Have you ever felt the stress of submitting a tax return only to realize later that you need to make corrections? You're not alone! Many individuals find themselves navigating the complexities of corrected tax returns, often unsure about the proper steps to take. If you're looking for guidance on how to write a letter for submitting your corrected tax return, keep reading for helpful tips and a sample template!

Accurate Taxpayer Information

Accurate taxpayer information plays a crucial role in the successful submission of corrected tax returns. Essential elements include full name, Social Security Number (SSN), mailing address, and tax year involved, ensuring alignment with Internal Revenue Service (IRS) records. Inaccurate details lead to processing delays and potential penalties. Correctly updating financial documents, such as W-2 forms, 1099 statements, and any related schedules, reinforces the integrity of submissions. The IRS typically requires a more detailed explanation for discrepancies, fostering transparency and compliance. Taxpayers should aim for precision in every entry, safeguarding against future audits or complications during the review process. Interactions with representatives and possible follow-ups may occur, requiring clear communication and reference to updated information.

Clear Description of Corrections

Submitting a corrected tax return involves precise details regarding the discrepancies in previous filings. For instance, incorrect income reporting may stem from a missed 1099 form, which details earnings from freelance work totaling $5,000, or unreported interest income lacking documentation from a bank statement showing $200. Additionally, adjustments to deductions such as a $1,500 medical expense overlooked due to insufficient records can be clarified. Tax credits, like the Child Tax Credit, may also require revision if the number of dependents changed due to a new addition to the family. It is important to attach supporting documents clearly labeled for each correction to ensure seamless processing by the tax authorities, such as the IRS in the United States, and referencing the original submission date, Form 1040, and the previous refund amount, if applicable.

Attach Relevant Documentation

Submitting a corrected tax return requires attaching relevant documentation such as the amended IRS Form 1040-X. This form details changes made to the originally filed tax return from the previous year, typically necessary for errors involving income misreporting, filing status adjustments, or deductions that were incorrectly calculated. It's crucial to include supporting documents like W-2 forms and 1099s from employers or financial institutions to substantiate the revised income figures. Additionally, any schedules or forms that require revision, such as Schedule A for itemized deductions, should be included to ensure that the IRS can accurately assess the adjusted return. Properly organizing this documentation can streamline the review process and expedite potential refunds.

Proper Formatting and Tone

A corrected tax return submission ensures compliance with IRS regulations. Each form, such as Form 1040-X for amended returns, requires precise information detailing changes. Tax year specificity (e.g., 2022) is crucial for accuracy. Including the revised figures, along with explanations for discrepancies, enhances clarity. Consideration of deadlines, typically within three years of the original filing date, is necessary to avoid penalties. Supporting documents, like W-2s or 1099s, should accompany the submission. Maintaining professionalism and accuracy in tone, alongside proper formatting with clear headings and structured sections, underscores the importance of this process.

Timely Submission and Follow-up

Submitting a corrected tax return promptly ensures compliance with IRS regulations while minimizing potential penalties. The Internal Revenue Service (IRS) typically allows taxpayers to amend returns within three years of the original filing date, so timely submission is crucial. Following up on the amended return, which is often done using Form 1040-X for individual taxpayers, provides reassurance regarding processing status. Taxpayers can track their amendments online through the IRS "Where's My Amended Return?" tool. Maintaining accurate records, including copies of original and amended forms as well as any correspondence with tax professionals, can aid in addressing any issues that may arise during processing.

