Getting ready for a tax audit can feel overwhelming, but it doesn't have to be! With the right preparation and clear organization, you can tackle the requirements head-on. Whether you're an individual or a business owner, understanding the key documents needed will set you up for success. So, let's dive in and explore how to prepare your tax audit documents effectively!

Taxpayer Identification and Details

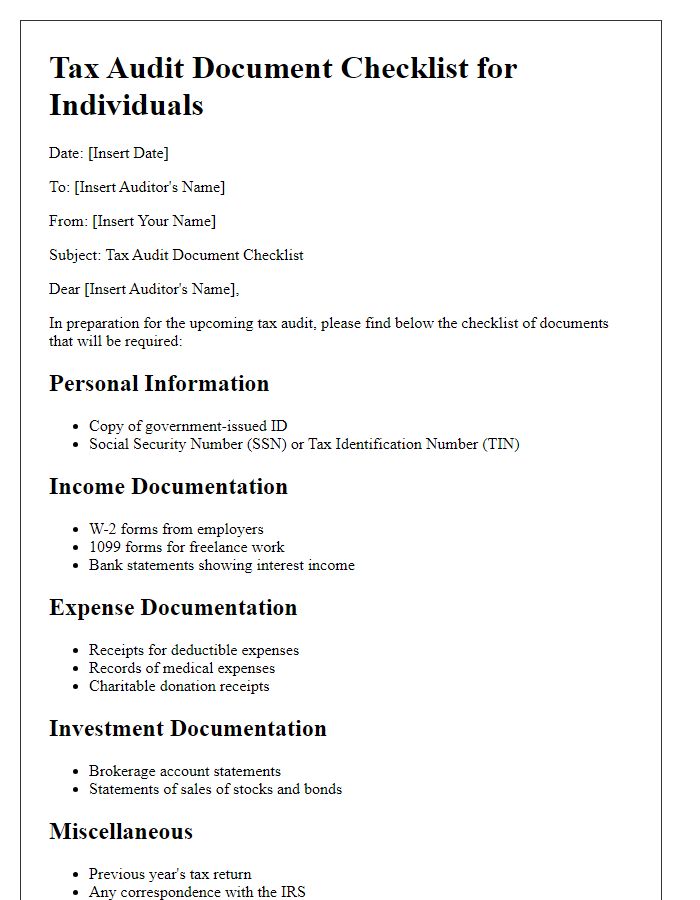

Taxpayer identification is crucial for tax audit preparation. Relevant details include Taxpayer Identification Number (TIN), issued by the Internal Revenue Service (IRS), which consists of nine digits crucial for tracking tax records. Total income must be accurately reported, reflecting all income streams, including salaries, business profits, investment earnings, and any other taxable sources. Supporting documentation encompasses W-2 forms from employers, 1099 forms for freelance or contract work, and any relevant receipts. The reporting period must align with the fiscal year, commonly January 1 to December 31 in the United States, ensuring all income and deductions are accurately captured. Relevant entities also include federal, state, and local tax authorities which may require specific forms and documentation for compliance.

