Are you looking to navigate the process of applying for a Trust Tax Identification Number (TIN)? This essential step can seem daunting, but it's crucial for managing your trust's tax obligations effectively. In this article, we'll walk you through everything you need to know, from gathering the necessary documents to completing the application. Stick around to discover how to streamline your TIN application process and ensure compliance with tax regulations!

Applicant's Full Name and Contact Information

The Trust Tax Identification Number (TIN) application requires precise details regarding the applicant's identity and contact data. This includes the applicant's full name, which must align with legal documentation, providing clarity for identification processes. Contact information encompasses a valid telephone number, ensuring effective communication for any follow-up inquiries, and an email address, which facilitates electronic notifications and documentation. Properly formatted addresses, including street name, city, state, and zip code, enhance the application's credibility and ease navigation for postal correspondence. Adhering to these attributes ensures accurate processing of the Trust TIN application as per the guidelines established by the Internal Revenue Service (IRS).

Purpose and Nature of the Trust

The purpose of the trust, established in [Year] under [State or Jurisdiction], is to manage and preserve assets for the benefit of [Beneficiaries, e.g., family members, charitable organizations]. The trust encompasses a variety of assets, including real estate located at [Property Address or Description], financial accounts held at [Bank Name or Institution], and personal property valued at approximately [Value]. The nature of the trust revolves around [Type, e.g., revocable, irrevocable, charitable] arrangements aimed at [Specific Goals, e.g., providing for education, supporting community initiatives]. This structure facilitates [Tax Planning Strategies, e.g., estate tax benefits, charitable deductions] while ensuring compliance with applicable regulations in [Relevant Law or Regulation, e.g., IRS codes]. The trust is governed by the terms outlined in the trust document dated [Document Date], which specifies the powers of the trustee [Trustee Name] and the rights of the beneficiaries.

Trustee Information and Responsibilities

Trustee information provides essential details about individuals responsible for managing and controlling the activities of a trust, a legal entity established to hold and manage assets for beneficiaries. These individuals must ensure compliance with applicable tax regulations, such as reporting income earned by the trust to the Internal Revenue Service in the United States. Responsibilities typically include filing annual tax returns, managing investments, distributing income, and maintaining accurate records of all transactions. The trustee must act in the best interest of the beneficiaries, adhering to fiduciary duties that require transparency and prudent handling of the trust's assets. It is crucial for trustees to understand their obligations under local laws to avoid any potential legal or financial repercussions.

Relevant Legal and Financial Details

A trust tax identification number (TIN) application requires precise legal and financial details to ensure compliance with the Internal Revenue Service (IRS) regulations. Essential information includes the trust's name, such as "Smith Family Trust," and the date of establishment, typically reflecting the legal document creation date, like January 1, 2020. The trust's structure, such as revocable or irrevocable, significantly influences tax implications and must be clearly indicated. The trustee's full name, including middle initial and suffix if applicable, along with their Social Security number (SSN) or employer identification number (EIN), is crucial, as this individual or entity is responsible for tax reporting. The trust's mailing address, often the trustee's residence or principal place of business, should be provided. Additionally, financial details, such as the estimated value of assets within the trust, which could range from thousands to millions of dollars, play a vital role in establishing the trust's tax obligations. Accurate completion of IRS Form SS-4 for TIN issuance is imperative for compliance with federal laws governing trusts.

Required Documentation and Compliance Statements

The application process for obtaining a Trust Tax Identification Number (TIN) necessitates specific documentation to ensure compliance with IRS regulations. Essential documents include the IRS Form SS-4, which serves as the official application for an Employer Identification Number (EIN). This form requires detailed information about the trust, including its legal name, the name of the trustee, and the trust's date of formation. Supporting documentation might also be necessary, such as a copy of the trust agreement or declaration, which outlines the terms of the trust and identifies beneficiaries. Additionally, compliance statements affirming that the trust has met all state requirements and is in good standing may be required. Properly organizing these documents will facilitate the application process with the Internal Revenue Service, accelerating the issuance of the TIN necessary for tax filings and financial administration.

