Have you ever faced the frustrating experience of having your VAT refund application denied? It can feel disheartening, especially when you believe you've provided all the necessary information. In this article, we'll explore some common reasons for denial and tips on how to effectively respond to enhance your chances of a successful appeal. So, if you're ready to turn that denial into approval, keep reading for some helpful insights!

Recipient's Information

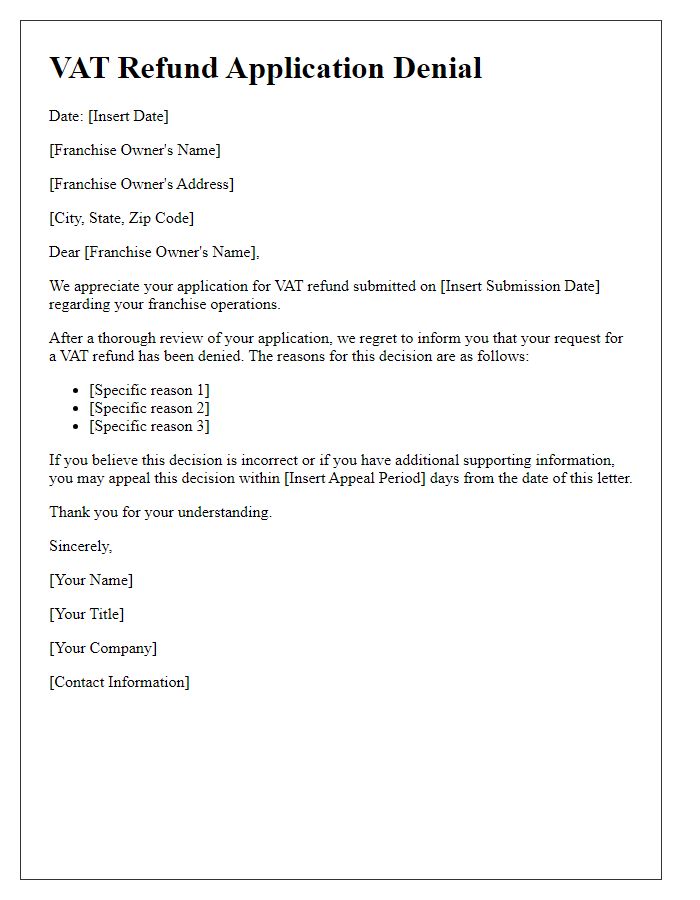

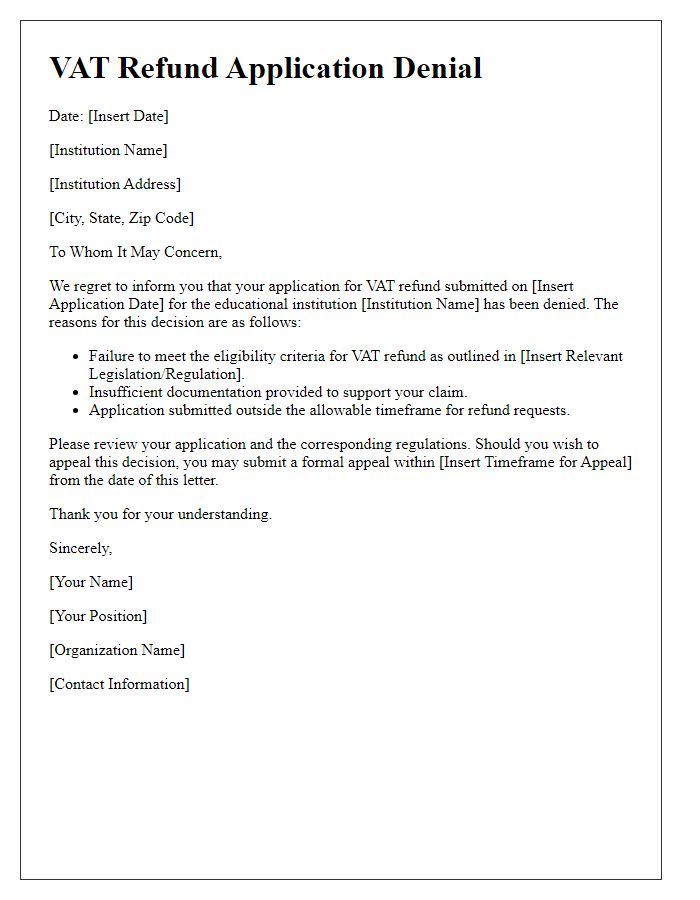

The VAT refund application process can be complex, often leading to complications that result in denial. Various reasons contribute to this outcome, such as incomplete documentation, inaccuracies in the submitted VAT reclaim forms, or failure to meet the eligibility criteria established by tax authorities like the HM Revenue and Customs (HMRC) in the United Kingdom or the Internal Revenue Service (IRS) in the United States. Applicants may also face rejection due to discrepancies in financial records, such as mismatched invoices or incorrect VAT registration numbers, which could amount to serious administrative errors. Furthermore, specific deadlines must be adhered to--typically ranging from 3 to 12 months post applicable tax period--failing which applications could be automatically denied.

Reference Number

The refusal of a VAT refund application can create significant financial implications for businesses navigating complex tax regulations. The letter from the tax authority typically includes a reference number for tracking, ensuring that businesses can easily reference their specific case during follow-ups. Common reasons for denial may encompass insufficient documentation, inaccuracies in submitted financial records, or failure to meet the eligibility criteria set by the tax laws of the concerned jurisdiction. Timeliness is crucial; many authorities have strict deadlines for appeals. Businesses must review the details in the denial letter thoroughly, addressing the specific points raised to improve the chances of a successful appeal or reapplication.

Reasons for Denial

VAT refund applications can be denied for various reasons, impacting businesses seeking reimbursement. Common reasons include incomplete documentation, such as missing invoices or receipts, which fail to provide adequate proof of purchase, crucial for substantiating claims. Errors in invoicing, like incorrect VAT amounts or non-compliance with local regulations, can lead to rejection. Additionally, purchases not directly linked to taxable business activities are often excluded from eligibility, undermining