Have you ever received a tax penalty notice and felt overwhelmed by the process of responding? It can be daunting, but knowing how to craft an effective letter can make all the difference. In this article, we'll guide you through the essential elements of a well-structured response, ensuring you address the issue with clarity and confidence. So, let's dive in and explore the best strategies to tackle that notice head-on!

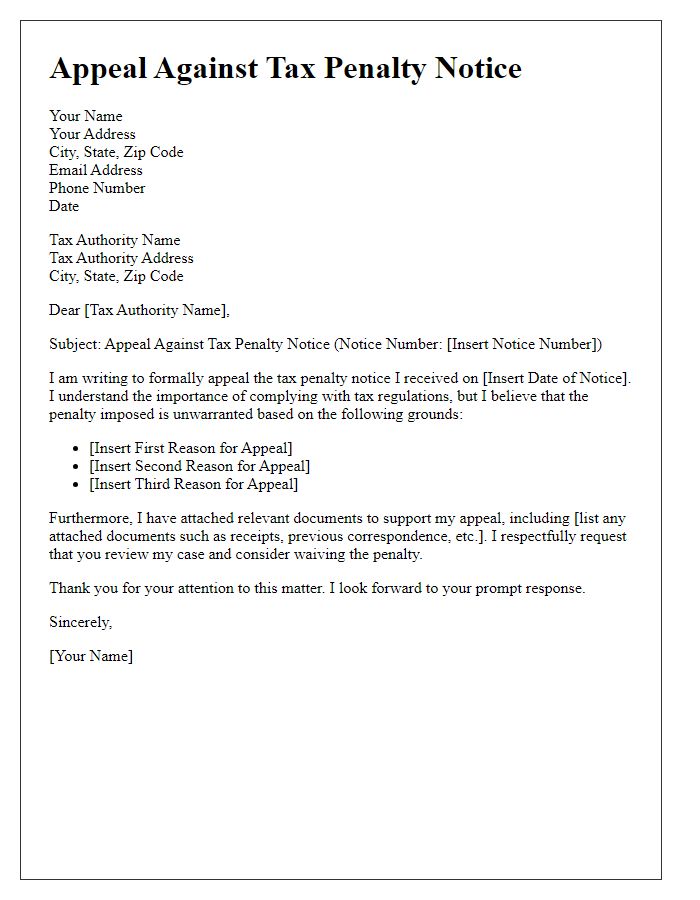

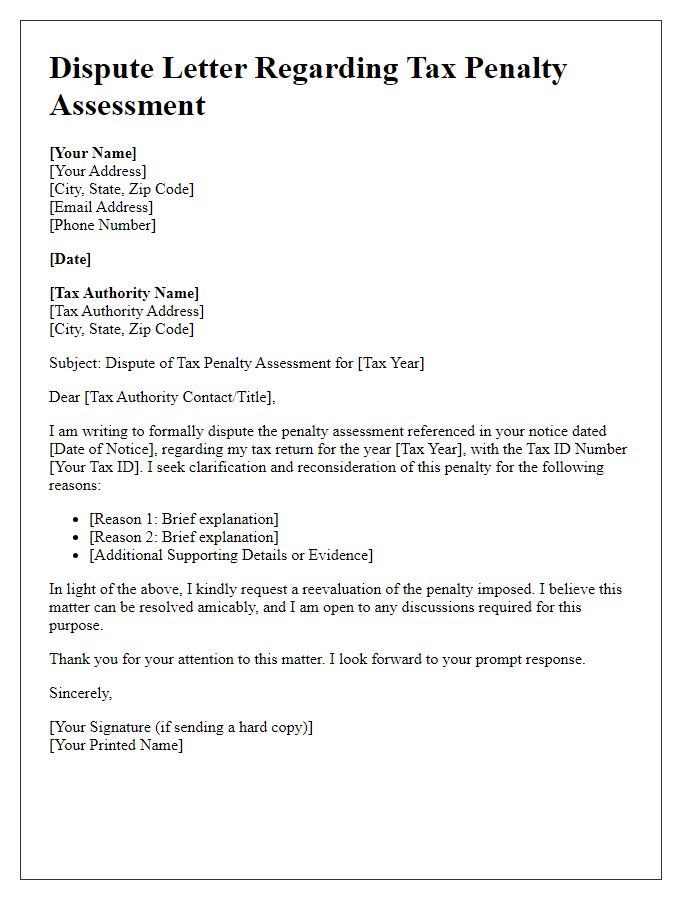

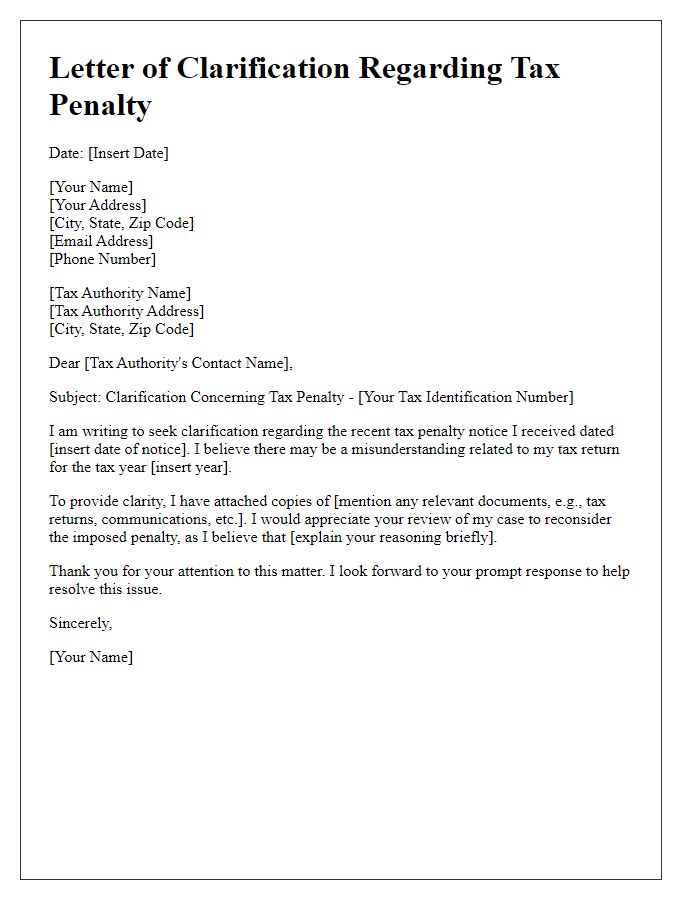

Professional and respectful tone

Receiving a tax penalty notice can be a stressful event for individuals and businesses alike. Tax penalties, often issued by the Internal Revenue Service (IRS) or local tax authorities, typically arise from late payments, underreporting income, or failure to file necessary tax documents. These penalties can accumulate significantly, sometimes reaching hundreds or thousands of dollars, depending on the circumstances and the tax laws applicable to the specific situation. Notably, taxpayers have the right to appeal or dispute penalties if they believe they have valid reasons, such as financial hardship, errors made by tax preparation software, or unforeseen personal circumstances. It is crucial to address penalty notices promptly, outlining your case clearly and respectfully, while also providing any supporting documentation that may help in resolving the matter effectively.

