Are you anxiously awaiting your tax refund and wondering why it's taking longer than expected? You're not alone; many taxpayers experience delays that can be caused by a variety of factors, from errors in your tax return to changes in government processing timelines. Understanding these delays can ease your concerns and help you navigate the situation more effectively. Stay tuned as we dive deeper into the reasons behind tax refund holdups and provide tips on what to do next!

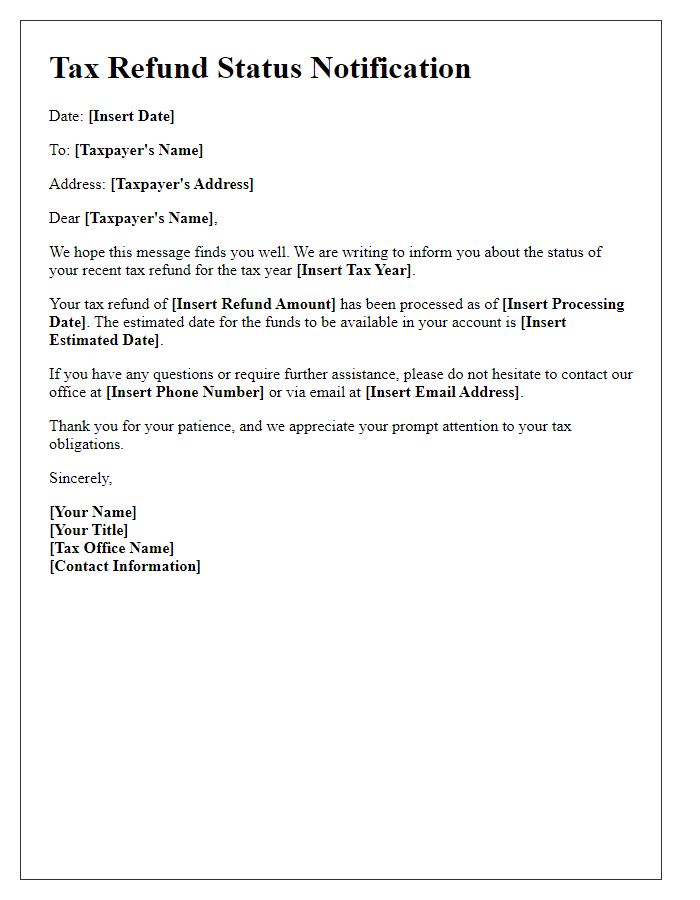

Clear subject line

Delayed Tax Refund Notification for [Tax Year] - Important Update on Your Refund Status

Reference number or taxpayer ID

Tax refund delays can occur due to various factors, impacting individual taxpayers across different states in the United States. Factors such as high volume processing during peak seasons, discrepancies in submitted information, or additional review requirements by the Internal Revenue Service (IRS) can contribute to these delays. Taxpayers may experience increased anxiety when waiting for refunds beyond the typical processing timeframe of 21 days for e-filed returns and 6 to 8 weeks for paper filings. It's advisable for taxpayers to monitor their refund status through the IRS "Where's My Refund?" tool, utilizing their reference number or taxpayer ID for accurate tracking.

