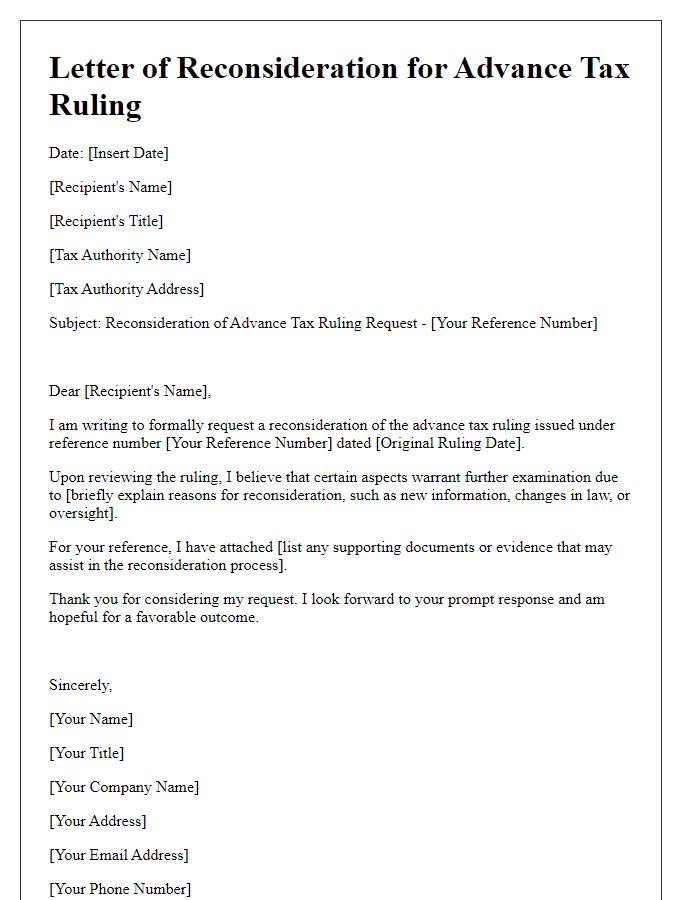

Are you looking to navigate the complexities of tax regulations with ease? Understanding how to properly request an advance tax ruling can save you from future headaches and unforeseen liabilities. In this article, we'll break down the essentials of crafting a compelling letter to the tax authorities, ensuring you have all the right details entailed. Ready to simplify your tax situation? Let's dive in!