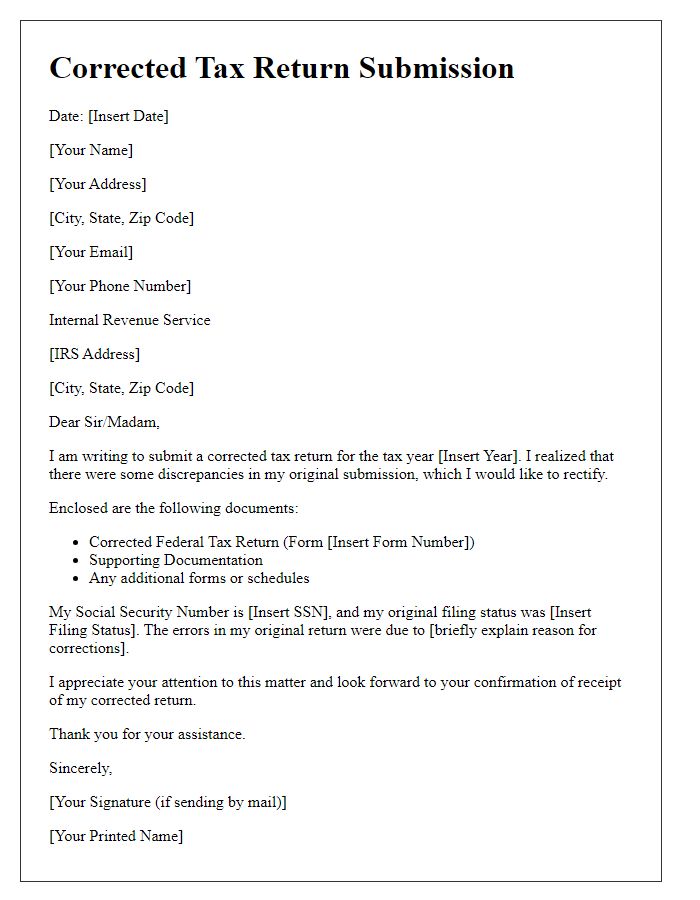

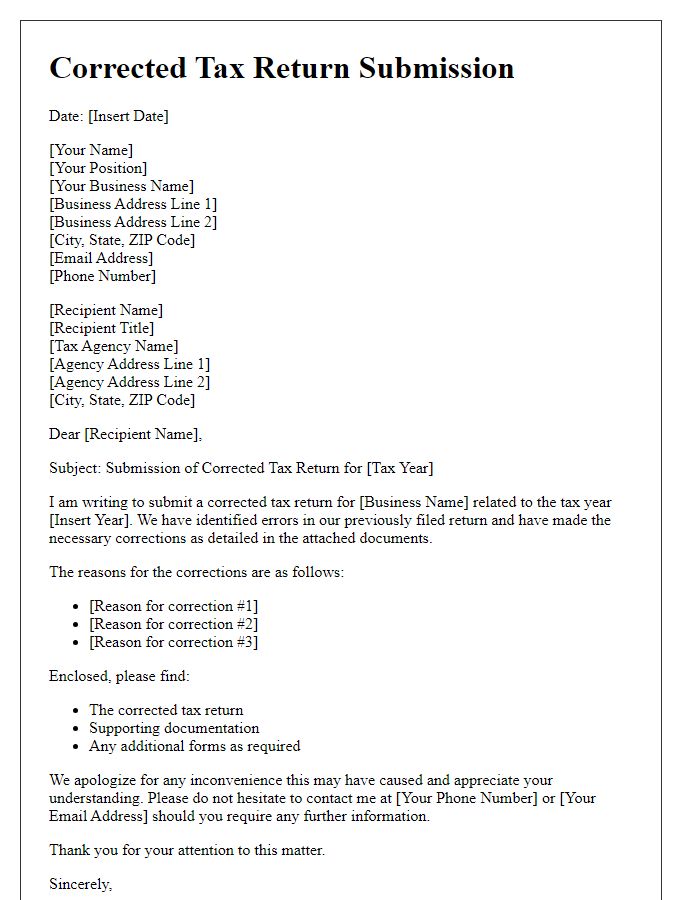

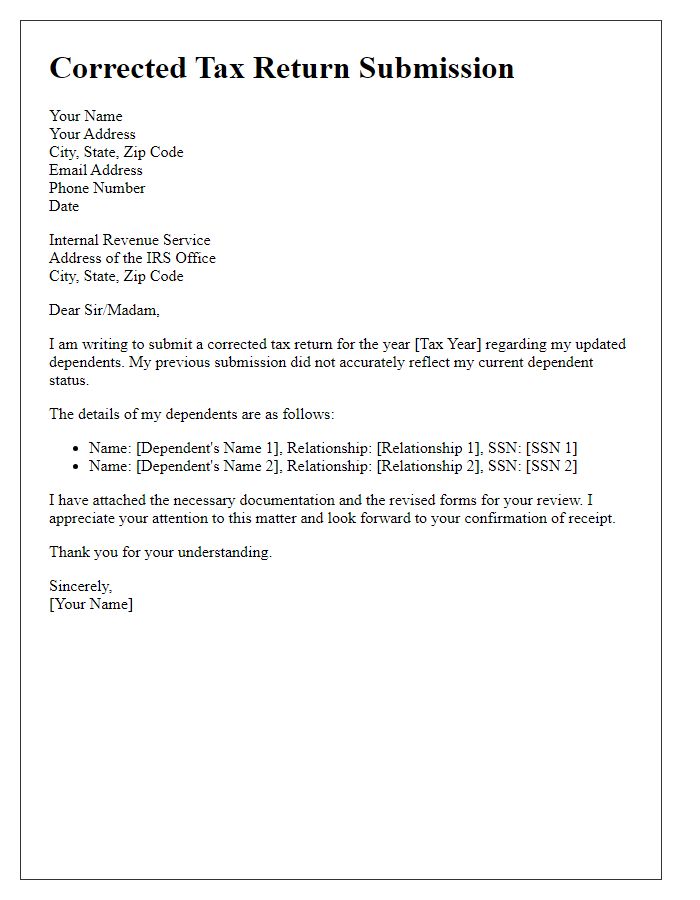

Letter Template For Corrected