application validity. Deadline violations, where submissions exceed the statutory time frame, further complicate recovery efforts. Lastly, discrepancies in reported income or discrepancies flagged by tax authorities may trigger additional scrutiny, resulting in denial. Understanding these factors is essential for businesses to enhance future applications and ensure compliance with the VAT refund process.

Relevant Tax Information

A VAT refund application denial can create significant financial implications for businesses engaging in international trade, especially in regions like the European Union where VAT regulations are particularly stringent. In this context, the claimant must understand the specific reasons for denial, such as incorrect invoice issuance, failure to meet the minimum claim threshold (often around EUR400 in many EU countries), or missing documents such as proof of export. The application process typically involves submitting detailed records, including transaction receipts and tax identification numbers. Compliance with deadlines is critical, as appeals often require action within a set period, typically 30 days from the denial notice date. Keeping detailed records and ensuring adherence to local regulations can facilitate smoother future applications and mitigate the likelihood of subsequent denials.

Contact Details for Appeal or Inquiry

In the event of a VAT refund application denial, taxpayers should utilize official contact channels for inquiries or appeals to the relevant tax authority, such as the Internal Revenue Service (IRS) in the United States or Her Majesty's Revenue and Customs (HMRC) in the United Kingdom. Taxpayers can reach out via dedicated telephone support lines, listed under VAT refund inquiries on the agency website. Additionally, formal appeal submissions must be sent to a specified address, often outlined in the denial notice. Online portals may offer an efficient way to communicate, providing tracking features to monitor the progress of the appeal. Accurate and timely correspondence is crucial for resolution, often requiring necessary documentation like previous VAT returns and proof of payment to support the case.

Letter Template For Vat Refund Application Denial Samples

Letter template of VAT refund application denial for individual taxpayers.

Letter template of VAT refund application denial for non-resident companies.

Letter template of VAT refund application denial for charity organizations.

Letter template of VAT refund application denial for service industries.

Letter template of VAT refund application denial for construction firms.

Comments