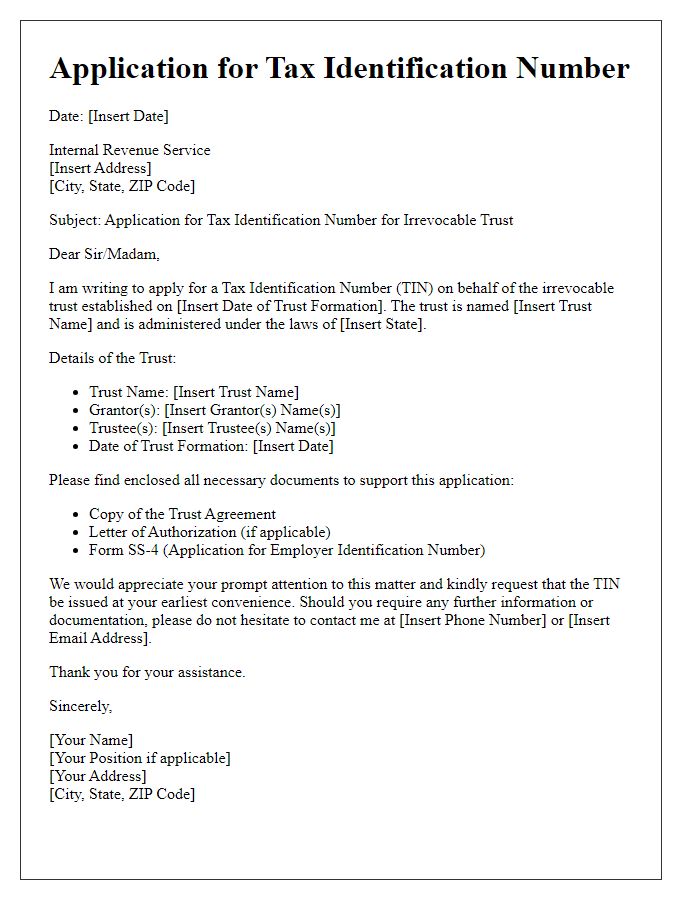

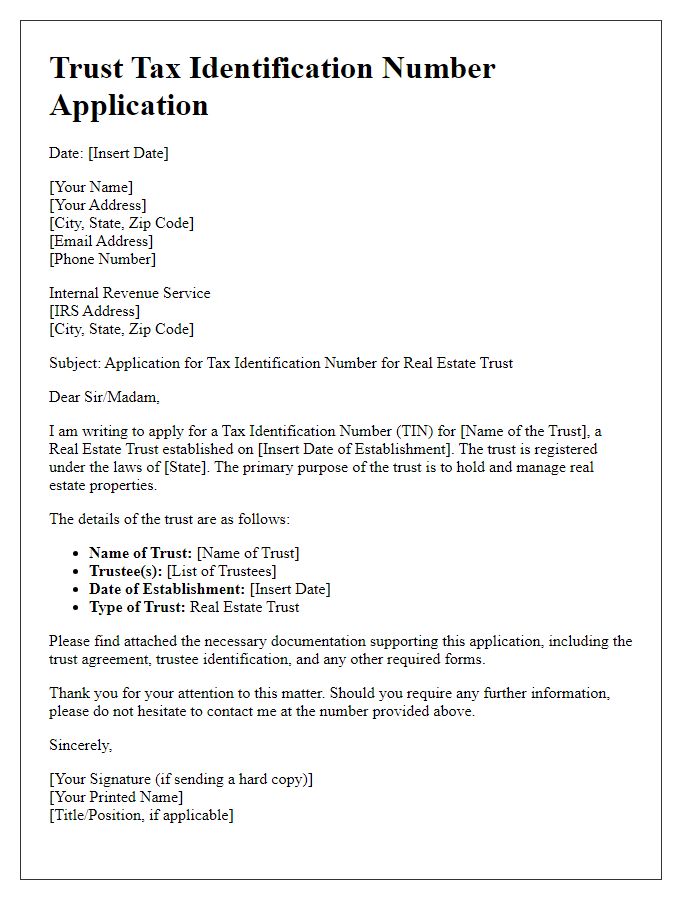

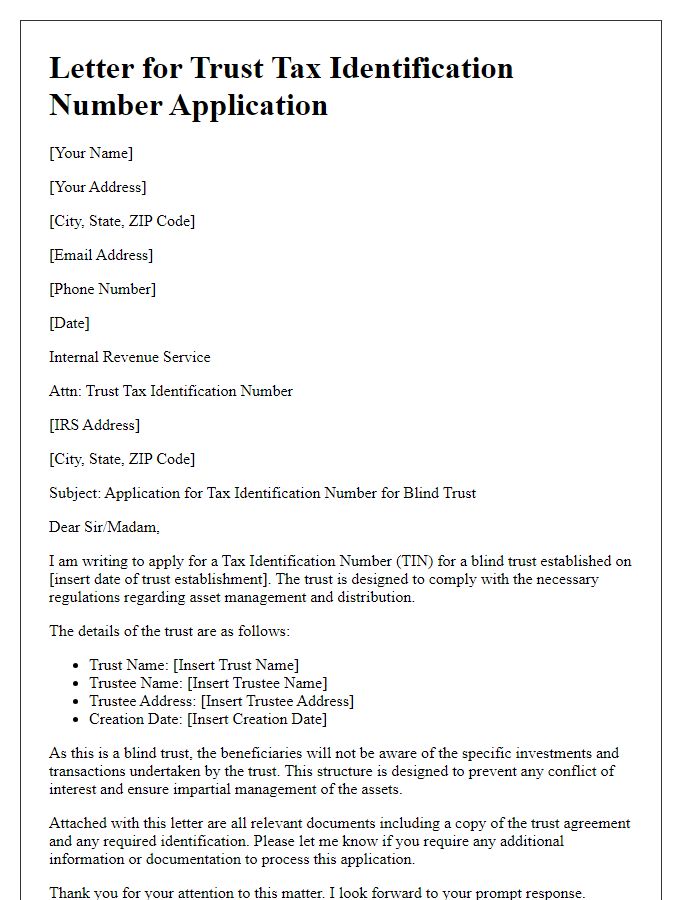

Letter Template For Trust Tax