Are you looking to confirm your non-filing status for a particular tax year? Whether you need this confirmation for personal records, loan applications, or simply peace of mind, requesting a non-filing letter is a straightforward process. It ensures that you have the necessary documentation to prove that you didn't file a tax return for that year, which can be crucial for various financial dealings. Let's dive deeper into how you can efficiently draft this request and what essential details to include!

Subject Line Clarity

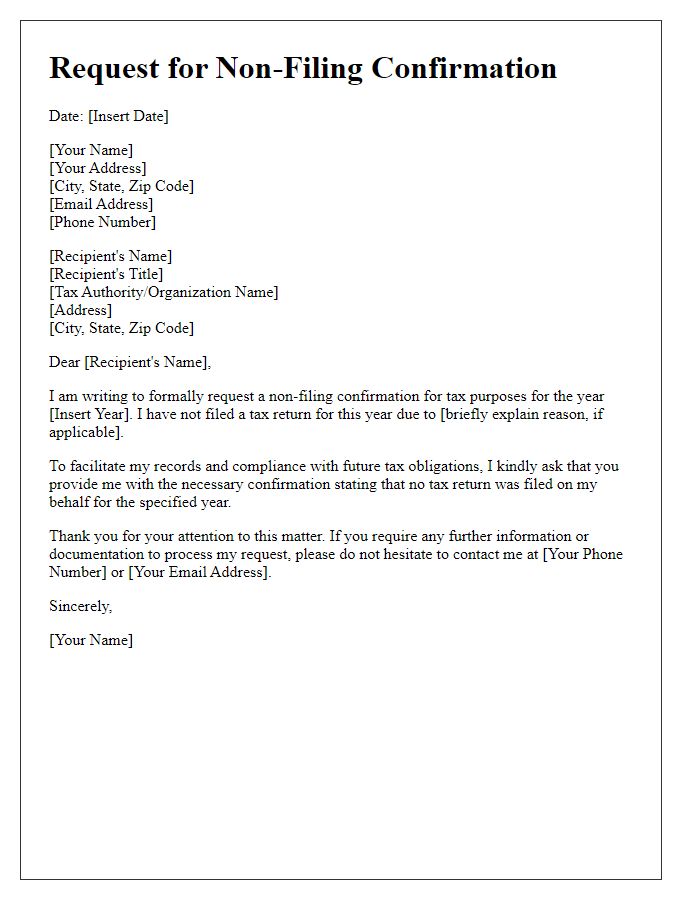

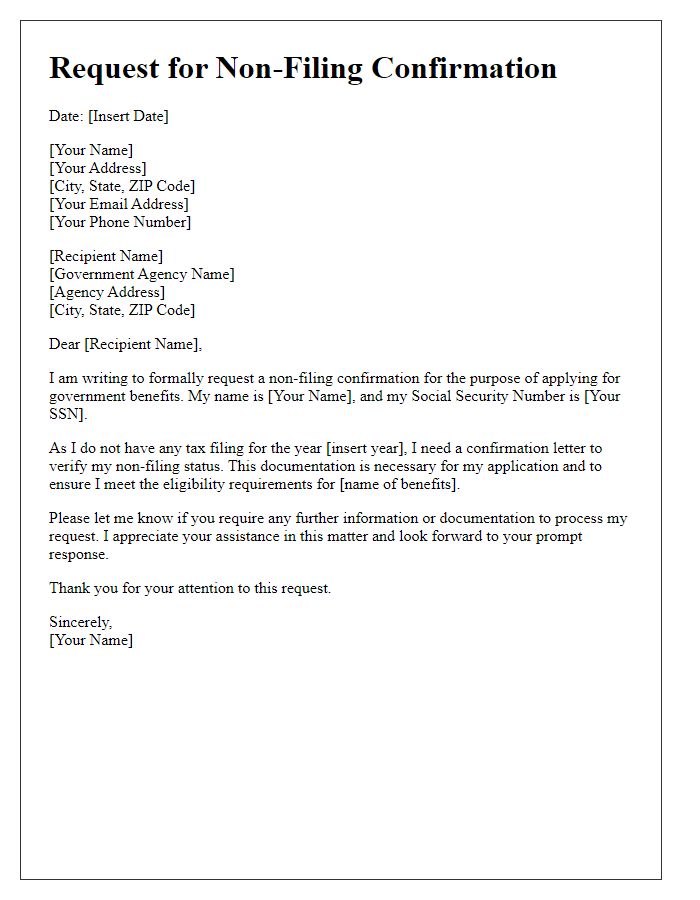

Requesting a non-filing confirmation letter is essential for individuals or businesses to prove that a specific tax return (for example, for fiscal year 2022) was not submitted to the Internal Revenue Service (IRS) or relevant local tax authority (such as the New York State Department of Taxation and Finance). This confirmation can support loan applications, financial statements, or legal matters. Typically, taxpayers should include their full name, taxpayer identification number, and specific tax year in the request. The IRS usually responds within 30 days, providing official documentation that confirms non-filing status. Obtaining this documentation can assist in managing future tax-related issues or inquiries.

Recipient Address

A request for non-filing confirmation often involves communication with specific federal or state tax authorities. Individuals or entities, like small businesses or non-profit organizations, may require this confirmation to validate their tax status, typically for the previous tax year. The confirmation serves as official notice indicating that an individual or organization did not file a tax return, which can be crucial for applying for certain grants or loans. Specific forms, such as IRS Form 4506-T, may be utilized to request this confirmation, and response times can vary based on the office's workload, usually ranging from a few weeks to several months. Recipients should ensure that all relevant information, such as full name, Social Security Number, and relevant tax periods, are provided accurately to facilitate the process.

Formal Salutation

