Have you ever faced the anxiety of waiting for your tax return to be processed, only to receive a rejection notice instead? It's a frustrating experience that many taxpayers encounter, often leaving them confused and unsure of the next steps. Thankfully, understanding the reasons behind the rejection and how to address them can help you navigate this challenging situation. Ready to learn how to tackle a tax return rejection effectively? Keep reading for valuable insights!

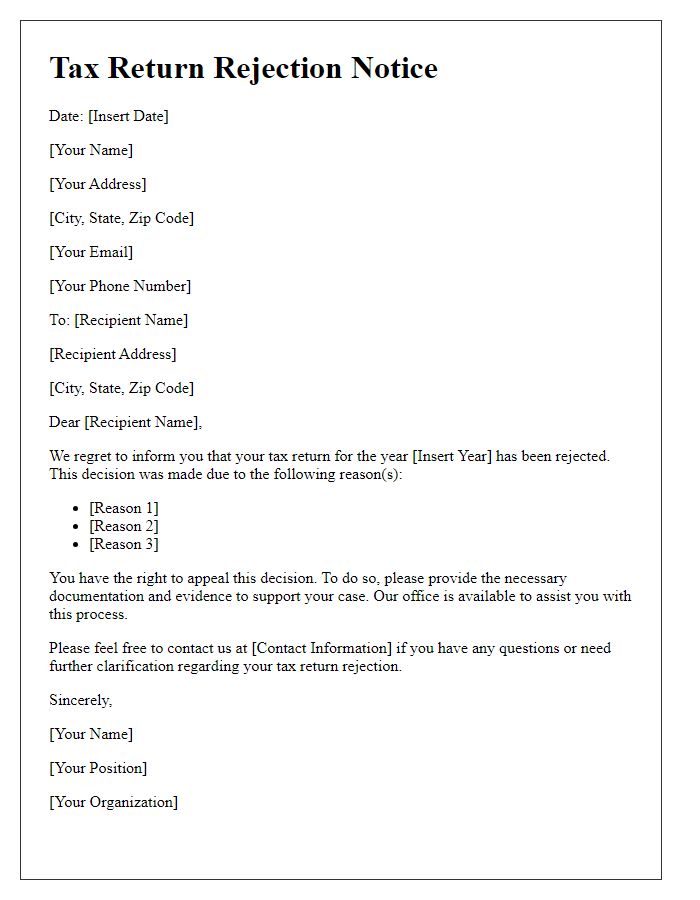

Clarity and Conciseness

Tax return rejection notifications can create confusion and concern for taxpayers. Affected individuals must receive clear and concise communication to understand the reasons behind rejection. Common issues may include incorrect Social Security numbers, mismatched income details, or missing supporting documentation. Agencies like the Internal Revenue Service (IRS) typically provide specific error codes alongside personalized guidance on rectifying the mistakes. Taxpayers are encouraged to review their submissions thoroughly, while understanding the appeal process can be crucial for timely resolution. Deadlines for appeals or resubmission should be highlighted to avoid penalties, ensuring taxpayers can act promptly and efficiently.

Formal Tone

Tax return rejection can occur for various reasons, such as discrepancies in reported income, missing signatures, or inaccurate data entry. The Internal Revenue Service (IRS) in the United States often issues notices to taxpayers detailing the rejection, which typically includes specific error codes related to the filing issue. For instance, a common error code is "R0000-501-01," indicating a mismatch between reported wages and those reported by employers. Taxpayers are encouraged to review their submission carefully, consult the IRS guidelines, and provide accurate information or documentation to amend the return. The notice typically outlines the necessary steps to rectify the situation and resubmit a corrected tax return to ensure compliance and avoid potential penalties.