Identification Number Application Samples

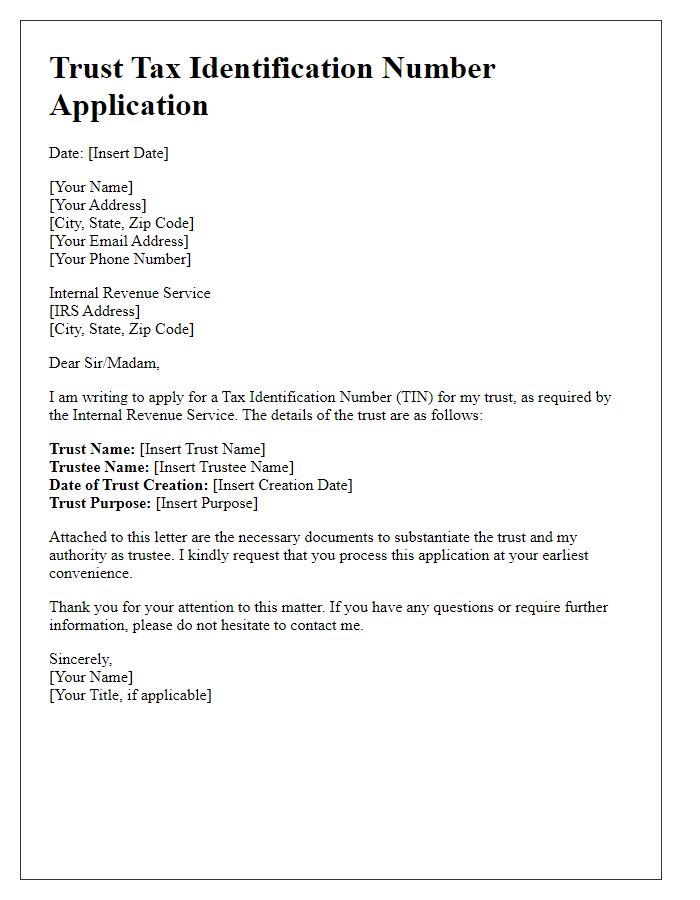

Letter template of trust tax identification number application for individuals.