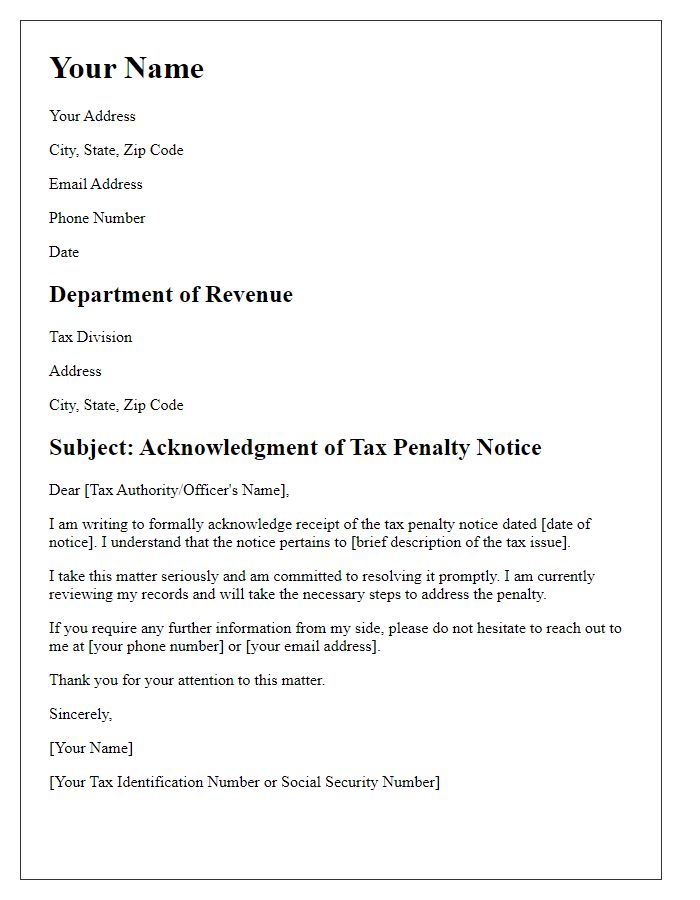

Clear reference to tax penalty notice details

Receiving a tax penalty notice, such as IRS Form CP21B, can lead to financial stress and confusion for taxpayers. The notice usually includes specific details, such as the penalty amount, the tax period affected (for example, the 2022 tax year), and the reasons for the penalty (often due to late filing or underpayment of taxes). Taxpayers may reference their unique taxpayer identification number, included in the notice, to streamline communication with the tax authority. Additionally, understanding the appeals process outlined within the notice is critical, as it provides a pathway to contest the penalty if there are valid grounds or documented evidence, like unforeseen circumstances or clerical errors, that contributed to the issue. Immediate action is advised to mitigate further penalties or interest that may accrue over time, underscoring the importance of timely responses to such notices.