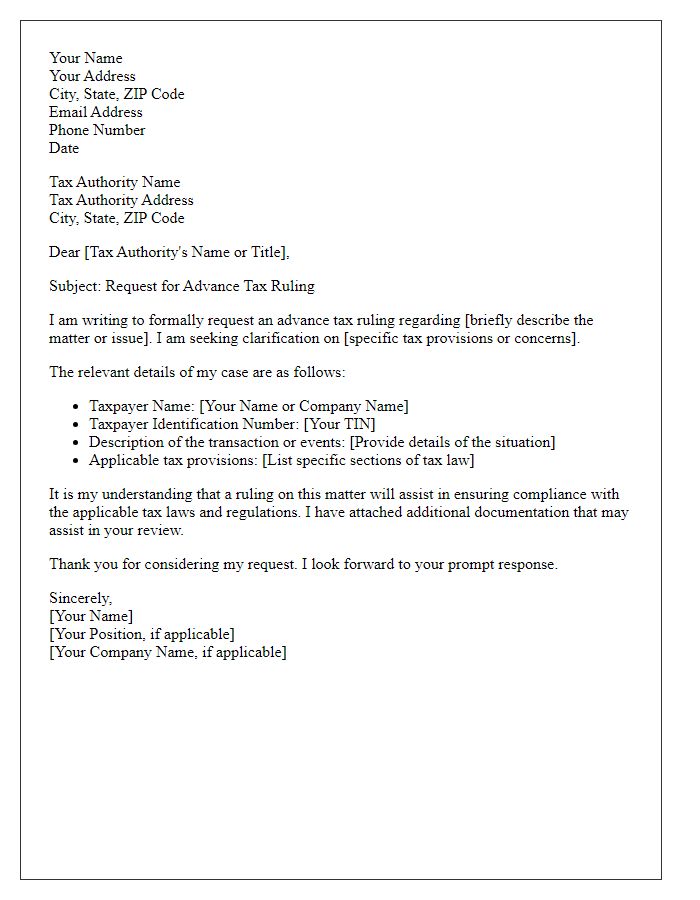

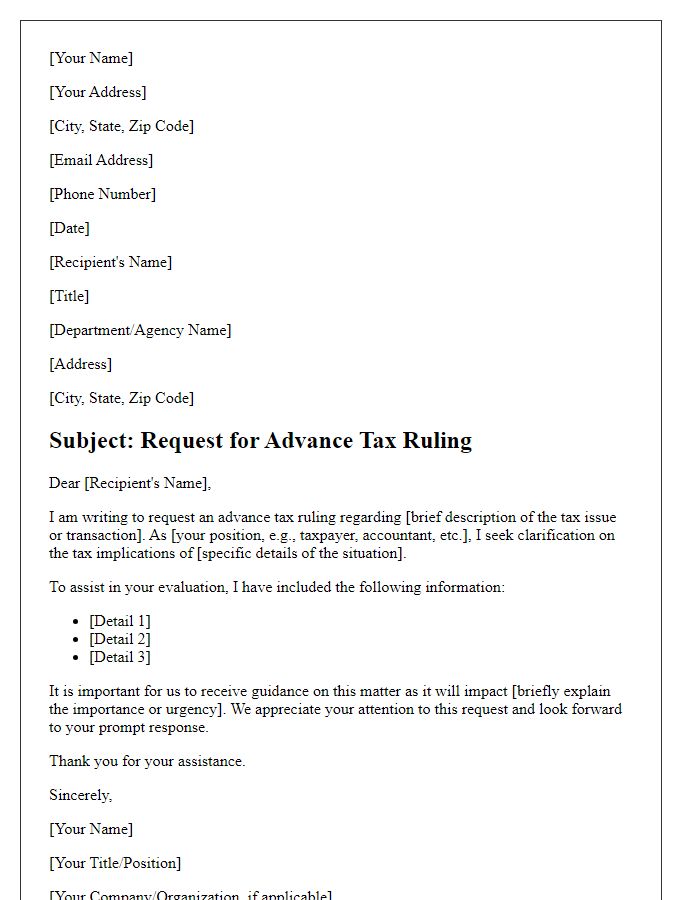

Clear identification of taxpayer and contact details

An advance tax ruling request necessitates a precise identification of the taxpayer along with their updated contact details. The taxpayer's identification includes their legal name, which must match the details registered with the tax authority, as well as their taxpayer identification number (TIN), often referred to as a Social Security Number (SSN) in the United States. Additionally, incorporating the taxpayer's physical address, including the street name, city, state, and ZIP code is vital for establishing jurisdiction. Contact details should also feature a current phone number and an email address for any necessary correspondence regarding the ruling. Ensuring this information is accurate aids in the efficient processing of the request and facilitates any communication needed by the tax authority.