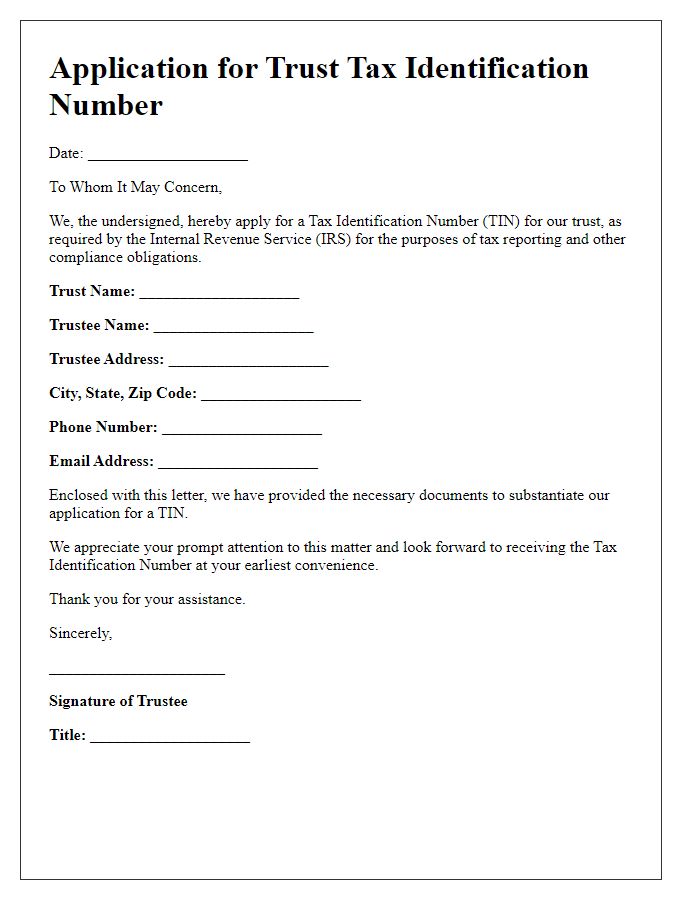

Letter template of trust tax identification number application for organizations.

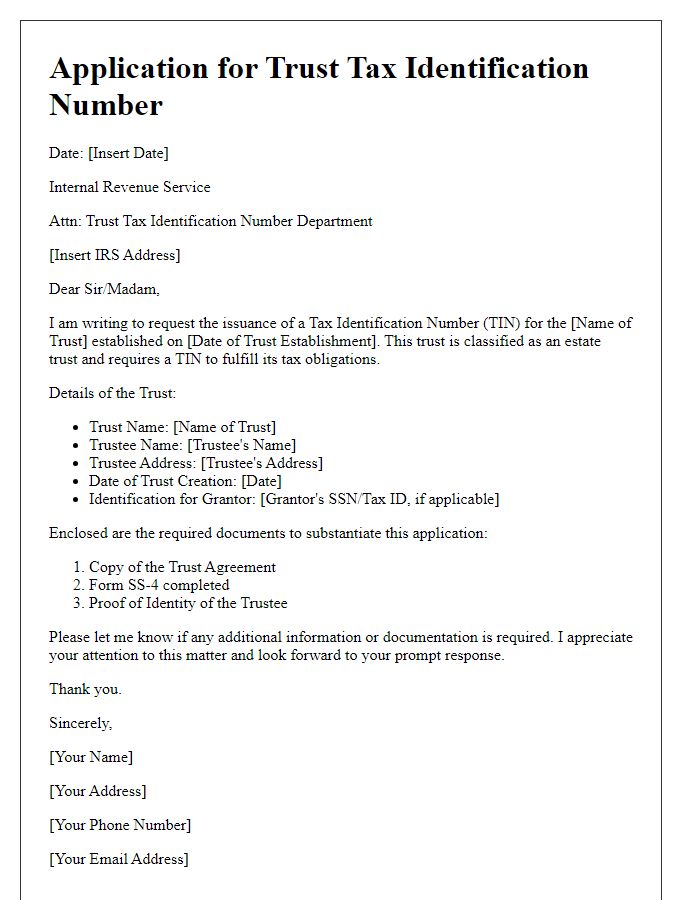

Letter template of trust tax identification number application for estate trusts.

