Are you overwhelmed by the thought of navigating the vehicle tax refund process? Don't worry, you're not alone! Many people are unsure about how to effectively request a refund for their vehicle taxes, and it can often lead to unnecessary stress. In this article, we'll provide you with a simple letter template that will make your request smooth and hassle-freeâso let's dive in!

Personal Identification Details

The vehicle tax refund request process often requires individuals to provide personal identification details to validate their identity and eligibility. Essential information typically includes full name (as registered with the tax authority), residential address (current address on file), date of birth (to verify age and identity), and a government-issued identification number (such as Social Security Number in the United States). Furthermore, vehicle-specific information might be required, including the Vehicle Identification Number (VIN), license plate number, and any receipts or documents proving payment of the vehicle tax. Proper documentation helps streamline the refund process and ensures compliance with state regulations.

Vehicle Information

Vehicle information is crucial for the processing of tax refund requests. The vehicle identification number (VIN) uniquely identifies each vehicle, consisting of 17 characters that include both digits and letters. Additionally, the make and model, such as Ford F-150 or Toyota Camry, provide essential details about the vehicle's manufacturer and specifications. Registration details, including the license plate number and state of registration (e.g., California or Texas), ensure the vehicle is correctly associated with the owner. Tax year information, typically the previous year, is required to establish the period for which the refund is being requested. Accurate documentation of mileage and any claimed deductions (for electric vehicles or hybrids) further supports the request for a refund.

Refund Amount Calculation

A vehicle tax refund request involves careful calculation of overpaid taxes, reflecting the specific amount eligible for return. For instance, if an individual paid $500 in vehicle taxes for the year 2023, yet the assessment determined only $300 was owed due to a change in vehicle valuation, the refund amount becomes $200. Important elements in this calculation include the payment date, vehicle identification number (VIN), and state tax regulations like the percentage tax rate applied. Documentation such as payment receipts and official notices from the tax authority also play a crucial role in substantiating the refund claim. Calculating the refund accurately requires attention to detail and adherence to local tax policies, ensuring all necessary forms are completed correctly to facilitate a smooth processing experience.

Justification for Refund

Vehicle tax refunds can be requested under specific circumstances involving eligibility criteria and regulations established by various tax authorities. In situations where a vehicle, such as a sedan or SUV, was sold or transferred (often within a tax year) before the tax payment was due, owners might be eligible for a refund covering the period post-sale. Documentation is essential; for instance, a bill of sale (indicating the transaction date) and proof of tax payment (such as a receipt) are often required. Additionally, if a vehicle was declared a total loss due to an accident (typically requiring a claims report from an insurance company), owners should also provide evidence to substantiate their claim. It's critical to comply with filing deadlines (usually within one year from the transaction date) to ensure the refund process is initiated smoothly.

Bank Account Details for Refund

The vehicle tax refund request form requires accurate bank account details to facilitate the return of funds. Essential information includes the account holder's name, corresponding to the vehicle registration details, ensuring a seamless transaction process. The bank name must reflect the financial institution where the account is held, whether it be a national bank, such as Chase or Bank of America, or a local credit union. Account number and routing number are critical components, enabling the direct deposit of the refund amount into the specified account, avoiding delays associated with check processing. Submission of these details should be accompanied by any relevant tax documents, like the previous year's vehicle tax statement, to substantiate the claim for a refund.