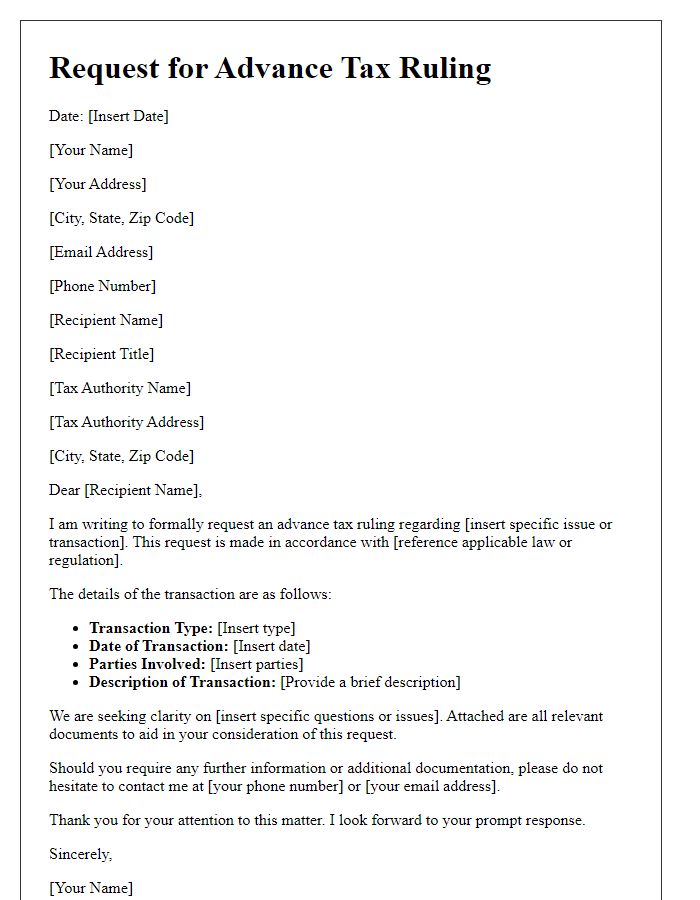

Detailed description of the transaction or arrangement

In a complex business scenario, a multinational corporation (MNC), XYZ Corp, headquartered in New York City, intends to engage in a significant cross-border transaction, specifically a merger with a mid-sized technology firm, Tech Innovations, based in Berlin, Germany. This planned acquisition, valued at approximately EUR500 million, aims to integrate advanced AI capabilities into XYZ Corp's product line to enhance competitiveness in the global market. The transaction involves transferring various intangible assets, including proprietary software and research data, which are crucial for the operational efficiency of the newly formed entity. The MNC seeks clarity regarding the tax implications of this transaction, particularly concerning double taxation agreements (DTAs) between the United States and Germany, and whether any withholding tax will apply to the payments made during the merger process. Additionally, XYZ Corp aims to understand how this arrangement will affect its existing tax liabilities and compliance requirements in both jurisdictions.