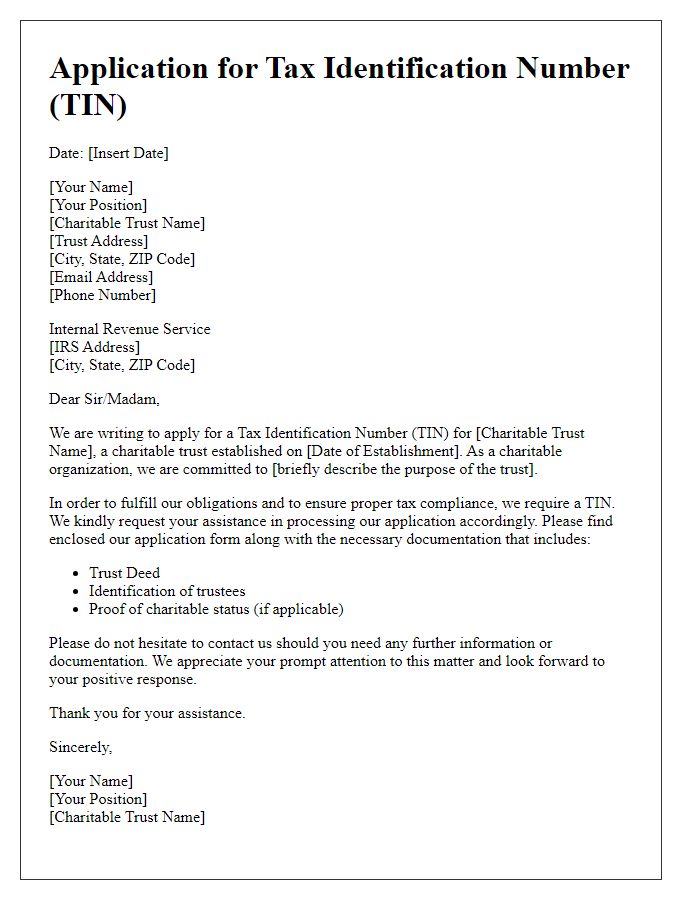

Letter template of trust tax identification number application for charitable trusts.

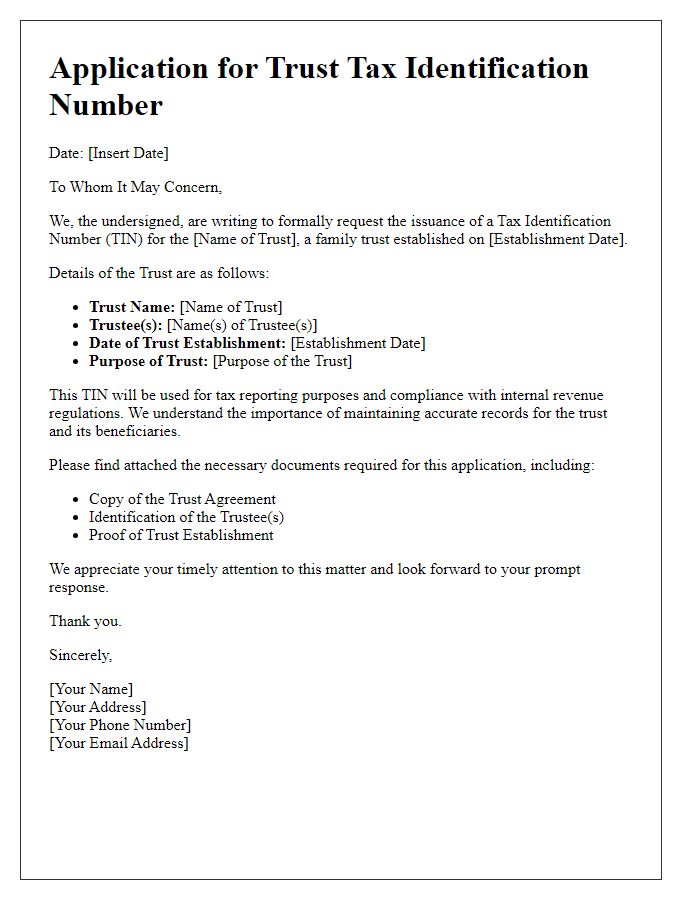

Letter template of trust tax identification number application for family trusts.

