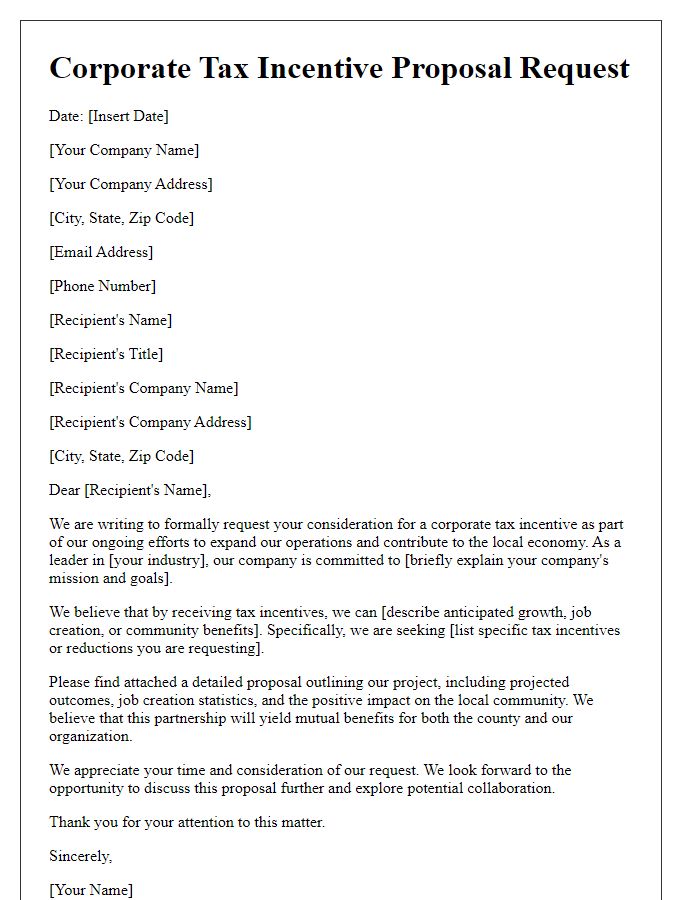

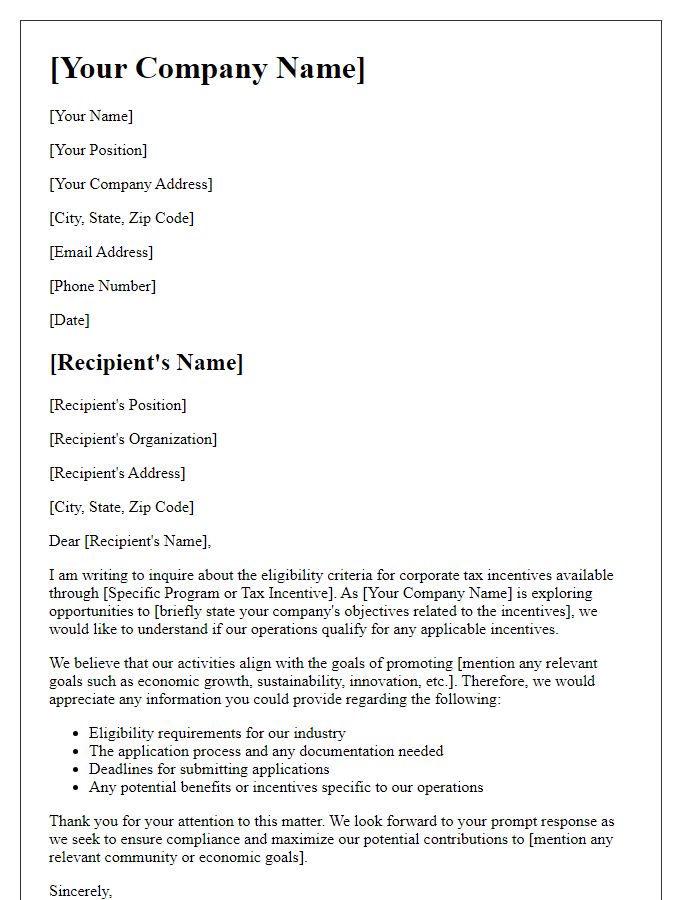

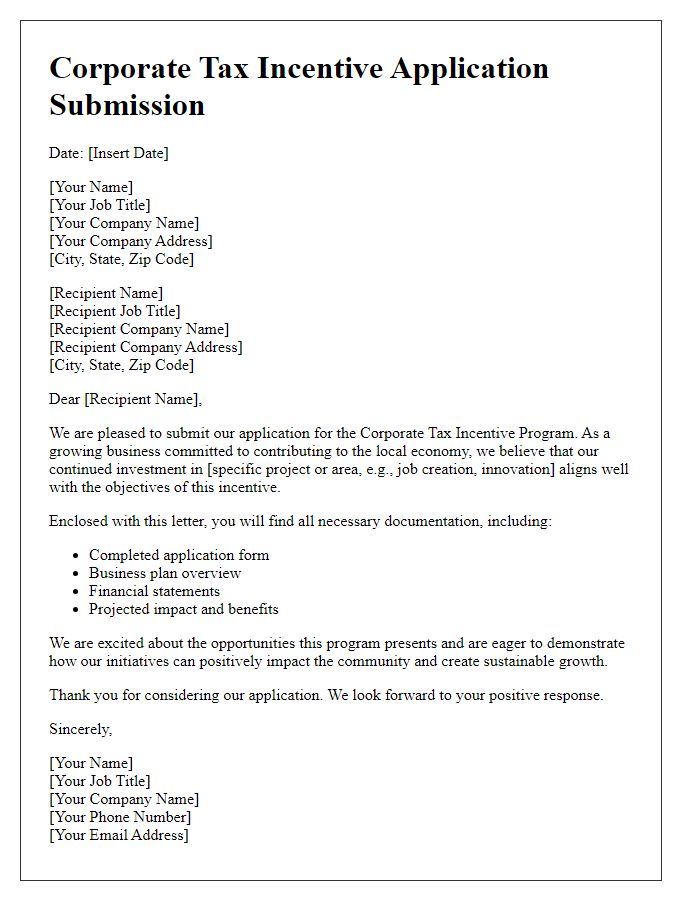

Are you navigating the complexities of corporate tax incentive applications? It can often feel overwhelming, but with the right guidance, the process can be much simpler. In this article, we'll break down the key components of a successful application and provide you with a handy template to get you started. So, let's dive in and explore how to secure valuable tax incentives for your business!

Company background and industry.

XYZ Corporation, established in 2010 and headquartered in Silicon Valley, California, operates within the technology sector, primarily focusing on cybersecurity solutions. The company has grown rapidly, reaching over 500 employees and generating annual revenues exceeding $100 million. As a leader in innovative security technologies, XYZ Corporation serves a diverse client base, including Fortune 500 companies and governmental agencies across North America and Europe. Products developed include advanced threat detection software and vulnerability assessment tools, designed to protect sensitive data from cyber-attacks. Committed to research and development, the company invests approximately 15% of its revenue annually to drive technological advancements and maintain a competitive edge within the ever-evolving landscape of cybersecurity threats.

Specific tax incentive being applied for.

The application for the corporate tax incentive is focused on the Research and Development Tax Credit (R&D Tax Credit), which encourages innovation and technological advancements within companies. This incentive, available under Section 41 of the Internal Revenue Code in the United States, aims to reduce taxable income by allowing businesses to claim a percentage of their qualified research expenses. Eligible activities include developing new products, improving existing processes, or conducting experiments to achieve technical uncertainty. Companies can benefit from this tax credit, with potential savings representing up to 20% or more of their R&D spending, depending on the calculation methods employed. The incentive not only fosters growth but also enhances competitive advantage in rapidly evolving industries.

Impact of incentive on business growth and community.

Corporate tax incentives significantly influence business growth and community development. These financial benefits, often in the form of reduced tax rates or credits, allow businesses, especially small to medium enterprises (SMEs), to reallocate resources towards expansion initiatives. For instance, a 10% reduction in corporate tax rates can lead to increased investments in technology, resulting in a 25% rise in productivity within three years. Furthermore, these incentives encourage job creation; studies demonstrate that