Tax Return Submission Samples

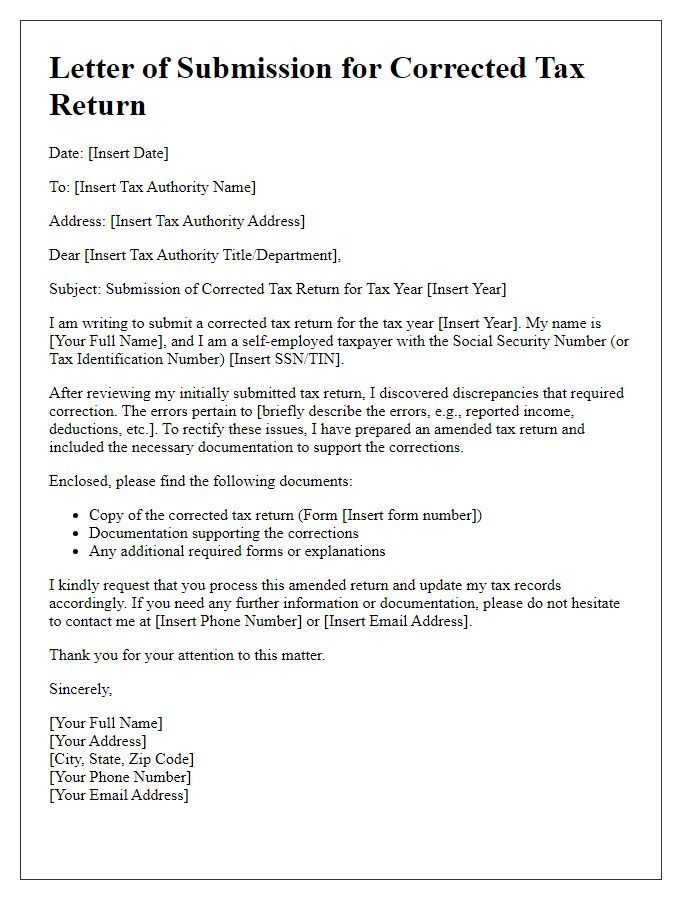

Letter template of corrected tax return submission for self-employed taxpayers.

