Are you feeling overwhelmed by tax levies and the implications they have on your financial well-being? You're not aloneâmany individuals find themselves navigating the complexities of tax regulations and the stress of potential levies. In this article, we'll explore how a tax levy release confirmation can provide relief and help you regain control of your finances. So, let's dive in and discover the steps you can take to alleviate this burden!

Taxpayer Identification and Information

The process of tax levy release confirmation involves detailed verification of taxpayer identification and related information. The Internal Revenue Service (IRS), established in 1862, utilizes a Taxpayer Identification Number (TIN) to represent each taxpayer, which may consist of an Employer Identification Number (EIN), Social Security Number (SSN), or Individual Taxpayer Identification Number (ITIN). Upon release, specific forms such as Form 668-D are issued, indicating that the levy has been lifted from assets, including bank accounts or wages, previously subjected to collection due to unpaid taxes. Taxpayers may experience significant emotional relief, as the release of a levy can restore their access to funds, enabling financial stability and compliance with federal tax obligations. It is imperative for taxpayers in such situations to maintain meticulous records, including copies of the release forms and related correspondence, to ensure future clarity regarding their tax status.

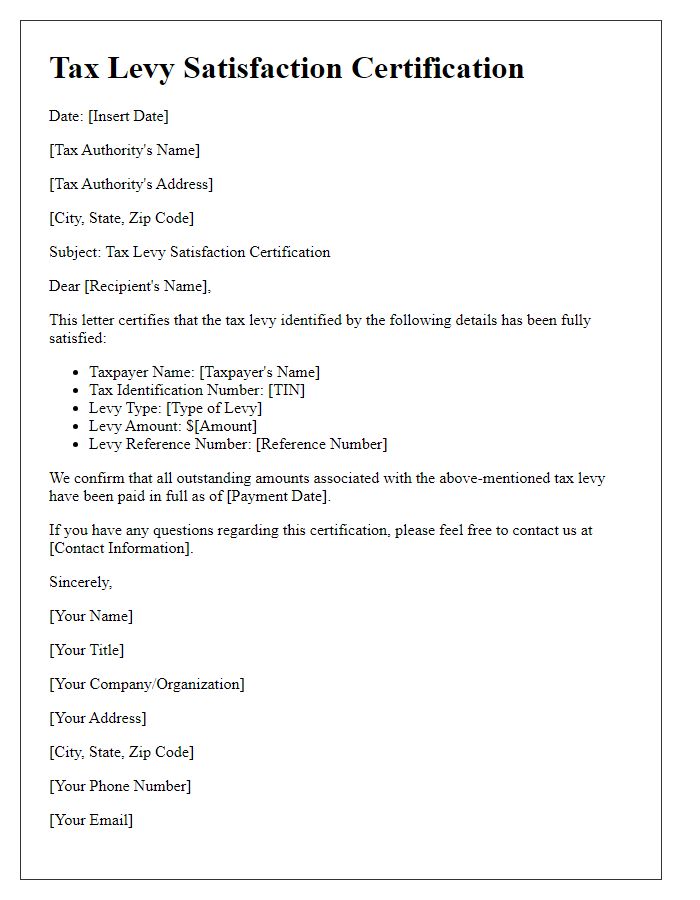

Levy Release Details and Specifics

Tax levies can significantly impact an individual's financial situation, especially in regions like the United States where the Internal Revenue Service (IRS) or state departments issue such measures. A levy release confirmation is critical, allowing taxpayers to regain access to their seized assets. During a tax levy, properties, bank accounts, or wages can be garnished, leading to potential financial distress. Upon the successful completion of tax payments or arrangements, such as an Offer in Compromise, taxpayers receive formal documentation confirming the release. This confirmation typically includes specific details, including the levy type, date of release, and the affected account or asset numbers. Understanding these details is essential for accurate financial records and can aid in future tax compliance.

Confirmation of Compliance

Tax levy release confirmation serves as an essential document indicating compliance with obligations set forth by tax authorities. A tax levy is a legal seizure of an individual's or entity's assets to satisfy outstanding tax debts, typically issued by agencies such as the Internal Revenue Service (IRS) in the United States. Upon fulfilling the necessary requirements, such as settling owed taxes or fulfilling payment plans, individuals receive this confirmation, often including specific details like the reference number, date of resolution, and the agency's contact information. This document acts as proof that the levy has been lifted, allowing financial transactions and restoring access to previously seized accounts or property, providing much-needed relief to tax debtors.

Contact Information for Further Assistance

Tax levy releases, specific to the Internal Revenue Service (IRS) and state tax authorities, often require detailed confirmation processes. Taxpayers can contact the IRS (telephone number: 1-800-829-1040) for assistance regarding federal tax issues, including levy releases. For state tax inquiries, individuals should refer to their respective state revenue department websites to find relevant contact information (e.g., California Franchise Tax Board: 1-800-852-5711). It is vital to have necessary documentation, such as Form 668(Y)(c) or proof of payment, ready during these communications, as they facilitate the processing of levy release confirmations. Taxpayers should also note the potential wait times, which could extend to over an hour, depending on call volume and the specific agency contacted.

Official Signature and Date

Official tax levy releases require precise documentation as mandated by the Internal Revenue Service (IRS). A tax levy represents a legal seizure of property to satisfy unpaid tax debts, with formal notification to the taxpayer. The release confirmation verifies that the taxpayer has settled the outstanding obligations, enabling the cessation of tax collection actions against personal assets such as bank accounts or wages. The official signature from an authorized representative, often from the tax authority, along with the date, serves as a crucial endorsement, ensuring the validity and legitimacy of the release. This document may be essential for re-establishing financial stability and restoring access to blocked resources.

Comments