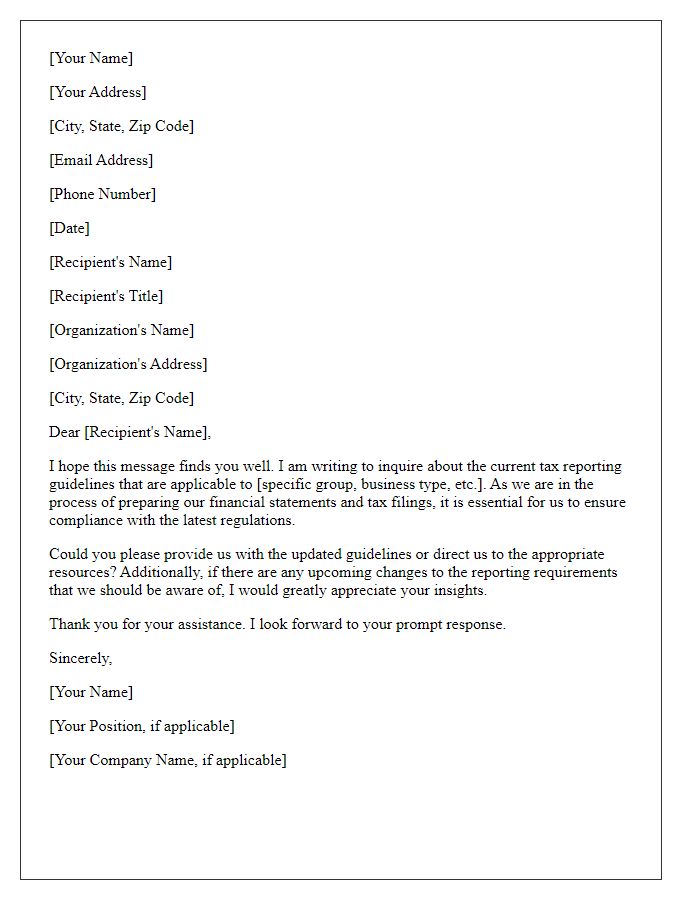

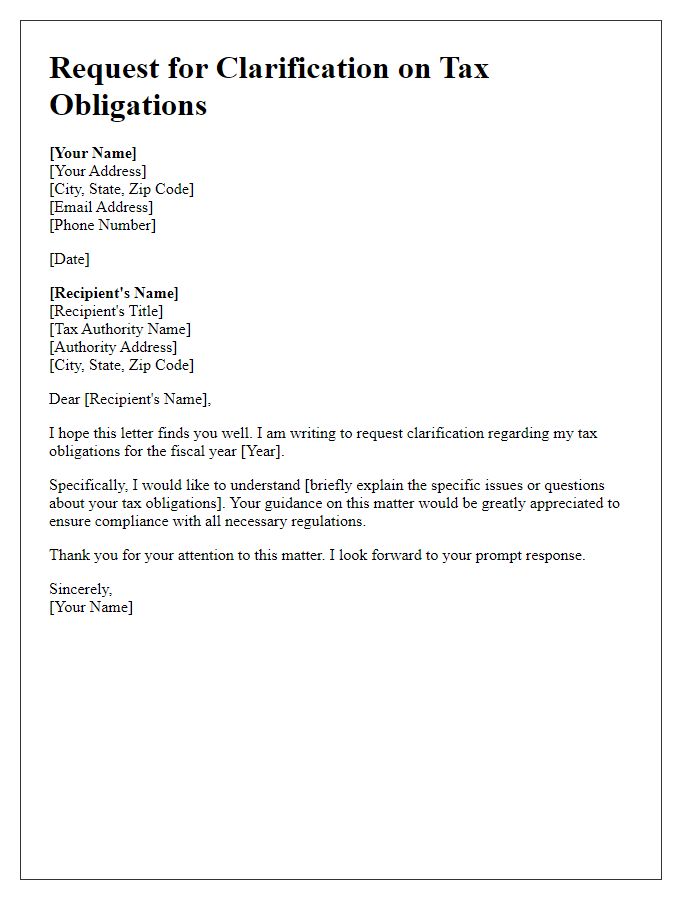

Are you feeling a bit confused about tax reporting requirements? You're not alone! Many individuals and businesses grapple with the nuances of tax obligations, from deadlines to specific documentation needed. To help clear up any uncertainties, we've put together a comprehensive guide that breaks down everything you need to knowâso why not dive in and read more?

Specific tax law references

Tax reporting requirements in the United States are governed by several key laws and regulations that dictate the obligations of individuals and businesses to accurately report income and deductions. Internal Revenue Code (IRC) Section 6012 outlines who must file income tax returns, specifying criteria based on filing status and income levels. Additionally, IRC Section 6050W mandates reporting requirements for payment processors and third-party network transactions, necessitating Form 1099-K for transactions exceeding $20,000 and 200 transactions annually. Furthermore, IRC Section 162 addresses business expense deductions, detailing what qualifies as a deductible expense for businesses. Compliance with these specific tax laws is crucial to avoid penalties from the Internal Revenue Service (IRS) and to ensure accurate and timely reporting of tax obligations.