A request for non-filing confirmation is essential for individuals or businesses needing to prove they have not filed certain documents, such as tax returns or legal filings, with governmental agencies or institutions. This request is commonly directed to authorities like the Internal Revenue Service (IRS) in the United States or similar tax offices in various countries. The letter should include key details such as the taxpayer identification number (TIN), specific tax years in question, and relevant contact information for follow-up. It is crucial to maintain professionalism and clarity in the communication to facilitate a prompt response from the agency.

Specific Request Statement

Non-filing confirmation requests are essential for individuals or businesses to verify the absence of filed documents, such as tax returns or legal claims, with the relevant authorities. A specific request statement must include pertinent details, such as the individual's full name (e.g., John Doe), date of birth (e.g., January 15, 1980), and social security number (e.g., 123-45-6789) or other identification numbers. It is vital to specify the time frame for which confirmation is sought (e.g., tax years 2019 to 2023) and the governing body (e.g., Internal Revenue Service) to whom the request is directed. Additionally, including a clear purpose for the confirmation, such as loan applications or legal proceedings, enhances the request's significance, ensuring a prompt and accurate response. Providing contact information, including a mailing address (e.g., 123 Main St, Anytown, USA), email, and phone number, facilitates effective communication and updates regarding the request status.

Contact Information

Non-filing confirmations serve as official documentation to affirm that a specific tax return or form was not filed for a particular year or period. These confirmations are often required for various purposes, such as loan applications or financial compliance. To obtain this confirmation, taxpayers must provide essential contact information, including full name, address, telephone number, and Social Security number (or employer identification number). Additionally, the request should specify the tax year or period in question, ensuring clarity for the tax authority during processing. Providing accurate contact information facilitates swift communication and follows up on the request, enabling individuals to effectively manage their financial obligations and maintain compliance with regulatory requirements.