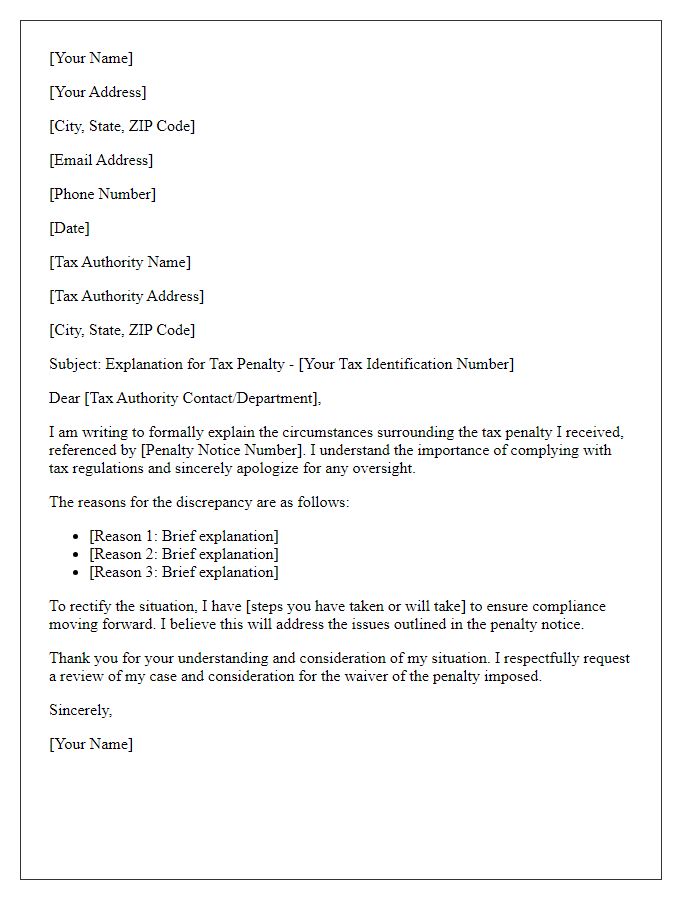

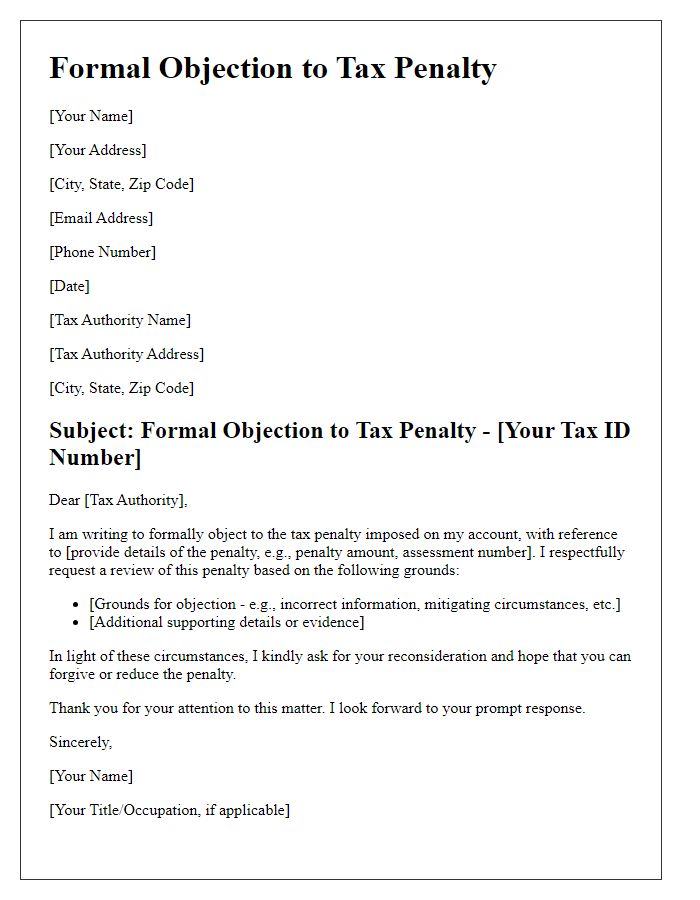

Explanation or clarification of circumstances

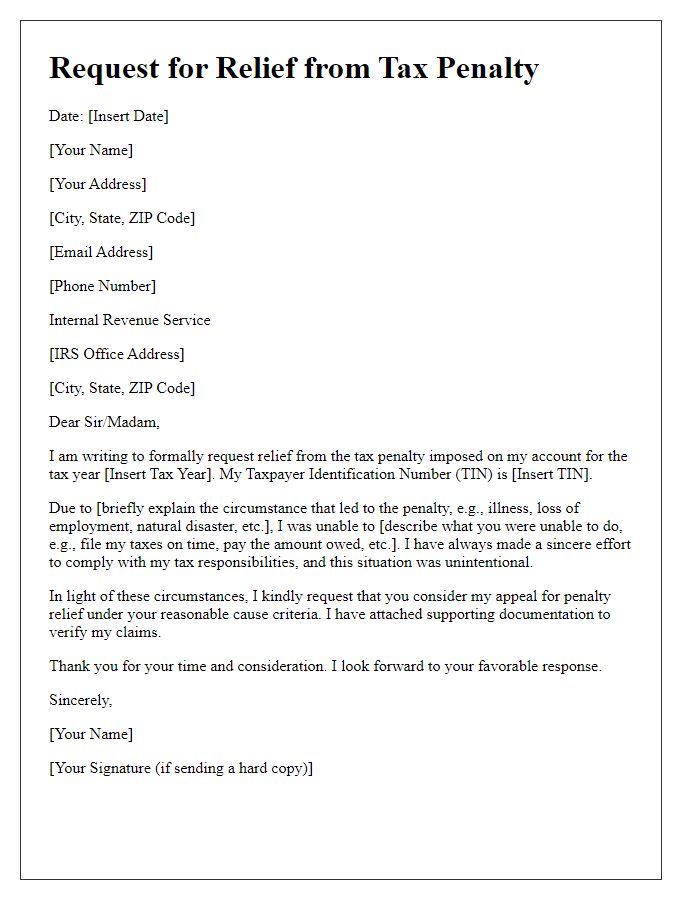

Receiving a tax penalty notice can be stressful, especially when circumstances surrounding the situation are complex. Many taxpayers face unique challenges, such as medical emergencies (hospitalization lasting over a month), job loss (redundancy affecting household finances), or unexpected natural disasters (hurricanes causing significant property damage) that impede timely tax payments or filings. In cases like these, providing detailed context can aid in understanding the taxpayer's situation. For instance, a recent relocation to a different state may have complicated record-keeping for tax submissions, or navigating a legal dispute could have diverted attention away from filing obligations. To effectively convey this message to the tax authority, documentation (medical records, termination letters, or disaster relief notices) can support claims and potentially lead to penalties being reconsidered or reduced. Clarity concerning dates, amounts due, and previous communication attempts enhances the response.