Financial Records and Statements

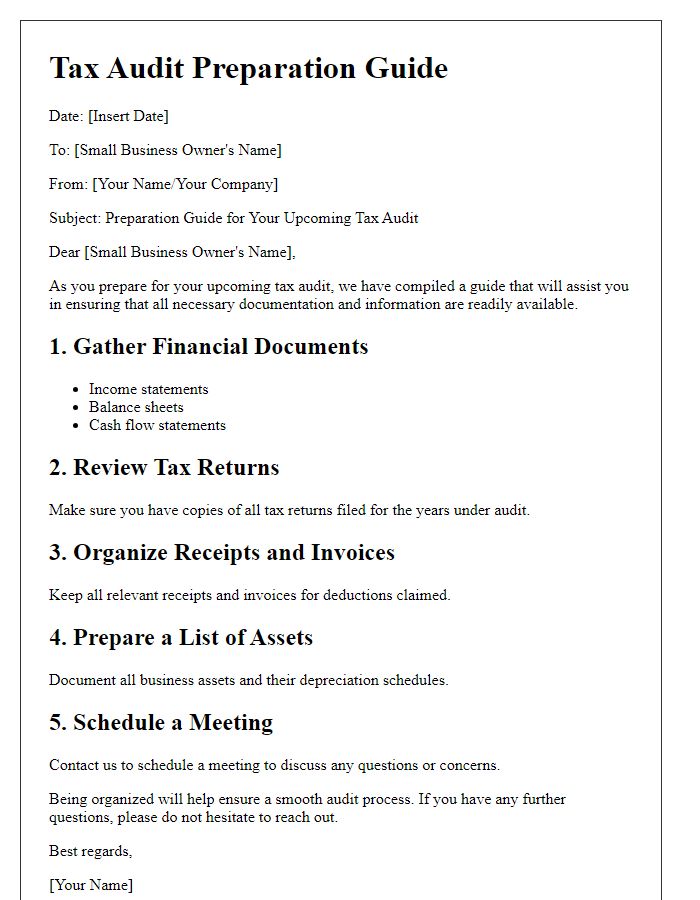

Financial records and statements are crucial for tax audit preparations, encompassing comprehensive documentation such as income statements, balance sheets, and cash flow statements. These records should accurately detail revenue sources, expenses, and liabilities for the fiscal year, facilitating transparency during audits. Additionally, supporting documents like receipts, invoices, and bank statements must be meticulously organized and readily accessible, as they substantiate reported figures. Maintaining electronic backups and physical copies in an orderly fashion with clear labeling is vital, ensuring compliance with IRS requirements and state regulations. Accurate preparation of these records can significantly streamline the audit process, reducing the likelihood of discrepancies and enhancing the credibility of financial reporting.

Relevant Tax Filings and Receipts

Organizing relevant tax filings and receipts is essential for a successful tax audit, specifically for documents pertaining to the fiscal year (e.g., 2022). Gather all federal tax returns, including IRS Form 1040 or corporate documents like Form 1120 for corporations. Collect state tax filings from respective state departments, such as the California Department of Tax and Fee Administration for California businesses. Ensure all supporting receipts, including those for deductible expenses like business travel (mileage records, hotel invoices), office supplies (purchase receipts), and relevant charitable contributions (donation receipts) are compiled meticulously. Financial statements, including profit and loss statements and balance sheets, should also be included to illustrate overall monetary transactions. Current and past year bank statements from financial institutions can corroborate income claims. Maintaining an accurate and organized filing system streamlines the audit process, reducing stress and potential discrepancies with tax authorities.

Compliance and Regulatory Documentation

During a tax audit, compliance and regulatory documentation is essential for verifying financial records and ensuring adherence to local tax laws and regulations. Important documents include tax returns filed with the Internal Revenue Service (IRS) for previous years, supporting schedules that detail income sources, deductions, and credits claimed. A comprehensive ledger of business expenses, receipts, and invoices must be organized systematically, ideally by year and category, such as travel, supplies, and employee wages. Any correspondence with tax authorities, such as notices of assessment or audit letters, should also be compiled for review. Additionally, keep records of any changes in business structure or ownership that might impact tax obligations, as well as documentation supporting any tax credits or incentives claimed, such as the Research and Development Tax Credit. Accurate records will facilitate a smoother audit process and help resolve any discrepancies that might arise.

Professional Advisor Contact Information

Tax audits require meticulous preparation of documentation, ensuring all financial records align with IRS regulations and accurately reflect a business's financial standing. Essential documents include income statements, balance sheets, tax returns, and receipts from transactions (commonly stored in accounting software like QuickBooks). Professional advisors, such as certified public accountants (CPAs) from firms like Deloitte or Ernst & Young, play a crucial role in organizing and interpreting these records. Additionally, maintaining communication with the tax audit team at the IRS, located in various regional offices across the United States, is vital to address inquiries and provide requested information promptly.