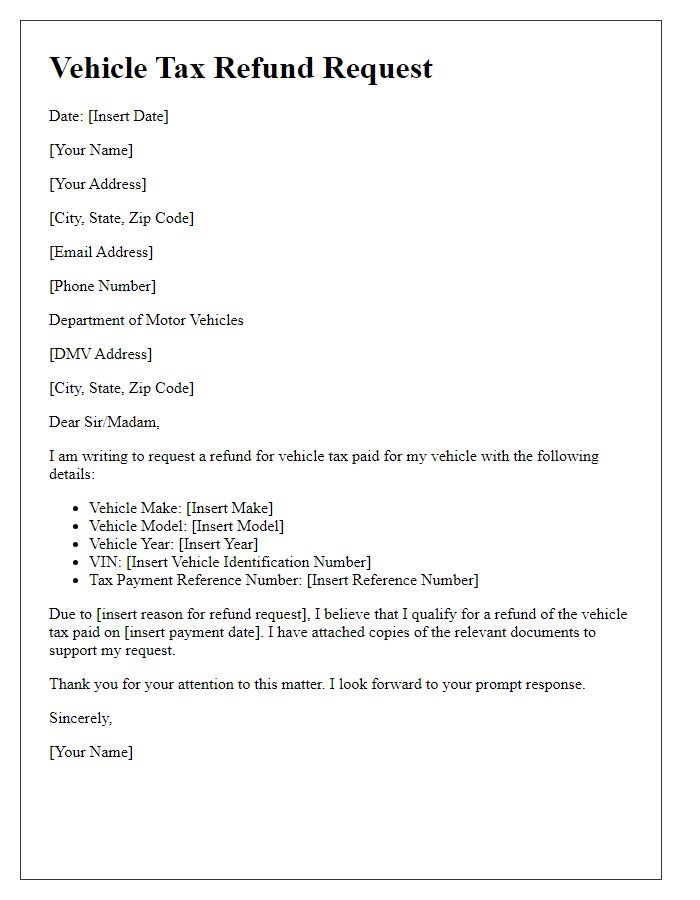

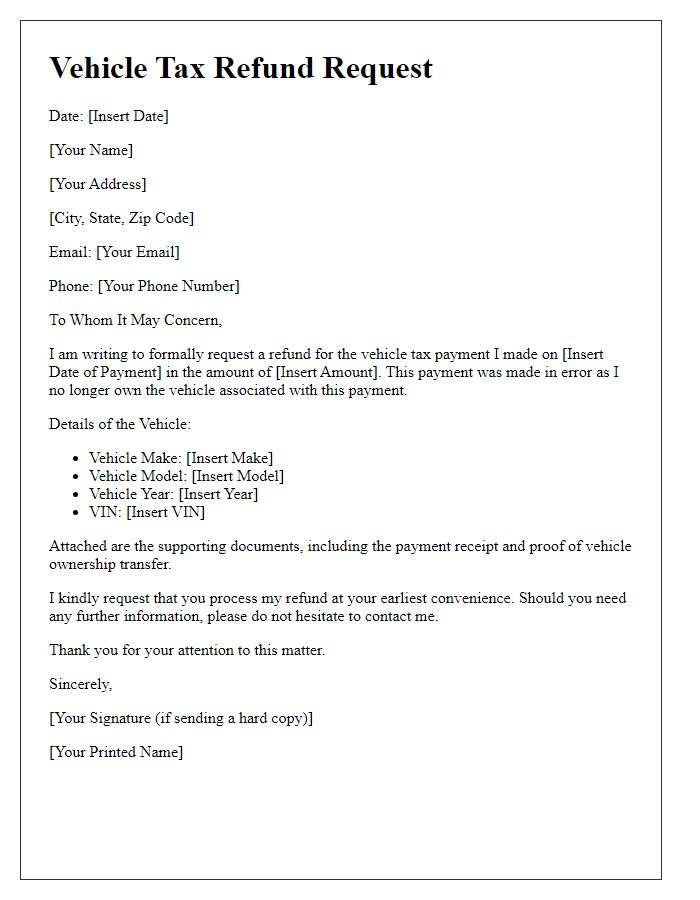

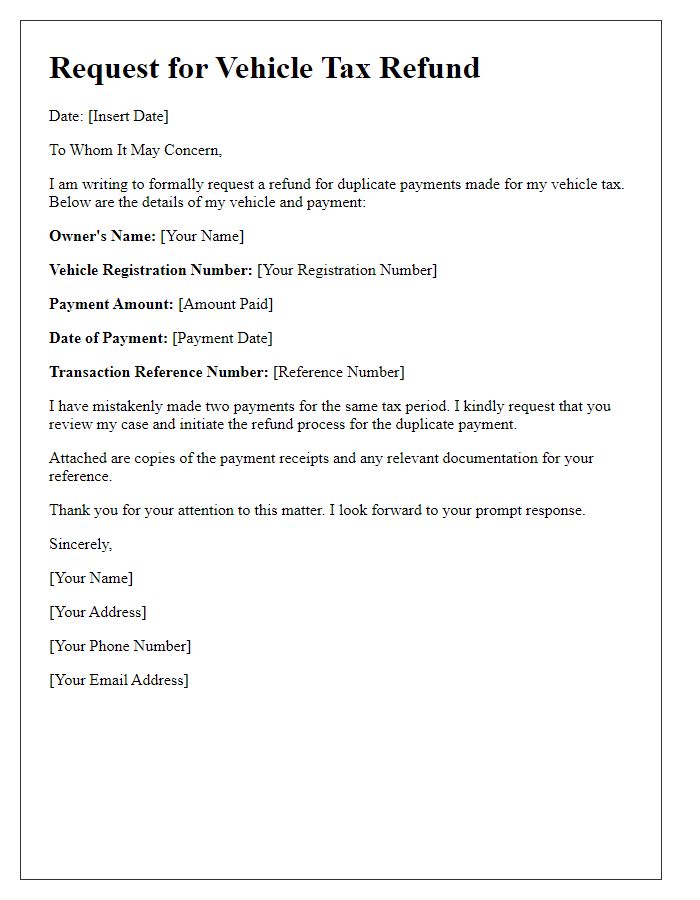

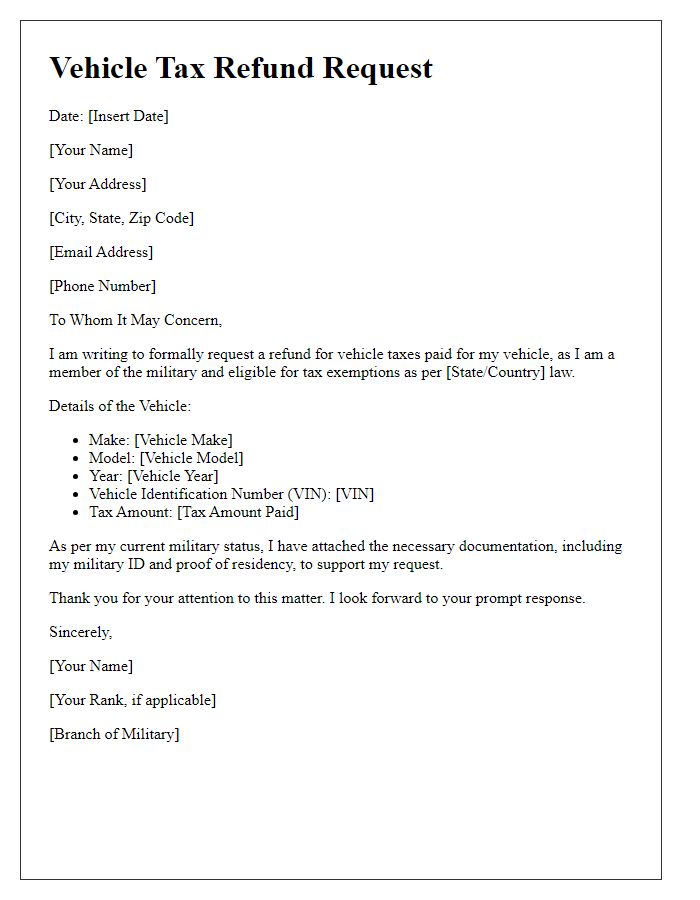