one new job is generated for every $50,000 of tax credits utilized. This influx of jobs positively impacts local economies, fostering community engagement and boosting local services. In cities like Detroit, where incentives have spurred business growth, local unemployment rates have dropped significantly, showcasing how tax benefits can transform communities. Ultimately, the strategic implementation of corporate tax incentives drives sustainable economic growth while enhancing the quality of life for residents.

Detailed financial projections and plans.

Creating detailed financial projections is essential for a corporate tax incentive application, particularly in demonstrating the financial viability of a business project. Comprehensive projections typically include a detailed breakdown of revenue forecasts, aligned with key metrics and market conditions. For instance, estimated sales growth should account for historical data, anticipated market trends, and competitive analysis within the industry. Cost breakdowns, including fixed and variable costs, must be meticulous, considering factors like labor costs, material expenses, and overheads, which can fluctuate based on external economic conditions. Additionally, cash flow projections provide critical insights into liquidity and working capital needs, forecasting inflows and outflows based on operating cycles from 2024 to 2028. Furthermore, a five-year profit and loss statement underlines the financial health, showcasing gross profit margins, net income, and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). Highlighting potential return on investment (ROI) based on tax incentives can further corroborate the project's attractiveness to stakeholders, with detailed plans on reinvestment strategies that align with local economic development goals. Overall, thorough analysis and realistic assumptions pave the way for successful tax incentive acquisition, reinforcing commitment to sustainable business practices.

Compliance with relevant laws and regulations.

Corporate tax incentives often hinge on adherence to specified laws and regulations, such as the Internal Revenue Code (IRC) in the United States, local tax statutes, and compliance guidelines provided by the IRS (Internal Revenue Service). Companies must ensure their operations align with both federal and state tax requirements, including proper filing of tax returns and payment of liabilities. Specific industries may be subject to additional compliance measures, necessitating documentation that demonstrates commitment to regulations such as the Foreign Corrupt Practices Act (FCPA) or the Sarbanes-Oxley Act (SOX). Understanding these legal frameworks helps demonstrate eligibility for incentives, ultimately benefiting the company's financial landscape while fostering responsible business practices.

Comments