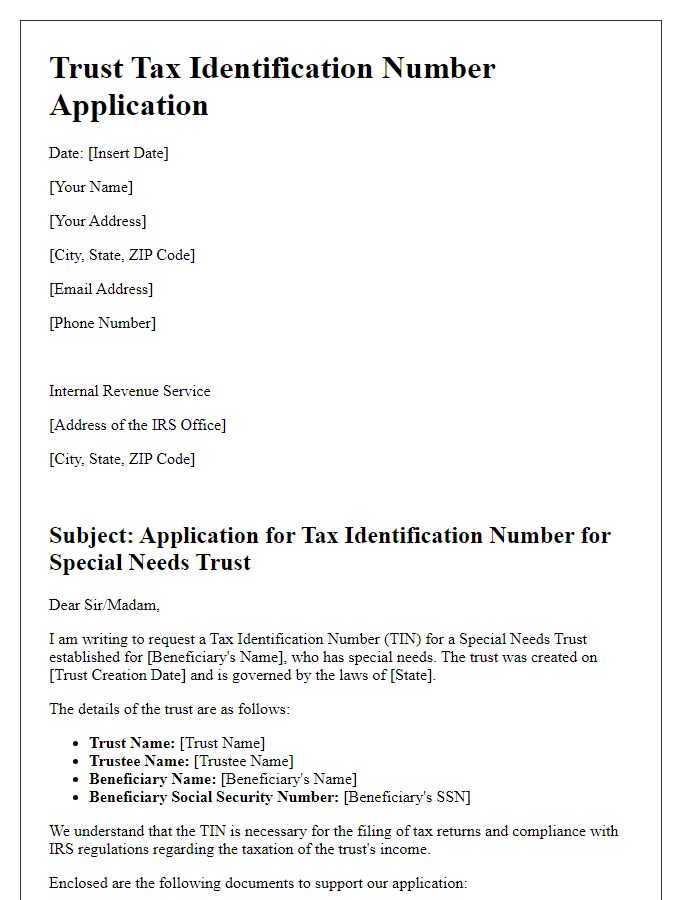

Letter template of trust tax identification number application for special needs trusts.

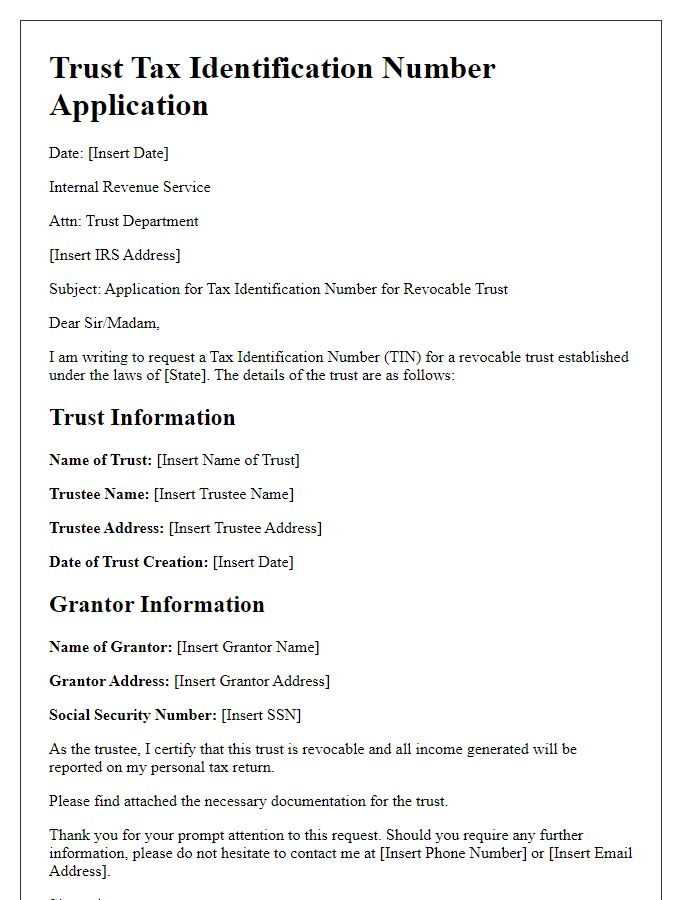

Letter template of trust tax identification number application for revocable trusts.

Letter template of trust tax identification number application for irrevocable trusts.

Letter template of trust tax identification number application for real estate trusts.

Comments