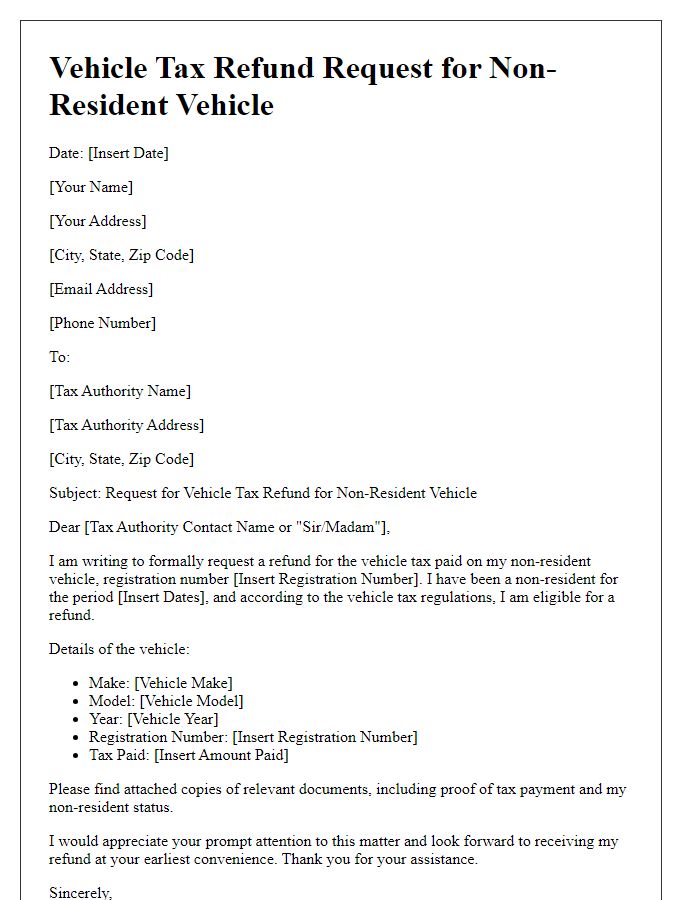

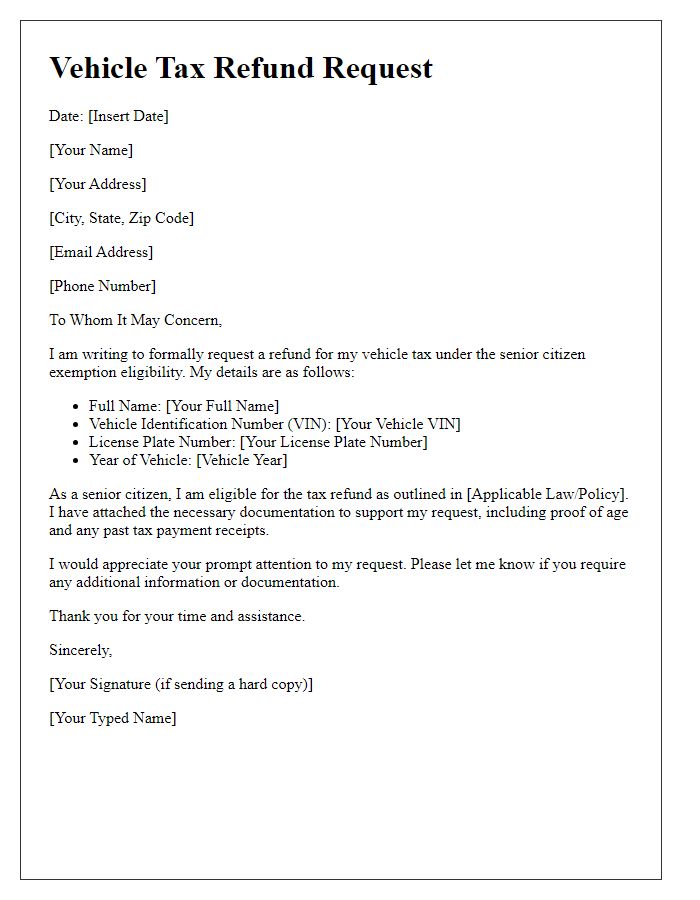

Letter Template For Vehicle Tax Refund Request Form Samples

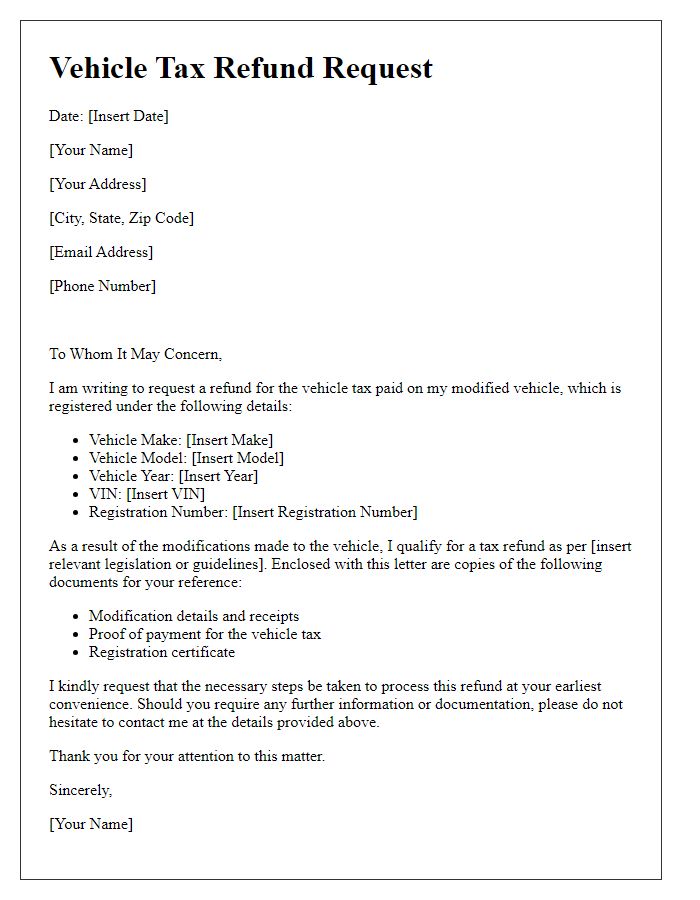