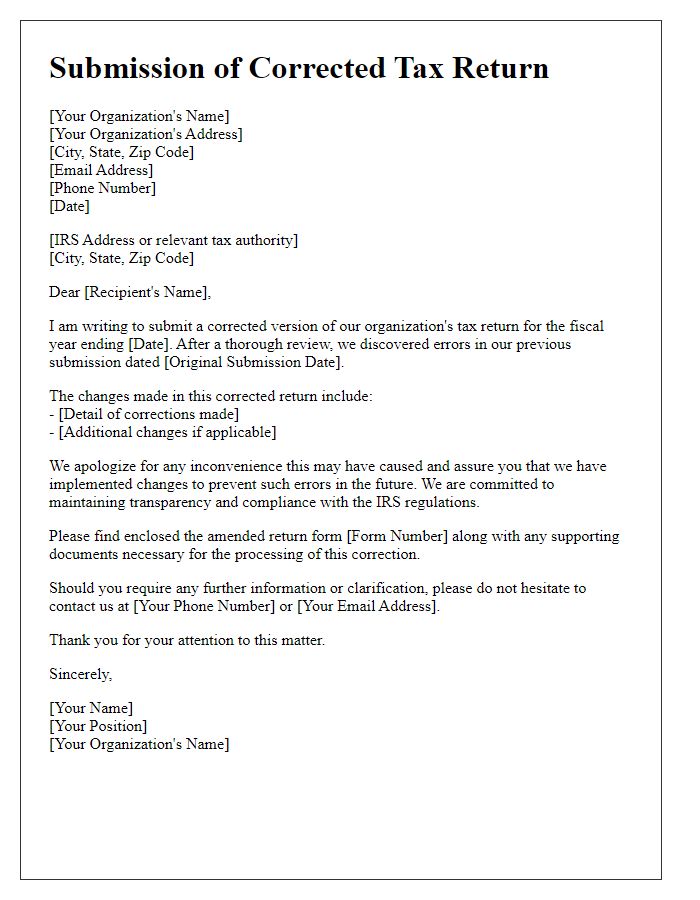

Letter template of corrected tax return submission for non-profit organizations.

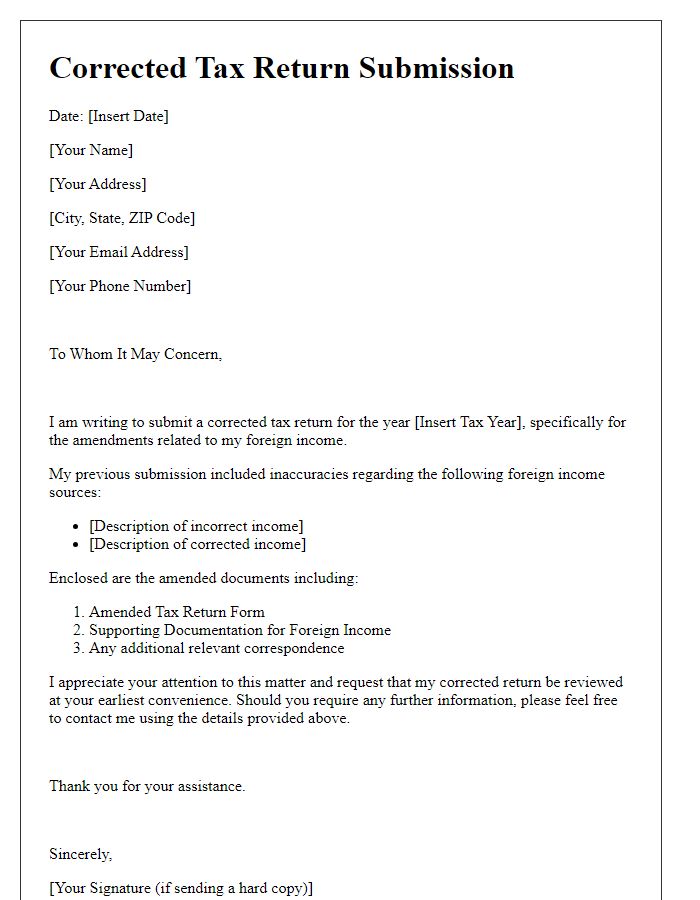

Letter template of corrected tax return submission for amended foreign income.