Letter Template For Request For Non-Filing Confirmation Samples

Letter template of request for non-filing confirmation for financial aid

Letter template of request for non-filing confirmation for loan application

Letter template of request for non-filing confirmation for rental agreement

Letter template of request for non-filing confirmation for legal matters

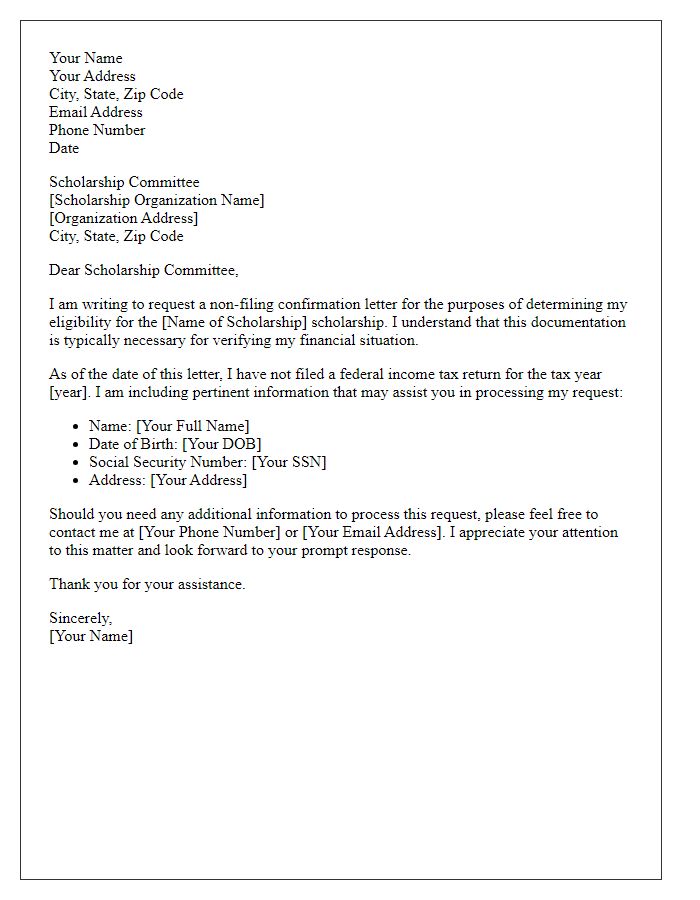

Letter template of request for non-filing confirmation for scholarship eligibility