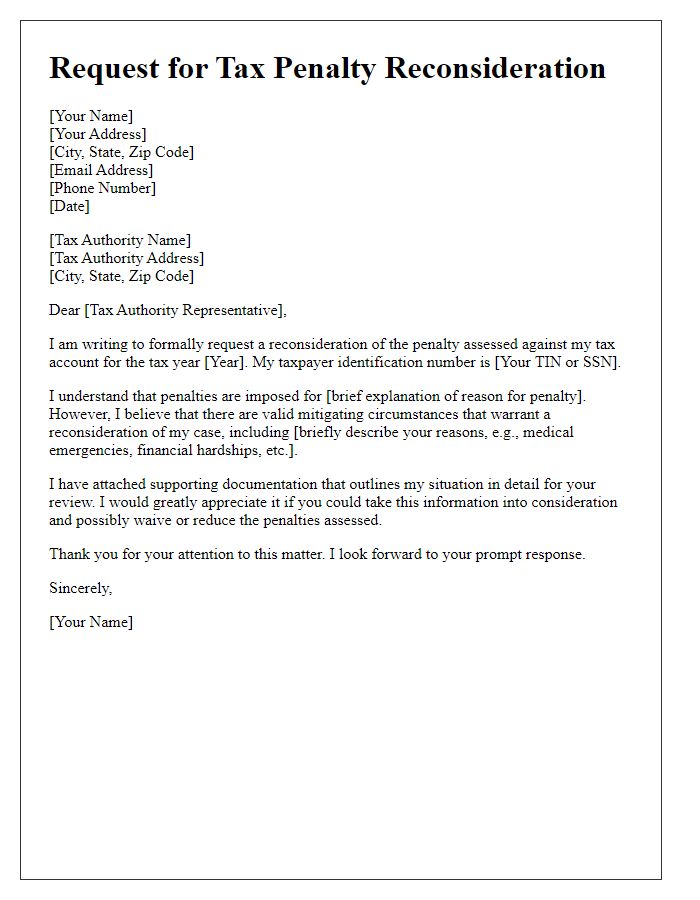

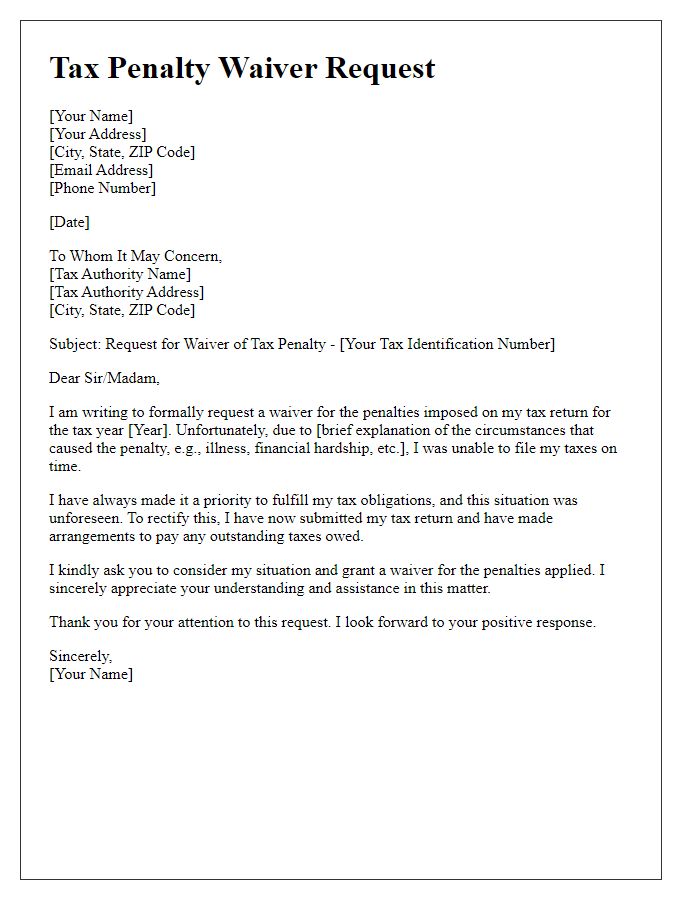

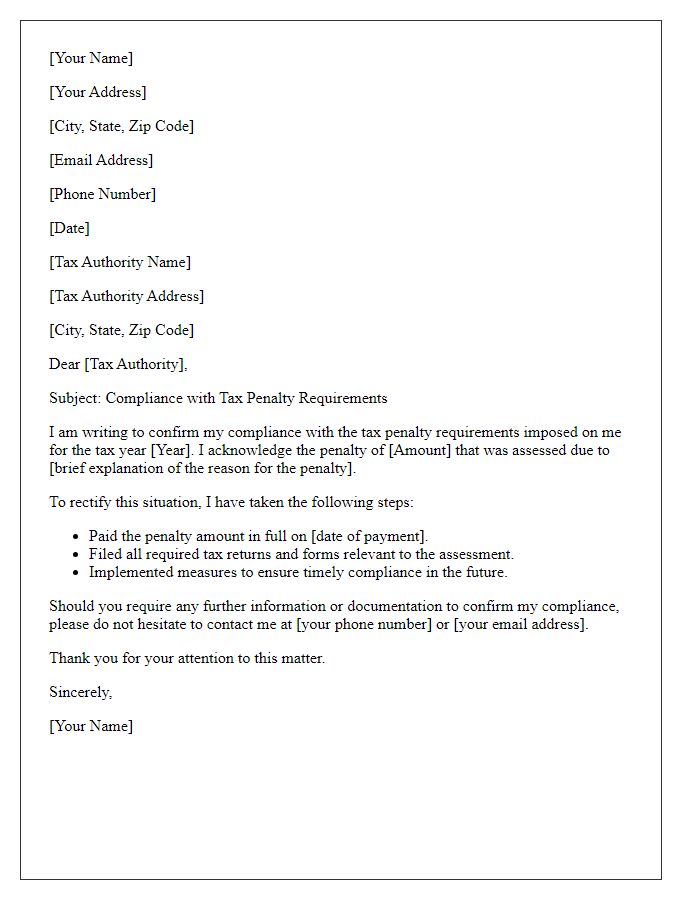

Request for reconsideration or penalty waiver

Tax penalty notices can cause significant concern for taxpayers, especially if they believe they have reasonable grounds for reconsideration, such as a misunderstanding or extenuating circumstances. A request for waiver often cites specific IRS regulations and pertinent dates, which bolster the case for leniency. Examples of situations warranting reconsideration include medical emergencies, natural disasters, or delays in paperwork submission, all of which can hinder timely tax payments. If appealing under IRS guidelines, it is essential to reference the Taxpayer Bill of Rights (RBT), providing an additional framework for equitable treatment by tax authorities. With proper documentation and a clear explanation of the circumstances, taxpayers can potentially mitigate penalties, reclaim financial peace, and maintain compliance with IRS standards.

Proper contact information and signature

Receiving a tax penalty notice can be stressful for individuals and businesses, especially when the amount owed can significantly impact financial stability. It is crucial to address the notice promptly. Begin by obtaining the correct contact information stated on the notice, including the agency's name, address, and phone number, which often belongs to the Internal Revenue Service (IRS) in the United States. A clear, concise response should include pertinent details such as the notice number, taxpayer identification number, and specific penalties listed. The signature should be from an authorized person, ensuring legitimacy in communication. Additionally, including the date of the response adds context to the timeline of the issue. Keeping copies of all correspondence is essential for future reference and potential appeals.

Comments