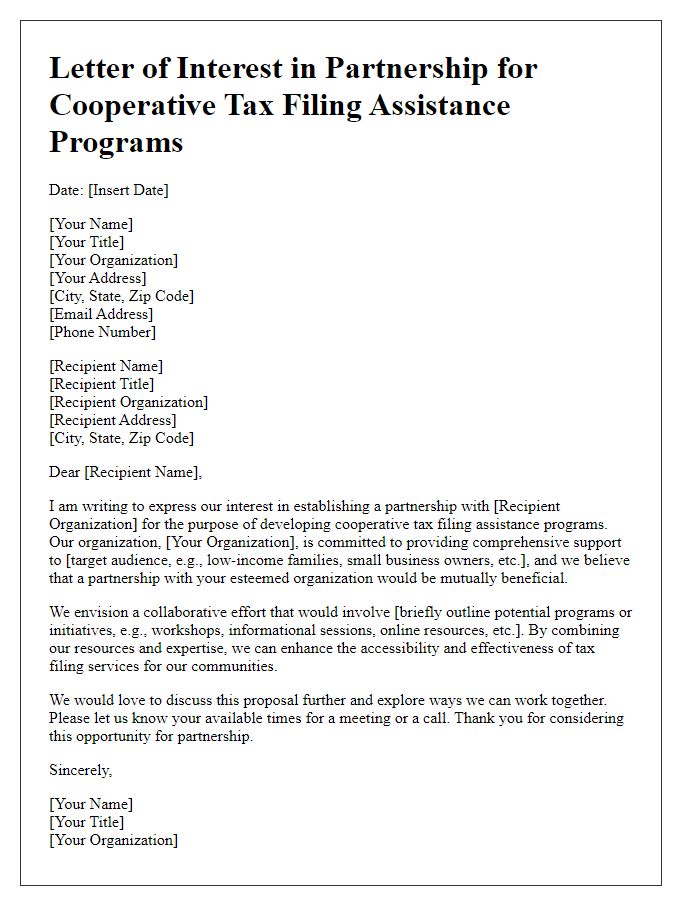

Letter template of recommendation for cooperative tax filing assistance for community organizations

Letter template of appeal for cooperative tax filing assistance for low-income individuals

Letter template of follow-up on cooperative tax filing assistance for students

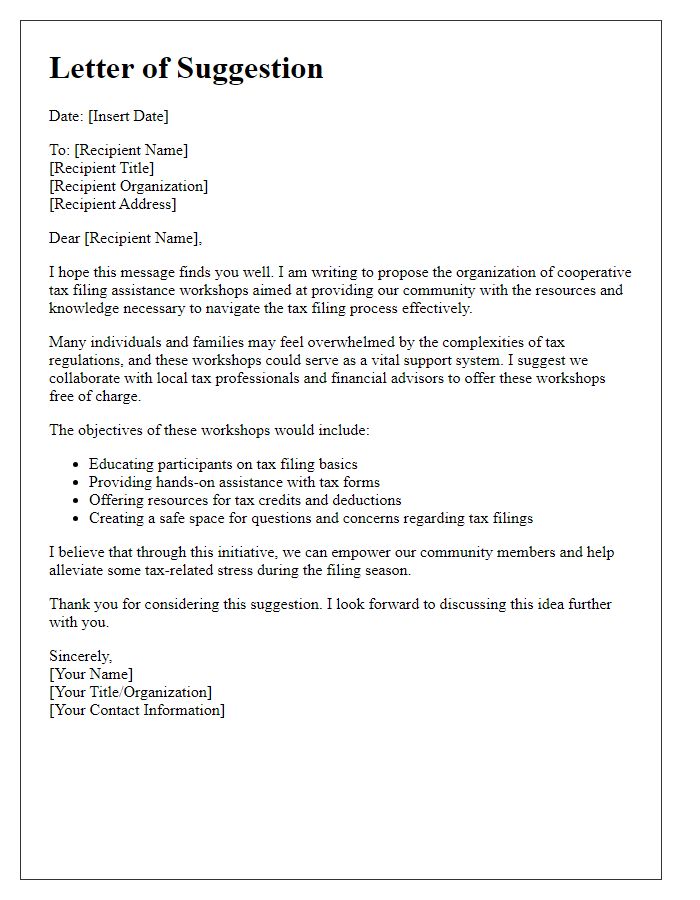

Letter template of suggestion for cooperative tax filing assistance workshops

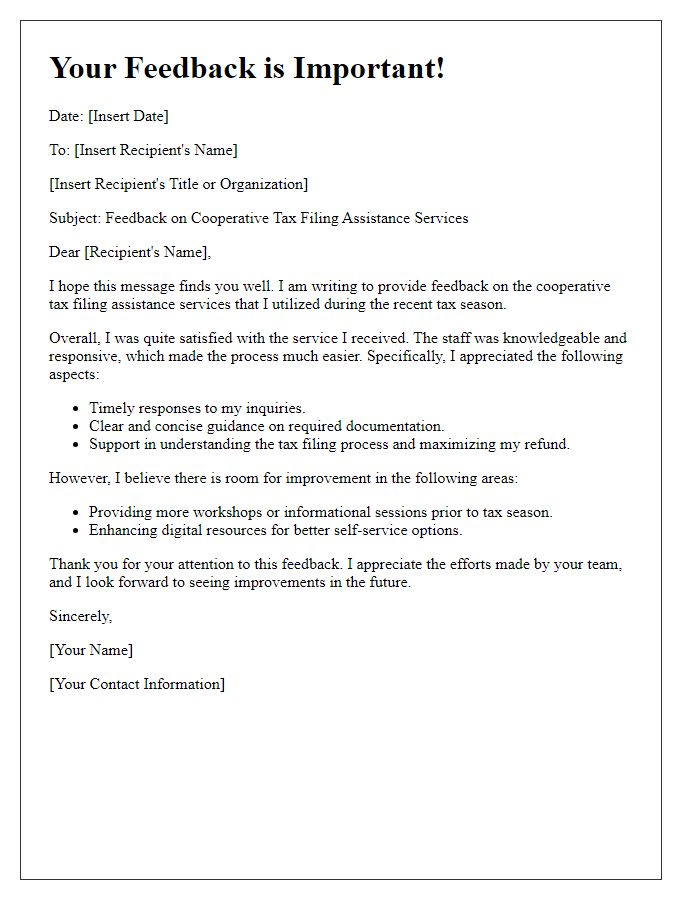

Letter template of feedback on cooperative tax filing assistance services

Comments