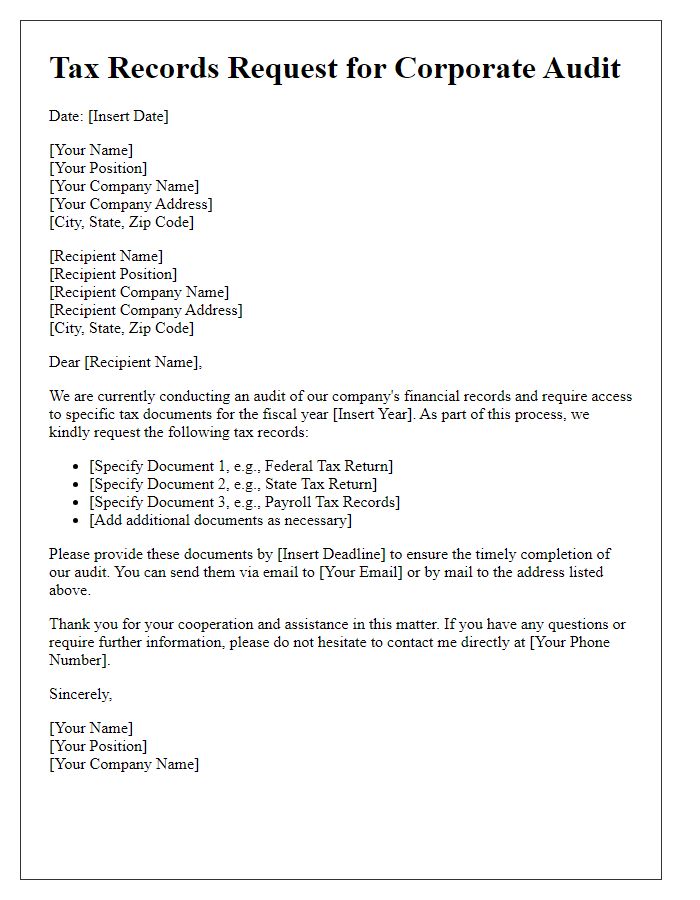

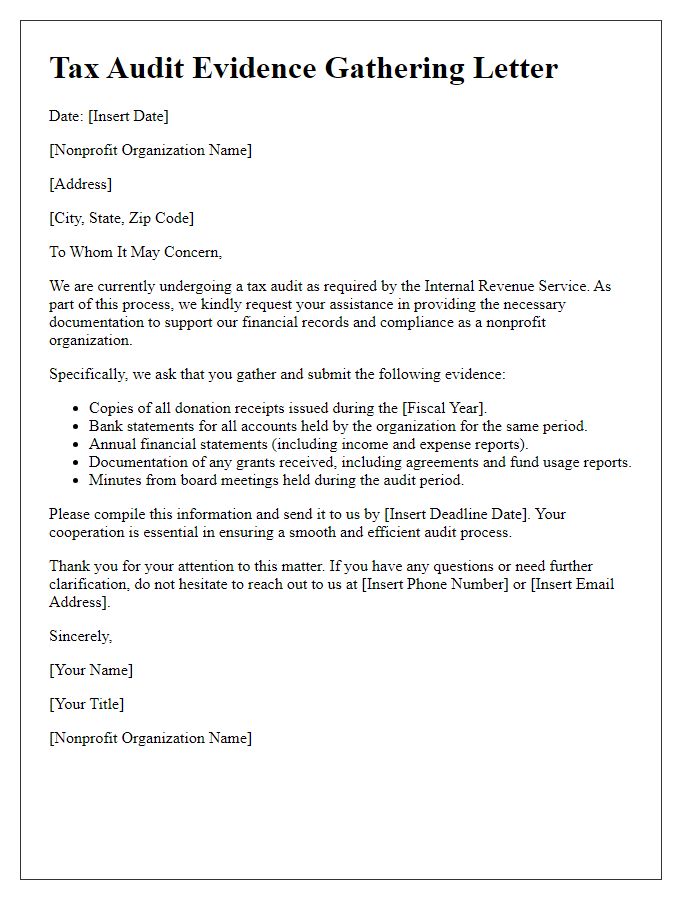

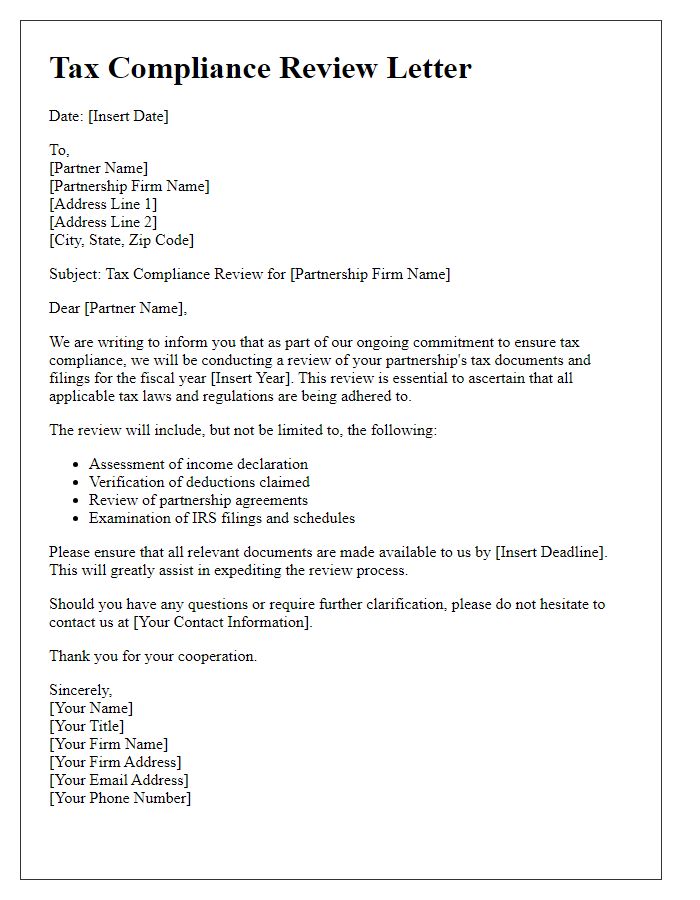

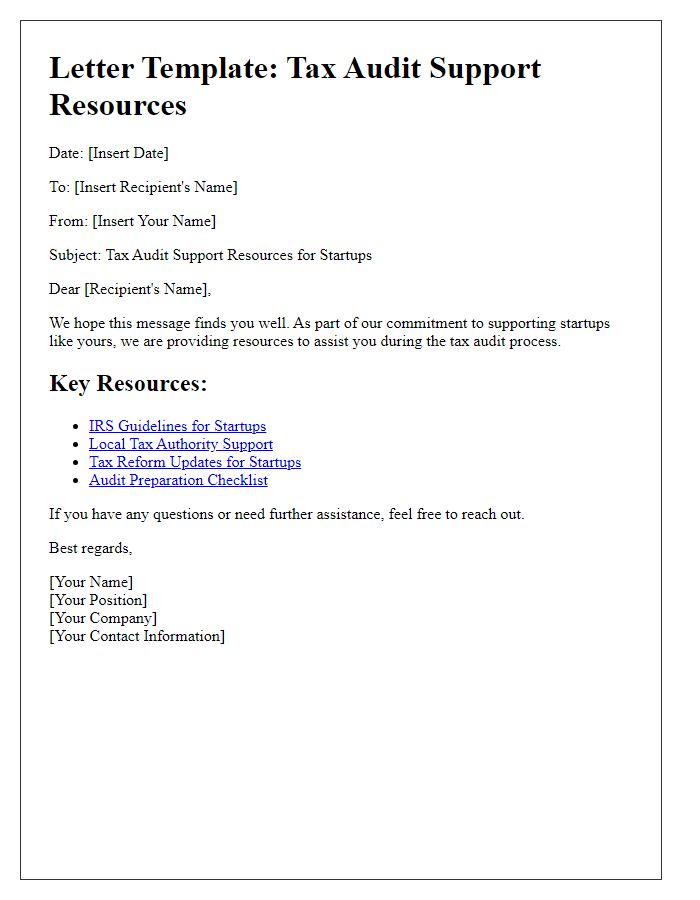