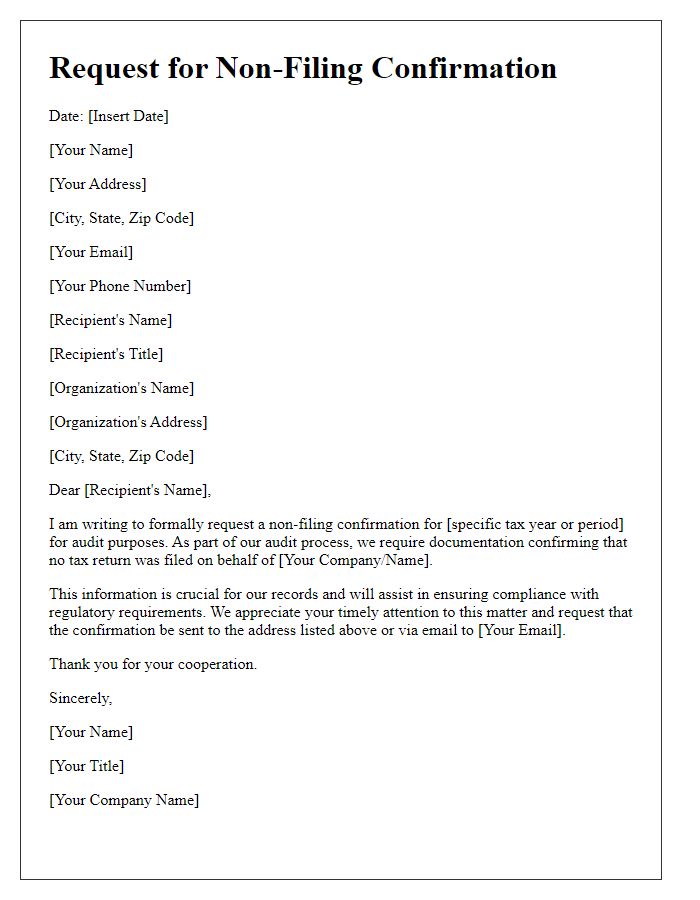

Letter template of request for non-filing confirmation for audit purposes

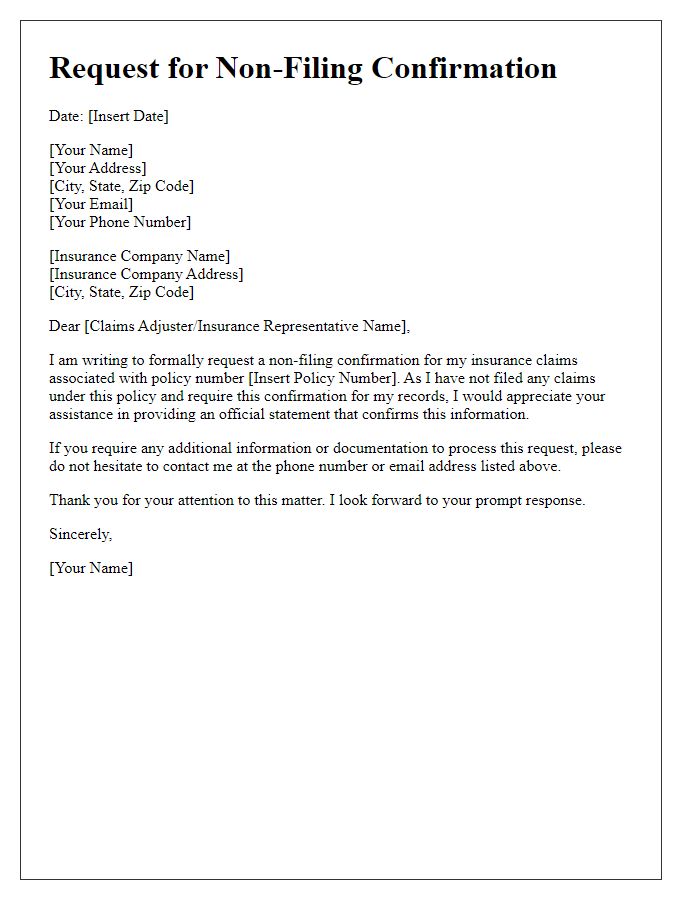

Letter template of request for non-filing confirmation for insurance claims

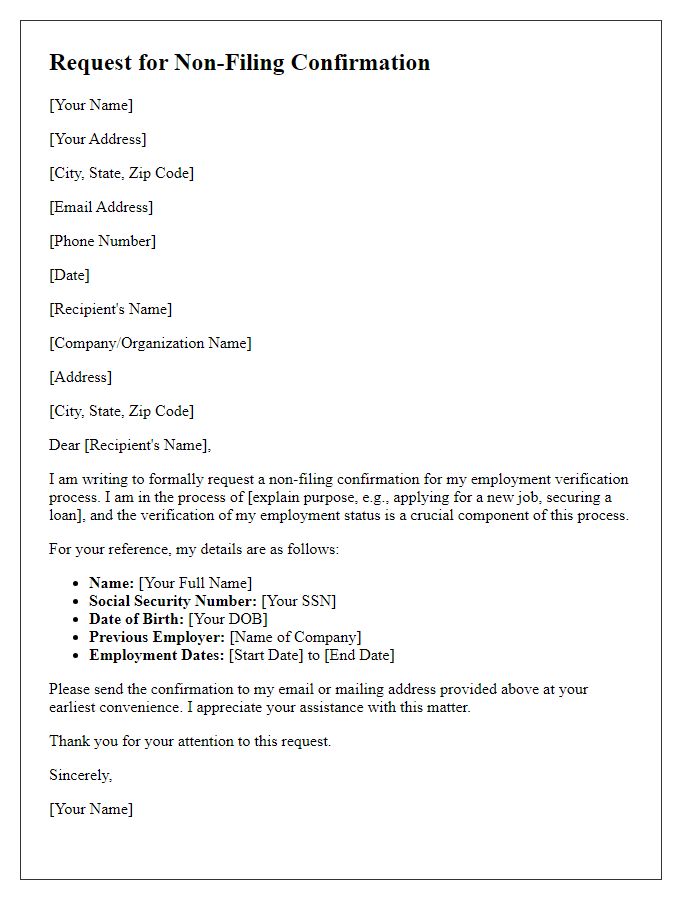

Letter template of request for non-filing confirmation for employment verification

Comments