Are you ready to navigate the complexities of healthcare tax credit certification? In today's fast-paced world, understanding how to maximize your tax credits can make a significant impact on your financial health. Whether you're a small business owner or an individual navigating the healthcare landscape, knowing the ins and outs of these credits is crucial. Join us as we delve deeper into the specifics of healthcare tax credit certification and empower yourself with the knowledge you need!

Applicant Information

Healthcare tax credit certification requires detailed applicant information. This includes full name, contact address (residential and mailing), date of birth, and Social Security Number (SSN) as identification numbers. Additionally, applicants must provide information regarding income sources, including salary from employment or self-employment earnings, typically documented through IRS Form 1040. Family size, which impacts eligibility and potential credit amount, must also be clearly stated, including details on dependents listed on tax returns. Finally, applicants should include any healthcare coverage details, specifying if they are enrolled in employer-sponsored insurance or if they are receiving coverage through government programs such as Medicaid.

Certification Criteria

Healthcare tax credit certification involves specific criteria essential for eligibility under various federal and state regulations. Eligible employers must maintain a workforce comprising primarily low-income employees, with annual wages not exceeding 400% of the federal poverty level; for example, in 2023, this threshold is approximately $54,120 for an individual. Employers need to provide health insurance under a qualified health plan that meets minimum essential coverage standards, ensuring it covers at least 60% of healthcare expenses. Additionally, employers must have fewer than 25 full-time equivalent employees, which is significant for small business tax credits. Proper documentation of employee hours, wages, and health insurance offerings is vital to secure certification. Timely submission of forms, such as IRS Form 8941, aligns with annual tax filing deadlines to maintain compliance and maximize potential credits, promoting healthcare coverage affordability for employees.

Required Documentation

Healthcare tax credit certification requires specific documentation to verify eligibility for the credit. Applicants must submit IRS Form 8941, which calculates the allowed credit amount for small employer health insurance premiums. Proof of insurance coverage includes copies of employee health plans, enrollment forms, and premium statements. Financial documentation such as payroll reports for all employees, covering periods relevant to the tax year, is necessary to confirm the number of employees and their wages. Additionally, a summary of benefits and coverage must be provided to demonstrate compliance with the Affordable Care Act guidelines, showcasing the healthcare options offered to employees. Lastly, a signed statement from the employer affirming accurate documentation submission is crucial for processing the application efficiently.

Submission Deadline

Healthcare tax credit certification requires careful adherence to submission deadlines to ensure eligibility for programs like the Affordable Care Act (ACA). Specific deadlines may vary annually, with important dates often set by agencies such as the Internal Revenue Service (IRS). For 2023, applications typically must be submitted by March 31 to qualify for credits retroactively claimed for prior tax years. Organizations must prepare necessary documentation, including IRS Form 8941, which details the health insurance premiums paid. Moreover, compliance with local and federal regulations regarding employment and healthcare coverage is critical to avoid penalties. Failure to meet submission deadlines can result in loss of tax credits, adversely impacting financial sustainability, particularly for small businesses in sectors like healthcare and retail.

Contact Information

Healthcare tax credit certification requires accurate documentation. Essential details include the organization's name, addressing information, phone number, email, and website link. The organization may be a health insurance provider or a non-profit health care company, actively providing services in specific regions. Ensure to include a contact person's name and title for direct communication. Additionally, the date of certification submission must also be recorded prominently. Accurate contact information streamlines the verification process for tax credits related to healthcare subsidies.

Letter Template For Healthcare Tax Credit Certification Samples

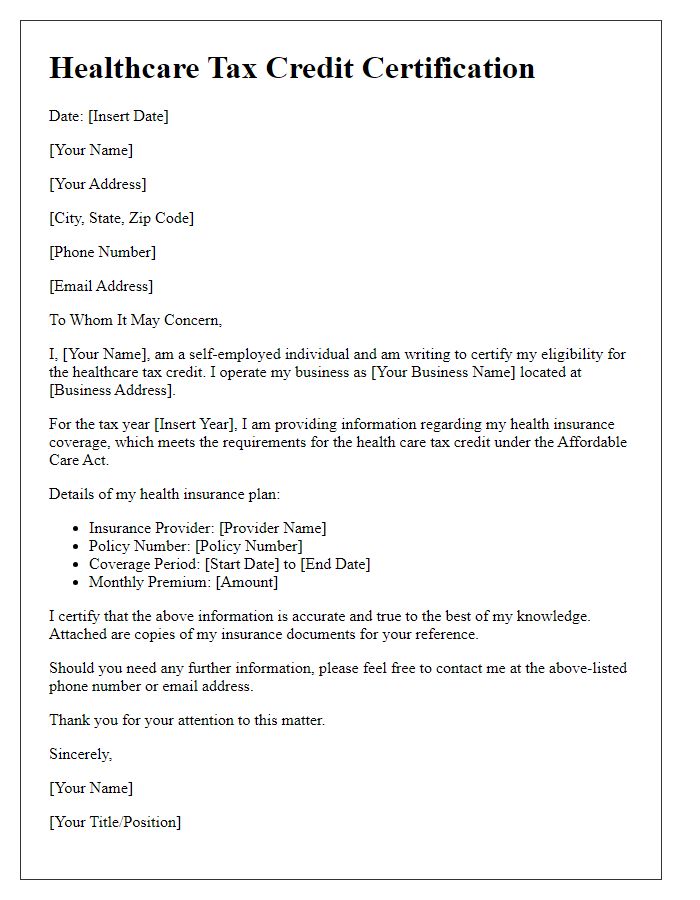

Letter template of healthcare tax credit certification for self-employed individuals