Letter Template For Preparation Of Tax Audit Documents Samples

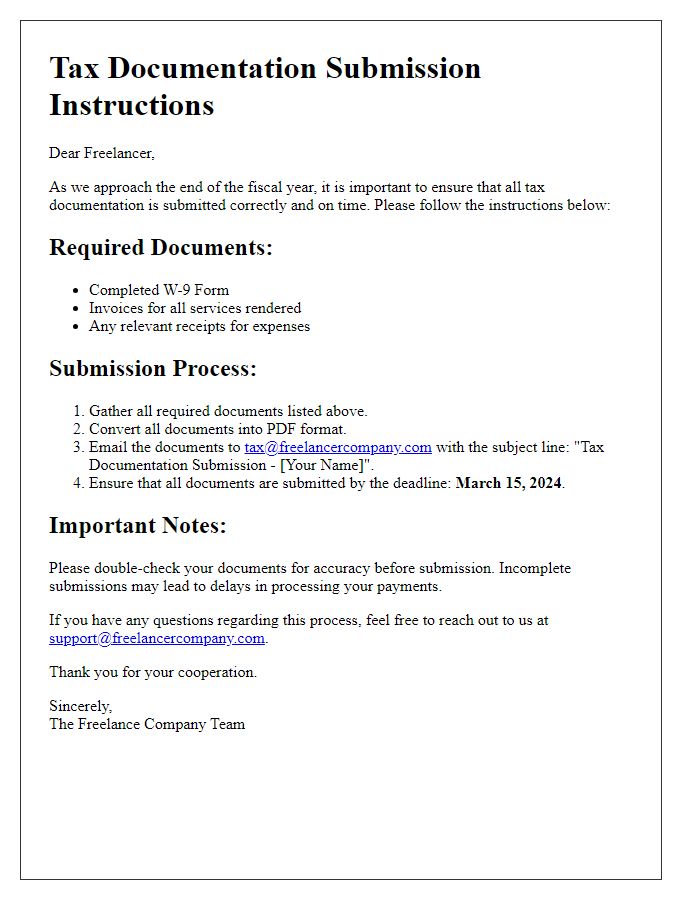

Letter template of tax documentation submission instructions for freelancers.

Comments