Detailed income sources

Clarification on tax reporting requirements emphasizes the necessity of accurately documenting detailed income sources. Taxpayers must report diverse categories of income, which may include wages, self-employment earnings, interest income from savings accounts at institutions like Bank of America, rental income from properties located in California, capital gains from stock sales through platforms like E*TRADE, dividends from investments in companies such as Apple or Microsoft, and any freelance income earned during the tax year. Proper receipts, 1099 forms, and other financial statements are crucial for substantiating these income sources, ensuring compliance with the IRS regulations. Failure to provide adequate details may lead to audits or penalties, particularly for individuals with significant earnings from multiple streams.

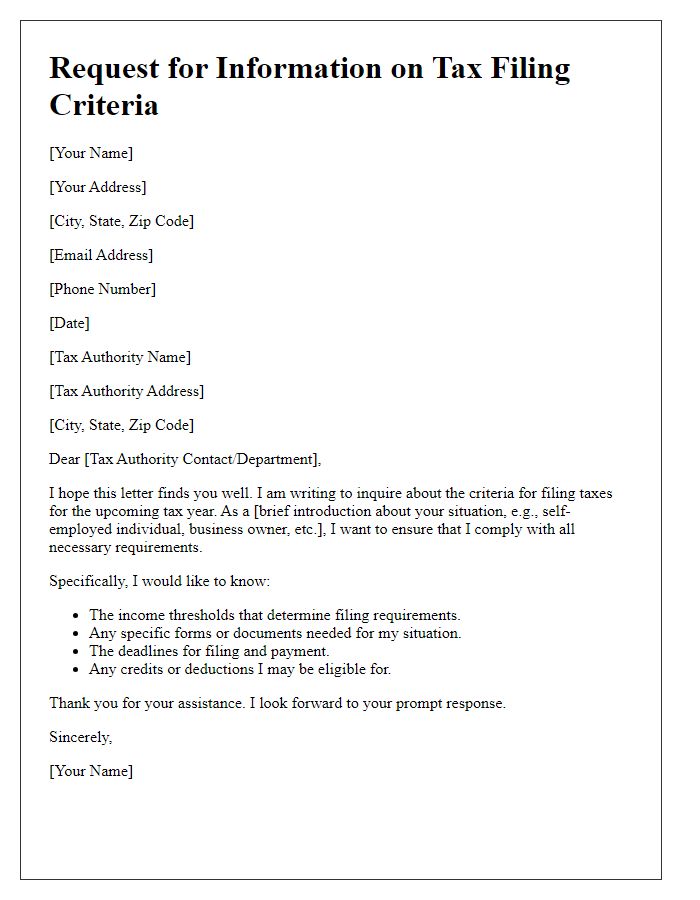

Filing status clarification

The classification of filing status significantly impacts income tax obligations for individuals in the United States. The Internal Revenue Service (IRS) identifies five primary filing statuses: Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er). Each category has unique tax rates, standard deductions, and eligibility criteria, influencing tax liability calculations. For instance, in the tax year 2023, the standard deduction for married couples filing jointly is $27,700, while single filers only receive $13,850. Correctly identifying the appropriate filing status ensures compliance with tax regulations, minimizes potential penalties, and maximizes refunds or reduces taxes owed. Understanding these distinctions is crucial for accurate tax reporting and effective financial planning.

Compliance deadlines

Tax reporting requirements necessitate meticulous adherence to specific compliance deadlines established by government entities such as the Internal Revenue Service (IRS). For individuals filing their annual income tax returns (Form 1040) in the United States, the primary deadline is typically April 15, barring weekends or holidays, which can extend the deadline. Businesses, depending on their structure, may have varying deadlines; for instance, C Corporations generally must file Form 1120 by the 15th day of the fourth month after the end of their fiscal year, while S Corporations file Form 1120S by the 15th day of the third month. Estimated tax payments are required quarterly, with due dates falling on April 15, June 15, September 15, and January 15 of the following year. Additionally, certain states impose their own reporting timelines and requirements, thus necessitating individualized attention to both federal and state obligations to ensure compliance.

Contact information for assistance

Tax reporting requirements can vary significantly based on jurisdiction and individual circumstances. Accurate reporting is crucial for compliance with local laws enforced by agencies such as the Internal Revenue Service (IRS) in the United States. Key deadlines, including April 15th for individual tax returns, must be met to avoid penalties. Examples of relevant forms include the IRS Form 1040 for individual filers and Form 1099 for reporting various types of income. For taxpayers seeking clarification, resources like the IRS Tax Assistance Center provide helpful guidance. Contact information, such as a dedicated helpline at 1-800-829-1040, is available for direct inquiries to clarify tax obligations, ensuring compliance and avoidance of potential legal issues.

Comments