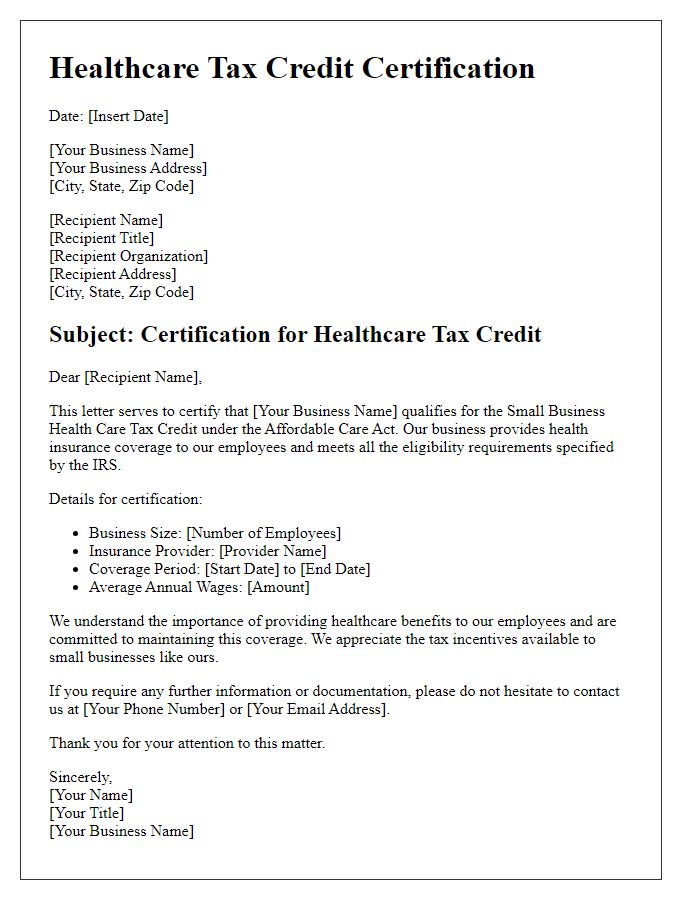

Letter template of healthcare tax credit certification for small businesses

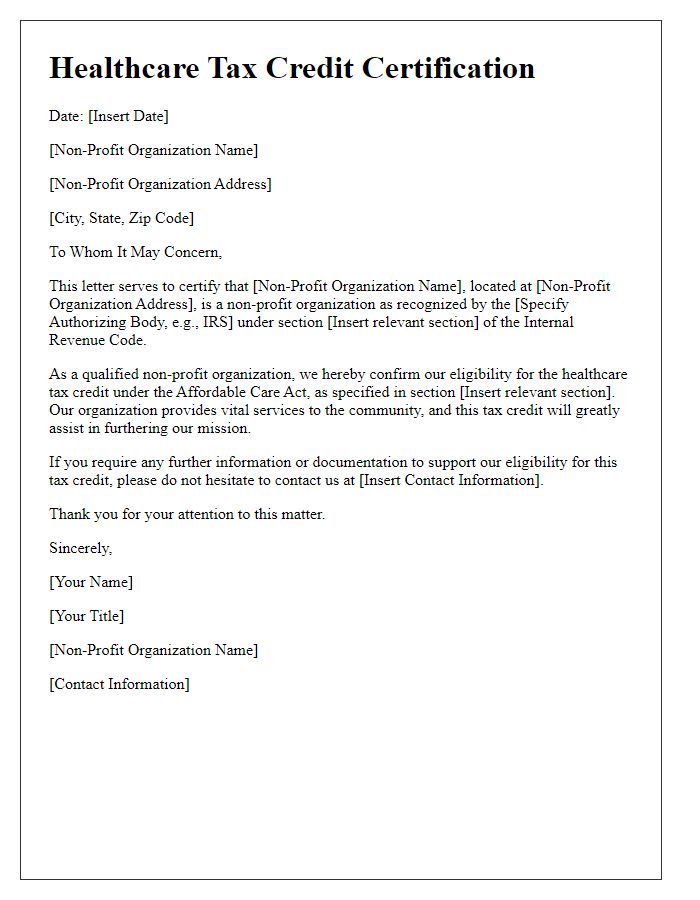

Letter template of healthcare tax credit certification for non-profit organizations

Letter template of healthcare tax credit certification for low-income households

Letter template of healthcare tax credit certification for part-time workers

Comments