Letter template of vehicle tax refund request for modified vehicle claims

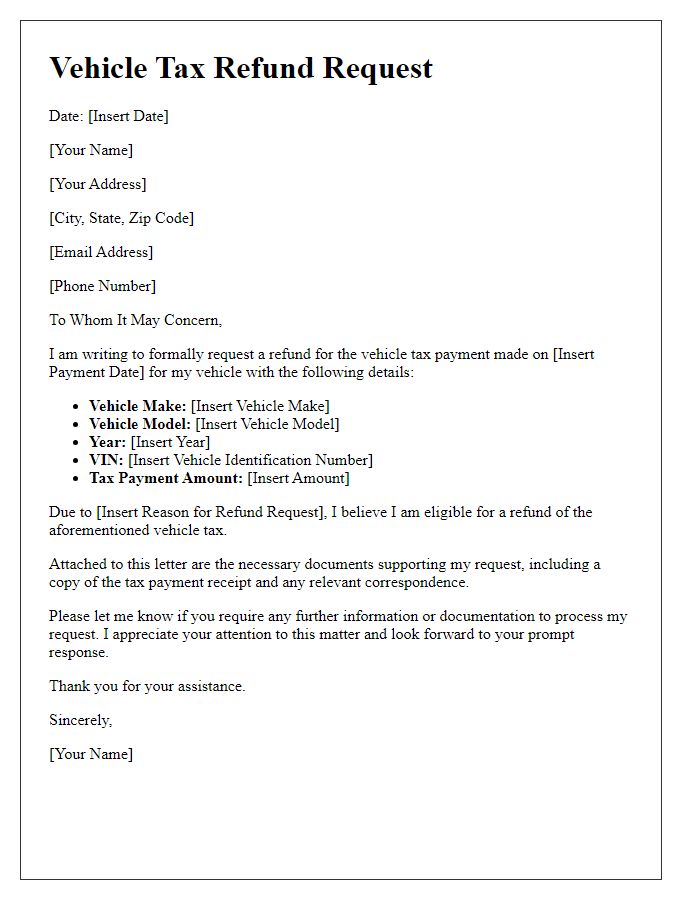

Letter template of vehicle tax