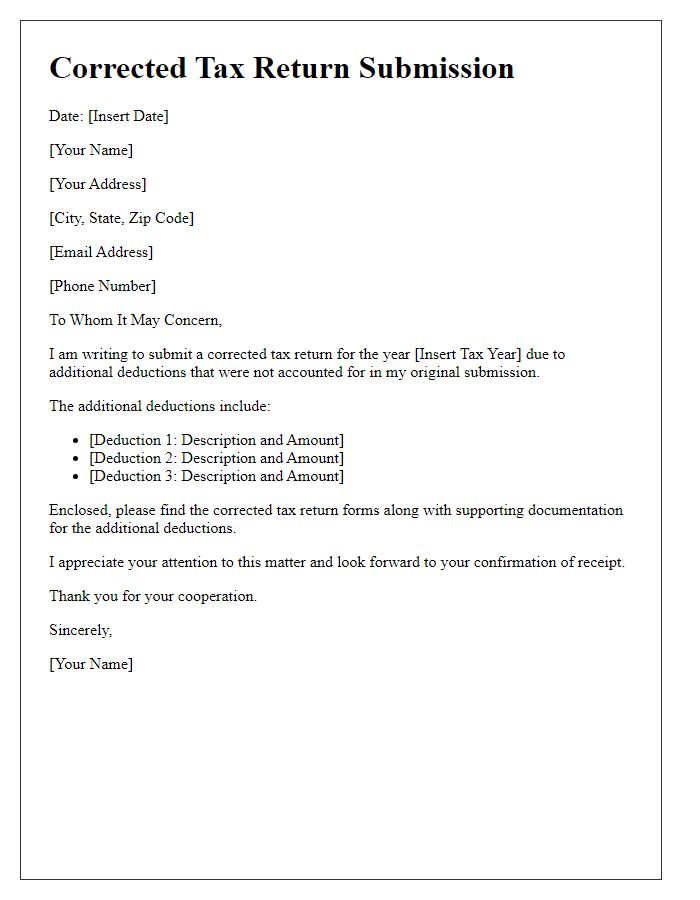

Letter template of corrected tax return submission with additional deductions.

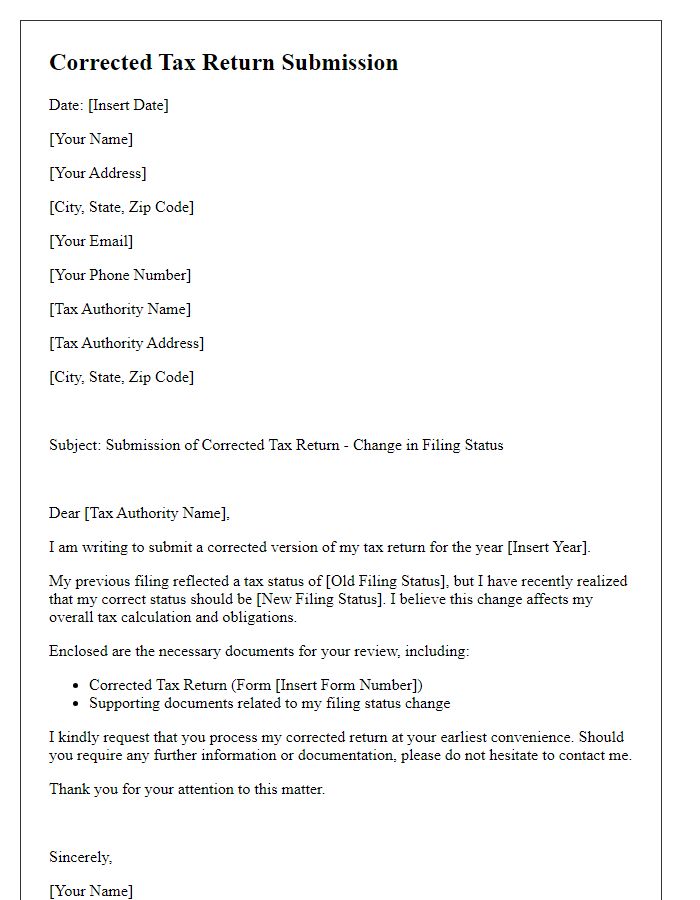

Letter template of corrected tax return submission for changes in filing status.