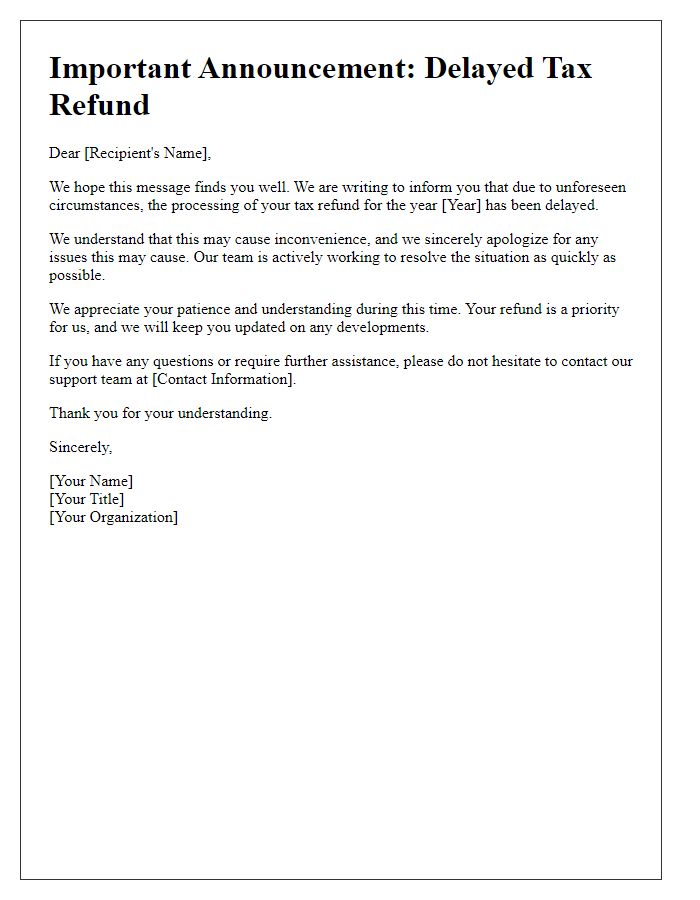

Explanation of delay

The recent announcement of delays in tax refund processing has caused concern among taxpayers nationwide. The IRS (Internal Revenue Service) reported that ongoing system upgrades and increased filing volumes, particularly during the 2023 tax season, contributed to these setbacks. Specifically, many taxpayers, especially those claiming multiple itemized deductions, may experience additional wait times, up to six weeks or longer in some cases, before receiving their anticipated refunds. Furthermore, around 3 million returns are currently under review due to discrepancies in reported income, extending the processing timeline significantly. This development can create financial strain for individuals expecting timely refunds to cover everyday expenses.

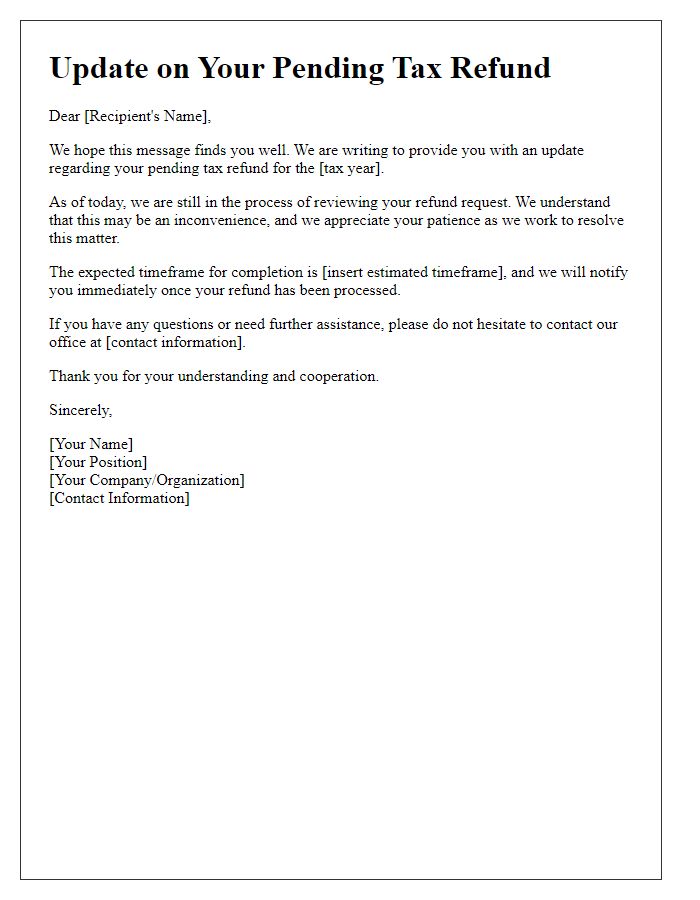

Estimated timeframe for refund

Tax refund delays can occur due to various issues such as inaccurate information or increased processing times. The Internal Revenue Service (IRS) typically assesses refund requests and announces estimated timeframes, indicating delays that might last up to 21 days for electronic filings. Additionally, factors like high volumes of tax returns during April, changes in tax laws, or the need for further review can contribute to extended timelines. Taxpayers can use the IRS "Where's My Refund?" tool to gain insights into their specific situation and expected payout dates.

Contact information for inquiries

Tax refund delays can significantly impact individuals' financial plans. Many taxpayers, especially first-time filers, rely on prompt refunds to manage expenses. Common causes of delays include discrepancies in personal information, incomplete forms, or additional reviews by the Internal Revenue Service (IRS), which handles millions of claims annually. For inquiries regarding tax refund status, taxpayers may contact the IRS directly at 1-800-829-1040. Furthermore, utilizing the "Where's My Refund?" tool on the IRS website can provide real-time updates on the refund process. Maintaining accurate personal details and ensuring tax forms are complete can help mitigate future delays.

Comments