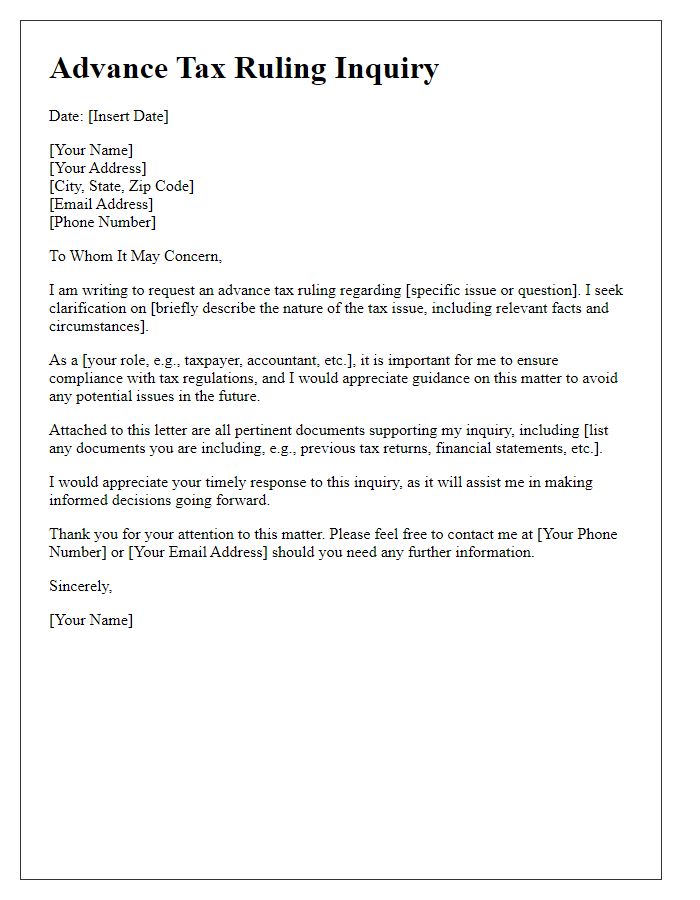

Specific tax issues or questions requiring clarification

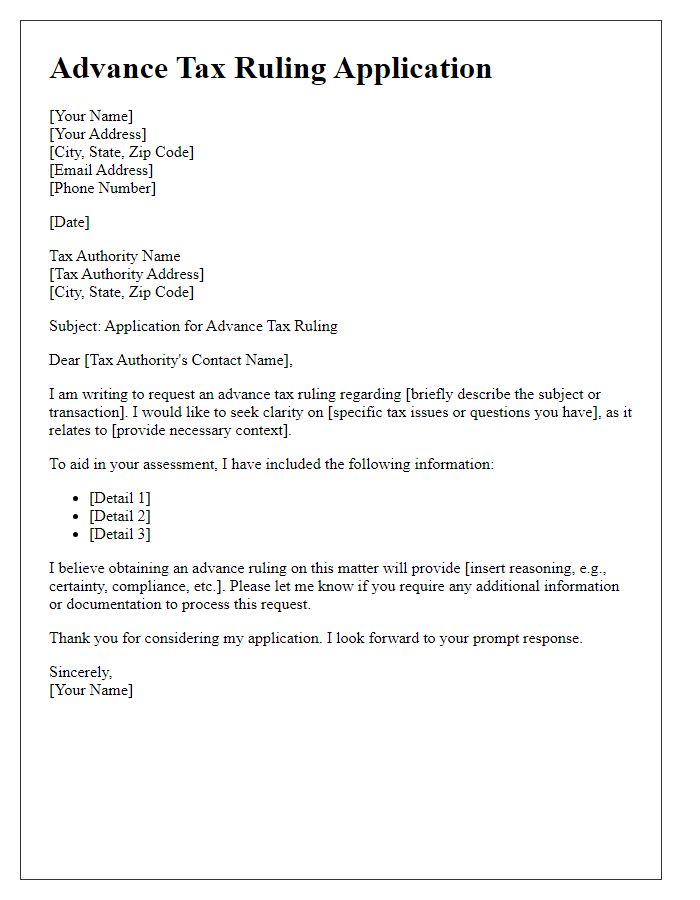

Advance tax rulings are essential for taxpayers seeking clarity on specific tax issues within their jurisdiction, including income taxes, goods and services tax (GST), or other applicable tax laws. In crafting a request, taxpayers must provide detailed context regarding the nature of the issue, such as investment structures, cross-border transactions, or tax treatment of specific types of income. Precise identification of relevant legislation, such as the Income Tax Act of Canada or the Internal Revenue Code of the United States, is crucial. Additionally, describing the potential impact of the ruling on the taxpayer's financial situation aids tax authorities in effectively evaluating the request. Supporting documents, including financial statements or transaction descriptions, bolster the request's credibility, ensuring compliance with the appropriate tax body's requirements for advance rulings.

Relevant legal provisions and interpretations

An advance tax ruling request involves seeking clarification and interpretation of specific tax laws before executing a transaction. This request is typically submitted to the tax authority, detailing relevant legal provisions, such as Income Tax Act sections (for example, Section 10 for exemptions), and referencing established case laws that could influence the ruling. The interpretation often requires a thorough analysis of regulations under the respective jurisdiction, which may include legal doctrine and administrative policies that govern the application of the law. Clearly stating the specific facts of the case, the proposed transaction, and how existing laws apply to it is crucial for obtaining a favorable ruling that aligns with tax compliance and minimizes potential liabilities.

Supporting documentation and evidence

An advance tax ruling request requires comprehensive supporting documentation and evidence to facilitate a clear understanding of the tax situation. Essential documents include financial statements (such as balance sheets and income statements) for the last three fiscal years, tax returns filed with the Internal Revenue Service (IRS), and any relevant contracts or agreements that establish the income streams or deductions in question. Detailed descriptions of the business operations (including business plans or strategies) must be provided, reflecting the entity's activities in a specific jurisdiction such as Delaware, known for favorable tax regulations. Additionally, legal opinions or interpretations of tax laws, particularly any relevant precedents established by previous rulings, should accompany the request. Identifying key stakeholders involved, such as legal advisors or accountants, and including their qualifications may bolster the credibility of the submission. Each document should be clearly labeled and organized for easy reference, ensuring the tax authority has a complete view of the context surrounding the advance ruling request.

Comments