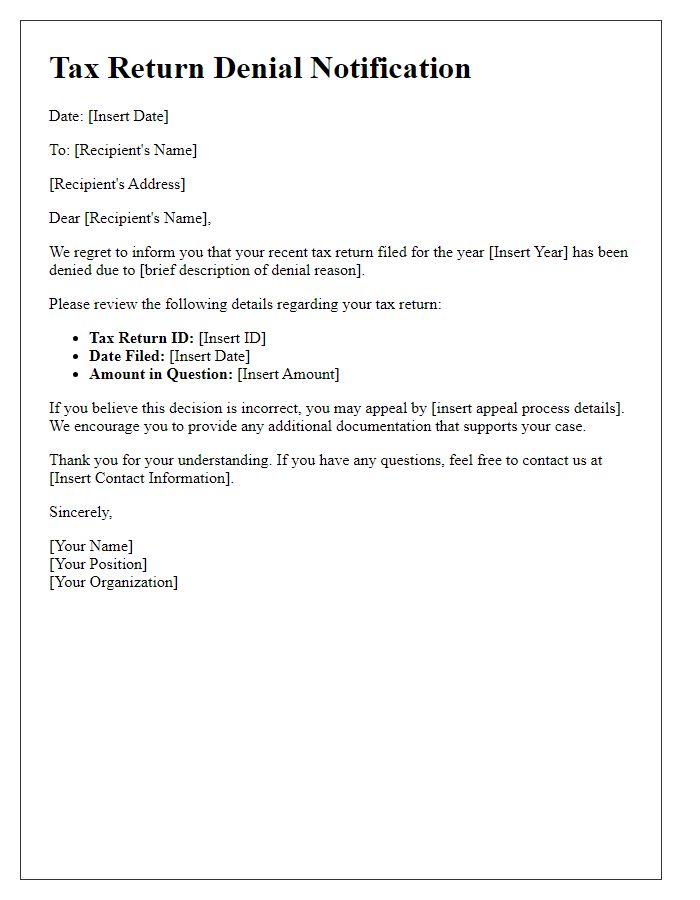

Specific Rejection Reasons

A tax return rejection can occur for various specific reasons, such as missing information or inaccuracies in reported income, which can lead to delays in refunds or tax liabilities. Common errors include mismatched information with IRS records, such as Social Security numbers or names that do not match, resulting in rejection notices. Incomplete forms, like missing Schedule C for sole proprietors or failure to sign and date Form 1040, can also lead to rejections. Furthermore, discrepancies in reported amounts, such as the difference between reported W-2 earnings and IRS records, can cause significant issues. Timely addressing these specific rejection reasons is crucial for ensuring compliance and minimizing potential penalties.

Corrective Actions and Deadlines

Tax return rejection notifications can often lead to confusion and delay in financial matters. When a tax return is rejected by the Internal Revenue Service (IRS), taxpayers may receive a detailed notice indicating the specific reasons for the rejection, commonly including errors in Social Security numbers, missing signatures, or discrepancies in reported income for the tax year. It is crucial for individuals to address these issues promptly to avoid penalties or further complications, as the IRS typically requires corrective actions to be taken within a 30-day period. Deadlines for resubmission can vary based on the nature of the error, so it is advisable to keep track of any correspondence from the IRS, especially for returns pertaining to significant tax years, such as 2022 or 2023, ensuring that all necessary documentation, like W-2 forms and 1099s, is accurately compiled and submitted. This organized approach can facilitate the re-filing process, ultimately helping taxpayers achieve compliance and potentially secure any refunds owed.

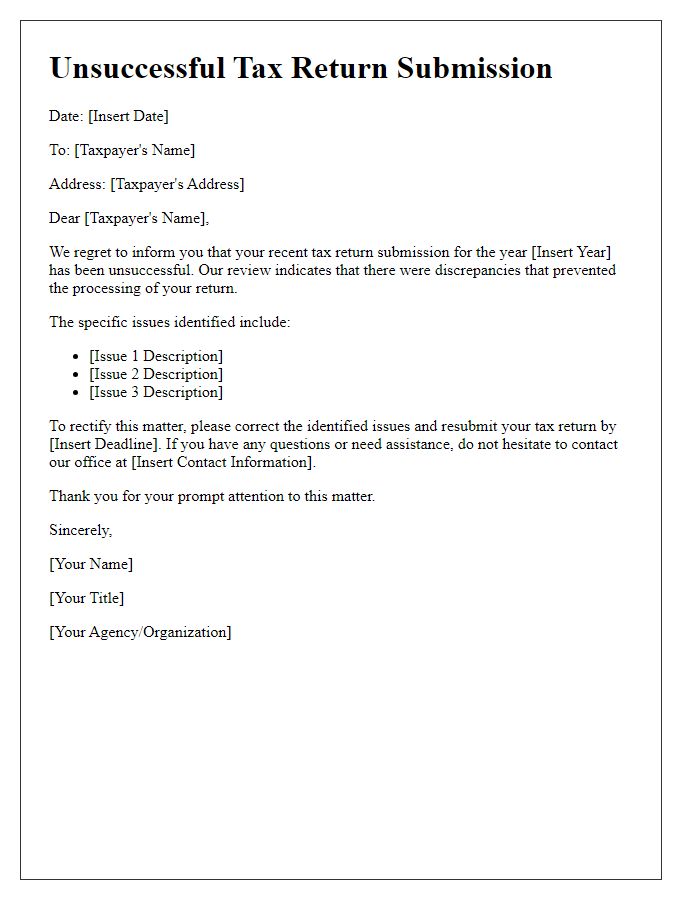

Contact Information for Assistance

A tax return rejection notification can be a complex situation for taxpayers to navigate. The Internal Revenue Service (IRS), responsible for overseeing tax collection and enforcement in the United States, provides specific contact information for assistance. Taxpayers may find it beneficial to reach out to IRS at their official helpline, which operates Monday through Friday from 7:00 AM to 7:00 PM local time. Additionally, the IRS website offers a comprehensive FAQ section where taxpayers can find information regarding common issues leading to rejection, such as mismatches with Social Security numbers or incorrect formatting of income figures. Understanding these resources can help taxpayers resolve their tax return issues more efficiently and avoid penalties associated with unfiled or incorrectly filed returns.

Comments