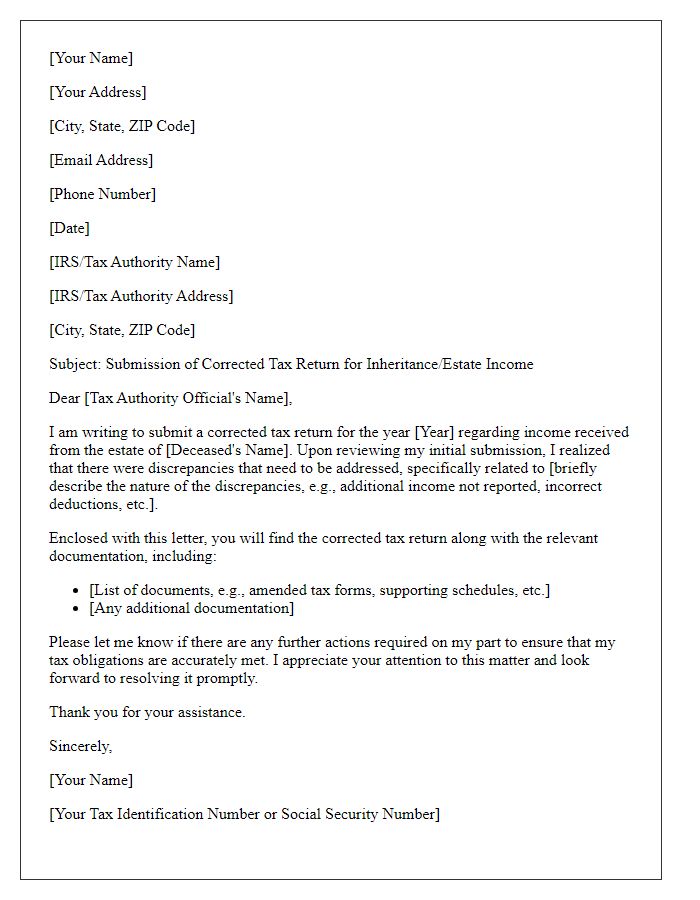

Letter template of corrected tax return submission for inheritance or estate income.

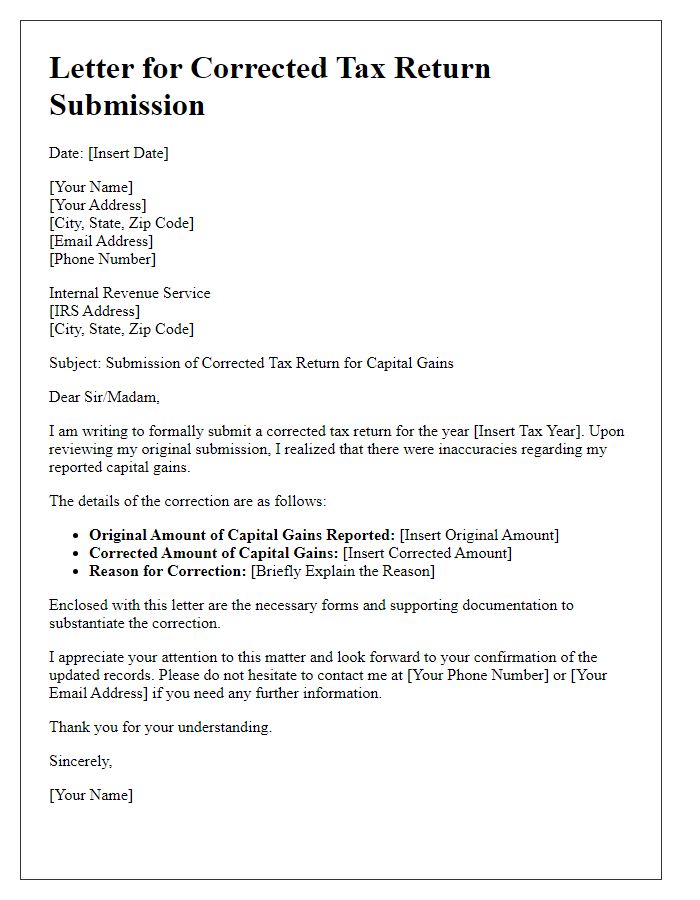

Letter template of corrected tax return submission for corrected capital gains.

Comments