refund request for business vehicle taxes

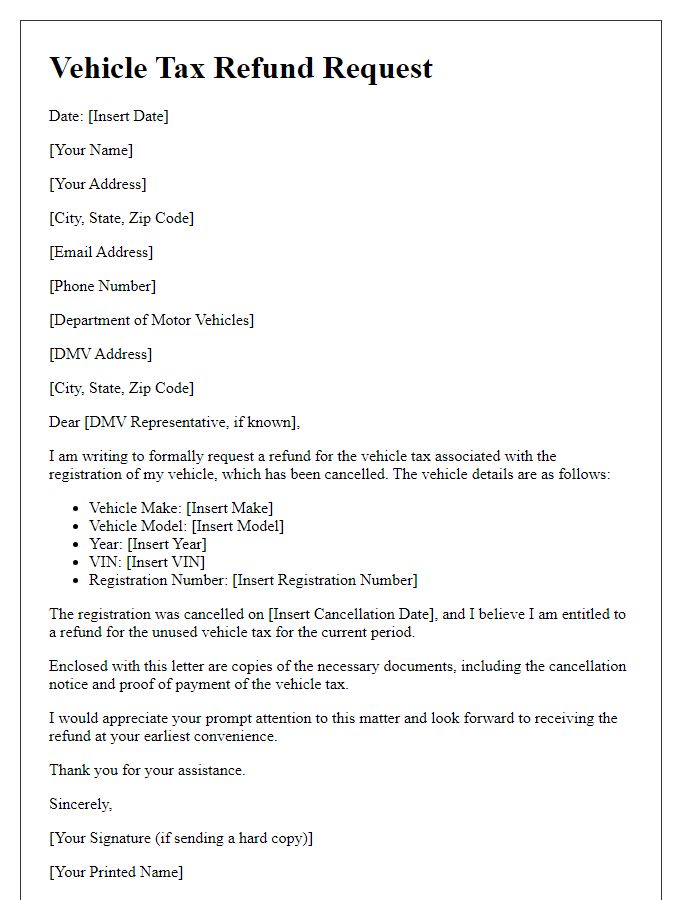

Letter template of vehicle tax refund request for cancelled registrations

Comments